Today I am analyzing a share that I personally consider to be a tenbagger or even more over the next 5-10 years. It's about Kraken Robotics, a company that operates at the interface of several megatrends: Robotics, underwater technology and defense! In the following, I will try to show you why I am so convinced of the company and how much growth potential it has, but also what risks could possibly hinder it...

This analysis has taken a lot of time, so I hope it doesn't get lost here...

- Foundation and history

- What does KR do?

- Strategic acquisitions

- Q3 2025

- Megatrends: robotics, military, underwater infrastructure

- Conclusion

- Sources

Foundation and history

Kraken Robotics was founded in 2012 in St. John's, Newfoundland and Labrador, Canada, and was born from the entrepreneurial vision of Karl Kenny, an experienced manager in the maritime technology sector. Today, he holds around 11% of the company.

From the outset, the company focused on the development of high-resolution synthetic aperture sonar systems, which offer significantly better image quality than conventional sonar solutions. This clear technological focus laid the foundation for a unique market position early on.

In the early years, Kraken Robotics was strongly development-driven, with the majority of sales coming from pilot projects and government-supported programs. The Canadian location proved to be a strategic advantage, as it offered access to maritime expertise, qualified specialists and funding programs.

In 2015, the company decided to go public in Canada, primarily to raise capital for further growth and dissemination of the technology. In the following years, Kraken Robotics supplemented its organic growth with targeted acquisitions and expanded its portfolio to include autonomous underwater vehicles, sensor technology and services.

I don't think more information is needed here for me as an investor.

What do they do specifically?

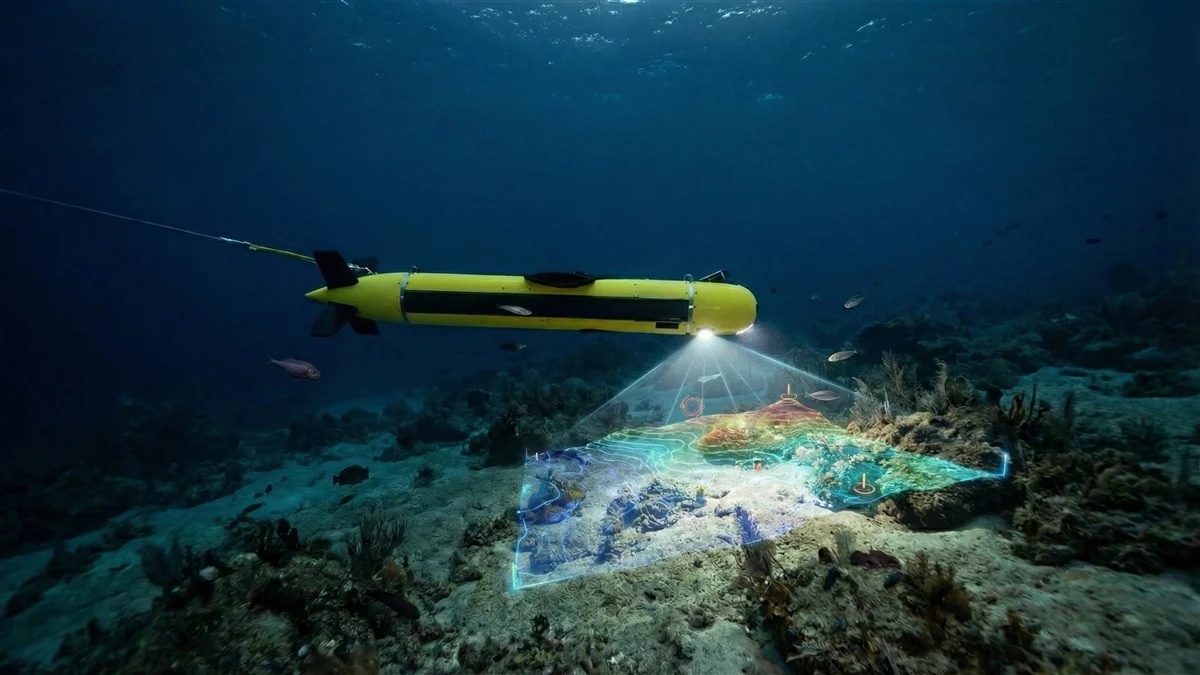

Kraken Robotics is clearly positioned technologically in the field of underwater sensor technology, autonomous robotics and maritime data analysis.

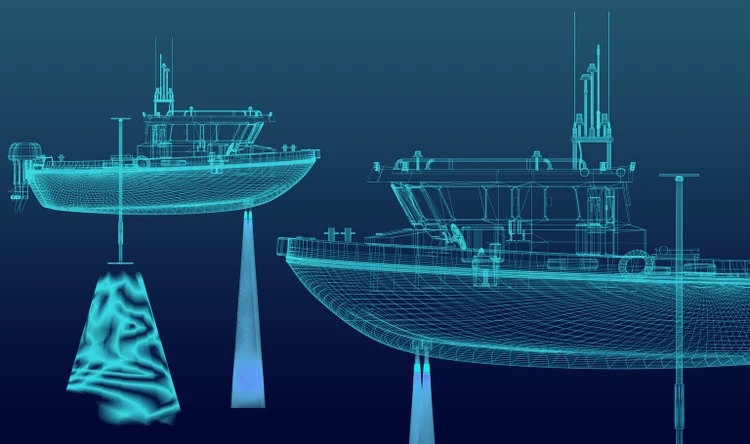

The company's core business lies in high-resolution acoustic imaging under water, as optical systems can hardly be used at great depths or in turbid water. At its heart is the so-called Synthetic Aperture Sonar (SAS), which calculates an extremely detailed overall image of the seabed from many individual sonar measurements. This technology enables resolutions in the centimeter range, even at depths of several thousand meters. There is virtually no competition for Kraken Robotics in this area.

This technology is used wherever precise underwater information is critical to safety or cost. This includes military applications such as mine defense, port surveillance and reconnaissance, but also civilian applications such as the inspection of submarine cables, pipelines, offshore wind farms or oil and gas facilities.

Kraken Robotics combines its sonar systems with autonomous underwater vehicles (AUVs) that can autonomously scan large areas and collect data without the need for a ship to remain directly over the target area at all times. Kraken Robotics builds these AUVs itself and thus covers the entire value chain.

In terms of technology, Kraken operates at the interface between robotics, signal processing, AI-supported data analysis and maritime safety. This area is particularly attractive because the data volumes are highly complex and customers are increasingly demanding complete system solutions including analysis. This is precisely where Kraken Robotics succeeds in moving away from pure, lower-margin hardware sales of AUVs and sensors through software, service and integration.

Strategic takeovers

In order to increase its technological lead and secure its market position, Kraken Robotics has made a number of acquisitions. Here are just a few of the most important acquisitions:

Kraken Power GmbH (2019)

The majority takeover of the German company Kraken Power GmbH kicked off 2019. The company specializes in pressure-tolerant underwater batteries and power electronics, which are crucial for the reliable operation of autonomous systems at great depths. Strategically, Kraken Robotics thus secured a key technology, increased its vertical integration and reduced its dependence on external suppliers.

PanGeo Subsea / PGH Capital (2021)

The acquisition of PanGeo Subsea followed in 2021. PanGeo specializes in high-resolution 3D acoustic imaging of the seabed and subsurface, especially for geological analysis and infrastructure projects. This acquisition significantly expanded Kraken Robotics' technological capabilities beyond pure object recognition and at the same time strengthened its service- and data-driven business model.

13 Robotics (2021)

Also in 2021, Kraken Robotics acquired the Brazilian company 13 Robotics. The focus here is on autonomous underwater vehicles and robotic solutions for offshore energy and the maritime industry. Strategically, this step enabled the expansion of complete end-to-end systems and also gave Kraken Robotics access to the South American market.

3D at Depth (2025)

The most recent and one of the most important acquisitions to date took place in 2025 with the acquisition of 3D at Depth from the USA. The company is a leader in high-precision underwater LiDAR surveying and metrology for offshore infrastructure. This acquisition complements Kraken Robtics' acoustic sonar technology with optical 3D measurement methods, strengthens the high-margin service business and consolidates the company's presence in the strategically important US market.

Q3 2025

In Q3 2025, Kraken Robotics generated revenue of CAD 31.3 million, which corresponds to strong annual growth of around 60% compared to Q3 2024 (CAD 19.6 million).

The revenue growth was mainly driven by higher shipments of underwater batteries and synthetic aperture sonar systems as well as the service contribution following the acquisition of 3D at Depth.

The gross margin improved to around 59%, which is higher than the previous year's figure of around 52% and indicates a more favorable sales mix with higher-margin products and services.

Adjusted EBITDA increased by around 92% to around CAD 8.0 million, resulting in a margin of around 25%, compared to just over 21% in the same quarter of the previous year.

Net profit was approximately CAD 3.3 million, more than double the figure for the same period last year, while earnings per share remained stable at CAD 0.01.

At the end of the quarter, the company had a cash position of around CAD 126.6 million, significantly more than in the previous year, and total assets grew to around CAD 330.7 million. This offers opportunities for further expansion or acquisitions.

For the full year 2025, management has maintained its forecast for the year, with expected total revenue of between CAD 120 million and CAD 135 million and adjusted EBITDA in the range of CAD 26 million to CAD 34 million.

On the whole, these are solid figures, and I am very pleased that the company is now profitable and can demonstrate both strong growth and increasing margins.

The Rule of 40 for the quarter is a strong 85!

Why Kraken Robotics is a multibagger candidate!

As mentioned above, Kraken Robotics is, in my opinion, active in very exciting growth trends and benefits from the expansion of subsea data cable infrastructure, expansion of renewable energy such as offshore wind farms, robotics and increasing military spending.

Data traffic and global internet expansion

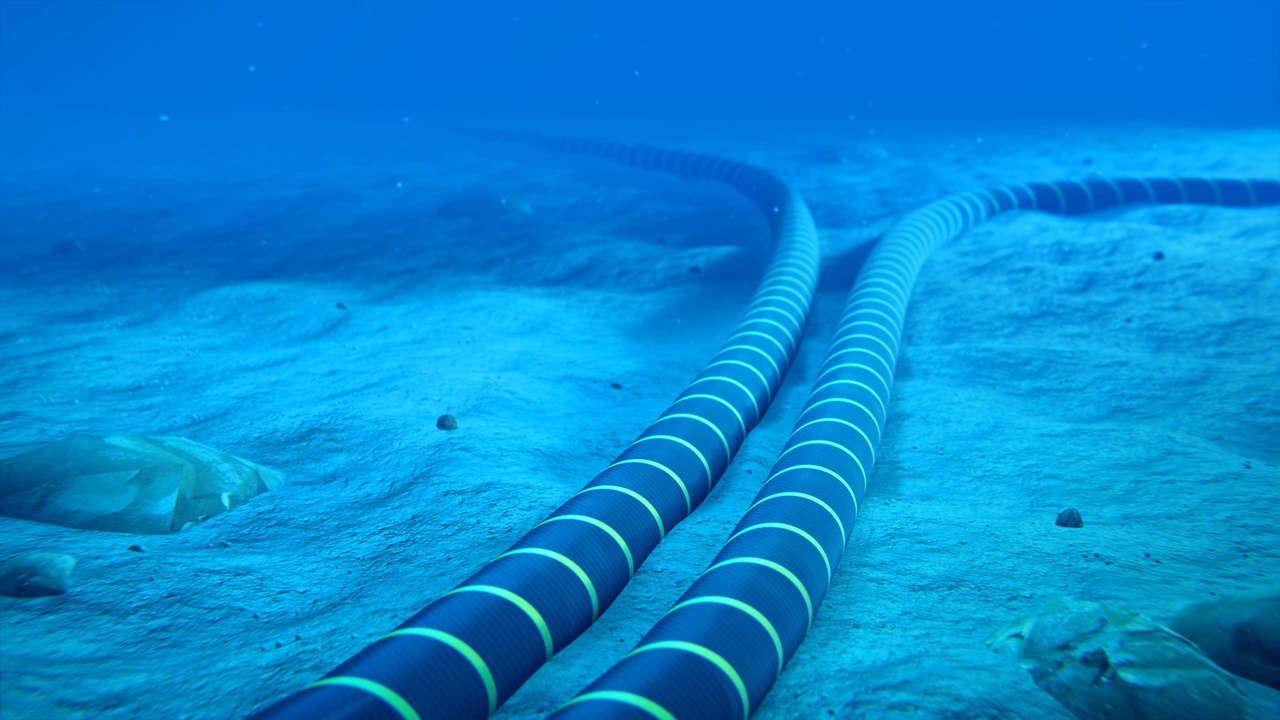

A key driver of this market is the massive submarine cable data traffic, which today transports around 97% of global internet traffic via sea routes and is therefore clearly a critical infrastructure.

The global submarine cables market was estimated at around USD 31.7 billion in 2024 and is expected to grow to around USD 44.3 billion by 2030, driven by increasing data transmission and offshore energy networking. This infrastructure must be protected!

One example of this trend is the plan by major technology companies such as Meta to realize a global submarine cable project with an investment of around USD 10 billion to improve data capacity and redundancy - a project for which security for this cable will certainly become crucial once completed.

On this topic, I really enjoyed a video from "What does the world cost", which summarizes the importance of submarine data cables very nicely: https://youtu.be/fU4b7P1TGBE?si=JwAXYAu8G1vAhjE0

Expansion of renewable energies - offshore

As part of the expansion of the offshore energy transition, for example through wind farms at sea, the requirements for underwater infrastructure are also increasing: power and data cables connect wind farms to the mainland and need to be regularly inspected, maintained and protected. This is also contributing to the growth of the market, as these projects are increasing worldwide and require robust subsea cables for power and data.

However, energy sources such as gas are also frequently transported through pipelines and are often indispensable, e.g. Nord Stream certainly comes to mind for us Germans 😔

Events such as the damage to Nord Stream pipelines or submarine cables in northern Europe have shown how vulnerable these systems are and how great the need for monitoring and protection has become - which in turn continues to drive the demand for underwater monitoring technologies.

Defense and military

And that brings us to the military.

In the defense sector, NATO has significantly expanded its activities to secure critical underwater infrastructure in recent years. Initiatives such as NATO Operation Baltic Sentry have been launched to monitor and protect cables, energy and communication routes in the Baltic Sea, in some cases with autonomous systems and surveillance technologies.

At the same time, NATO member states pledged at a 2025 summit to spend around 5% of their GDP on defense and related security issues by 2035 - which indirectly means more funding for technologies to secure critical infrastructure.

At national level, countries such as Denmark are investing several hundred million US dollars to procure specialized surveillance and security vessels as well as drones for monitoring underwater cables and pipelines.

Kraken Robotics already supplies its systems to various NATO navies and defense agencies: These include the Royal Canadian Navy, the Royal Australian Navy, Danish and Polish navies, as well as partners in North America and Europe that use systems for mine countermeasure (MCM), underwater surveillance and infrastructure inspection.

I think that this is actually where the greatest risk lies. If peace is achieved in Ukraine, things could become volatile for Kraken Robotics in the short term. But I assume that the protection of the underwater infrastructure will continue to be expanded even in the event of peace. However, in contrast to pure defense stocks such as Rheinmetall, the share has not shown any weakness in the latest negotiations.

Underwater robotics

This trend is somewhat derived from the other areas and forms the basis.

Robotics is a clear growth driver. The market for autonomous underwater vehicles, which, according to analyses, was worth around USD 2.7 billion in 2024 and is expected to grow to around USD 5.9 billion by 2030, is a clear sign of rapidly increasing demand for robotics in the sea.

Conclusion

I don't think I need to write much more here: I am convinced by the company. I also see a unique opportunity here to invest in a growth company due to the currently not too large market capitalization. I made my initial purchase at EUR 2.17 and have now bought in at just under EUR 2.90 through various additional purchases ($PNG portfolio share of approx. 20% besides $IREN

$RKLB (+0%)

$SOFI

$HIMS ). Thanks to Tenbagger2024 who gave a rough introduction to the company here!

Of course, there are risks here, such as a possible peace or the sudden emergence of competitors that have not yet been present and have a technological edge.

In my opinion, the opportunities clearly outweigh the risks: I believe Kraken Robotics is strategically very well positioned to maintain its high growth rate...

With this in mind, I wish you a happy, healthy and successful start to 2026! This analysis has taken a lot of time and I hope you have noticed and experienced added value as a result. Please feel free to give me feedback and tell me what else I should pay attention to...

LG KleinAnleger 😊

Sources:

https://www.krakenrobotics.com

https://de.wikipedia.org/wiki/Kraken_Robotics

https://www.finanznachrichten.de/nachrichten-aktien/kraken-robotics-inc.htm

https://www.sharedeals.de/kraken-robotics-aktie-ist-die-euphorie-uebertrieben/

https://leitz-cloud.com/internetkabel

https://mugglehead.com/de/kraken-robotics-boosts-bought-deal-offering-to-cad45m/

https://finimize.com/content/kraken-robotics-lands-global-deals-and-analyst-praise

and several more 🙃🫣

@Tenbagger2024

@Multibagger

@BamBamInvest

@SAUgut777

@Aktienfox

@All-in-or-nothing

@Shiya

@Hotte1909

@Simpson

@Wiktor_06

@TradingHase

@TomTurboInvest

@Semos25

@Iwamoto

@HoldTheMike

@ImmoHai

@EpsEra