Fast forward 6 months, the portfolio’s up heavy. Regret selling $TLNE and $ONDS (+3,62%) early (especially $ONDS (+3,62%) from 2 → 11 in 4 months). $BITF (+9,41%) helped offset some of that.

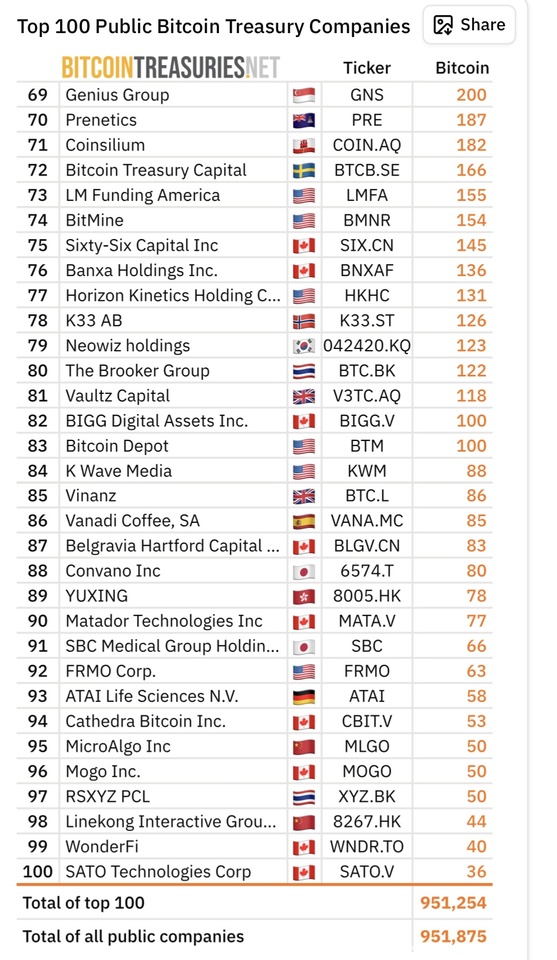

Core remains long-term, but I’ve carved out a small short-term sleeve in $BMNR (+4,27%) , $SBET (+3,02%) , $JD (-0,09%) and $OSCR (+6,05%) .

Plan: take profits by year-end and rotate back into core themes ( AI, Nuclear, Space, Quantum, and Robotics) as i have too many positions right now even after selling some