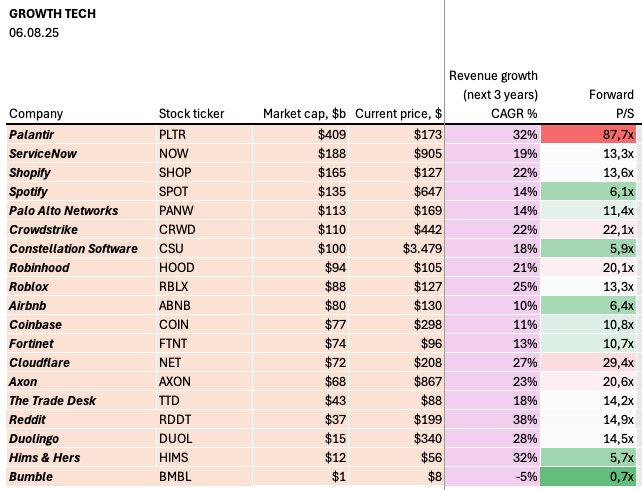

- $PLTR (+2,29%) : 77x 🤯

- $NET (+0,22%) : 31x

- $FIG (+0,87%) : 30x

- $CRWD (+0,86%) : 30x

- $SNOW (+2,02%) : 16x

- $SHOP (+3,64%) : 15x

- $GWRE (-0,85%) / $ZS (+1,56%) : 14x

- $NOW (-0,5%) : 13x

➡️ The premium investors pay for growth is massive in some names.

Postos

47➡️ The premium investors pay for growth is massive in some names.

Just added Salesforce $CRM (-0,22%) to my portfolio.

For me, it’s a mix of strong fundamentals and long-term potential:

Not chasing hype — just building positions I believe can grow for years to come.

Who else is holding $CRM (-0,22%)?

Anyone think there’s a more attractive company in this space than $CRM (-0,22%) ?

Maybe ServiceNow $NOW (-0,5%), HubSpot $HUBS (-1,26%), Adobe $ADBE (-0,07%), or Oracle $ORCL (+1,12%)

The price/sales ratio (P/S) relative to sales growth is a one-dimensional view, but nevertheless provides a good initial overview:

Table = sorted in descending order by market capitalization

Which companies do you see as having the greatest potential in the next 5 years?

Subscribe to the podcast so that Jerome can start the money printer.

00:00:00 Tesla

00:33:30 Alphabet

01:09:00 Jerome's money printer

01:12:00 Blackstone

01:32:00 Service Now

01:49:50 Intel

Spotify

https://open.spotify.com/episode/04SQs9epnHicj8HNlyPJrI

YouTube

https://www.youtube.com/watch?v=gAykuGJTRyU

Apple Podcast

$TSLA (-3,07%)

$INTC (-7,3%)

$NOW (-0,5%)

$GOOG (+1,83%)

$GOOGL (+1,8%)

$BX (-0,15%)

$ (+6,32%)AMD (+6,32%)

Very objective analysis of $NOW (-0,5%) If you are interested in the share, please do.

ServiceNow, Inc. (NYSE: NYSE:NOW) consolidates its position as a leader in the enterprise software market with a market capitalization of $204.5 billion. It is leveraging its strengths in artificial intelligence (AI) and workflow automation to drive growth and innovation. According to data from InvestingPro the company achieves impressive gross profit margins of 78.5% and generated revenues of USD 12.06 billion in the last twelve months. As the company expands beyond its core IT Service Management (ITSM) business into new areas such as Customer Relationship Management (CRM), investors and analysts are keeping a close eye on its performance and strategic initiatives.

Recent financial development

ServiceNow reported strong results for the first quarter of 2025, beating expectations on key metrics. Non-GAAP earnings per share (EPS) reached $4.04, above the consensus estimate of $3.83. Revenue for the quarter totaled $3.088 billion, representing year-over-year growth of 18.5% (adjusted) and 19.5% (constant currency). This performance is in line with the robust five-year compound annual growth rate (CAGR) of 26% reported by InvestingPro reported by Based on InvestingPro's fair value analysis, the stock currently appears slightly overvalued. Discover more insights and over 16 additional ProTips with an InvestingPro subscription.

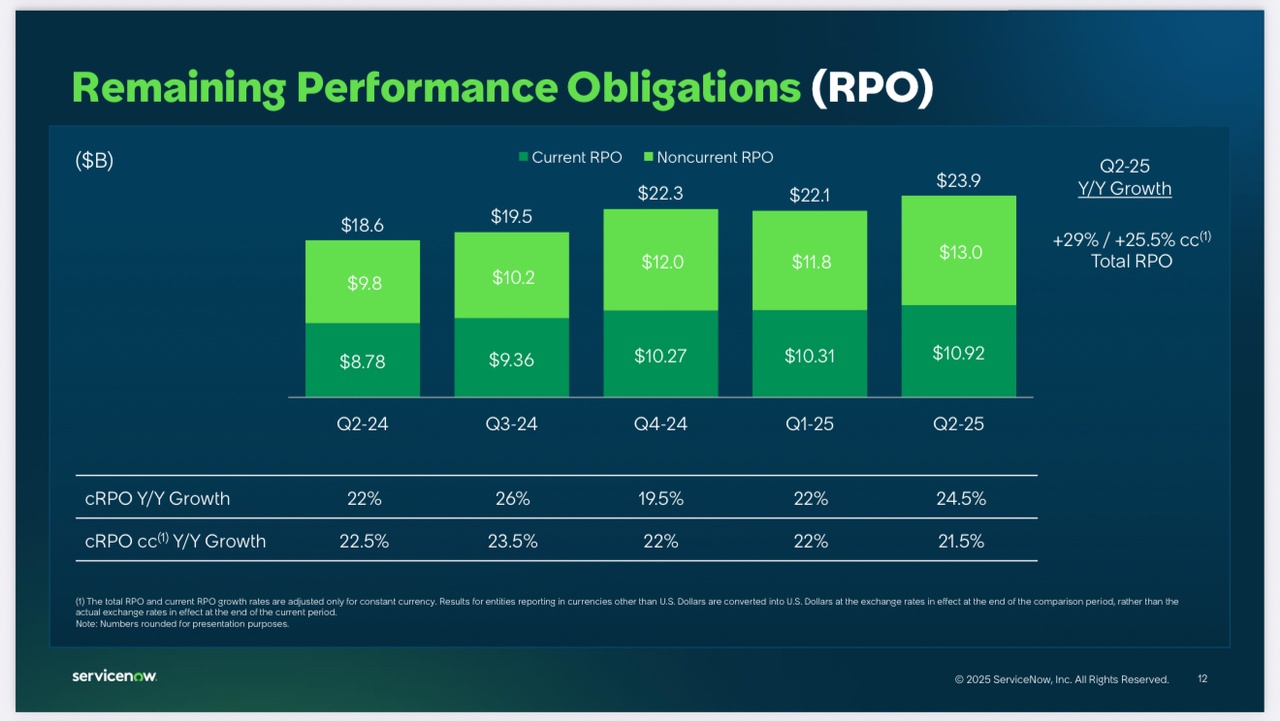

Subscription revenue, a key indicator of the company's recurring business, increased 19% year over year to $3.005 billion. The remaining performance obligations (cRPO), reflecting future contracted revenues, reached USD 10.310 billion, showing strong year-on-year growth of 22% in both reported and constant currency terms.

In response to these strong results, management slightly raised its guidance for the coming quarter and the full year. However, it took a cautious approach due to potential geopolitical risks and macroeconomic uncertainties.

AI and product strategy

ServiceNow's focus on AI has been a key driver of its recent success and future growth prospects. The strong financial condition score of 2.85 (from InvestingPro rated GOOD) and moderate leverage ratio support the company's ambitious AI initiatives. Want to dive deeper into ServiceNow's AI strategy and financials? Access our comprehensive Pro Research Report, available exclusively to InvestingPro subscribers. The company has made significant progress in integrating AI capabilities into its platform and has introduced several new AI-powered solutions:

1. Now Assist: an AI-powered assistant that has gained significant traction with over 1,000 customers using Plus SKUs and an annualized contract value (ACV) of $250 million.

2. AI Control Tower: A solution that helps organizations effectively manage and orchestrate their AI initiatives.

3. AI Agent Orchestration: A tool that facilitates the coordination and management of AI agents across different workflows.

ServiceNow's ambitious target of reaching $1 billion in AI ACV by the end of 2026 underscores the company's commitment to AI-driven growth. The recent acquisition of Moveworks, a conversational AI platform, further strengthens ServiceNow's AI capabilities and positions the company to compete more effectively in the rapidly evolving AI landscape.

Market position and competition

While ServiceNow maintains a strong leadership position in the ITSM market, the company is actively expanding into new areas, particularly CRM and industry workflows. This expansion is supported by strong fundamentals, including a solid current ratio of 1.09 and impressive revenue growth of 21.12% over the last twelve months, according to data from InvestingPro. For detailed valuation metrics, growth forecasts and expert analysis, explore our comprehensive pro research report on ServiceNow. This strategic move aims to increase ServiceNow's total addressable market (TAM), which is expected to grow from $165 billion in 2023 to $350 billion by 2027.

The CRM and Industry Workflows business has already reached an annual contract value (ACV) of USD 1.4 billion and is growing by over 30% annually. This expansion brings ServiceNow into direct competition with established providers such as Salesforce in the CRM sector. Although this move offers significant growth opportunities, it also brings new challenges as ServiceNow operates in a highly competitive market.

Growth prospects and challenges

ServiceNow's growth prospects remain strong, driven by several factors:

1. expansion of the TAM: The projected increase in ServiceNow's addressable market to $350 billion by 2027 provides ample room for growth.

2. AI adoption: The rapid adoption of AI-powered solutions such as Now Assist and the company's ambitious AI-ACV target point to significant growth potential in this area.

3. platform expansion: ServiceNow's strategy to expand beyond ITSM into CRM and industry workflows opens up new revenue streams and cross-selling opportunities.

4. strong financial profile: analysts forecast revenue growth rates of 18-20% over the coming years, with the company maintaining a robust free cash flow margin.

However, ServiceNow also faces several challenges:

1. macroeconomic uncertainties: Geopolitical risks and potential economic headwinds could impact corporate spending on software solutions.

2) Increasing competition: As ServiceNow expands into new markets such as CRM, it faces stiff competition from established providers and emerging AI-focused start-ups.

3. implementation risks: The company's ambitious AI strategy and expansion plans pose inherent implementation risks, particularly in scaling new solutions for production use.

4. valuation concerns: ServiceNow's high valuation compared to peers could make the stock vulnerable to market volatility if growth expectations are not met.

Bear Case

How could increasing competition in the CRM space affect ServiceNow's growth?

As ServiceNow expands its offering into the CRM market, it faces intense competition from established players such as Salesforce. These competitors have deep market penetration, extensive partner ecosystems and significant resources to invest in AI and other emerging technologies. ServiceNow's ability to gain market share in this highly competitive environment could prove difficult, potentially impacting growth rates and profit margins.

The company's lack of a long-standing presence in the CRM market could also lead to longer sales cycles and higher customer acquisition costs. This could put pressure on ServiceNow's operating margins and cash flow in the short to medium term as the company invests heavily in sales and marketing activities to establish its presence in the CRM space.

What risks does ServiceNow face in implementing its AI strategy?

Although ServiceNow has set ambitious goals for its AI initiatives, there are several risks associated with implementing this strategy. The rapidly evolving nature of AI technology means that ServiceNow must continually innovate to stay ahead. Any delays or missteps in product development could result in the company falling behind the competition or failing to meet customer expectations.

In addition, integrating acquired AI companies like Moveworks into ServiceNow's existing platform can present technical challenges and potential cultural clashes. If these integrations are not managed effectively, it could lead to delays in product launches, customer dissatisfaction and ultimately failure to achieve the goal of reaching $1 billion in AI ACV by 2026.

Bull Case

How could ServiceNow's AI initiatives drive long-term growth?

ServiceNow's strong focus on AI positions the company at the forefront of a transformative technology trend. As organizations increasingly look to leverage AI to increase efficiency and drive innovation, ServiceNow's AI-powered solutions could become critical components of their digital transformation strategies. The company's target of $1 billion in AI-ACV by 2026 demonstrates the significant growth potential in this area.

The integration of AI across ServiceNow's entire platform could also lead to increased customer retention and higher average revenue per user. As customers adopt more AI-powered features and realize tangible benefits, they are more likely to expand their use of the ServiceNow platform, driving upsell and cross-sell opportunities. This could lead to sustainable revenue growth and improved profitability in the long term.

What advantages does ServiceNow have in expanding beyond its core ITSM market?

ServiceNow's strong position in the ITSM market provides a solid foundation for expansion into adjacent areas such as CRM and industry workflows. The company's existing relationships with enterprise customers and its reputation for delivering robust, scalable solutions give it a significant advantage in cross-selling new offerings.

In addition, ServiceNow's platform approach enables seamless integration of different workflows across IT, customer service and other business functions. This integrated approach could be particularly attractive to organizations looking to consolidate their software stack and improve operational efficiency. As ServiceNow expands its capabilities, it has the potential to become an even more important partner for companies undergoing digital transformation, driving long-term growth and customer loyalty.

SWOT analysis

Strengths:

Weaknesses:

Opportunities:

Risks:

Analyst price targets (Target)

This analysis is based on information available up to July 29, 2025 and reflects the latest analyst reports and company announcements as of that date.

🧠 Background

The idea for this article came from the current Saturday episode of Alles auf Aktien (AAA) with Frank Fischer as a guest. He heads Shareholder Value Management AG and is responsible for the Frankfurt UCITS ETF Modern Value, among other things. In the episode, he presented his Modern Value Investing approach with a focus on profitable, high-growth companies that are still reasonably valued.

I found four stocks from this episode particularly exciting: $NOW (-0,5%) , $A1OS (+0,36%) , $MCE (-2,6%) and $APP (+5,16%) . I took a closer look at these stocks and compiled the latest cash flow figures, market capitalization and a brief assessment for you.

📊 Company overview

ServiceNow (NOW) - Enterprise Software, USA

Operating cash flow (TTM): approx. USD 4.7 billion

Free cash flow: approx. USD 3.85 billion

Market capitalization: around USD 201 bn

Assessment: Cloud platform for digital workflows. Impressive cash flow, established market position, but ambitious valuation

All for One Group (A1OS) - IT consulting, Germany

Operating cash flow: EUR 46.6m

Free cash flow: approx. EUR 42m

Market capitalization: approx. USD 280m

Assessment: Small IT service provider with focus on SAP projects. Solid cash flows, but heavily dependent on the DACH market

CHAPTERS Group (CHG) - investment company, Germany

Operating cash flow: approx. EUR 11.5m

Free cash flow: approx. EUR 7.8m

Market capitalization: approx. USD 1.1 bn

Assessment: Active investor in SMEs and services. Young listed model with high valuation level, but exciting approach

AppLovin (APP) - AdTech, USA

Operating cash flow (TTM): approx. USD 2.5 bn

Free cash flow (Q1 2025): USD 826 million

Market capitalization: approx. USD 120 billion

Assessment: Profitable provider in the mobile ad ecosystem. Very strong cash flow, aggressive growth. Somewhat overheated, but strategically focused

🚀 My takeaways

1. the selection reflects the Modern Value approach well. Cash flow strong, technology driven, but no classic hype stocks.

2. AppLovin and ServiceNow have global scale. The German stocks look like targeted small or mid cap building blocks with defensive substance

3. in terms of valuation, you have to take a closer look at AppLovin and CHAPTERS. High growth, but also a lot of expectation priced in.

❓ Question for the community

Do you already know any of these companies in detail? Do you have ServiceNow, AppLovin, All for One or CHAPTERS in your portfolio or have you already analyzed them? How do you currently rate the risk/return ratio of these stocks?

Source

Inspiration: All about stocks Saturday episode with Frank Fischer

Data status: July 2025 (via stockanalysis, Yahoo Finance, Morningstar, company websites)

I assume that the agreement between the USA and the EU will be announced at the weekend.

Therefore, in addition to the trades on $IBM (+8,06%) and on $NOW (-0,5%) I also made a small trade on a German customs gainer yesterday with $BMW (+0,67%)

Let's see if it works out. It's a bit of a runtime.

Leverage 5 long $NOW (-0,5%)

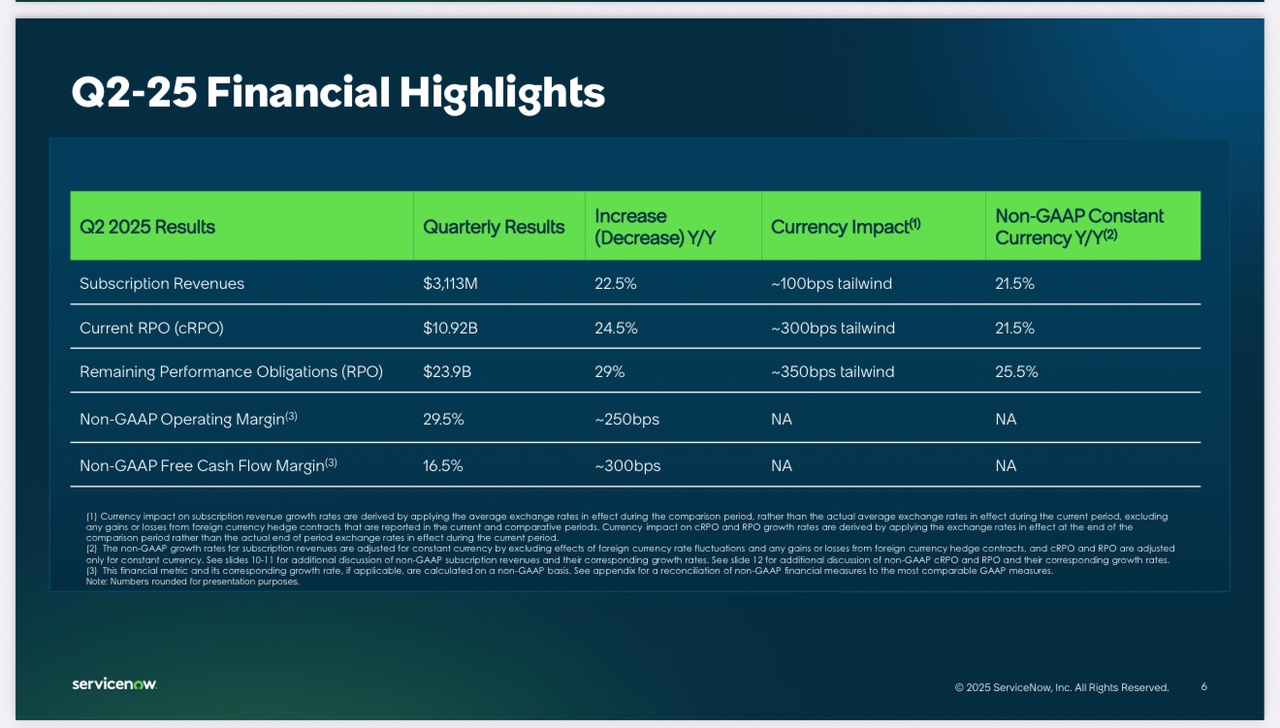

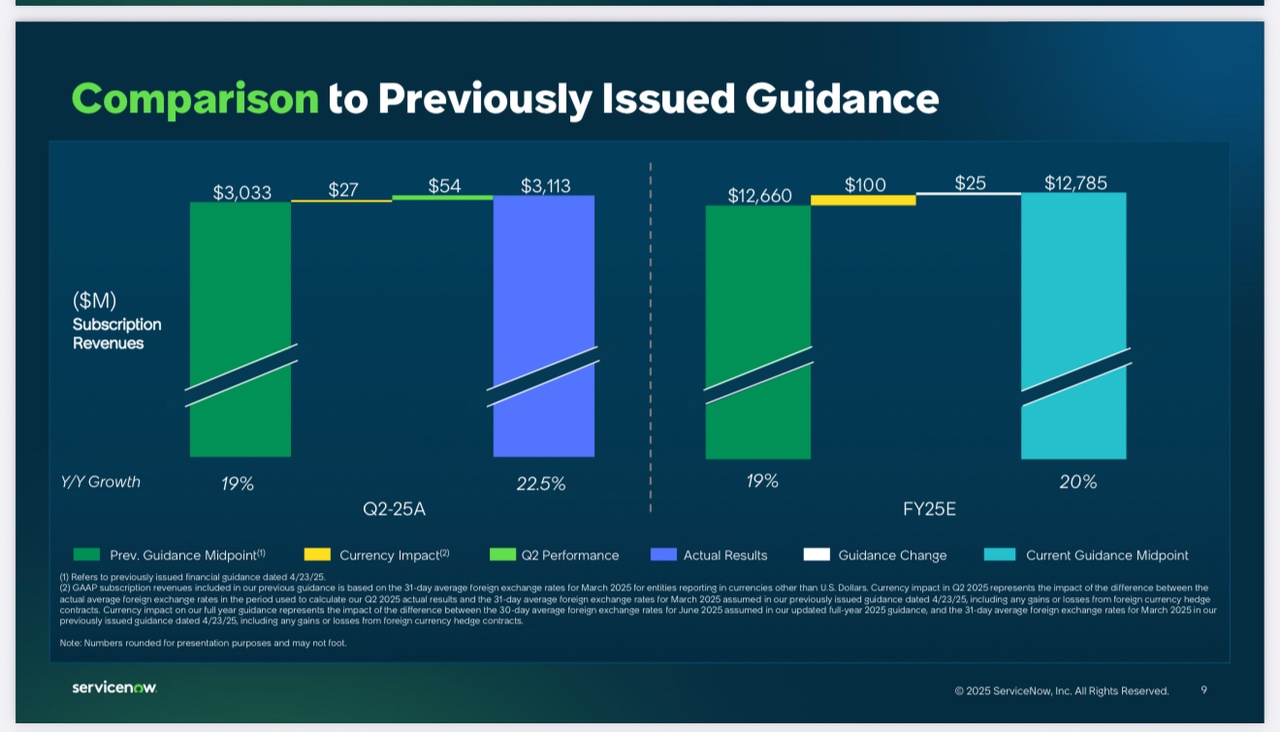

$NOW (-0,5%) presented consistent and convincing results in the second quarter of 2025, underlining the company's leading role in the field of AI-supported enterprise software.

Financial highlights (Q2 2025 vs. Q2 2024):

Revenue:

Contract portfolio (RPO):

Customer growth:

Profitability (non-GAAP):

Cash flow:

Strategic development:

AI integration: the "ServiceNow AI Platform" is positioning itself as the central operating system for business transformation. The "Now Assist" offering continues to be in high demand and is on track to reach an ACV of USD 1 billion by 2026.

Product focus areas: Focus on "Agentic AI", data management, CRM and workflow automation. Introduction of the "AI Control Tower" and "AI Agent Fabric".

Partnerships: Strengthening the ecosystem through partnerships with AWS, NVIDIA, UKG and Cisco.

Acquisitions: Completion of the acquisition of data.world to improve data catalog and governance capabilities.

Market recognition: Renewed positioning as a leader by leading analysts such as Forrester and IDC.

Outlook & assessment

Forecast 2025 (non-GAAP, raised):

Q3 2025 forecast (non-GAAP):

Assessment: ServiceNow continues to show that its business model with high recurring revenues and significant profitability is working extremely well. The strategic focus on AI-driven enterprise solutions positions the company optimally in a growing market. The raised annual forecast signals management confidence and sustainable growth. ServiceNow remains an attractive core investment in the tech sector.

Principais criadores desta semana