$PDD (-1,52%)

$601318

$EH

$OKTA (-1,16%)

$MDB (-1,49%)

$3690 (+0,57%)

$KSS (+3,55%)

$ANF

$CRWD (-0,46%)

$SNOW (-0,55%)

$HPQ (+0,88%)

$NTNX (+0,03%)

$NVDA (-0,26%)

$DHER (-0,51%)

$LI (-4,32%)

$DELL (-1,69%)

$S (+0,99%)

$IREN (+9,75%)

$ULTA (+0,4%)

$MRVL (+0,22%)

$AFRM (-1,47%)

$ADSK (-0,33%)

$BABA (+0,12%)

Discussão sobre PDD

Postos

50Quarterly figures 25.08-29.08.25

Small portfolio update If you're interested, you can add your two cents. Portfolio sale:

$CCL (-0,33%) One of my long-term stocks has been trimmed back from overweight (4%) to normal size (2.5%). A few months ago I bought at €15 and €17 and have now partially sold at €25. The share will not disappear completely for me. I am hoping for a recovery of €30+. If it falls below €20 again, I will slowly overweight again. This game has been played from time to time for the last 5 years and the positive management of the debt, in addition to the constant good news, slowly speaks for a breakthrough.

$BAYN (-0,88%) I bought in at the beginning of April at €22, but have now decided to close the position at just under €27. I actually wanted to hold the share long, but somehow I can't warm to it. Perhaps it will find its way back into my portfolio at some point.

$AVGO (+0,39%) In the April crash, I bought the stock at €151 (2% weighting) using a Lombard loan (10% portfolio size), among other things, and the position has now been closed at €224. More was not my target recovery to old ATH.

$9618 (-0,44%) Unfortunately, this position was closed with a minus of 13%. The reason for this was the annual rebalancing in which the China portion had become too large for me. As I was convinced by $1211 (-3,15%) , $BABA (+0,12%) and $PDD (-1,52%) JD had to give way.

Portfolio purchase:

$OXY (+0,65%) Bought another small tranche. After the 10% slump, I had some capital left over, which was invested at 36.50. One of my larger individual bets with a 5% portfolio weighting.

A new addition to the portfolio is $TX (+2,99%) with a small position of 1%. The reason sounds stupid, but it's a little chat GPT experiment. I wanted to be told which stocks were selected according to the Columbia Buffet approach. I was given 5 suggestions, some of which were frankly garbage. But this stock somehow got me hooked. Which is why I took the risk with only 1% of my portfolio (just over 1k).

Note:

My single stock portfolio Smartbroker plus makes up 2/3 of the asset class equities.

1/3 are Etf's with Trade Republic.

In total, equities make up 90% of my investable assets.

In addition to my three equity ETFs, TR holds my real estate REIT ($O (+0,83%) approx. 5%), as well as my gold ETC ($SGBS (+0,38%) 2.5%) and my gold miner Etf ($GDXJ (+0,15%) 2.5%) which make up the remaining 10%.

Approximate total assets 100k (more like 95k :/ due to volatility) but debt free (except for a 3.5k balance on the Lombard loan). I have been investing since 2020 and am 28 years young.

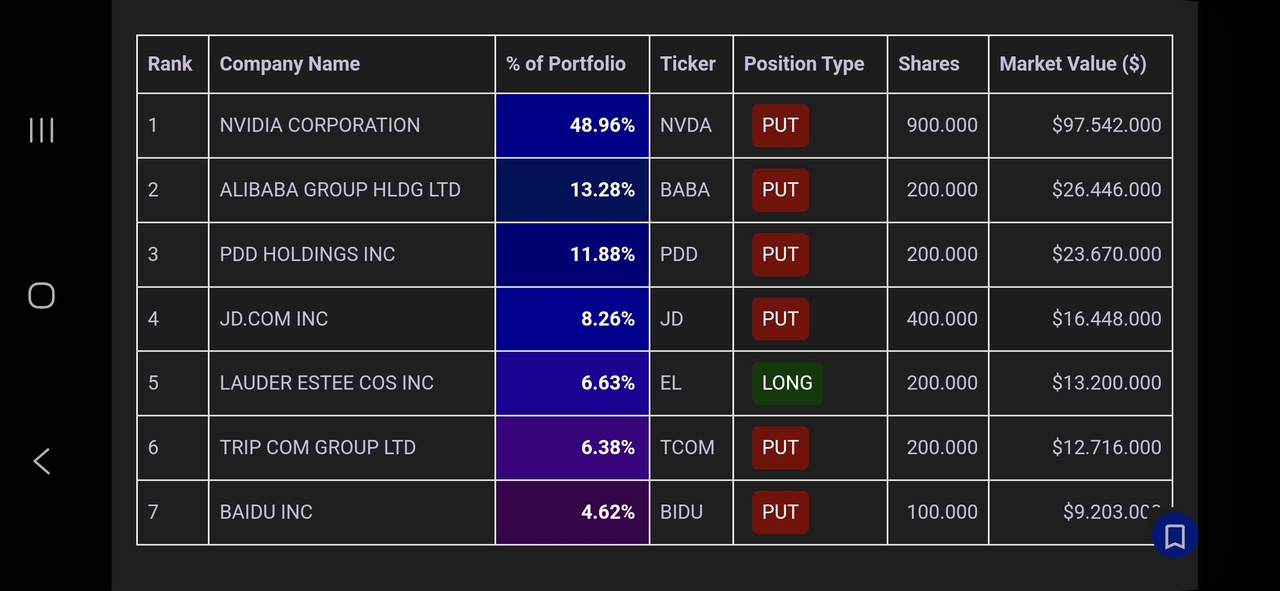

Portfolio Michael Burry Q1/25

That doesn't look very optimistic. 🤔

$NVDA (-0,26%)

$BABA (+0,12%)

$PDD (-1,52%)

$JD (-0,33%)

$EL (+0%)

$TCOM (-1,57%)

$BIDU (+2,17%)

Source: www.michael-burry.com

“COMPRAS POR IMPULSO? SÓ SE FOR EM AÇÕES DA PDD” - PDD HOLDINGS: TESE DE INVESTIMENTO

A PDD Holdings opera as plataformas Pinduoduo e Temu, duas das mais relevantes iniciativas de e-commerce da atualidade.

📌 Destaques do relatório:

✅ Modelo asset-light e escalável, com forte uso de dados, gamificação e inclusão digital — focado em consumidores sensíveis ao preço.

🛒 Pinduoduo domina o interior da China com mais de 900M MAUs, enquanto a Temu cresce de forma acelerada no Ocidente, já presente em +70 países.

💰 A empresa cresceu 67% CAGR (2019–2024) e, mesmo com margens brutas em ligeira queda (impacto da Temu), mantém margens operacionais sólidas (27,5% em 2024) e um ROIC de 94% (!).

💼 $PDD (-1,52%) tem um balanço robusto, com mais de $45B em cash, que poderia ser usado para recompras estratégicas ou aquisições no futuro.

🌍 A empresa atua num mercado global competitivo, enfrentando players como Alibaba, Amazon e Shein, mas diferencia-se com uma estrutura ágil, foco em custo-benefício e estratégias sociais de aquisição de usuários.

⚠️ Riscos? Sim: concorrência feroz, tensões regulatórias China-EUA, e possível pressão sobre margens. Ainda assim, o modelo da PDD mostra-se resiliente e altamente eficiente na conversão de receita em cash.

📉 Face à cotação atual a Empresa aparenta estar bastante desvalorizada, oferecendo uma margem de segurança muito interessante para quem quer ter exposição ao mercado chines.

📊 Uma Empresa com fundamentos sólidos, crescimento estrutural, e potencial de valorização num dos setores mais dinâmicos da economia digital global.

🔎 Se quiseres saber mais sobre esta oportunidade de investimento visita a análise completa em: https://substack.com/@dalemcapital/note/p-161005463

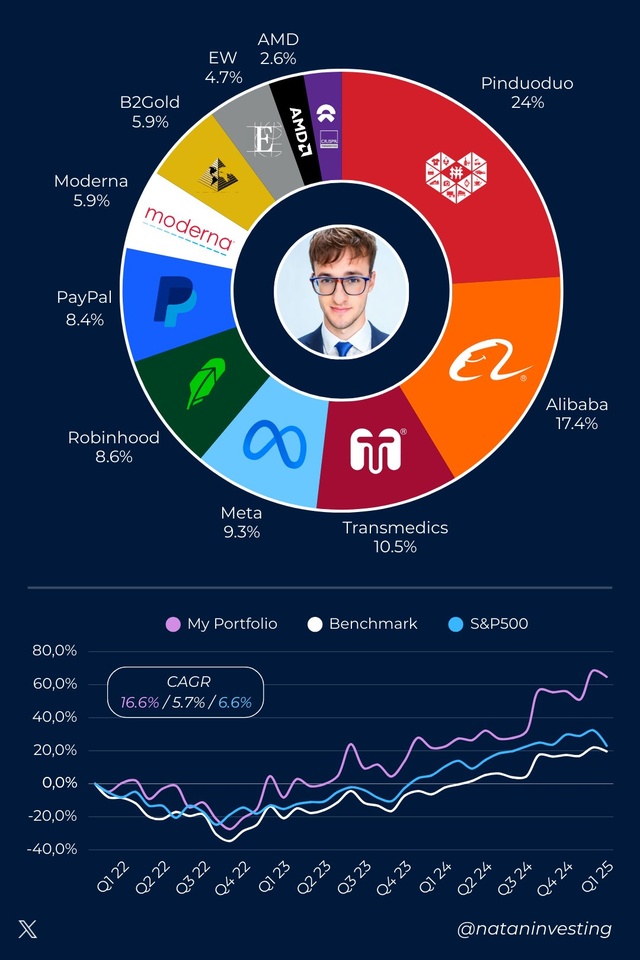

Q1 PORTFOLIO UPDATE

Natan YTD: +9.1%

S&P500 YTD: -4.6%

My positions: $PDD (-1,52%)

$BABA (+0,12%)

$TMDX (+2,02%)

$META (-1,14%)

$HOOD (+2,68%)

$PYPL (+0,33%)

$MRNA (-0,92%)

$BTO (+0,4%)

$EW (+0,45%)

$AMD (-1,14%)

ALLOCATION BY COUNTRY:

🇺🇸 US: 50%

🇨🇳 China: 42%

🇨🇦 Canada: 6%

🇨🇭 Switzerland: 2%

What do you think about my portfolio?

Pinduoduo Q4'24 Earnings Highlights:

🔹 Adj. EPS: ¥20.15 (Est. ¥19.68) 🟢

🔹 Revenue: ¥110.62B (Est. ¥116.03B) 🔴; UP +24% YoY

🔹 Operating Profit: ¥25.59B; UP +14% YoY

🔹 Net Income: ¥27.45B; UP +18% YoY

Segment Performance

🔹 Online Marketing Revenue: ¥57.01B; UP +17% YoY

🔹 Transaction Services Revenue: ¥53.60B; UP +33% YoY

Key Financial Metrics

🔹 Operating Expenses: ¥37.22B; UP +19% YoY

🔹 Sales & Marketing Expenses: ¥31.36B; UP +18% YoY

🔹 R&D Expenses: ¥3.78B; UP +32% YoY

🔹 General & Admin Expenses: ¥2.09B

Cash & Balance Sheet Metrics

🔹 Operating Cash Flow: ¥29.55B

🔹 Cash, Equivalents & Short-Term Investments: ¥331.6B

Management Commentary

🔸 Co-CEO Lei Chen: "We remained committed to driving sustainable growth for both our platform ecosystem and the broader supply chain."

🔸 Co-CEO Jiazhen Zhao: "Leveraging our digital capabilities, we continue to give back to consumers and support quality merchants."

🔸 VP of Finance Jun Liu: "Stable financial results supported by resolute execution of our high-quality development strategy."

JD.com - The Chinese e-commerce giant with potential for 2025?

JD.com - The Chinese e-commerce giant with potential for 2025?

JD.com ($9618 (-0,44%)) is one of the leading e-commerce providers in China and has established itself as a serious competitor to Alibaba. After struggling with economic challenges and regulatory problems in recent years, the question is: can JD.com regain its former strength in 2025?

Overview: What does JD.com do?

JD.com is a Chinese company that sells a wide range of products through its platform, including electronics, household goods and groceries. It operates both traditional e-commerce retail and an extensive logistics network that enables it to deliver products faster and more efficiently.

✅ JD Mall: The main platform for B2C e-commerce, which has a large market share in China.

✅ JD Logistics: A leading logistics company that also operates for other brands and platforms.

✅ JD Health & JD Digits: Subsidiaries operating in the health and digital services sectors.

✅ Collaborations with Walmart and Google: Global partnerships to expand reach and innovative strength.

JD.com relies on an integrated business modelthat ranges from logistics and cloud services to digital healthcare solutions, which sets the company apart from other competitors.

Competition: Who are the competitors?

🔸 Alibaba $9988 (+0,12%) (Tmall, Taobao): The largest e-commerce competitor in China with a broader market coverage.

🔸 Pinduoduo $PDD (-1,52%)

: An emerging competitor that has established itself through group buying and low prices.

🔸 Amazon $AMZN (-0,19%)

: Even though Amazon is less dominant in China, it still has a presence in the international market, especially in cloud services.

🔸 Meituan $3690 (+0,57%)

: Another player in online retail and on-demand services, especially in food delivery.

JD.com has the advantage that it has a strong logistics network and a good B2B business However, it continues to be burdened by competition and regulatory challenges in China.

Opportunities: Why could JD.com make a comeback in 2025?

✅ Strong growth in logistics and cloud: JD Logistics and JD Cloud offer promising growth opportunities, especially in international business.

✅ Expansion into rural areas: JD.com has a strong presence in rural areas of China and could benefit from broader urbanization and increasing demand.

✅ Resurgent e-commerce market: Despite economic uncertainties, the Chinese e-commerce market is expected to grow in the long term - JD.com could benefit greatly from this.

✅ Innovations in FinTech and healthcare: JD.com has made great strides in FinTech and digital health solutions in recent years. These sectors could provide stable revenues in the future.

✅ Reduced regulatory uncertainty: After years of regulatory challenges, the situation in China could stabilize, making the market attractive for JD.com again.

Risks: What could continue to weigh on JD.com?

⚠️ Regulatory uncertainties: The Chinese state still retains significant influence over the market, and new regulations could weigh on JD.com.

⚠️ Competitive pressure from Alibaba & Pinduoduo: Strong competition from Alibaba and Pinduoduo remains a major challenge.

⚠️ Weak consumption in China: Weak economic recovery and falling consumer spending in China could slow growth.

⚠️ Dependence on B2B: JD.com generates a large proportion of its sales in the B2B sector. A slowdown in this market could affect growth targets.

⚠️ Geopolitical risks: Tensions between China and the West could have a negative impact on business activities, particularly in international trade and cloud services.

Conclusion: turnaround opportunity or value trap?

JD.com has the potential to benefit from the growth areas of logistics, cloud and FinTech in 2025. The company has been through tough times in recent years, but the fundamentals remain strong. If JD.com can maintain its market position in China and successfully expand into new business areas, it could make a remarkable comeback.

What do you think? Can JD.com take off again in 2025 or will it remain under pressure? 🚀

Opinion on China

Hello,

I wanted to hear your views on the China stocks / China situation. Basically I am bullish on China but open to all arguments / points of view.

I am currently still holding $BABA (+0,12%) (Alibaba) $1211 (-3,15%) (Byd) $PDD (-1,52%) (Pindudu) $9618 (-0,44%) (JD). I have sold $700 (+0,25%) (Tencent) (+- 40%) in the last China high October / September.

At that time I sold all China stocks (alibaba byd tencent) completely (almost optimal moment through 2 sales tranches) due to the exaggerated reaction after the press conference, despite my personal bullish attitude, with 10-50% profit margins per stock. After the exaggeration flattened out, I got back in (approx. 10-20% lower than the exit point) in November / December. Tencent was replaced by jd and pdd but will continue to be monitored.

I am currently in the situation of considering jumping out again, but I see the current performance for almost 1-2 months differently than in the first phase in October.

The shares have not risen as sharply and the current news is, in my opinion, different from back then. This makes it difficult for me to see the current situation as an exaggeration like back then, when there was only the government promise. Furthermore, many of the shares are established companies with currently still low -> fair valuations. Do you think the world is slowly making up for the neglect or is it just being exaggerated again?

Many large investors have generally been getting back into China for years in medium to large style, which is why I am still bullish.

I am aware of the political risk, which everyone has been reminded of since the Alibaba crash.

I'll share my individual share portfolio to show you the current weighting there.

I have another portfolio with TR with etfs, 1 reit (approx. 10%) and 1 physical gold and miner etf (both 5%). I have just under 40% individual stocks/60% etfs reit gold cash

Podcast episode 73 "Buy High. Sell Low."

Podcast episode 73 "Buy High. Sell Low."

Subscribe to the podcast to beat cancer.

00:00:00 Donald Trump inauguration

00:15:40 Tempus AI A40EDP $TEM (+3,61%)

00:26:00 Groupon $GRPN (+5,32%)

00:30:20 Palantir $PLTR

00:35:00 Insider Trading

00:40:20 Netflix $NFLX (-0,42%)

00:59:00 Adobe AI $ADBE (-0,75%)

01:01:00 Alibaba $BABA (+0,12%)

$9988 (+0,12%)

01:07:40 Baidu $BIDU (+2,17%)

$9888 (+1,85%)

01:15:15 JD com $9618 (-0,44%)

$89618

$JD (-0,33%)

01:16:40 PDD Holdings $PDD (-1,52%)

01:19:00 Xpeng $9868 (-4,66%)

$XPEV (-4,78%)

01:21:00 Nio, BYD, Xiaomi, Huawei $9866 (-3,31%)

$NIO (-3,35%)$1810 (-0,61%)

$XIACY (-0,66%)

$81810

01:28:00 Li Auto $AUTO (+0,73%)

$LI (-4,32%)

01:35:20 Bitcoin $BTC (+2,08%)

Spotify

https://open.spotify.com/episode/4xzXvdMeMtWs5fgYoQaNHU?si=3JuxaaqaQ2KM55PHh5IYWg

YouTube

Apple Podcast

Títulos em alta

Principais criadores desta semana