$NDAQ (+1,49%)

$RTX (+0,72%)

$KO (-1,23%)

$MMM (+2,81%)

$NOC (+1,54%)

$LMTB34

$OR (+0,6%)

$TXN (+0,46%)

$NFLX (-0,47%)

$HEIA (-1,21%)

$SAAB B (-1,74%)

$UCG (+0,96%)

$BARC (+1,78%)

$GEV (+3,33%)

$TMO (+0,14%)

$T (-3,77%)

$MCO (+1,63%)

$IBM (+3,79%)

$SAP (+2,92%)

$TSLA (+1,82%)

$AAL (+5,1%)

$FCX (+1,08%)

$HON (+6,73%)

$DOW (+12,42%)

$NOKIA (+10,84%)

$TMUS (-3,47%)

$INTC (+11,6%)

$NEM (+0,57%)

$F (+4,11%)

$PG (+0,24%)

$GD (+1,24%)

Discussão sobre NOC

Postos

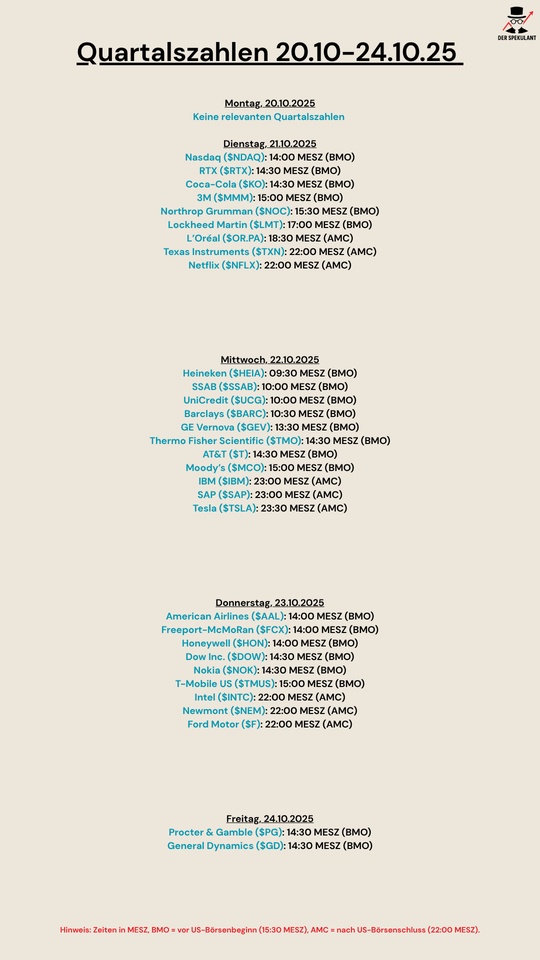

60Quartalsberichte 21.10-24.10.25

Good luck

Since my Staffel purchase lowered the EK twice, we have seen worse prices in good times.

Now that the waves are rising, the stop loss was triggered yesterday.

10 % + 3x dividend over approx. 9 months - target reached.

Hope my motivated repeat buyers

@GHF

@Thomas_1963

@ColdzeroNL

@trade_commander_725

reach their target.

S

ome like the rest who haven't posted.

When I buy, the price falls, when I sell, the price rises.

Notice when GQ buys it is a negative trend.

My forecast: annual low will be reached, customs and profit margins will cut the dividend.

Money will be invested in Ares $ARCC (-0,29%) <16, Freenet $FNTN (-0,73%) <26 will be invested.

$NOC (+1,54%) Northrop is just running away from me and $4X0 (-0,93%) Steyr is coming back.

Oshkosh also a winner of the strong armament of the USA and possible quadrupling of the budget on the part of the Pentagon?

$LMT (+0,78%)

$NOC (+1,54%)

$RTX (+0,72%)

$BA (+0,49%)

Oshkosh Defense, a division of the financially strong $OSK (+3,43%) Corporation with an annual turnover of over 10.3 billion US dollars, announced on Wednesday that it had received a contract from the U.S. Army worth 89 million US dollars.

The order includes new Palletized Load System (PLS) A2 vehicles, kits and installations under the Family of Heavy Tactical Vehicles contract.

According to Investing.com, the company has strong liquidity, with current assets exceeding current liabilities.

The PLS A2 vehicles are equipped with advanced technologies, including by-wire functionality for autonomous operation and active safety systems designed to enhance the protection of soldiers in complex operational environments.

These capabilities support cross-domain operations on long-range battlefields and along contested supply lines.

"Together, we are delivering next-generation capabilities that better protect soldiers in today's missions while laying the foundation for future fleet sustainability," said Pat Williams, Chief Programs Officer at Oshkosh Defense.

The Family of Heavy Tactical Vehicles program includes the A4 Heavy Expanded Mobility Tactical Truck and enables the U.S. Army to reduce lifecycle costs through the use of standardized, militarized commercial components. The program allows the U.S. Army to efficiently integrate new and modernized variants, with vehicle procurement possible through August 2029.

The company has maintained its dividend payments for 13 consecutive years and currently has a dividend yield of 1.57%.

In other recent news, Oshkosh was the focus of several analysts following the publication of the second quarter report. UBS raised its price target for Oshkosh to USD 164, citing strong quarterly results in which earnings per share exceeded consensus estimates and profit margins improved in all business segments.

Raymond James also raised the price target to USD 155 and emphasized the adjusted earnings per share of USD 3.41, which exceeded expectations.

DA Davidson also raised its target to USD 160, citing a normalization of the situation in the Access segment.

KeyBanc was even more optimistic and raised its target price from USD 140 to USD 180.

The reason given was higher estimates for the 2027 financial year, despite lower expectations for the "Access" segment.

KeyBanc also reiterated its "Overweight" rating and emphasized Oshkosh's solid progress in achieving its 2028 targets and the elimination of a previously expected tariff charge of USD 0.50.

Pentagon plans to quadruple production - billion-euro opportunity for US defense stocks

$RTX (+0,72%)

$LMT (+0,78%) . $BA (+0,49%)

$NOC (+1,54%)

Good morning, my dears,

Yesterday, the Minister of War invited his generals from all over the world to a meeting.

This was certainly not just about domestic policy.

As it appeared to the outside world.

In the spring, everyone was still pouncing on the European defense companies, and hardly anyone wanted the US stocks, even at good valuations.

Even here, my words were "You can't do it without the USA". But I hardly took the opportunity myself.

Although in hindsight it was also good to buy up my existing US stocks during the small 🍊 crash.

Dear all, which US defense companies do you think are worth buying in terms of growth and valuation?

Hundreds of missiles used up in the Middle East and the spectre of China breathing down our necks: The US defense industry is said to be ramping up like never before. For investors, this could set off a price rocket.

US arms industry to massively increase missile production.

Pentagon demands doubling or quadrupling of production.

Geopolitical tensions drive demand for armaments.

You can find the full article under the link ⬇️

What the EU is planning with its "drone wall" / Dobrindt announces drone defense center / Austria discusses drones & drone defense

Hello my dears,

as I was shocked to discover while watching today's "Presseclub". The EU, and Germany in particular, is very poorly positioned when it comes to critical infrastructure, cyber attacks and drone defense. The plan here is to improve security at all costs.

Dear all, which companies do you think should benefit from this?

$DRO (+2,66%)

$AVAV (+3,27%)

$ESLT (+1,94%)

$EOS (+9,91%)

$YSN (+0%)

$LMT (+0,78%)

$RTX (+0,72%)

$HAG (+2,22%)

$AXON (+1,94%)

$FLT (-0,48%)

$FQT (+4,62%)

$RHM (-0,42%)

Following airspace violations in Denmark and Eastern Europe, the European Union is pushing ahead with the construction of a "drone wall". What is known about the project so far.

Following several mysterious drone overflights in Denmark and repeated airspace violations by Russian drones in Eastern European countries, the EU wants to better protect its eastern flank. At the heart of the plans is a so-called "drone wall" - a defense system designed to detect, track and intercept unmanned aerial vehicles. What exactly the EU is planning, who is involved and how quickly the wall could be built: the most important questions and answers.

Who is building the drone wall?

The plans for the drone wall were presented at a video conference of EU defense ministers. The conference was mainly attended by Eastern European EU states, Bulgaria, Estonia, Latvia, Lithuania, Poland and Romania, as well as Finland. EU High Representative for Foreign Affairs Kaja Kallas, several representatives of the NATO defense alliance and the current Danish EU Council Presidency also took part. Conspicuously absent from the meeting was Germany - although security experts in this country have long warned of serious gaps in drone defense.

The EU wants to use its own financing instruments to fund this. EU Defense Industry Commissioner Kubilius spoke of a "protective shield for the eastern flank that will benefit the whole of Europe". At the same time, national defence budgets and the European defence industry are to be mobilized.

When will the drone wall be in place?

EU Defense Industry Commissioner Kubilius said in an interview with the news website Euractiv that the drone wall could be built within a year. However, EU officials do not expect the development of a comprehensive sensor network to improve airspace surveillance to be completed until the end of 2026. The development of an interception system is likely to take even longer. In the short term, additional sensors are to be installed first.

With material from the news agencies dpa and AFP

Dobrindt announces drone defense center

Following numerous drone sightings in Europe, the German government wants to introduce countermeasures. Interior Minister Dobrindt classifies the threat as "high" and is planning a drone defense center.

The German government wants to set up a drone defense center. This is Interior Minister Alexander Dobrindt's response to the numerous sightings of missiles of unknown origin. The CSU politician said that there was a threat that could definitely be classified as "high".

Detecting, intercepting and shooting down drones are the basis for drone defense. Repositioning is an urgent project, explained Dobrindt.

Pooling expertise

According to him, the drone defense center should bundle the competencies of the federal police, the Federal Criminal Police Office and the police authorities of the federal states. Dobrindt said he wanted to bring together expertise and initiate new research projects.

New technology for fighting drone against drone

Fighting drones with nets or by so-called "jamming" (interrupting radio signals) has limited effect, according to Dobrindt. The Minister of the Interior is focusing on developing new technologies for drone-on-drone combat: "We can't wait for others to make this available".

According to the Interior Minister, the new drone defense center is the first part of a two-pillar strategy. As the second pillar, Dobrindt announced a new version of the Aviation Security Act in order to regulate the legal basis for defense measures.

DroneVation in Vienna - Austria discusses drones & drone defense. $RHM (-0,42%)

Appropriate systems are needed for defense. The Austrian head of armaments was accordingly proud to announce that he was the first customer for Rheinmetall's Skyranger system. He was in Zurich just last week and was able to see the progress of the procurement. "I can tell you that the 3.5 cm cannon systems will arrive on time and on schedule."

Painful for the German Bundeswehr - it will have to wait longer than planned for its new Skyrangers. Austria will receive its 36 air defense turrets earlier. The German Armed Forces have selected the Pandur Evo from GDELS as the carrier platform, as the vehicle is also available in other functions in the troops.

https://defence-network.com/1-dronevation-oesterreich-diskutiert-drohnen/

AeroVironment: Step by step towards becoming a defense tech group

One of the biggest beneficiaries of the drone trend has traditionally been the US company AeroVironment from Arlington in the US state of Virginia. Founded in 1971, the company once made a name for itself with aircraft innovations and has been taking off as a drone supplier since the 2000s. AeroVironment primarily manufactures small and medium-sized reconnaissance drones and unmanned ground vehicles. Until 2025, AeroVironment was mainly known as a drone specialist, but in May the company bought defense technology provider BlueHalo for USD 4.1 billion as part of a share swap. Thanks to this acquisition, the company is now a diversified defense company with capabilities in space, drone defense, cyber, laser weapons and satellite technology. At the end of the third quarter of the 2025 financial year, the order backlog reached a record high of USD 764 million.

While AeroVironment is valued at around USD 10 billion on the stock exchange, the Canadian drone specialist Volatus Aerospace, which has also been active for many years, only has a valuation of around EUR 200 million. Despite the significant difference in valuation, Volatus has also already proven that it is compatible with NATO standards. In 2025, Volatus landed NATO contracts in the areas of education and training as well as for the delivery of reconnaissance drones. Analyst Rob Goff from Ventum Capital sees these successes as indications of further potential for NATO contracts. Media reports repeatedly refer to Volatus' bulging order pipeline.

In addition to the military sector, Volatus also offers civilian solutions, for example for monitoring infrastructure such as bridges or pipelines, through to the Condor XL transport drone, with which the company intends to carry out test flights from the end of the year to test its use in the areas of logistics and forestry. Military use of such transport drones is also conceivable in principle.

Airborne lasers - the next generation of drone defense

While the ground-based laser weapon developed in Israel has already proven its effectiveness against drones, efforts to develop an airborne system have been intensified. The airborne laser program is being led by the Israeli company Elbit Systems. Meanwhile, the lasers developed as a defensive weapon are also being considered for offensive use.

https://defence-network.com/luftgestuetzte-laser-drohnenabwehr/

Israeli drone defense for German warships?

https://marineforum.online/israelische-drohnenabwehr-fuer-deutsche-kriegsschiffe/

Drone defense: Bundeswehr receives first interceptor drones from Argus Interception

https://www.hartpunkt.de/drohnenabwehr-bundeswehr-erhaelt-erste-fangdrohnen-von-argus-interception/

https://argus-interception.com/de/

$FQT (+4,62%) Frequentis

$AXON (+1,94%) (my dears, perhaps the Kassel-based company has a good chance)

US group Axon buys Kassel-based company Dedrone

The company Dedrone discovered a gap in the market for itself with the defense against approaching drones. With great success. Now it is being taken over by an American security company. The company site in Kassel is also set to benefit from this.

https://esut.de/2025/08/meldungen/62305/eos-liefert-100-kw-laser-drohnenabwehr/

Echodyne launches the EchoShield Rapid Deployment Kit on the market

With the proliferation of drones in the airspace, the need to quickly deploy situational awareness zones that detect, track, identify and contain threats is increasing. The RDK is designed for quick and easy deployment of four radars for robust, high-precision hemispheric coverage. The addition of the RDK to the EchoShield portfolio creates leading positions in all areas - from fixed sites to mobile deployments (OTM) to rapidly deployable temporary missions.

About Echodyne. $NOC (+1,54%)

Echodyne, the radar platform company, is a U.S. designer and manufacturer of advanced commercial radar systems for defense, government and commercial market applications. The company combines the patented Metamaterials Electronically Scanned Array (MESA®) architecture with powerful software and machine learning to deliver highly accurate situational awareness data that locates airborne and ground-based activity with unmatched speed, accuracy and precision. Echodyne's products are proven and trusted by military, government, integrators and critical infrastructure around the world. They set a new standard for radar quality. The privately held company is headquartered in Kirkland (WA, USA) and is backed by Bill Gates, NEA, Madrona Venture Group, Baillie Gifford, Northrop Grumman and Supernal, among others. See Radar in action at Echodyne.com.

Rohde & Schwarz presents new multi-band jammer for drone defense.

(Rohde & Schwarz GmbH & Co. KG is a privately held company and therefore has no shares,)

Cyber security - the armor of the future

Hello dear Getquin Community,

Over the past few days, I have been working intensively on the topic of cyber security and its fundamental importance in various sectors such as healthcare, technology, energy, armaments & defense, e-commerce, software, insurance, industry, utilities, commodities, banks, fintech, holdings, crypto and blockchain. I took a closer look at the big players, the hidden champions and the essential blade manufacturers in the industry. My aim was to gain as comprehensive a picture as possible of the different levels of this industry.

If I have overlooked any important aspects or have not categorized something correctly, I look forward to your comments and interesting additions @Tenbagger2024

@Multibagger

@Simpson

@Vegasrobaina . Together we can understand the topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

At the request of @Multibagger I have subsequently added my personal favorites in each sector. I have an investment horizon of five to ten years. In addition to the quarterly figures, my main focus was on the long-term competitive advantages and the strength of the respective moat.

Contribution:

Cybersecurity is evolving from a peripheral topic to the foundation of global markets. Whether healthcare, banking, utilities, armaments & defense, energy, industry or the digital infrastructure for artificial intelligence and blockchain, the need for protection mechanisms is increasing everywhere. While the big players such as $PANW (+0,76%) Palo Alto Networks, $CRWD (+4,14%) CrowdStrike or $ZS (+3,15%) Zscaler are in the spotlight, more and more specialized providers are emerging that are essential in their niches and often have disproportionately high growth potential. Hidden champions such as $SECT B (+1,48%) Sectra in the healthcare sector, $NCNO (+0,9%) nCino in the banking sector or $ESTC (+1,16%) Elastic in the data center show that cyber security has long been a diversified ecosystem. In addition, we must not overlook the blade manufacturers, i.e. the companies that provide the technological basis. These include chip manufacturers such as $NVDA (+1,16%) , $INTC (+11,6%) Intel or $AMD (+3,4%) AMD, data center operators such as $EQIX (+0,28%) Equin$DLR (+2,65%) Digital Realty as well as software and infrastructure providers such as $ESTC (+1,16%) Elastic, $DDOG (+2%) Datadog or $ANET (+5,04%) Arista Networks, without whose technology the security providers' solutions would not be scalable. The capital markets are reacting to this with valuation premiums, as the dependence on secure infrastructures is comparable to electrification in the 20th century. Investors are now faced with the question of whether to favor the established market leaders or invest in smaller companies that fly under the radar but could potentially be the real winners of tomorrow.

🔑Takeaway:

Cybersecurity is not an isolated trend, but a key investment factor across all industries from hospitals to data centers from payments to crypto platforms.

Healthcare

Major players:

$PANW (+0,76%) Palo Alto Networks (PANW), $FTNT (+0,03%) Fortinet (FTNT), $CHKP (-0,94%) Check Point (CHKP), $CRWD (+4,14%) CrowdStrike (CRWD), $S (+0,5%) SentinelOne (S), $CYBR (+1,11%) CyberArk (CYBR), $ZS (+3,15%) Zscaler (ZS), $NET (+3,26%) Cloudflare (NET), $AKAM (-0,6%) Akamai Tech. (AKAM)

- Core provider for firewalls, zero trust, endpoint and web security

My top 2 recommendation in this sector are $ZS (+3,15%) Zscaler global Zero Trust Exchange, huge barrier to entry as infrastructure is built globally and $PANW (+0,76%) All-in-one platform, extremely high customer retention, hard to replace + acquisition of the company $CYBR (+1,11%)

Hidden champions:

$SECT B (+1,48%) Sectra (SECT-B.ST) - secure imaging & healthcare security

$VRNS (+1,52%) Varonis Systems (VRNS) - protection of sensitive patient data

Imprivata (private, partnerships with listed players) - identity management for clinics

My top recommendation

$SECT B (+1,48%) Niche leadership in healthcare security & medical technology

Blade manufacturer:

$NVDA (+1,16%) Nvidia (NVDA), $INTC (+11,6%) Intel (INTC), $AMD (+3,4%) AMD (AMD) - Chips & computing power for security appliances

$EQIX (+0,28%) Equinix (EQIX), $DLR (+2,65%) Digital Realty (DLR) - Data center infrastructure for clinical data

$ESTC (+1,16%) Elastic (ESTC), $DDOG (+2%) Datadog (DDOG) - basic software for monitoring & analytics

My top 2 recommendations are $NVDA (+1,16%) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,28%) - largest global colocation provider, enormous switching costs

🔑 Takeaway healthcare

Healthcare data is highly sensitive and clinics are at high risk of ransomware. In addition to large security providers, hidden champions such as Sectra and Varonis are gaining in importance as they secure directly at the interface between patient data and medical devices.

Technology, Data centers & AI, Telecommunications

Major players:

$ZS (+3,15%) Zscaler (ZS), $S (+0,5%) SentinelOne (S), $CHKP (-0,94%) Check Point (CHKP)

- Protection for cloud and AI environments

My top recommendation $ZS (+3,15%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$ESTC (+1,16%) Elastic (ESTC) - Security-Analytics

$ANET (+5,04%) Arista Networks (ANET)

- Network switches for data centers

My top recommendation $ANET (+5,04%) - High-end switches, hyperscaler customers

Shovel manufacturer:

$EQIX (+0,28%) Equinix (EQIX), $DLR (+2,65%) Digital Realty (DLR)

- Data center infrastructure

$NVDA (+1,16%) Nvidia (NVDA), $INTC (+11,6%) Intel (INTC), $MRVL (-0,07%) Marvell Tech. (MRVL)

- Chips & computing power for AI and security

My top 2 recommendation $NVDA (+1,16%) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,28%) - largest global colocation provider, enormous switching costs

Special players Telecommunications

$AKAM (-0,6%) Akamai Tech. (AKAM) & Cloudflare (NET) - secure traffic and mobile data

$RDWR (+1,81%) Radware (RDWR) - DDoS protection for telcos

$CSCO (-0,46%) Cisco (CSCO) - network security for carriers

$CLAV (-2,99%) Clavister Holding AB (CLAV) - through SD-WAN and carrier security

My top recommendation $AKAM (-0,6%) - Established CDN + Security

🔑 Takeaway technology, data centers & AI

Data centers and AI platforms are the backbone of the digital economy. Zero Trust and cloud security from Zscaler or SentinelOne meet shovel manufacturers such as Equinix or Nvidia, who are indispensable with infrastructure and chips.

Energy

Major players:

$FTNT (+0,03%) Fortinet (FTNT, NASDAQ) - OT/ICS security for power grids and power plants

$PANW (+0,76%) Palo Alto Networks (PANW, NASDAQ) - Zero Trust & network protection for energy suppliers

$CHKP (-0,94%) Check Point (CHKP, NASDAQ) - Critical infrastructure protection, gas and oil industry

My top recommendation $FTNT (+0,03%) - ASIC hardware + software, cost advantage

Hidden champions:

Dragos (private, IPO candidate) - leader in OT security, specialized in energy infrastructures

$RDWR (+1,81%) Radware (RDWR, NASDAQ) - DDoS defense for energy networks

$NCC (-0,55%) NCC Group (NCC.L, London) - penetration tests & audits for utilities

$CLAV (-2,99%) Clavister Holding AB (CLAV) - OT/ICS and infrastructure security

My top recommendation $CLAV (-2,99%) - small niche player (carrier security)

Shovel manufacturer:

$SBGSY (+1,53%) Schneider Electric (SBGSY, OTC) - OT/ICS hardware with security components

$ENR (+2,9%) Siemens Energy (ENR, Frankfurt) - Energy infrastructure with embedded security solutions

$AVGO (+2,3%) Broadcom (AVGO, NASDAQ) - Security chips for networks in energy environments

My top recommendation $AVGO (+2,3%) - Chip giant + Symantec Enterprise Security

E-Commerce

Major players:

$NET (+3,26%) Cloudflare (NET, NYSE) - DDoS and API protection for online stores & payment platforms

$AKAM (-0,6%) Akamai (AKAM, NASDAQ) - Application security & bot management in e-commerce

$FFIV (+1,95%) F5 Networks (FFIV, NASDAQ) - API & payment security for digital platforms

My top recommendation $NET (+3,26%) - worldwide network for DDoS/API, network effects

Hidden Champions:

$RSKD (+0,24%) Riskified (RSKD, NYSE) - Fraud prevention in online trading

$VRNS (+1,52%) Varonis Systems (VRNS, NASDAQ) - Protection of customer data

$CYBR (+1,11%) CyberArk (CYBR, NASDAQ) - Identity & access protection for payment processes

My top recommendation $CYBR (+1,11%) - Standard for Privileged Access

Shovel manufacturer:

$V (+0,05%) Visa (V, NYSE) & $MA (-0,01%) Mastercard (MA, NYSE) - not classic cybersecurity, but operators of secure payment networks

$ESTC (+1,16%) Elastic (ESTC, NYSE) - fraud analytics for e-commerce platforms

$DDOG (+2%) Datadog (DDOG, NASDAQ) - monitoring & security analytics for retail infrastructure

My top recommendation $V (+0,05%) - Global payment network, enormous network effect

🔑 Takeaway:

Energy is particularly vulnerable due to OT/ICS systems, specialists such as Dragos are emerging here.

E-commerce needs fraud prevention in addition to traditional web security, which is why players such as Riskified are occupying a niche.

Armaments & Defense

Major players:

$NOC (+1,54%) Northrop Grumman (NOC, NYSE) - leader in cyberdefense for military & intelligence agencies, also developing offensive cyber capabilities

$BAESY (+0%) BAE Systems (BAESY, OTC) - strong cyber intelligence division, protects critical military and government networks

$RTX (+0,72%) Raytheon Technologies (RTX, NYSE) - defense company with growing cybersecurity portfolio for military communications & satellites

My top recommendation $NOC (+1,54%) - Top defense contractor with cyber dominance

Hidden champions:

$PLTR (+2,84%) Palantir Technologies (PLTR, NYSE) - Data and analytics platform with strong cybersecurity component, often for defense contractors

$CACI (+12,26%) CACI International (CACI, NYSE) - specializes in cyber intelligence, network protection and military IT services

$LDOS (+1,89%) Leidos Holdings (LDOS, NYSE) - IT and cybersecurity service provider for US defense and NATO

$CLAV (-2,99%) Clavister Holding AB (CLAV) - used by government and military organizations

$ADVE Advenica (ADVE) - Specialized security, relevant for government agencies and national infrastructure

My top recommendation $CACI (+12,26%) - Cyber intelligence, deep roots in the defense sector

Shovel manufacturer:

$LHX (+1,41%) L3Harris Technologies (LHX, NYSE) - provides communications and cyber hardware for military networks

$GD (+1,24%) General Dynamics (GD, NYSE) - with its IT division GDIT also a provider of cyber defense infrastructure

$KTOS (+6,05%) Kratos Defense (KTOS, NASDAQ) - specializes in drones, satellite systems and cyber hardening of defense communications

My top recommendation $GD (+1,24%) - strong role in defense cyber with GDIT

🔑 Takeaway:

In the defence sector, the boundaries between traditional defense and cybersecurity are becoming blurred. Alongside the large defense contractors, hidden champions such as Palantir, CACI and Leidos are emerging to provide pure cyber and data expertise. Shovel manufacturers such as L3Harris and Kratos secure the technical infrastructure.

Software & insurance

Big players:

$OKTA (+1,27%) Okta (OKTA), $CYBR (+1,11%) CyberArk (CYBR), $CRWD (+4,14%) CrowdStrike (CRWD)

- Identity, endpoint and cloud security

My top recommendation $CRWD (+4,14%) - Network effect through Falcon & Threat Graph

Hidden champions:

$VRNS (+1,52%) Varonis (VRNS) - Data Security

SailPoint (private, formerly NYSE) - Identity Governance

$FROG (-0%) JFrog (FROG) - DevSecOps & Supply-Chain-Security

$CYBE CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0%) Gen Digital (GEN) - one of the largest consumer cybersecurity providers worldwide (Norton, Avast, LifeLock), strong in identity protection and data protection for consumers & small businesses

$RBRK (+0%) Rubrik (RBRK) - data compliance and security in the area of cloud data security

My top recommendation $GEN (+0%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$MSFT (-0,03%) (MSFT), $GOOG (+1,14%) Alphabet (GOOGL), $AMZN (+1,02%) Amazon (AMZN)

- Cloud security base

$FFIV (+1,95%) F5 Networks (FFIV) - API protection for SaaS & insurance platforms

My top recommendation $GOOG (+1,14%) - global cloud security + Mandiant, strong moat through infrastructure & Threat Intel

🔑 Takeaway Software & Insurance

Data and identity protection take center stage. Major players such as Okta and CyberArk secure access, while hidden champions such as Varonis and JFrog provide specialist solutions. Cloud providers such as Microsoft and Amazon are both platform operators and security suppliers.

Industry, supply & raw materials

Major players:

$FTNT (+0,03%) Fortinet (FTNT), $CSCO (-0,46%) Cisco (CSCO), $PANW (+0,76%) Palo Alto Networks (PANW)

- Network protection for critical infrastructures

My top recommendation $FTNT (+0,03%) - ASIC hardware + software, cost advantage

Hidden champions:

$RDWR (+1,81%) Radware (RDWR) - DDoS protection

$NCC (-0,55%) NCC Group (NCC.L) - OT-Security & Penetration Tests

$SECT B (+1,48%) Sectra (SECT-B.ST) - secure infrastructure in the OT/healthcare intersection

$CLAV (-2,99%) Holding AB CLAV) - OT/ICS and infrastructure security

$ADVE Advenica (ADVE) - Specialized security, relevant for public authorities and national infrastructure

My top recommendation $ADVE - Specialized Crypto/OT-Security for public authorities

Shovel manufacturer:

$AVGO (+2,3%) Broadcom (AVGO) - security chips

Juniper Networks (JNPR) - network backbones

$ANET (+5,04%) Arista Networks (ANET) - high-end switches

My top recommendation $AVGO (+2,3%) - Chip-Giant + Symantec Enterprise Security

🔑 Takeaway Industry, Utilities & Commodities

OT/ICS systems in production, energy and raw materials are attractive targets. Fortinet and Palo Alto dominate, but hidden champions such as Radware and the NCC Group offer special expertise for attacks on industrial control systems.

Banks, Fintech & Holdings

Big players:

$CRWD (+4,14%) CrowdStrike (CRWD), $PANW (+0,76%) Palo Alto Networks (PANW), $ZS (+3,15%) Zscaler (ZS)

- Core protection for banks & digital platforms

My top recommendation $ZS (+3,15%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$NCNO (+0,9%) nCino (NCNO) - Cloud Banking Security

$NCC (-0,55%) NCC Group (NCC.L) - Audits & Compliance

$CYBE CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0%) Gen Digital (GEN) - through fraud prevention and identity topics

My top recommendation $GEN (+0%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$FFIV (+1,95%) F5 Networks (FFIV) - API security for payments

$AKAM (-0,6%) Akamai Tech. (AKAM) - Web & Payment Security

$ESTC (+1,16%) Elastic (ESTC) - Fraud Analytics

My top recommendation $FFIV (+1,95%) - Leader in Application & API Security

🔑 Takeaway Banks, Fintech & Holdings

High regulatory pressure makes cybersecurity a mandatory field. In addition to established providers, banks are relying on hidden champions such as nCino or Darktrace for cloud banking and anomaly detection. Shovel manufacturers such as F5 or Akamai secure payment APIs and banking portals.

Crypto & blockchain

Big players:

$PANW (+0,76%) Palo Alto Networks (PANW), $FTNT (+0,03%) Fortinet (FTNT), $CRWD (+4,14%) CrowdStrike (CRWD)

- Core protection for exchanges, wallets and blockchain infrastructure

My top recommendation $FTNT (+0,03%) - ASIC hardware + software, cost advantage

Hidden champions:

$BBAI (+5,47%) BigBear.ai (BBAI) - Blockchain Fraud Detection

$RIOT (+7,82%) Riot Platforms (RIOT) - Mining with a focus on security

$CHKP (-0,94%) Check Point - the new blockchain firewall initiative (Web3)

My top recommendation $CHKP (-0,94%) - Strong brand & existing customers, but limited innovative strength

Shovel manufacturer:

$NVDA (+1,16%) Nvidia (NVDA), AMD (AMD) - chips & mining hardware

$NET (+3,26%) Cloudflare (NET), $AKAM (-0,6%) Akamai Tech. (AKAM)

- Network protection for wallets & exchanges

My top recommendation $NVDA (+1,16%) - GPUs, quasi-monopoly in high-end compute

🔑 Takeaway crypto & blockchain

Crypto ecosystems are heavily affected by attacks on exchanges, wallets and smart contracts. While traditional security players provide protection, niche providers such as BigBear.ai and Riskified are emerging that specialize specifically in fraud and blockchain risks.

Source: Own analysis, image material: schwarz-digits

Market News

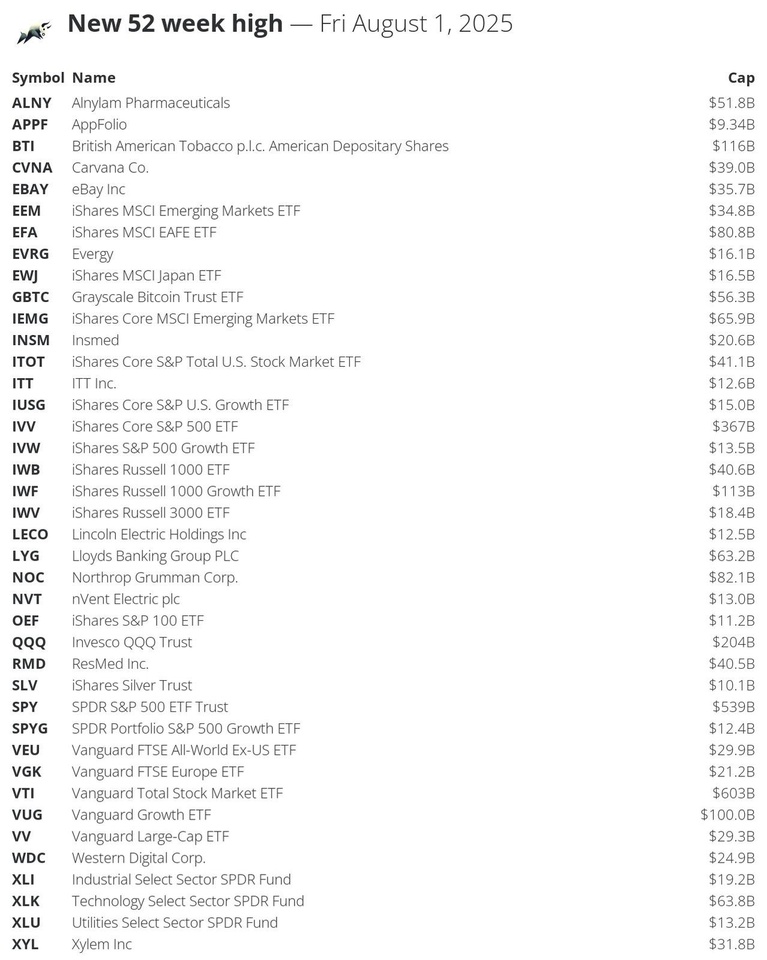

🔝 Stocks that made a new 52-week high today: $VTI (+0,63%)

$SPY (+0,56%)

$IVV (+0,53%)

$QQQ

$BTI (+1,71%)

$IWF (+0,79%)

$VUG (+0,76%)

$NOC (+1,54%)

$EFA

$IEMG (+0,73%)

$XLK

$LYG

$GBTC

$ALNY (-0,42%)

$ITOT (+0,65%)

$IWB (+0,57%)

$RMD (-0,44%)

$CVNA (+4,36%)

$EBAY (+0,13%)

$EEM

$XYL (+1,31%)

$VEU (+0,47%)

$VV (+0,54%)

$WDC (+4,08%)

$VGK (+0,52%)

$INSM (-0,72%)

$XLI

$IWV (+0,6%)

$EWJ (-0,07%)

$EVRG (-1,06%)

$IUSG

$IVW

$XLU

$NVT

$ITT (+2,69%)

$LECO (+0,97%)

$SPYG

$OEF (+0,47%)

$SLV

$APPF (+0,29%)

#52weekHigh

Northrop Grumman exceeds forecasts for Q2 2025 - share price rises significantly

Aerospace and defense company Northrop Grumman Corporation (NYSE:NOC) has reported strong financial results for the second quarter of 2025, beating forecasts for earnings and revenue. The company reported earnings per share (EPS) of $8.15, beating the forecast of $6.82, a positive surprise of 19.5%. Sales reached $10.4 billion, slightly above the expected $10.07 billion. As a result of these results, Northrop Grumman shares rose 8.31% in pre-market trading, reflecting investor optimism.

Key takeaways

Northrop Grumman's earnings per share (EPS) of $8.15 beat expectations by 19.5%.

Sales amounted to $10.4 billion, an increase of 1% year-on-year.

The share price rose 8.31% in pre-market trading.

The company raised its full-year guidance for earnings per share and free cash flow.

International sales grew 18%, driven by increased defense spending.

Company performance

Northrop Grumman delivered a robust performance in the second quarter of 2025, with revenue up 1% year over year. The company's segment operating profit increased 11% and the segment operating margin improved 100 basis points to 11.8%. This growth was driven by strong demand in the Defense and Aerospace segments as well as strategic investments in production capacity.

Financial highlights

Sales: $10.4 billion, an increase of 1% year-on-year

Earnings per share: $8.15, an increase of 28% compared to the previous year

Segment operating profit: increase of 11

Segment operating margin: increase of 100 basis points to 11.8

Military stock picks

Like it or not, this is my stock pick for the military sector long term. No hypes, just pure core well diversified industries, free from all the junk that NATO and other ETFs have in them.

$LMT (+0,78%)

$RTX (+0,72%)

$NOC (+1,54%)

$BA. (-0,35%)

Check out the pie here:

https://www.trading212.com/pies/lua2LbG5mCkbey2atfkE807rM83oY

The Military Core 2040 Pack is a four-company portfolio designed to capture the full architecture of 21st-century defense capability.

Each company plays a distinct and complementary role in a layered global security model.

No redundancy: Each firm operates in a unique domain with minimal overlap.

Not financial advice.

Additional notes:

If I had to add any company at all to this, it would only be $PLTR (+2,84%) for the AI military play, but I already have it in my future of tech pack, not duplicating

If you wish more companies to include, you can consider satelite positons on $SAAB B (-1,74%) and $KOG (+0,78%) , both are pretty solid choices too, not as main choices though, not using them on my core DCA.

Títulos em alta

Principais criadores desta semana