September was the month in which my account shone like the last rays of summer sunshine! Why? The half-year bonus catapulted this month into the month with the highest income of all time. Of course, the money doesn't go into savings, but is put into the market the following month, because share price growth and dividends beat any consumption. There was also an unexpected refund from the dental supplement, which has already been reinvested. Who says that prophylaxis doesn't bring returns after all?

And what else? Business as usual: preparations for ice swimming started at the end of the month thanks to colder temperatures, daily sport and exercise, a nice community meeting of frugalists and investors. Yes, we talked about dividends rather than the latest fashion. Everything was rounded off with a donation. My portfolios went sideways, but did what they are supposed to do: Generate cash flow. And from this month onwards, there will be additional risk figures presented. A little growth and distribution. Time for a review!

Overall performance

This month was a typical month of consolidation for me. My investments moved sideways with only a very slight increase. Is this a good sign for a year-end rally? There was also an initial cut in the Fed's key interest rate. However, there were no major movements, and Q4 is more likely to be responsible for this. As always, income rained down on the account. My key performance indicators for my overall portfolio at a glance:

- TTWROR (month under review): +1,76 % (previous month: +1.01 %)

- TTWROR (since inception): +76,55 %

- IZF (month under review): +9,64 % (previous month: +12.50 %)

- IZF (since inception): +11,15 %

- Delta: +€615.12

- Absolute change: +€2,635.52

Performance & volume

The rise in the price of $AVGO (+2,3%) allows my largest single share position to grow further and strengthens its dominance. And the class leader has not spilled the beans in terms of performance since purchase either: +337%! After the $BAC (+1,25%) climbed into the top 5 by volume in the previous month, it remains in this group. The banks are currently doing well. Also$WMT (-0,47%) The retail giant is a reliable dividend payer and an important pillar among my individual stocks. The competitor$TGT (+0,51%) on the other hand, is the red lantern in my portfolio. Despite thefts and sales problems, I see a healthy business model. I am sure that this share will bounce back and continue to invest on a monthly basis.

Size of individual share positions by volume in the overall portfolio:

Share (%) of total portfolio and associated portfolio:

$AVGO (+2,3%) 3.30 % (main share portfolio)

$NFLX (-0,47%) 1.87 % (main share portfolio)

$WMT (-0,47%) 1.74 % (main share portfolio)

$FAST (-0,19%) 1.72 % (main share portfolio)

$BAC (+1,25%) 1.49 % (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio and associated securities account:

$SHEL (+2,04%) : 0.41 % (crypto follow-up portfolio)

$NOVO B (-0,39%) 0.50 % (main share portfolio)

$TGT (+0,51%) 0.55 % (crypto follow-on deposit)

$HSBA (-0,35%) 0.58 % (main share portfolio)

$GIS (-2,45%) 0.60 % (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) and the respective portfolio:

$AVGO (+2,3%) a: +337 % (main share portfolio)

$NFLX (-0,47%) : +153 % (main share portfolio)

$WMT (-0,47%) : +78 % (main share portfolio)

$FAST (-0,19%) +76 % (main share portfolio)

$SAP (+2,92%) +75 % (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) and the respective portfolio:

$TGT (+0,51%) : -38 % (main share portfolio)

$GIS (-2,45%) -31 % (main share portfolio)

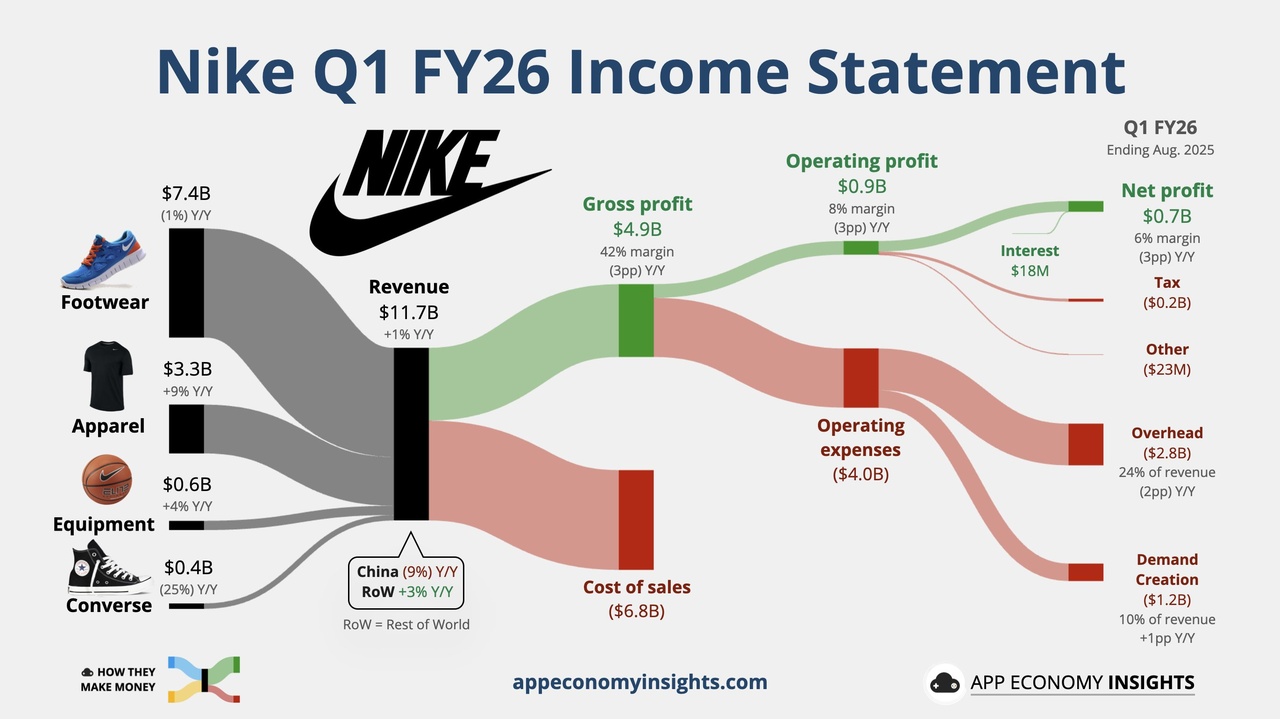

$NKE (+0,61%) -27 % (main share portfolio)

$CPB (-1,25%) -24 % (main share portfolio)

$UPS (+0,03%) -24 % (main share portfolio)

Asset allocation

My asset allocation is as follows:

ETFs: 39.1%

Equities: 58.6%

Crypto: 2.2 %

P2P: less than 0.01 %

Investments and subsequent purchases

I have invested the following amounts in savings plans:

Planned savings plan amount from the fixed net salary: € 1,030

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: € 1,140

Savings ratio of the savings plans to the fixed net salary: 49.75

In addition, the following additional investments were made from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: € 73.00

Subsequent purchases/non-recurring savings plans as cashback annuities from bonuses/incentives from the KK: € 0.00

Subsequent purchases from other surpluses: € 31.00

Automatically reinvested dividends by the broker: € 5.03 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

Additional purchases were made:

Number of additional purchases: 2

73.00 € for $TDIV (-0,08%)

25.00 € for $ZPRG (+0,17%)

Passive income from dividends

My income from dividends amounted to € 139.14 (€ 128.42 in the same month of the previous year). This corresponds to a change of -1.36% compared to the same month last year. The slight decrease is due to the fact that my large Vanguard ETFs postponed the distribution to the following month. The following are further key data on the distributions:

Number of dividend payments: 34

Number of payment days: 17 days

Average dividend per payment: € 4.09

average dividend per payment day: € 8.18

The top three payers are:

My passive income from dividends (and some interest) mathematically covered 16.05% of my expenses in the month under review.

Crypto performance

My crypto portfolio ran sideways in September with highs and lows. The hope here lies more in the coming Q4. My key figures:

Performance in the reporting period: +8.66 %

Performance since inception: +135.10

Share of holdings for which the tax holding period has expired: 98.57 %.

Crypto share of the total portfolio: 2.20 %

I am vigilant with regard to crypto. The exit should continue. I don't want to provide the exit liquidity for the other market participants. There will be news in the following month.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows:

TTWROR (current month): +1,76 %

$VWRL (+0,55%) : +2,63 %

$VUSA (+0,49%) : +2,56 %

One possible explanation for the poorer performance compared to the index values could be a higher proportion of individual shares,

New: Risk indicators

Here are my key risk figures for the month under review (and in brackets YTD)

Maximum drawdown: 0.94% (17.17%)

Maximum drawdown duration: 19+ days (231+ days)

Volatility: 1.68% (11.51%)

Sharpe Ratio: 5.73 (0.29)

Semi-volatility: 1.21% (9.04%)

An extremely low drawdown of only 0.94% shows that your portfolio had hardly any fluctuations during the month. This is typical for a sideways phase or stable markets.

The YTD drawdown of 17.17% is no coincidence: Trump's tariffs have mainly affected consumer-related stocks such as $TGT (+0,51%) have been hit. However, my focus on stable dividend payers and broad-based ETFs has limited the losses. The fact is, however, that Trump has put a dent in my figures.

Outlook

As you can see from the introduction, there were no highlights, but there were also no disasters for me to report on. So we're done for this month. Thanks for reading!

However, I still have some questions for you to improve my review:

Are you also interested in the performance and top/flop5 of my ETFs or cryptos? Then let me know in the comments and I'll include it in the coming months.

In my posts on Instagram and also here, I keep talking about my cashback pension. Would you like to know more about the concept, what's behind it for me and how it will supplement my "share and ETF pension"?

My review here on getquin includes additional key figures as well as those from my Instagram reviews. Would you also like to see more from the budget review of my private finances included here as a little extra?

👉 Would you like to view my review as an Instagram Carousel post?

Then follow me on Instagram:

📲 There's also 3 posts a week in addition to the portfolio and budget review: @frugalfreisein

Please pay close attention to the spelling, unfortunately there are too many fake and phishing accounts on social media. I have also been "copied" several times now.

👉 How was your month in the portfolio? Do you have any tops and flops to report?

Leave your thoughts in the comments!