$JNJ (-0,67%) is facing a lawsuit in the UK. It concerns the allegation that Babatalk was carcinogenic. The potential fine is €1 billion.

Discussão sobre JNJ

Postos

359Johnson and Johnson is sued for 1 billion for talc in the UK

Quarterly figures JNJ

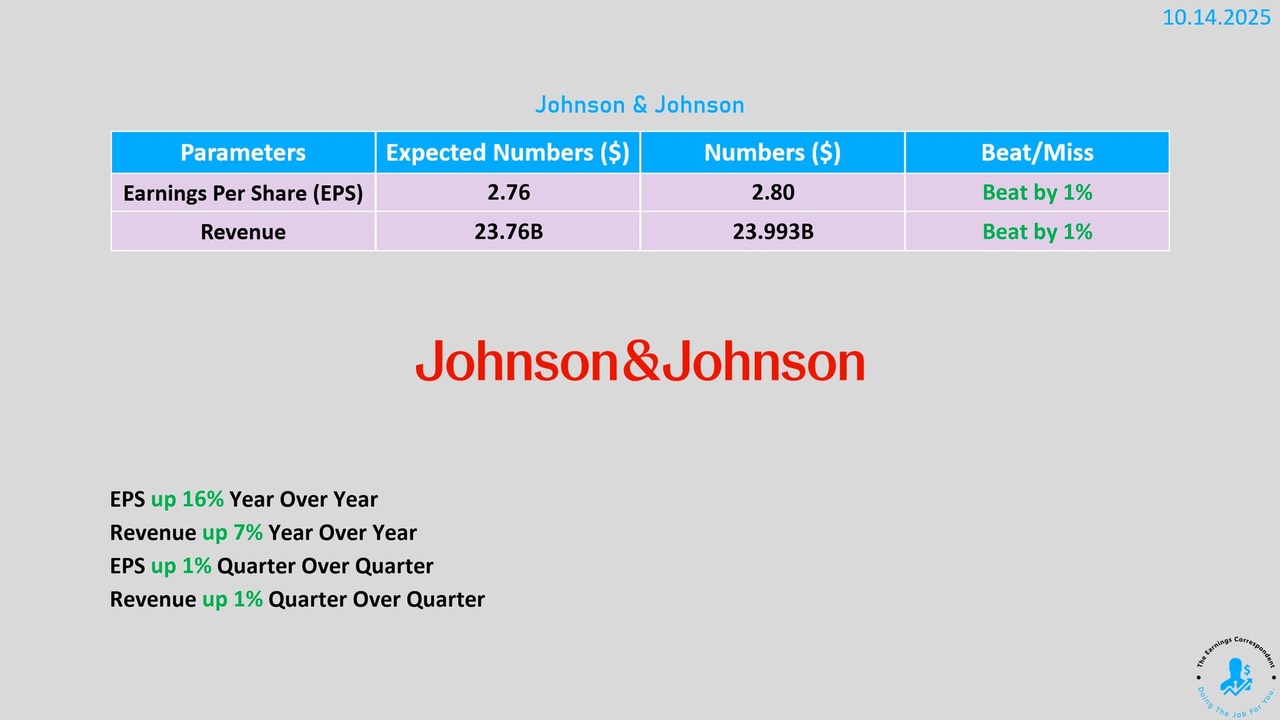

On October 14, 2025 reported $JNJ (-0,67%)

strong quarterly results. Earnings per share (EPS) were $2.80, above expectations of $2.76, while revenue of $23.993 billion was also 1% above estimates. Year-on-year, EPS was up 16% and revenue up 7%, underscoring the company's growing strength. There was also a slight 1% increase quarter-on-quarter.

These results show that Johnson & Johnson, supported by strong pharmaceutical and medical business, continues to grow despite economic challenges.

Johnson & Johnson Q3 2025 – Solid Beat on EPS and Sales; Outlook Raised

• Adjusted EPS: $2.80 vs. $2.76 expected

• Revenue: $24.0B vs. $23.76B expected

• Net Earnings: $5.15B (+91% YoY)

• Reported EPS: $2.12 (+91% YoY)

• Innovative Medicine Sales: $15.56B (+6.8% YoY)

• MedTech Sales: $8.43B (+6.8% YoY)

• Full-Year Sales Outlook: Raised to ~$93.7B (midpoint +5.7%)

• FY Adjusted EPS Guidance: Reaffirmed at $10.85

Johnson & Johnson delivered another solid quarter, with both top- and bottom-line results surpassing expectations. Growth was driven by oncology (Darzalex, Carvykti), immunology (Tremfya), and MedTech innovations (Abiomed, Shockwave). The company also highlighted several key FDA approvals, including INLEXZO for bladder cancer and TREMFYA in ulcerative colitis.

Quartalsberichte 13.10-17.10.25

$ERIC A (+0,24%)

$DPZ (-0,74%)

$JNJ (-0,67%)

$JPM (+0,09%)

$WFC (+0,35%)

$BLK (+0,15%)

$GS (+0,87%)

$C (+0,43%)

$MC (+0,69%)

$ASML (+2,17%)

$BAC (+1,25%)

$MS (+0,69%)

$JBHT (-1,9%)

$EQT (+0,04%)

$SRT (-0,62%)

$NESNE

$TSM (+0,6%)

$ABBN (+3,15%)

$UAL (-1,5%)

$TOM (+1,22%)

$VOLV B (+1,28%)

$AXP (+0,98%)

$SLBG34

$STT (+1,15%)

Building Portfolio

You have $5,000 to build a portfolio, how are you building it based on these prices:

$1,000 each - $AAPL (+0,3%)

$TSLA (+1,82%)

$NVDA (+1,16%)

$MSFT (-0,03%)

$META (+0,13%)

$750 each - $HD (-0,98%)

$SBUX (-0,35%)

$LOW (+0,07%)

$AVGO (+2,3%)

$COST (-0,49%)

$500 each - $JNJ (-0,67%)

$ABBV (-0,51%)

$CSCO (-0,46%)

$UNH (-0,46%)

$KO (-1,23%)

Hoje aumentei a minha posição em Johnson & Johnson

🔹 Dividend King

Mais de 60 anos consecutivos a aumentar o dividendo anual, um histórico que poucas empresas no mundo conseguem igualar.

🔹 Payout controlado

Mesmo com dividendos consistentes, a empresa mantém um payout relativamente baixo, garantindo margem para reinvestir e continuar a crescer no pagamento de dividendos no futuro. (~57%)

🔹 Negócio diversificado

Farmacêutica, dispositivos médicos e consumo: três áreas que reduzem riscos e trazem resiliência em diferentes fases do ciclo económico.

🔹 Marcas de consumo globais

Tylenol, Band-Aid, Listerine, Neutrogena, Aveeno… um portefólio de marcas fortes, presentes no dia a dia de milhões de pessoas.

👉 Vejo a JNJ como um pilar de estabilidade na minha estratégia de dividendos.

Here we go again

Hello everyone,

Almost 3 years have now passed since my last portfolio presentation.

A lot has happened in that time.

About me: I follow a core-satelite strategy and focus on dividends/dividend growth. My current savings rate is around €1000 per month and I am 27 years old.

I want to continue saving in the portfolio until I retire and use it as additional income.

I am well aware that I would be better off with an accumulating ETF due to my still long savings period, but the regular distributions help me to stay "on the ball".

The aim over the next few years is to increase the proportion of ETFs as core to 70-80%. Monthly savings will be made in the $VWCE (+0,53%) and the $TDIV (-0,08%) . The second is currently being built up. The second FTSE All World is saved separately at €20 per month.

I'm currently wondering whether I should invest in stocks like $KO (-1,23%) / $NEE (+0,5%) / $JNJ (-0,67%) into the $TDIV (-0,08%) to keep the portfolio simpler.

Feel free to leave your opinion - I'm curious 🫡

These are all stocks, you can buy them and then leave them. Wait and see.

An investor who put Johnson & Johnson in his portfolio 30 years ago has seen his share package increase in value by 850 percent to date. However, if he consistently reinvested the dividend, the total return is now 1,850 percent. 61% : per year!

These companies have outperformed the index for decades.

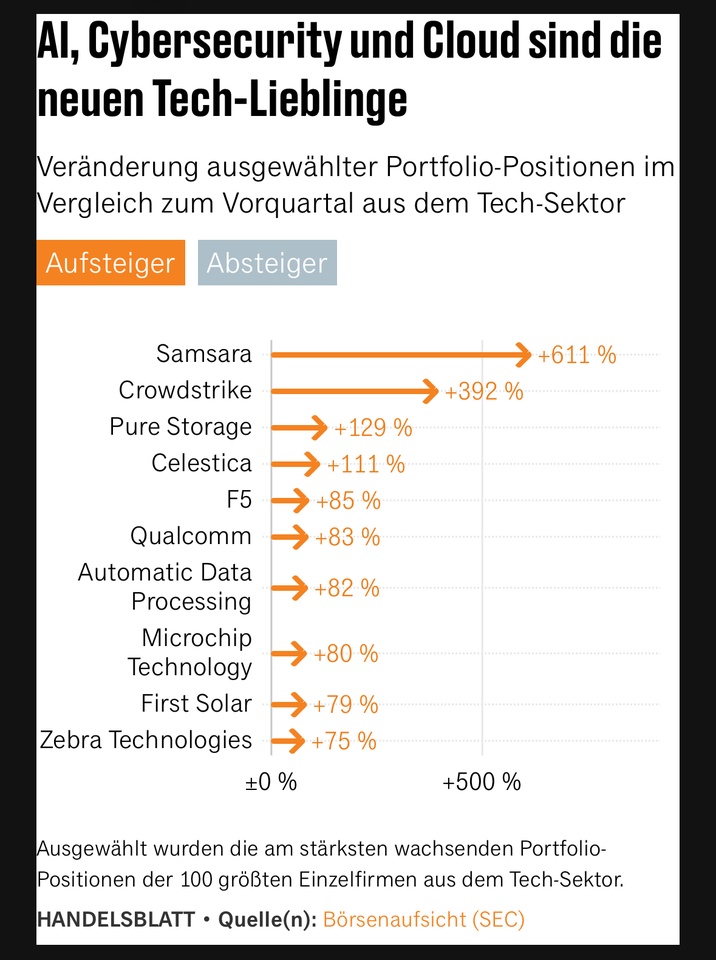

The current stock favorites of the professionals

Handelsblatt evaluated the portfolios of the 1,000 investors with the highest investment amounts who had reported fewer than 250 positions to the SEC as of June 30, 2025. This is intended to exclude providers of particularly broadly diversified ETF funds.

The tech sector continues to dominate the portfolios as the most important industry. At 21.8%, the share rose again to its highest level since the end of 2024. The financial sector follows in second place with 14.5%. The healthcare sector and real estate shares have lost much of their importance. Both were represented in the portfolios at the end of July with just under 5% less weighting.

Many professional investors took shares in Microsoft $MSFT (-0,03%) Amazon $AMZN (+1,02%) , Alphabet $GOOGL (+1,25%) and Nvidia $NVDA (+1,16%) into their portfolios or increased their weighting. Tesla $TSLA (+1,82%) also made strong gains. A quarter of institutional investors had Elon Musk's company in their portfolios at the end of July.

Of the major tech stocks, only Apple $AAPL (+0,3%) clearly shows weaknesses. The average share of the iPhone manufacturer in the professional portfolios fell by almost 20 percent to 5.3 percent.

Smaller software companies have also moved the portfolios. Handelsblatt has calculated the fastest-growing portfolio positions among the 100 largest tech companies.

According to the report, the most hotly traded tech climber at the moment is Samsara $IOT which produces networked solutions for industrial means of production, including networking and tracking trucks. The number of shares in the Californian company in the portfolios increased sevenfold in the second quarter. The cybersecurity provider Crowdstrike $CRWD (+4,14%) from Texas also made strong gains.

The most important investments outside of tech companies

Alongside the tech giants, the list of the most important companies is headed by Visa $V (+0,05%) and Broadcom $AVGO (+2,3%) followed by Johnson & Johnson $JNJ (-0,67%) and Mastercard $MA (-0,01%) and Eli Lilly $LLY (+0,99%)

New among the 20 most important investments after the Mag Seven is the accounting software provider Intuit $INTU (-0,48%).

Source: Text (excerpt) and graphics: Handelsblatt, 25.08.2025

Likewise, no players in infrastructure.

Energy plays no role here.

What about

Raw materials and rare earths.

Growth shares

Everything is at an all-time high. While growth stocks are starting to fall, my dividend stocks are benefiting from the rise. I am quietly waiting for growth stocks to fall further to buy back in until then I continue to expand my dividend positions.

$VWRL (+0,55%)

$ASML (+2,17%)

$GOOGL (+1,25%)

$MSFT (-0,03%)

$JNJ (-0,67%)

$O (+0,02%)

$BTC (+0,36%)

New 52-week highs for these stocks

These shares reached a new 52-week high today:

Johnson & Johnson $JNJ (-0,67%)

Unity $U (+2,67%)

Reddit $RDDT (-0,02%)

Celsius $CELH

Altria $MO (+0,28%)

Do you hold any of the shares?

@thewolfofallstreetz

Títulos em alta

Principais criadores desta semana