$UNH (-0.11%)

$OSCR (-3.64%)

$XDWH (+0.02%)

$ELV (-1.46%)

$LLY (-1.18%)

$XLV (+0.04%)

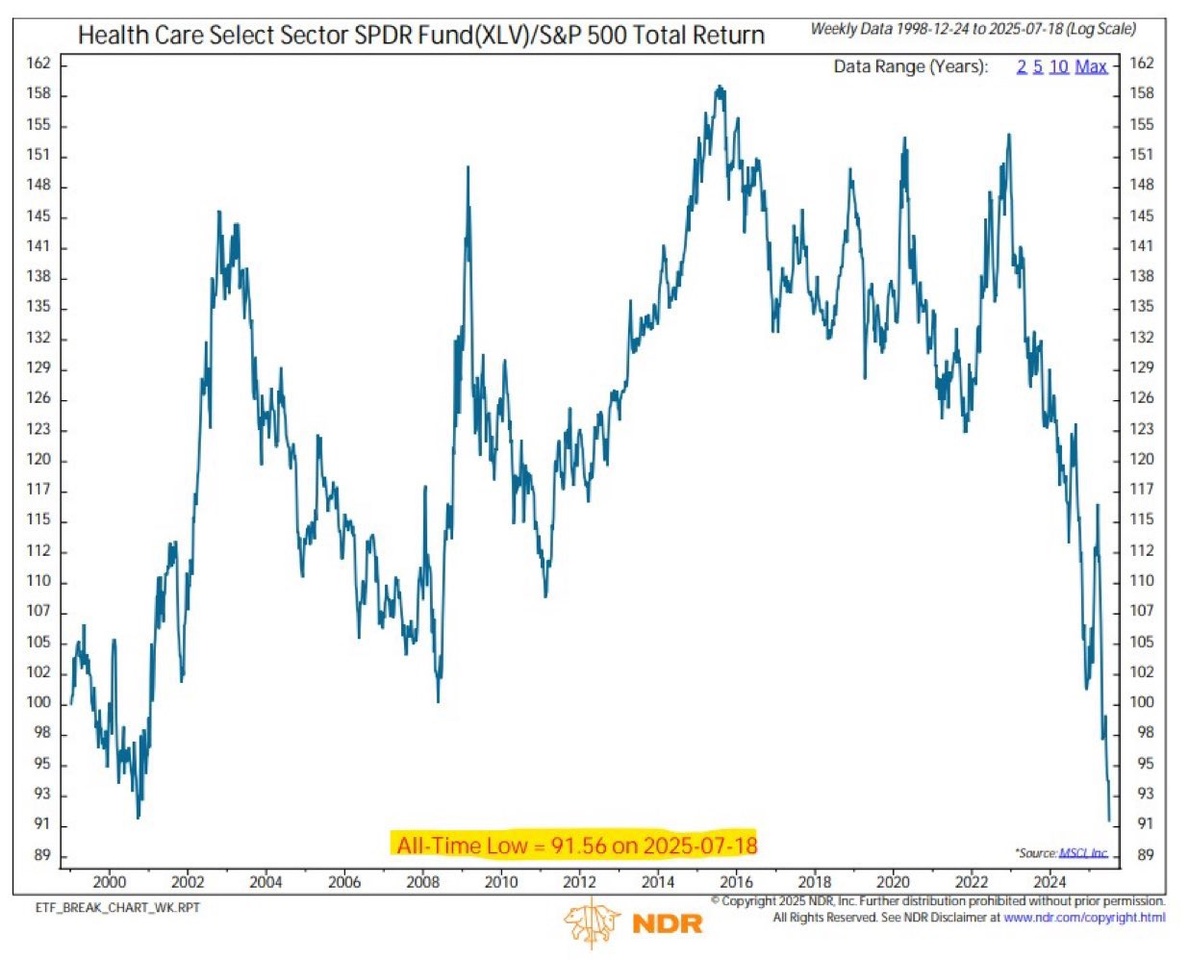

The US healthcare sector is experiencing its biggest crash in the last 20 years.

If the strong weighting no. 1 $LLY (-1.18%) (over 12%), one would have to go back even further/longer. (probably before the existence of the ETF).

I have positioned myself strongly here as I believe this is a great opportunity.

I also believe that a lot of capital will flow into the sector in the coming months. ✌️

Do you have a similar view? ✌️