Discussão sobre ISRG

Postos

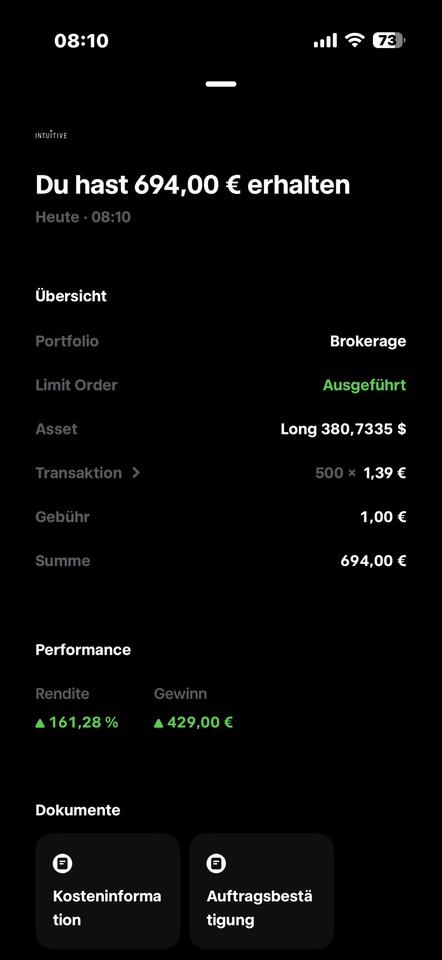

72Intuitive Surgical Q3'25 earnings highlights 👌

Revenue: $2.51B (Est. $2.41B) ✅ +23% YoY

- EPS (Non-GAAP): $2.40 (Est. $1.99) ✅ +30% YoY

- Non-GAAP OI: $976M (vs. $755M) ✅

FY25 Outlook

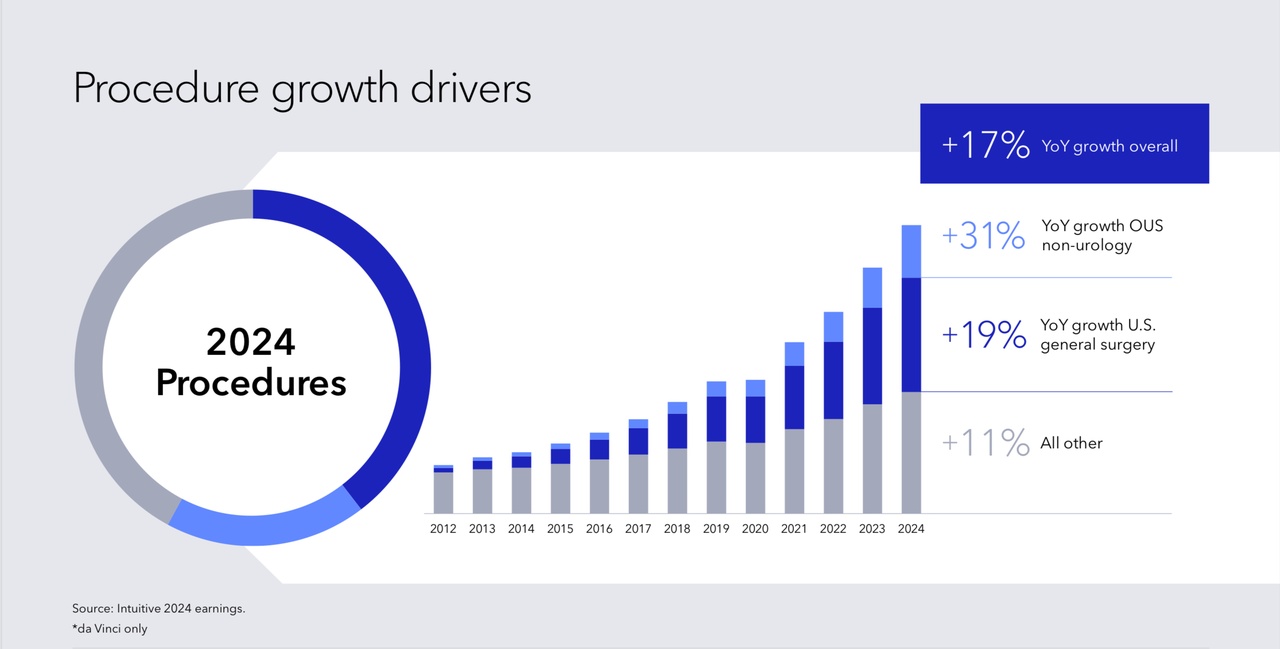

- da Vinci Procedure Growth: +17 - 17.5% YoY (vs. 17% FY24)

- Non-GAAP Gross Margin: 67 - 67.5% (vs. 69.1% FY24)

→ Includes ~70 bps impact from tariffs

- Non-GAAP OpEx Growth: +11 - 13% YoY (vs. +10% FY24)

Q3 Operational Highlights

- Worldwide Procedures: +20% YoY

- da Vinci: +19% YoY

- Ion: +52% YoY

- System Placements:

- da Vinci Systems: 427 (vs. 379 YoY)

- Includes 240 da Vinci 5 systems (vs. 110 YoY)

- Ion Systems: 50 (vs. 58 YoY)

- Installed Base:

- da Vinci: 10,763 (+13% YoY)

- Ion: 954 (+30% YoY)

Revenue Breakdown:

- Instruments & Accessories: $1.52B (+20% YoY)

- Systems: $590M (+33% YoY)

- Service & Other: $400M (approx., steady YoY)

Balance Sheet & Capital Return

- Cash & Investments: $8.43B (↓ $1.1B QoQ)

- Share Repurchases: 4.0M shares for $1.92B in Q3

- Operating Cash Flow: Strong, offset by buybacks + capex

Comment from the CEO (Dave Rosa)

⭐️ "We are pleased with our strong results this quarter, highlighted by the continued growth and adoption of our Ion and da Vinci 5 platforms."

⭐️"We remain focused on the Fivefold Goal: better patient outcomes, improved care team experience, broader access to quality care and lower overall costs."

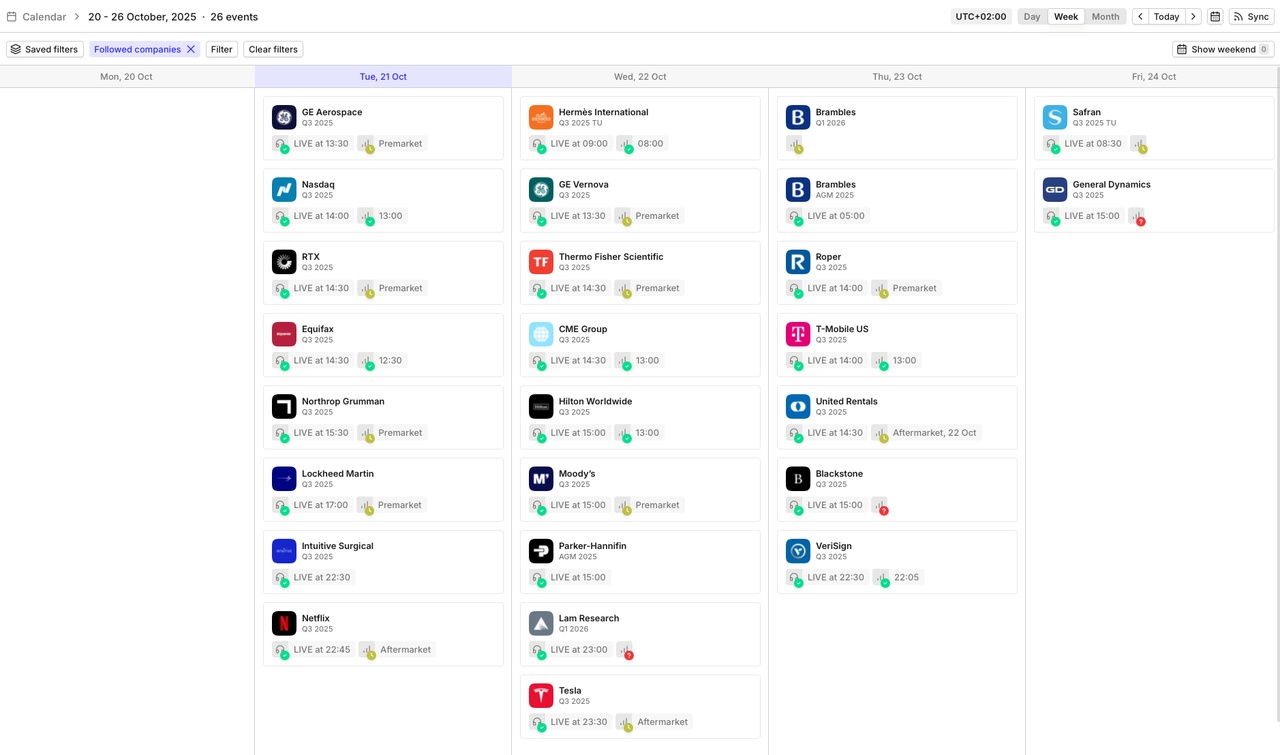

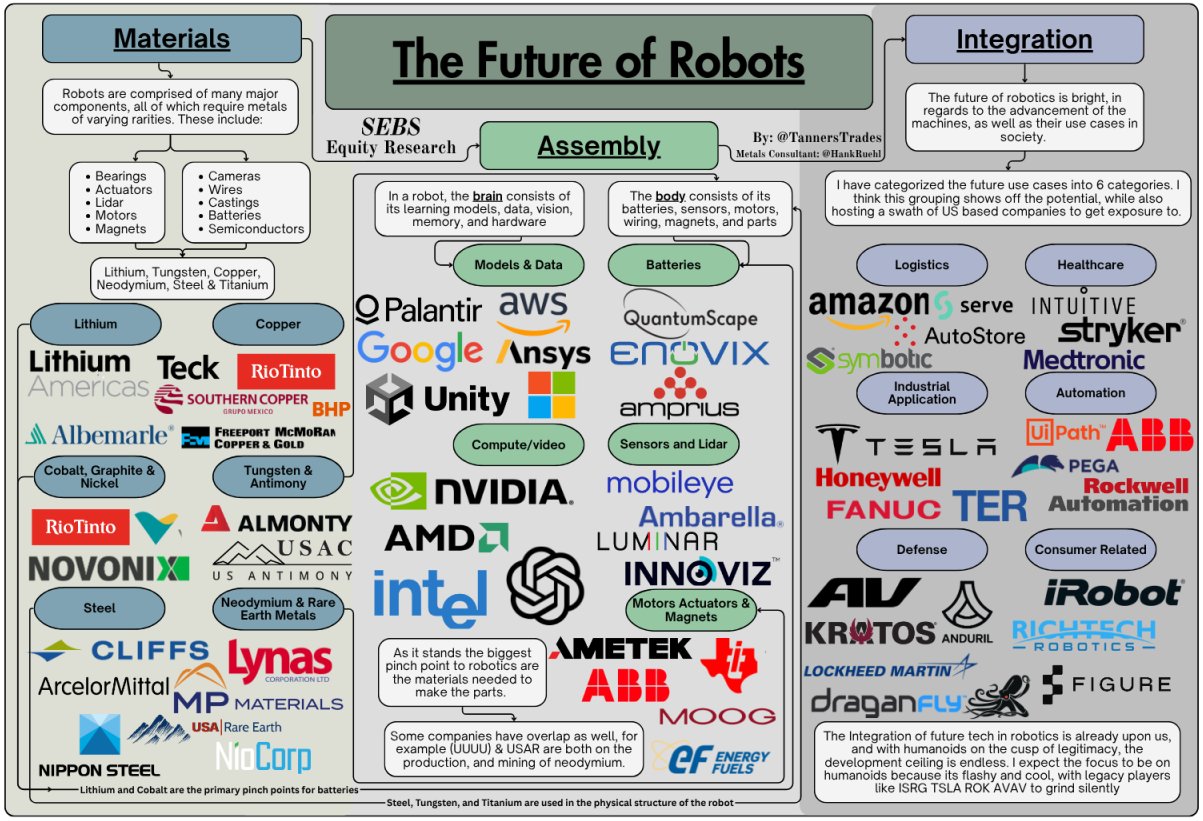

The Future of Robots 🤖🦾🦿

$ISRG (+4,41%)

$PATH (+2,39%)

$RR

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (+2,39%) also $ISRG (+4,41%) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (+1,02%)

$MSFT (-0,03%)

$NVDA (+1,16%)

$AMD (+3,4%)

$GOOGL (+1,25%)

$GOOG (+1,14%)

$RIO (+1,5%)

$ALB (+6,83%)

$INTC (+11,6%)

$PLTR (+2,84%)

$IRBT (+4,66%)

$SYK (-1,49%)

$MDT (-1,04%)

$LMT (+0,78%)

$DPRO (-0,69%)

Intuitive Surgical Q3’25 Earnings Highlights

🔹 Revenue: $2.51B (Est. $2.41B) 🟢 +23% YoY

🔹 EPS (Non-GAAP): $2.40 (Est. $1.99) 🟢 +30% YoY

🔹 Non-GAAP OI: $976M (vs. $755M) 🟢

FY25 Outlook

🔹 da Vinci Procedure Growth: +17 – 17.5% YoY (vs. 17% FY24)

🔹 Non-GAAP Gross Margin: 67 – 67.5% (vs. 69.1% FY24) 🟡

→ Includes ~70 bps impact from tariffs

🔹 Non-GAAP OpEx Growth: +11 – 13% YoY (vs. +10% FY24)

Q3 Operational Highlights

🔹 Worldwide Procedures: +20% YoY

🔹 da Vinci: +19% YoY

🔹 Ion: +52% YoY

🔹 System Placements:

🔹 da Vinci Systems: 427 (vs. 379 YoY)

🔹 Includes 240 da Vinci 5 systems (vs. 110 YoY)

🔹 Ion Systems: 50 (vs. 58 YoY)

🔹 Installed Base:

🔹da Vinci: 10,763 (+13% YoY)

🔹Ion: 954 (+30% YoY)

Revenue Breakdown:

🔹 Instruments & Accessories: $1.52B (+20% YoY)

🔹 Systems: $590M (+33% YoY)

🔹 Service & Other: $400M (approx., steady YoY)

Balance Sheet & Capital Return

🔹 Cash & Investments: $8.43B (↓ $1.1B QoQ)

🔹 Share Repurchases: 4.0M shares for $1.92B in Q3

🔹 Operating Cash Flow: Strong, offset by buybacks + capex

CEO Comment (Dave Rosa)

🔸 “We’re pleased with our strong results this quarter, underscored by continued growth and adoption of our Ion and da Vinci 5 platforms.”

🔸 “We remain focused on the Quintuple Aim — better patient outcomes, improved care team experience, wider access to high-quality care, and lower overall costs.”

The Future of Robots 🤖🦾🦿

$ISRG (+4,41%)

$PATH (+2,39%)

$RR

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (+2,39%) also $ISRG (+4,41%) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (+1,02%)

$MSFT (-0,03%)

$NVDA (+1,16%)

$AMD (+3,4%)

$GOOGL (+1,25%)

$GOOG (+1,14%)

$RIO (+1,5%)

$ALB (+6,83%)

$INTC (+11,6%)

$PLTR (+2,84%)

$IRBT (+4,66%)

$SYK (-1,49%)

$MDT (-1,04%)

$LMT (+0,78%)

$DPRO (-0,69%)

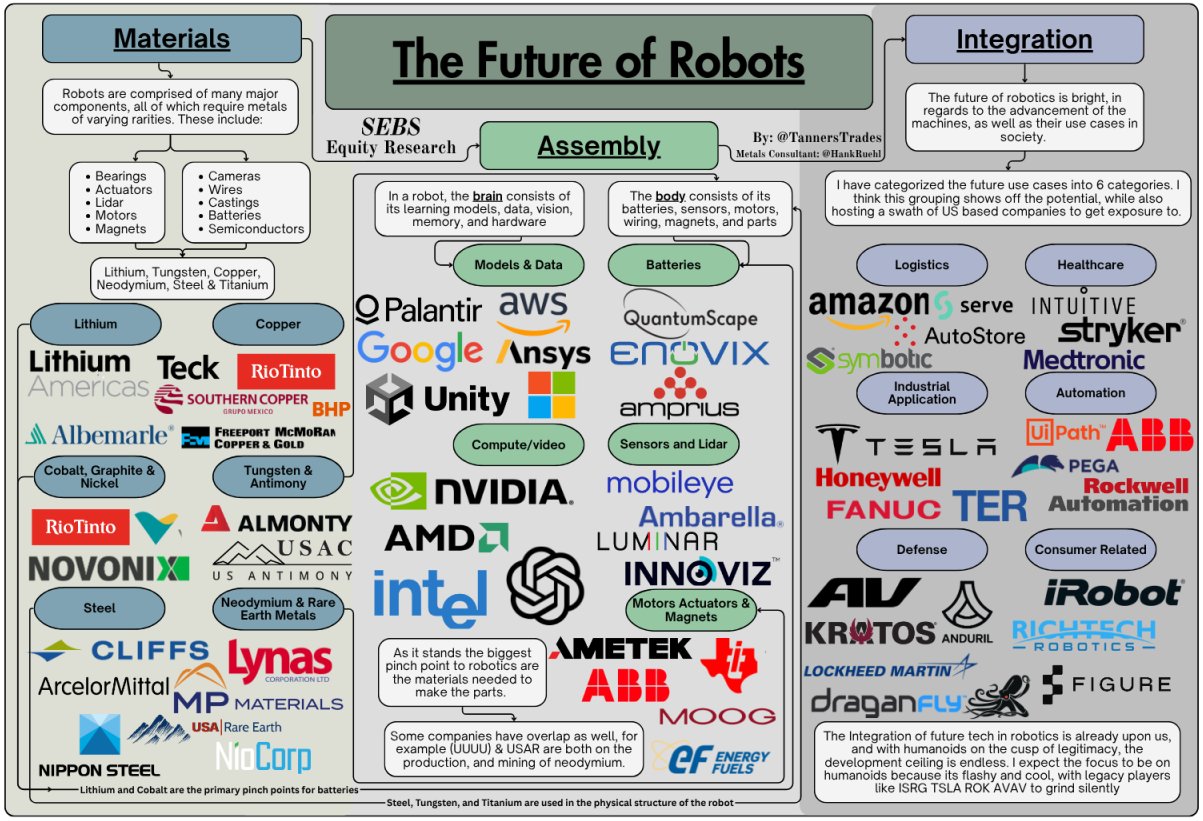

📊 October Update — Staying Calm While Markets Chase New Highs

The market continues to push toward new ATH and today it looks ready to recover from last Friday’s sharp drop following Trump’s threat of 100% tariffs on China.

While many investors keep chasing momentum, I’ve stayed calm and rotated my portfolio toward what I see as real value.

My focus has been on companies that are deeply undervalued yet essential to people’s daily lives, some to balance.

Here’s a glimpse of my current positions:

Pepsi $PEP (-1,25%) Cintas $CTAS (-1,45%) Bristol Myers ($BMY (-0,68%) ), TMF, Intuitive Surgical ($ISRG (+4,41%) ), General Mills $GIS (-2,45%) , Lululemon ($LULU (-0,37%) ), Campbell Soup (CPB), iShares MSCI India (INDA), American Water Works $AWK Airbnb (ABNB), and Novo Nordisk $NVO (-0,22%)

This rotation has kept my portfolio on a steady growth plateau — not chasing short-term rallies, but positioning for sustainable performance in the months ahead.

I’m focusing on strong fundamentals, stability, and pricing power in an environment where volatility and political headlines can change the mood overnight.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice

Still the Surgical Robot Leader, Just Slightly Cheaper

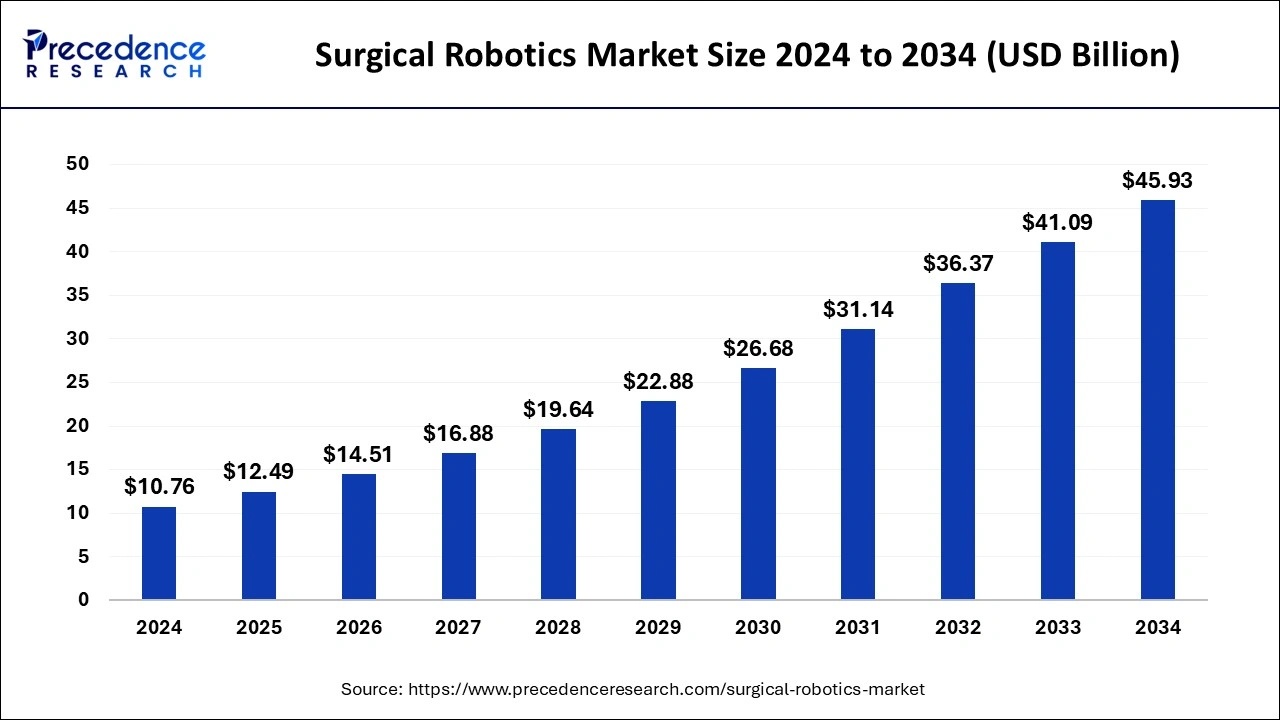

Intuitive Surgical (ISRG) remains the clear technology leader in robotic-assisted surgery. This field keeps expanding as hospitals and surgeons adopt automation and AI-driven tools.

Why I like it:

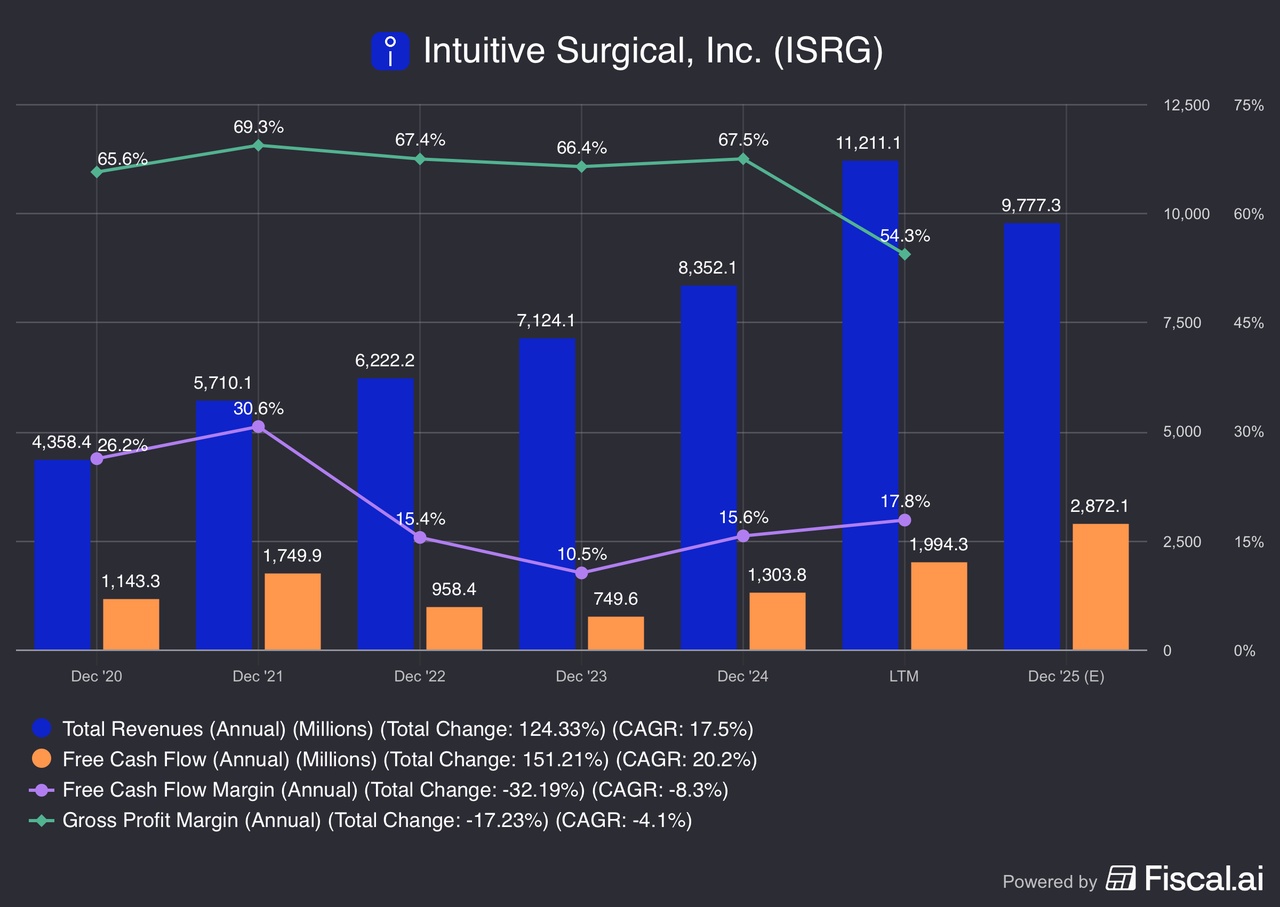

Strong growth: Revenue hit $8.35B in 2024 (+17% YoY), net income up 29% to $2.3B, and the installed base grew +14% to 10,488 da Vinci systems.

EPS still climbing: TTM EPS around $7.2 (+23% YoY), even with slight dilution from stock-based comp. Cash generation remains excellent.

Deep moat: Years of regulatory approvals, surgeon training, and a global service ecosystem make ISRG the default standard in surgical robotics.

AI tailwind: As robotics and AI converge, expect smarter systems with better vision, automation, and decision support, expanding ISRG’s lead.

Why now: Recent tariff concerns pushed valuation down a bit. Still not cheap, but the pullback looks more like a mid-term pause than a structural issue. For me an opportunity to buy.

Intuitive Surgical — Expensive Robotics Leader with a Wide Moat

1. Executive Summary

Intuitive Surgical has built one of the most impressive business models in healthcare, deeply entrenched within the hospital system. Since its inception 30 years ago, management has done nothing but innovate, scale, and integrate. Starting out with a little prototype developed by founder Dr Frederick Moll, Intuitive turned robotic-assisted surgery from a niche experiment into an indispensable global standard of care, under the leadership of long-term CEO Gary Guthart. The robotic surgery company focuses on developing and manufacturing robots used for minimally invasive surgery, and sits at the clear top of this market. It was not just the first in the market, it is still the most successful, by a great margin.

With its market-leading da Vinci platform, Intuitive built a substantial recurring revenue stream. Once a hospital chooses the platform, switching costs are considerable – not just monetarily but also in the specific training surgeons continually engage with. Doctors and hospitals are locked in Intuitive’s ecosystem, which ensures them as long-term customers.

What makes Intuitive stand out is not only its scale, but the durability of its moat: switching costs are enormous, and competitors seem years behind in development. If advancements are made, then mainly in specific areas such as PROCEPT’s AquaBeam, used for resecting prostate tissue. However, on a broader scale Intuitive’s position remains untouched.

Additionally, the rise of demand for robot-assisted surgeries creates a self-reinforcing cycle: more procedures → more trained surgeons → more demand → more recurring revenue.

The financials reflect this strength: double-digit revenue and earnings growth, gross margins near 70%, operating margins above 30%, and a pristine balance sheet with no debt and steady, growing cash flows. Still, the stock trades at a premium valuation, because the market knows what it owns — a near-monopoly in a growing field. However, as it often is with great companies operating at elevated valuations, they are priced for perfection. Blemishes in earnings reports can lead to sharp selloffs in the stock. Within hours the whole narrative can change and the market leader with stellar prospects becomes an unloved, disrupted business without a future.

The most obvious risk is that competition is rising: from Medtronic’s Hugo to CMR Surgical’s Versius, and the previously mentioned specialty-focused entrants like PROCEPT BioRobotics. None threaten Intuitive’s dominance today, but they could erode pricing power and slow growth at the edges, which might rattle the stock price even more.

Intuitive is therefore not a “value” story but a structural growth one. It is the reference name for exposure to robotic surgery, with a wide moat but growing competitive noise. Valuation remains elevated even after the recent gradual decline and sideways trading.

2. Macro Environment

Healthcare is, and has been for years, in a shift toward digitization and automation. Surgeons are still the gold standard for complex procedures, however robots can improve outcomes for minimally invasive and less demanding surgeries significantly, while reducing manpower needed. Hospitals adopt these systems to not just improve precision and reduce complications, but also to lower lifetime patient costs. Platforms like da Vinci might be expensive at the beginning, but in the long term total costs per patient are expected to go down, due to shorter recovery time and fewer staff, together with relevant training required for the procedures.

An aging population across almost every country worldwide just exacerbates demand, with rising volumes in cancer, cardiology, and surgery in general. To keep costs down while providing the best care possible, robotic systems are very likely to be part of the solution.

On the other hand, hospital budgets are under real pressure. U.S. healthcare providers are squeezed by labor costs and reimbursement cuts, while European systems are dealing with decades of misuse of resources and a shortage of skilled workers across the entire medical field. Europe is fighting with incentives to keep skilled medical professionals, without sacrificing quality. High taxes and bureaucratic hurdles weigh on European publicly funded healthcare systems.

Robotic platforms are expensive upfront, which means adoption can slow in weaker macro environments and economic slowdowns. That is where Intuitive’s installed base matters: even if new system placements decline temporarily, recurring instrument revenue from procedures provides resilience. While new adoption can be cyclical, recurring revenue streams are the compensation.

Regulation is another factor. The FDA is supportive, but reimbursement in international markets can be mixed. Broader coverage in Asia and Europe could materially accelerate adoption. Intuitive reports strong growth across all major regions, however the total addressable market is still huge. With increased pressure, governments are more likely to lower regulatory obstacles rather than tighten them.

3. Company Overview & Segmentation

Intuitive’s business model blends hardware, consumables, and services into a highly profitable ecosystem.

- da Vinci Systems are the company’s flagship platforms, installed in hospitals globally. These carry a high upfront cost, but once in place, they lock institutions into Intuitive’s network. Hospitals are not going to rotate out of Intuitive after they have spent millions on these systems. Currently, Intuitive is the market leader and as they continue to expand, they lock in more and more hospitals worldwide, increasing pressure on competitors significantly.

- Instruments & Accessories are the economic engine. Every da Vinci procedure requires specialized tools, which drives recurring, high-margin revenue. As procedure volumes rise, so does this revenue stream.

- Services provide additional stickiness: hospitals pay for maintenance, upgrades, and surgeon training. This is the safe revenue stream, also in weaker economic cycles.

- Pipeline & Innovation: The da Vinci 5 system, launched in 2024, promises improved ergonomics, imaging integration, and software features. Single-port platforms and future AI-enabled tools extend Intuitive’s reach into new specialties. Intuitive continues to innovate and the perception of new products is excellent.

The key dynamic is utilization. The more procedures each installed system performs, the higher the recurring revenue. This makes procedure growth as important as new system placements. It is a positive feedback loop: an expanding network leads to broader adoption, which leads to an even greater widening of the network and specialized doctors. All that drives recurring revenue in the long term and makes Intuitive a well-positioned company for the future.

4. Financial & Operational Performance

In Q2 2025, Intuitive reported revenue of $2.1 billion, up 12% year-over-year. Procedure volumes grew 15%, highlighting robust demand despite broader hospital budget pressures. Gross margins remained near 67%, while operating income reached $680 million, a margin of about 32%. Free cash flow was comfortably above $500 million for the quarter, and the company continues to run a debt-free balance sheet with over $8 billion in cash.

The financial profile is enviable: recurring revenues account for nearly 80% of sales, margins are consistently high, and the balance sheet gives management flexibility to reinvest or defend against competition. These are the main reasons for the elevated valuation. While maturing and growing into its market-leading position, Intuitive continues to innovate and impress with strong growth numbers. The business is prepared for rapid expansion in good times and can easily survive bad times with its enormous recurring revenue streams.

5. Growth Drivers

The central growth driver is procedure expansion. Urology still remains a core franchise, but demand for general surgery is rising and the shorter recovery times due to minimally invasive robot-assisted surgeries are not to be discounted. Globally the population is aging, which exacerbates demand significantly. Cancer rates are climbing, while robots are advancing. There might be a future in which 95% of all procedures will be, at least, assisted by robots. The initial investment might be hefty for some budget-constrained hospitals, but long-term spend per patient will decrease substantially.

The rollout of the da Vinci 5 is another catalyst. It improves surgeon ergonomics, offers advanced imaging, and is designed for higher throughput, which appeals to hospitals under pressure to do more with fewer resources. Intuitive is addressing concerns about pricing and economic viability through excelling with innovation and making its products “mass-friendlier.” Even more by investing in single-port systems and smaller footprints that can penetrate price-sensitive markets and operating rooms with less space.

International expansion often remains overlooked. The U.S. is relatively mature, especially in the more sophisticated, modern facilities located in urban areas, but Europe, Asia, and emerging markets are still early in adoption. As regulations loosen up, adoption could get a significant boost and further solidify Intuitive as the global market leader.

Finally, longer-term innovation matters. Intuitive is integrating AI and imaging tools into its platforms, with the goal of improving real-time decision-making in the operating room. This optionality keeps the company relevant as digital health evolves.

6. Competitive Landscape

While Intuitive remains dominant, the competitive field is growing more crowded, mainly by small specialized players or large companies trying to take over one particular type of procedure:

- Medtronic (Hugo RAS): The most credible challenger, given Medtronic’s resources and distribution. However, adoption has been slow, regulatory approvals lag Intuitive, and feedback on system performance has been mixed.

- Stryker (Mako): A leader in orthopedic robotics, especially knee and hip replacements. It does not compete directly with da Vinci but shows how specialty robotics can scale. Expansion beyond orthopedics is a risk worth watching.

- CMR Surgical (Versius): A UK-based company offering a modular, portable system with lower upfront costs. Versius has gained traction in Europe and Asia but lacks U.S. approval and the clinical track record of da Vinci. If Versius keeps gaining traction, European systems might prefer it over Intuitive’s products, which could meaningfully erode its sales in that region.

- PROCEPT BioRobotics (AquaBeam): Focused on benign prostatic hyperplasia (BPH), PROCEPT has created a strong niche in urology. While it does not threaten Intuitive across the board, it demonstrates that smaller, focused players can succeed in specialties where da Vinci is less dominant.

The key competing risk at play here is not about one specific rival overtaking it. None of the aforementioned companies compete directly head-to-head with Intuitive, but rather try to snatch small parts of its business individually. This could lead to an erosion in pricing power over the long term, and Intuitive is at risk of becoming the unspecialized legacy company in the middle of very specific competitors. Still, Intuitive’s entrenched base of systems, training cycle, and decades of outcome data and understanding customer needs form an almost insurmountable moat that is difficult to replicate.

7. Risks & Headwinds

Intuitive’s growth strategy stems from hospitals adopting its systems, while the existing network drives recurring cash flows. However, Intuitive’s growth is hindered by hospital budget constraints during downturns. The robot company combats that to some extent through its global engagement and excellence of product, nevertheless a meaningful deceleration of growth prospects might lead to a further decline in the already eroded stock price.

The second and biggest long-term risk is competitive pressure. Regardless of whether one newcomer can ever outshine Intuitive, many new entries in the market could lead to an erosion in its pricing model. Competitive products might never be as advanced, but they could put pressure on the market leader, as smaller hospitals with more constrained budgets might be inclined to choose the “budget-friendly” version.

More broadly, as the field matures, growth rates naturally decelerate, which can be seen in Intuitive’s numbers over the last few years. AI-assisted surgery adoption is still a secular trend, but the likelihood of this happening rapidly and only focusing on one individual company is extremely low.

From an investor’s perspective, it is also crucial to note that the stock is very ambitiously priced at a forward P/E ratio north of 60 and free cash flow yield around 1.9%. This is, in part, justified by an impeccable balance sheet, high recurring revenues, and exceptional market position. However, the stock is priced for perfection, and has fallen almost 30% from its all-time highs, while still being expensive compared to peers. The market is clearly re-rating and re-evaluating the share price at the moment, and negative news could amplify this downward trend substantially.

8. Catalysts & Timeline

Over the next 12 months, the rollout of da Vinci 5 and continued procedure growth will be closely watched. Over the medium term (2–3 years), international adoption and specialty expansion could sustain double-digit growth. Beyond that, the key question will be how Intuitive adapts to a more competitive environment and whether AI integration can create new revenue streams.

Furthermore, the ongoing re-evaluation of the stock price is troubling and might hinder meaningful upside. The market seems to question Intuitive’s recent innovations, leadership changes, and premium valuation. A quality business without a doubt, however the price still matters to investors.

9. Conclusion

Intuitive Surgical is the undisputed leader in robotic-assisted surgery, with a business model built on sticky recurring revenues, exceptional margins, and a balance sheet that removes financial risk. Competitors are eroding the market, but Intuitive has the network and the pricing power to outmatch them. Innovation is still a core part of Intuitive’s culture and its developers continue to dominate the competitive landscape. Some niche alternatives might appear at some points, but the only reason why they can succeed is because Intuitive chooses not to engage. The enormous power this business has held to this day should be appreciated. The landscape is evolving, but Intuitive’s scale and ecosystem remain unmatched.

However, this is not a cheap stock by any metric — it trades at a premium because investors recognize its quality. The question is not whether Intuitive will remain dominant, but whether growth can stay strong enough to justify its valuation as rivals slowly gain ground. There is not much room for disappointments, even after the recent selloff. If investors lose confidence there is still a long way to fall, but Intuitive’s pristine balance sheet might ensure a soft landing. For those looking for exposure to the structural trend of robotics in healthcare, Intuitive is arguably the purest play, combining stability with long-term innovation. The price is only stretched if the company does not deliver, which there is no indication of at this moment.

+ 5

Thanks to bring the Investment idea of procept to me. Could be a Great Chance to be in the Stock from the start. Definitly Need a further Look.

Portfolio update

Hello GetQuin Community,

since it has also become a bit quiet for me, there is a small update today.

My core still includes $IWDA (+0,44%)

$CSNDX (+0,88%) and $EIMI (+0,71%)

Total: (approx. 46.4%)

across all assets: $WGLD (+0,59%)

$BTC (+0,95%) and $XEON (+0,01%)

Total: (approx. 17.08%)

Here the $IWDA (+0,44%) with 120€/month and $BTC (+0,95%) with 70€/month

Individual purchases will of course be made on occasion.

----------

Two new shares were added over the course of the year. The following were added $ISRG (+4,41%) and $RKLB (+5,26%) these are still in the expansion phase ($ISRG (+4,41%) = 100€/month and $RKLB (+5,26%) with targeted individual purchases). Total, all shares: (approx. 36.52%)

There should also be a candidate from the cyber 'sector, which I have been watching for some time $ZS (+3,15%) and $CRWD (+4,14%) and from the network technology sector $ANET (+5,04%)

This leaves a balanced mix of growth and quality stocks.

----------

In addition, the cash position is also being built up a little more each month (approx. €350/month), which currently stands at around €1,500

Nest egg also remains stable at around €10,000

---------

My goal was to bring the portfolio up to €30,000 by the end of the year. This was already achieved in September, at least in terms of "momentum". I have therefore revised my forecast upwards and now expect to reach around €34,000 by the end of the year (including the savings ratio).

That was my word for Sunday.

LG

Paul

Sep 25 / Surgical Robots – Intuitive Surgical & PROCEPT BioRobotics

Groundbreaking Tech, Stretched Valuations, and New Leadership

Surgical robots are one of the most fascinating areas, not just in medtech, but overall. The technology feels like science fiction turned real, and it will without doubt shape the future of surgical procedures. I’d like to highlight two names in this space: Intuitive Surgical and PROCEPT BioRobotics. Both are pioneers, both are innovating, but the investment case is very different.

Let’s start with Intuitive Surgical. This is the undisputed heavyweight of surgical robots, a super high-quality company that has delivered for years. Their da Vinci systems have basically become the industry standard. The company has an impeccable track record, immaculate reputation, and is the single most important defining power in the surgical robots sector. But here’s the catch: valuation. With a forward EV/revenue north of 15 and a forward P/E around 60, the stock is priced for absolute perfection. Nothing material has changed in the business — yet shares have retreated almost 30% from highs over the past months. To me, that looks like investors finally questioning if paying such a premium is still justified. I love the company, I admire the moat, but at these levels it would need to come down a fair bit more for me to even consider buying. The new CEO, stepping in after Gary Guthart’s retirement, who played a crucial role in the company’s success over the last 15 years, will also need to prove himself. That’s no small task when expectations are sky-high. And yes, Intuitive Surgical doesn’t really disappoint, but from the looks of it, even that isn’t enough anymore. At current valuation levels, the market needs more than solid quarters and silent progress. It needs something groundbreaking.

PROCEPT, on the other hand, is a very different story. They focus on men’s health, especially procedures like benign prostate hyperplasia (BPH), with their AquaBeam robotic system. Unlike Intuitive, the stock looks attractive on valuation: a forward EV/revenue of around 5, with rapid mid-double-digit revenue growth. The stock is still down more than 60% from all-time highs, despite a clear path forward. Why then? Profitability. They’re getting closer every year, but they haven’t crossed that line yet. Investors want to see it — and until then, volatility is part of the game. The company prioritizes top-line growth over margin expansion at the moment, which is a fair strategy, however over time management will need to show if they can make PROCEPT into a cash monster of a similar stature to Intuitive. Like Intuitive, PROCEPT also has a new CEO stepping in. He’ll have to show that execution continues seamlessly, especially with growth expectations this high.

The contrast between the two is clear: Intuitive is the established leader with stretched multiples and stability, while PROCEPT is the scrappy disruptor with growth, lower multiples, and profitability questions. Both are fascinating in their own right. Personally, I am close to opening a position in PROCEPT — still weighing it in my head. For Intuitive, as much as I like the business, it would have to come down a lot more before I’d buy. I just can’t see the potential at these levels, but for PROCEPT though…

Títulos em alta

Principais criadores desta semana