$CALM (+0,73%) Position increase

Discussão sobre CALM

Postos

14🐔

$CALM (+0,73%) I go in

Cal-Maine Foods reports the strongest first quarter in the company's history

Cal-Maine Foods Inc ( CALM ) announced first quarter earnings that were up from the same period last year

The company's earnings totaled $199.34 million, or $4.12 per share. In the previous year, it amounted to 149.98 million US dollars or 3.06 US dollars per share.

The company's turnover increased by 17.4% to USD 922.60 million in this period, compared to USD 785.87 million in the previous year.

Cal-Maine Foods Inc. earnings at a glance (GAAP):

-Profit: $199.34 million compared to $149.98 million in the prior year.

-EPS: $4.12 vs. $3.06 in the prior year.

-Sales: USD 922.60 million compared to USD 785.87 million in the previous year.

- Cal-Maine Foods ( NASDAQ: CALM ) announces eine vierteljährliche Dividende von 1,37 USD pro Aktie a 41.7% decrease from the previous dividend of $2.35.

- Payable Nov. 13; for shareholders of record Oct. 29; ex-div. on Oct. 29.

- Under Cal-Maine Foods' variable dividend policy, the company pays a cash dividend to shareholders equal to one-third of each quarter's net income for each quarter in which it reports net income.

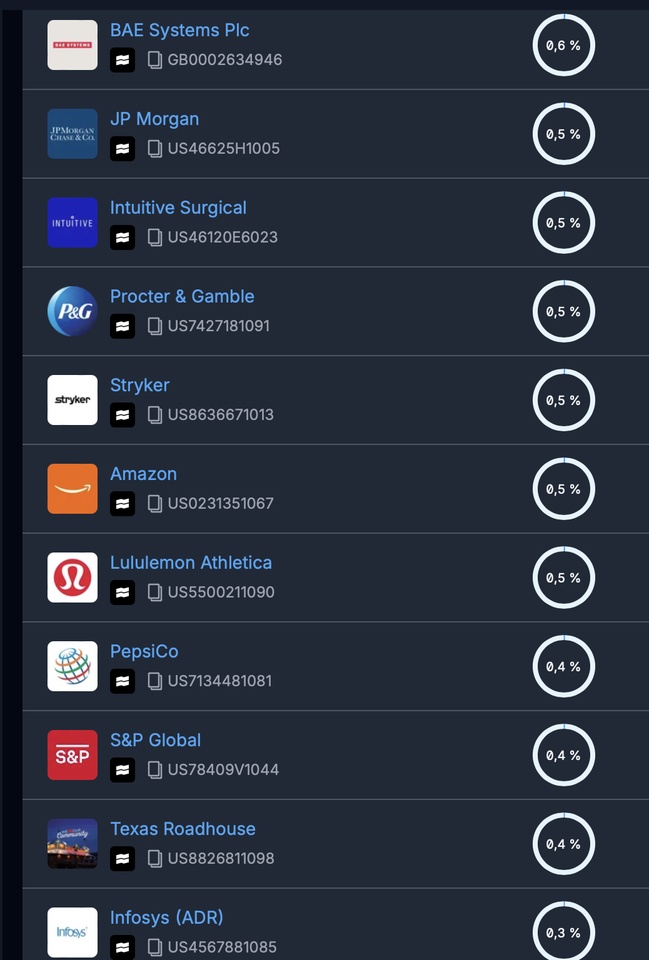

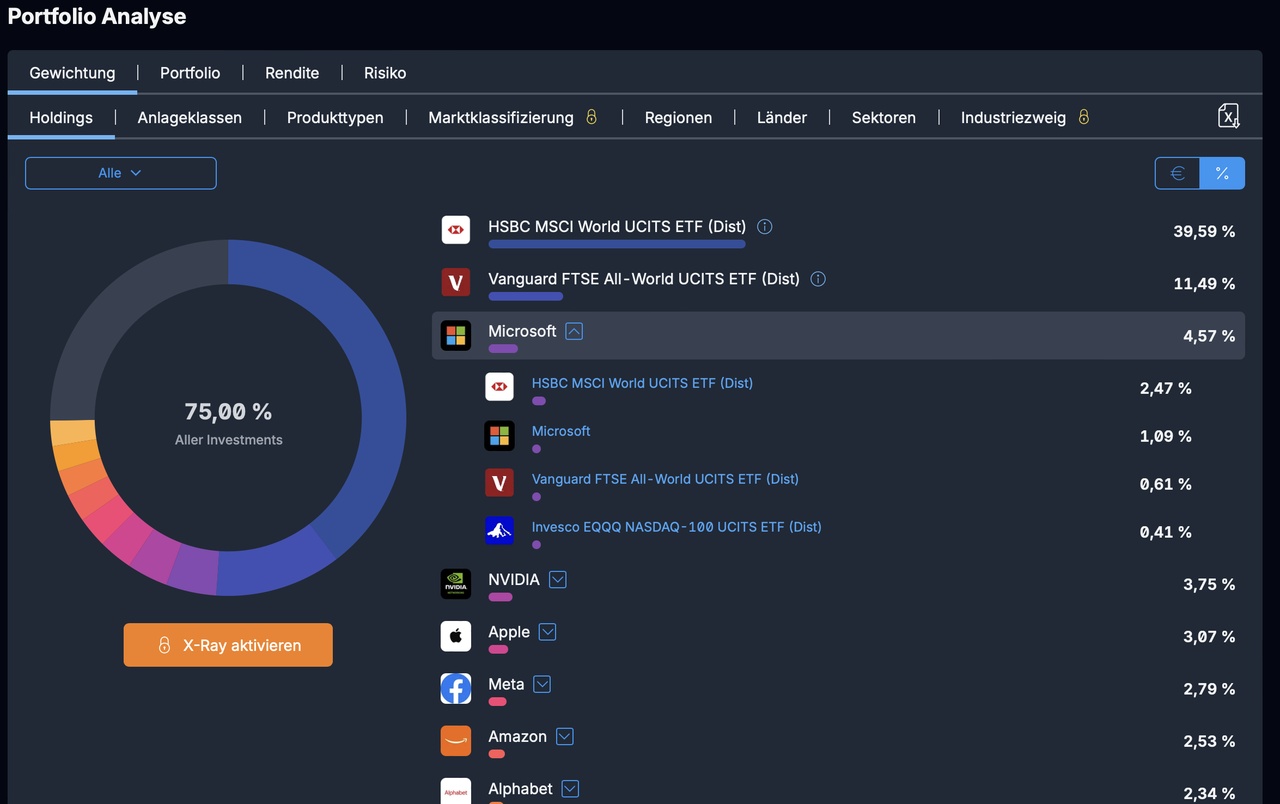

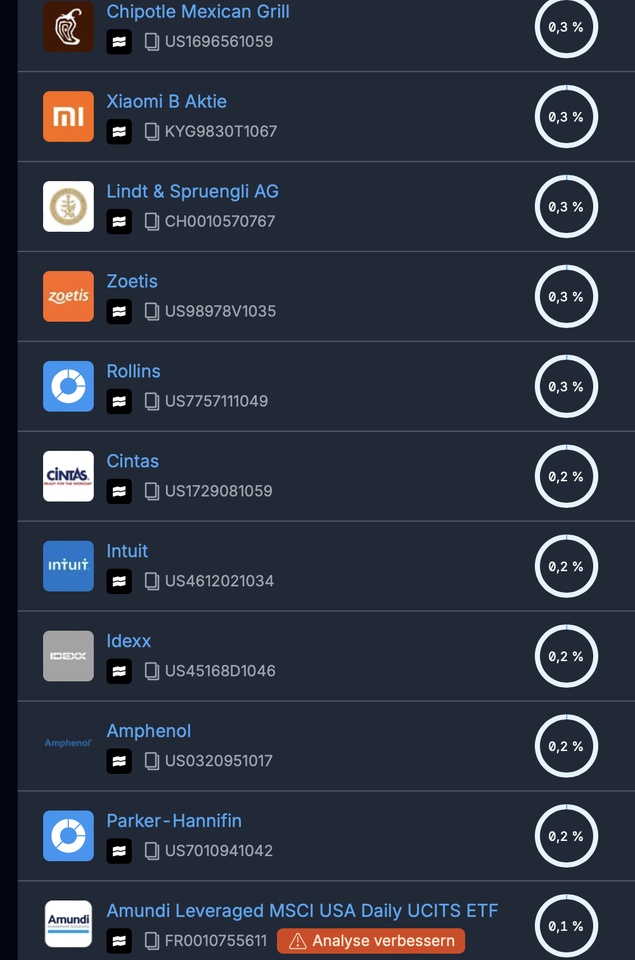

I would like to tidy up my portfolio again.

Good morning,

I continue to invest in my ETFs, which means that the relative weighting of individual stocks continues to shrink.

Because of this rock-solid ETF core, I can and want to do without supposedly safe stocks, especially so-called value stocks. I am prepared to take higher risks and focus mainly on growth stocks. After all, ETFs are there for everything else.

Here is my current portfolio: https://app.extraetf.com/de/shared/4MEaYJVdHN

Now I would like to move away from $III (+0,5%) and $CALM (+0,73%) possibly also from $BNTX (+0,47%) and a few others 🤭 I hope this is not a mistake and would therefore like your opinion?

I would also be happy to receive general criticism, suggestions, advice and guidance

PatitosFortune Mag7 (August 31, 2025)

The flock’s flying high again — with the top 7 positions now making up ~40% of the portfolio! That’s 6 points over last month showing how conviction is compounding 📈🪶

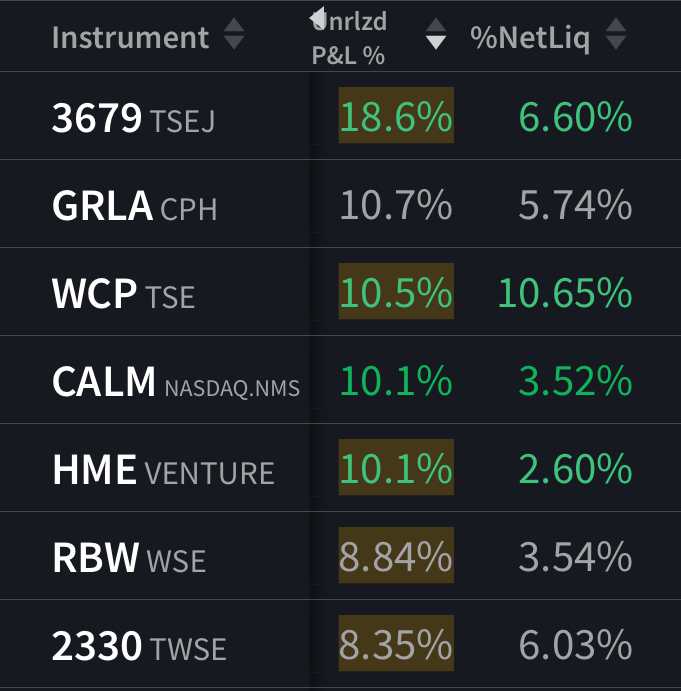

🏆 Top 7 Gainers August 2025:

$3679 (-2,69%) — Japan's quiet beast Zigexn is back on top with +18.6%, still among Patito's favorite conviction plays (6.60% of the nest).

$GRLA — Groenlandsbanken holds strong with +10.7%, proof you don’t need hype to win.

$WCP (-0,03%) — Our favorite dividend dripper slows slightly but keeps marching with +10.5%, and making up for largest holding (10.65%) as we have progressively added to the position. It doesn't show there but we have already received another full 1% in dividends since our start in February that have been fully reinvested to the portfolio. Did we mention it's a monthly dividend payer?

$CALM (+0,73%) — A new protein-powered entry: Cal-Maine cracks into the top 7 with +10.1%. 🍳

$HME (+0,78%) — Small Canadian energy keeps climbing, also +10.1% and currently holding the title for our top dividend score in our scoring system

$RBW (-0,58%) — Polish pick surprises with +8.84%, diversifying with promise.

$2330 — Taiwan Semi still making chips and making gains: +8.35%, and holding 6.03%.

🔁 Returning Leaders:

✅ $3679, $GRLA, $WCP, $HME, $2330

💪 These are not one-hit quacks — they’re holding their spots through volatility and growing stronger.

Our stronghold gold ETF $4GLD (-0,61%) has been pushed down the top ladder which is good news!

🍳 New Cracks in the Shell:

- Welcome to $CALM (Cal-Maine) and $RBW! Both breaking into the leaderboard with solid performance and strong fundamentals.

🎯 Strategy Update:

Patito's top 7 holdings now represent nearly half the portfolio — a clear sign of rising conviction and performance concentration.

We continue to prioritize:

- 🏅 High Patito Score picks (Elite + Excellent)

- 🧠 High WB Score conviction

- 🌍 Global diversification from Japan to Canada to Poland

- 🧈 Stable dividends and strong capital efficiency

🐣 Patito's holding steady, sleeping well, and reinvesting smart. August was golden.

Onward to September — let’s fluff up more feathers and hope for our other half of the portfolio to wake up (yes we're looking at you $BRK.B (+0,36%) , $SIGA , and $WRB (+0%) ).

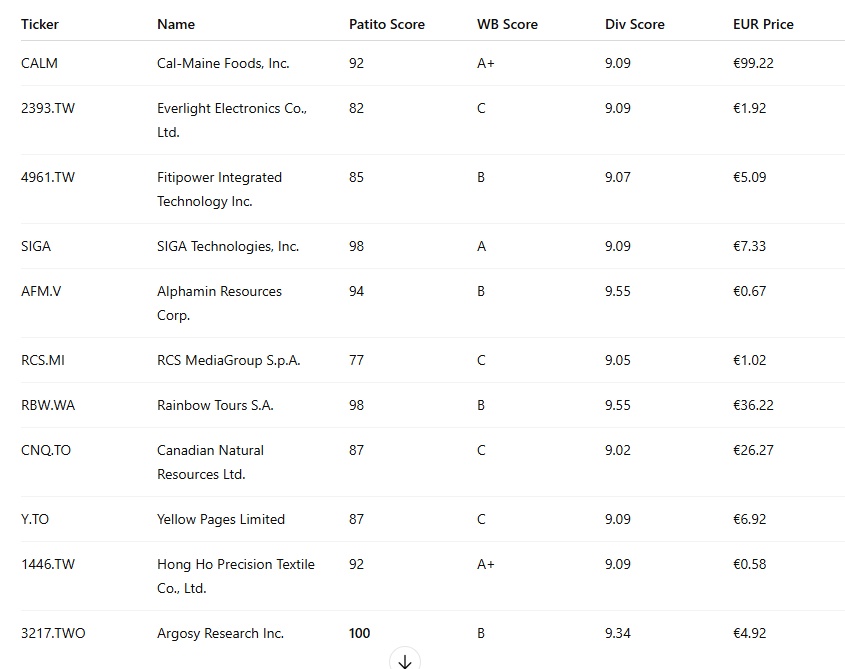

🦆💰 Patito’s Top Dividend Candidates (Aug 27, 2025) 💰🦆

Every week, thanks to my excel powered Patito Automated Scoring System(PASS), I screen over 3500 stocks looking for dividend stocks that combine strong fundamentals (Patito Score), quality (WB Score), and healthy yield profiles (Div Score).

I can’t invest in them all — but I decided to share my findings maybe someone will discover a new name worth your own due diligence.

🦆✨ My Shortlist This Week

From this pool, here are the names I’d personally highlight:

- $HME (+0,78%) – Micro-cap Canadian energy with a perfect Patito Score.

- $BETS B (+5,35%) – Scandinavian gaming powerhouse, strong mix of growth + yield.

- $PLUS (+0,4%) – High-margin UK broker with strong cash returns.

- $PLW (+0%) – Polish gaming studio, resilient business model.

- $CALM (+0,73%) – U.S. egg giant, cyclical but dividend-rich.

- $SIGA – Biotech niche player with reliable contracts.

- $3217 – A Taiwan candidate I’m tracking closely. Not available to trade with my current broker though...

Several of those stocks I do currently own in my portfolio and the ones I am definitely hoping to include are $RYN (-4,98%) (to diversify into Real Estate to my portfolio), $PLUS (+0,4%) as a possible replacement of $WRB (+0%) and $1446 because penny stocks with potential value provide a liquidity combination that helps me DCA, and I like the idea~

🐥 Obviously this is not financial advice. I share my screeners and top dividend candidates for discussion and discovery. Always do your own due diligence before investing.

I hope to keep these posts regularly, every two weeks or so.

quack!

Investment update: Strong growth in CALM and strategic shift from US to Japanese single stocks.

$CALM (+0,73%) -Investment pays off:

Q4 sales at USD 1.1 billion (previous year USD 640.8 million) +70% 🟢

Profit 342.5 million or 7.04 per share (previous year 113.2 million or 2.32). +200% 🟢

https://finance.yahoo.com/news/cal-maine-foods-reports-financial-200500405.html

I also swapped a few smaller tranches of US shares for Japanese shares, which should also be worthwhile due to the new agreements. 💹

Are you still invested? In your opinion, can the relatively sharp fall in recent weeks be considered normal volatility or cyclical? 🙈

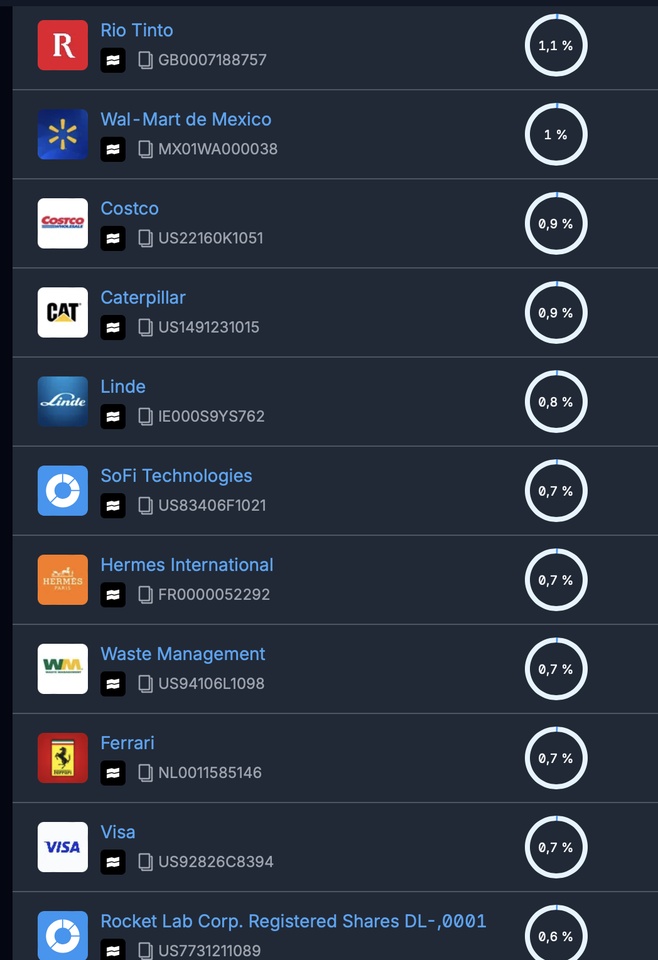

My securities account as of today - Update

Here in the link my previous portfolio (unfortunately can no longer be updated here at the moment) and the train of thought of the last months briefly summarized:

-----------------------------------------------------------------------------------------------------------

This is my portfolio as of today.

-----------------------------------------------------------------------------------------------------------

I probably won't manage to get rid of individual stocks completely.

But at least I could eliminate supposedly unnecessary overweightings and overlaps and focus more on second-tier stocks, such as $CALM (+0,73%)

$TXRH (-0,68%)

$SOFI (+3,57%)

In any case, I haven't reallocated much since the article linked above.

I'm taking it rather slowly, as it still feels wrong to me, although the opposite would be more accurate.

So far I have sold the following stocks:

Lotus $LOTB (-1,69%) -7,3 %

Hims $HIMS (+3,16%) +202 %

DE Telekom $DTE (-1,24%) +-0

Church&Dwight $CHD (-0,3%) -6 %

Ecolab $ECL (+0,46%) +1 %

-----------------------------------------------------------------------------------------------------------

Below is the X-Ray, which illustrates overweightings and allocations. Nvidia and Apple are not in my portfolio as individual stocks, but are strongly represented due to the ETFs. However, I have $MSFT (+0,68%) and $GOOGL (+2,32%) shares in the portfolio, which leads to an overweighting. Alphabet convinces me in many ways, so the overweight could make sense here. But with Microsoft, the ETF share could actually be enough for me. I am therefore considering adding an SL to Microsoft, for example 7% below the current price level.

-----------------------------------------------------------------------------------------------------------

+ 1

Títulos em alta

Principais criadores desta semana