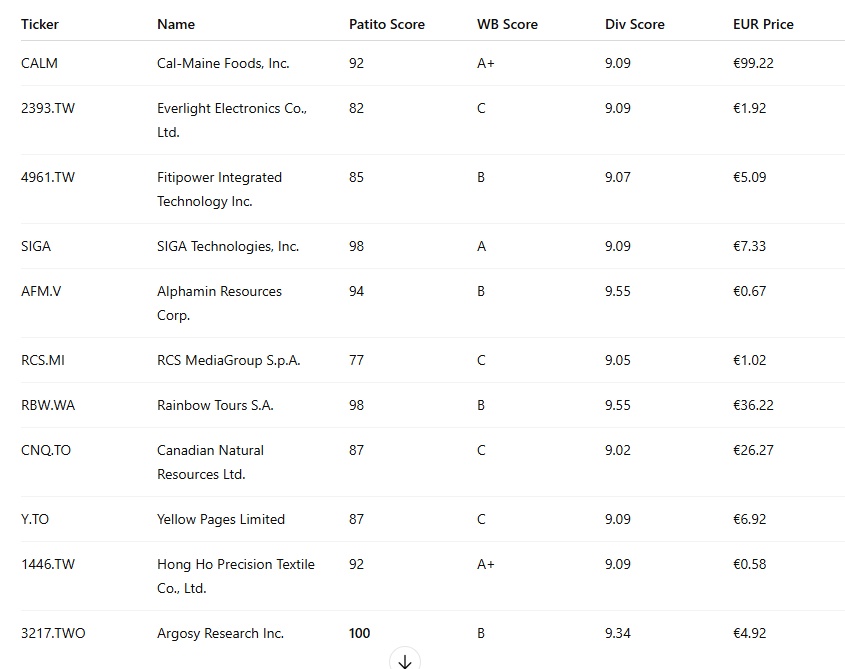

Every week, thanks to my excel powered Patito Automated Scoring System(PASS), I screen over 3500 stocks looking for dividend stocks that combine strong fundamentals (Patito Score), quality (WB Score), and healthy yield profiles (Div Score).

I can’t invest in them all — but I decided to share my findings maybe someone will discover a new name worth your own due diligence.

🦆✨ My Shortlist This Week

From this pool, here are the names I’d personally highlight:

- $HME (+2,59%) – Micro-cap Canadian energy with a perfect Patito Score.

- $BETS B (+0,73%) – Scandinavian gaming powerhouse, strong mix of growth + yield.

- $PLUS (+0,32%) – High-margin UK broker with strong cash returns.

- $PLW (+0,09%) – Polish gaming studio, resilient business model.

- $CALM (+0,89%) – U.S. egg giant, cyclical but dividend-rich.

- $SIGA – Biotech niche player with reliable contracts.

- $3217 – A Taiwan candidate I’m tracking closely. Not available to trade with my current broker though...

Several of those stocks I do currently own in my portfolio and the ones I am definitely hoping to include are $RYN (-1,59%) (to diversify into Real Estate to my portfolio), $PLUS (+0,32%) as a possible replacement of $WRB (+1,11%) and $1446 because penny stocks with potential value provide a liquidity combination that helps me DCA, and I like the idea~

🐥 Obviously this is not financial advice. I share my screeners and top dividend candidates for discussion and discovery. Always do your own due diligence before investing.

I hope to keep these posts regularly, every two weeks or so.

quack!