Trump Meets Putin in Alaska – A Meaningless PR Stunt?

Finally, after weeks of speculation, President Trump has arrived in Alaska to supposedly discuss how to end the war in Ukraine. This is the first face-to-face meeting in several years for the two presidents.

Trump warned of “very severe consequences” if a ceasefire can’t be reached – whatever that’s supposed to mean. Hopefully, it has nothing to do with the ballistic submarines stationed near Russia after Trump and a Russian official engaged in a verbal sparring match on social media. Let’s see where this goes.

UnitedHealth – The Stock Has Found Its Savior

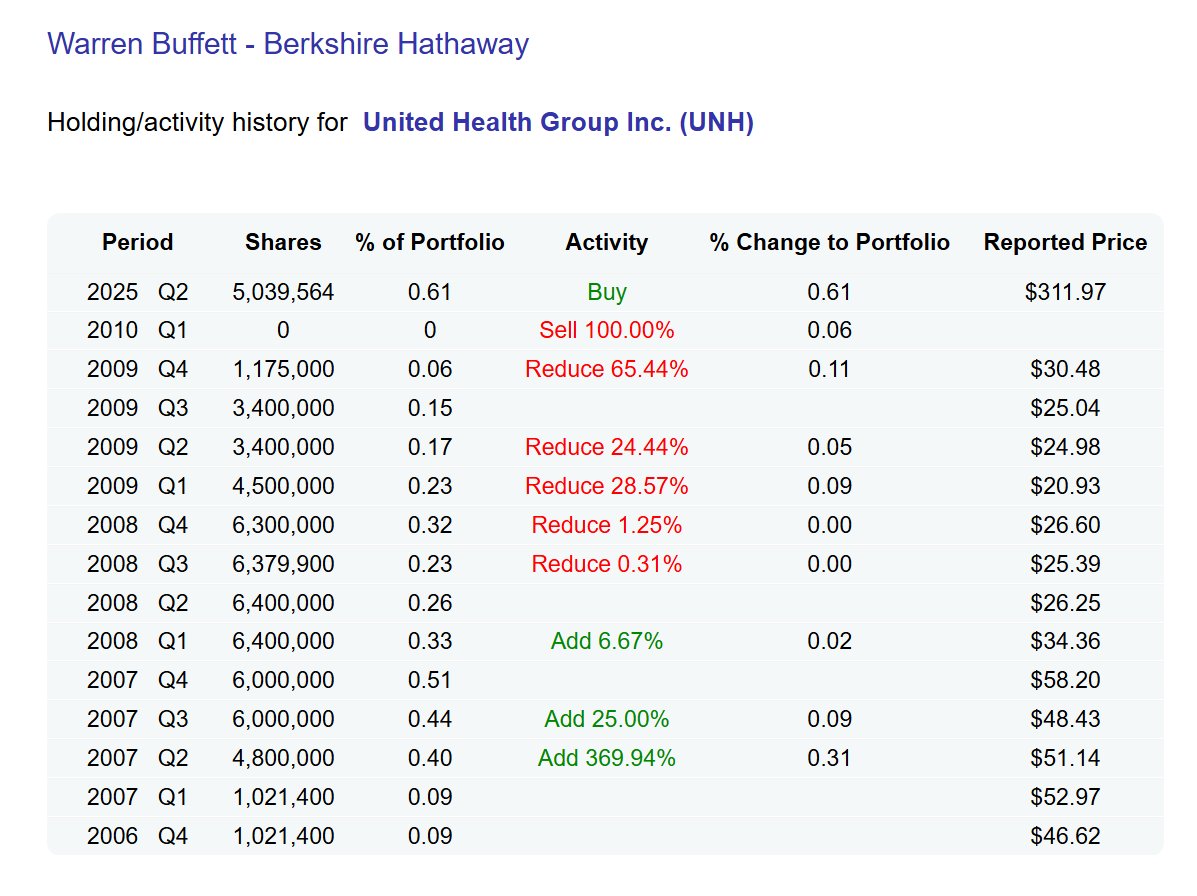

Berkshire Hathaway sold shares in Apple and added to a new, very attractively valued position: UnitedHealth Group. Warren Buffett is known to buy when others are fearful, and speculation surrounded his latest pick until it was finally announced yesterday.

I can gladly say that I’m apparently not the only one who sees great potential in the unloved giant. The company has faced major headwinds – including the vicious and brutal killing of its CEO, higher medical costs, and controversies over its business practices. However, let’s not forget: UnitedHealth is the 9th-largest employer in the U.S. and the largest health insurer worldwide. 1 in 6 Americans is covered by UnitedHealth.

Warren Buffett finally gave the stock the spark it so badly deserved. UnitedHealth is a great company that – and quote me on this – will climb back to all-time highs. The insurer has a massive moat, strong fundamentals, and generates cash like King Midas. This is one of the positions in my portfolio I’m least worried about. I’ll let it sit there and take profits in two years.

Dlocal vs. Adyen – I Suppose I Chose Correctly

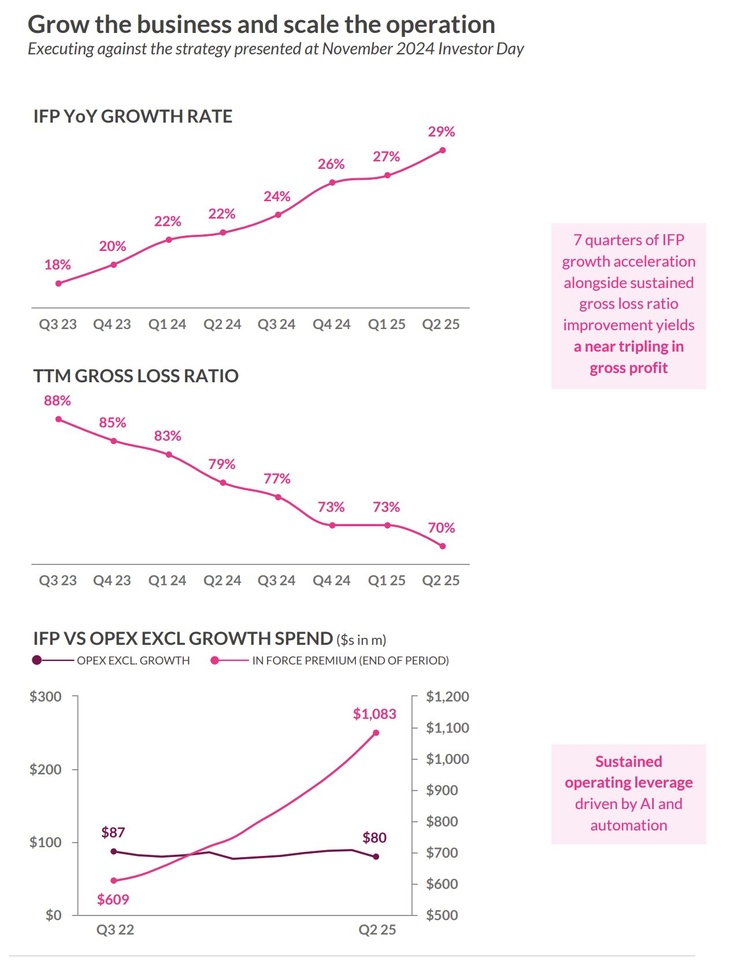

Investor’s reaction to the earnings of these two fintech companies couldn’t have been more different. One stock fell 20% after the report, while the other jumped more than 40%. Dlocal and Adyen both operate as international payment processors – Dlocal primarily in South America and other emerging markets, and Adyen across global markets.

Dlocal raised its guidance, beat expectations, and impressed with excellent execution, while Adyen struck a cautious tone and predicted a soft outlook. I find both companies highly interesting, but I decided to invest in Dlocal a few weeks ago due to its superior expansion potential, more attractive valuation, and strong leadership.

I feel proven right after the recent reports, though I wouldn’t be opposed to opening a position in Adyen if the stock drops further.

$UNH (+0,49%)

$BRK.A (+0,36%)

$BRK.B (+0,2%)

$AAPL (+0,3%)

$DLO

$ADYEN (+0,44%)

$ADYEN (+0,44%)

$BRNT (-0,13%)

$CRUD (+0,98%)