Reading time: approx. 10 minutes

The last article was about leveraged daily ETFs - in other words, about momentum, short-term market movements and strategies where timing is crucial. Today it will be much quieter. It's about what remains when markets fluctuate and hypes fade: the fundamentals.

This article is aimed primarily at beginners and is intended to help them find their way through the ETF jungle - to understand which products are truly global, how they differ and how to build a stable core portfolio.

After all, long-term wealth accumulation does not start with the search for the highest return, but with a solid core. In my case, this core consists of three pillars:

- $ISAC (+0,69%) (iShares MSCI ACWI UCITS ETF) - as a global equity building block

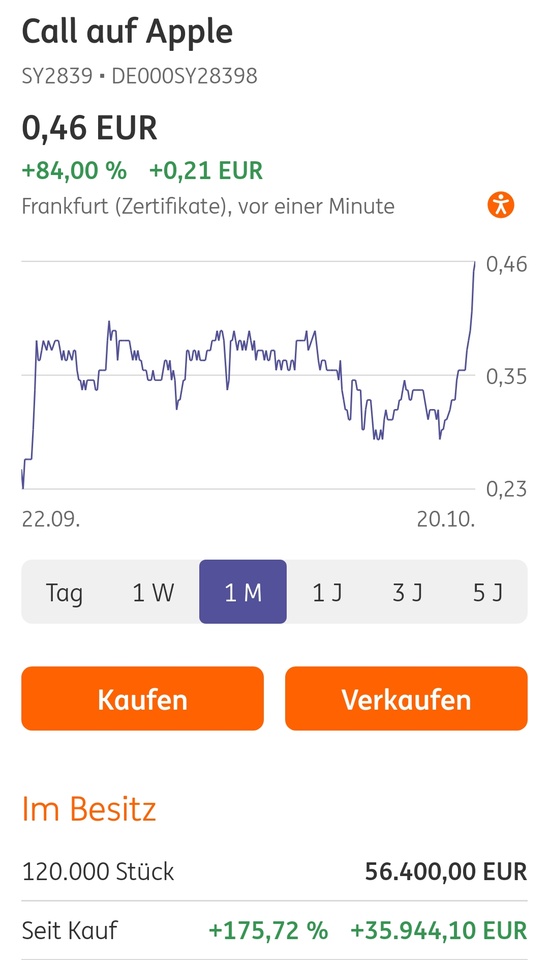

- $BTC (+3,05%) (Bitcoin) - as a diversifying, asymmetric building block with its own risk profile

- $SEGA (-0,13%) (iShares Core Euro Government Bond ETF) - as a defensive counterbalance on the bond side

These three positions form the backbone of my portfolio. The rest - i.e. rotation strategies, thematic investments or leveraged products - complement the foundation.

Why an ETF comparison is important

"World ETF" sounds like global diversification. In practice, however, many of these funds only cover industrialized countries. The difference between $XDWD (+0,59%) (iShares MSCI World UCITS ETF), $ISAC (+0,69%) (iShares MSCI ACWI UCITS ETF) and $VWCE (+0,6%) (Vanguard FTSE All-World UCITS ETF) is not a marginal detail, but crucial for your own investment strategy.

Anyone who understands these differences quickly realizes how much the selection of the index determines the actual distribution in the portfolio - and how much "world" is actually in your own ETF.

The $ISAC (+0,69%)

(iShares MSCI ACWI UCITS ETF)

The $ISAC (+0,69%) tracks the MSCI All Country World Index - around 2,800 stocks from 47 countries, covering around 85% of global market capitalization.

Regional breakdown (as at October 2025):

- USA: approx. 65 %

- Europe: approx. 15 %

- Asia (incl. Japan & China): approx. 10%

- Emerging markets: approx. 10 %

This combines the $ISAC (+0,69%) industrialized and emerging markets in one product - exactly what many investors replicate themselves with two ETFs (MSCI World + MSCI Emerging Markets).

The total expense ratio (TER) is currently 0.20% p.a. - extremely favorable for a global fund of this breadth.

I use it as a core building block because it combines global diversification with simplicity: one ETF, one decision, global participation.

$ISAC (+0,69%)

vs. $XDWD (+0,59%)

(iShares MSCI World)

The $XDWD (+0,59%) (iShares MSCI World UCITS ETF) only tracks 23 industrialized countries - no emerging markets, no China, no India. It contains around 1,500 stocks and is heavily dominated by the USA.

The $ISAC (+0,69%) (iShares MSCI ACWI UCITS ETF) expands this base to include 24 emerging markets and thus has around 2,800 stocks. This means:

- $XDWD (+0,59%) is more focused, somewhat more stable, but limited to mature markets.

- $ISAC (+0,69%) is broader, more future-oriented and contains more growth markets.

In recent years, the MSCI World has been slightly ahead because the emerging markets have underperformed. In the long term, these phases tend to even out - and this is precisely where the ACWI shows its strength: It automatically grows with the global economy, even if the regional focus changes.

$ISAC (+0,69%)

vs. $VWCE (+0,6%)

(Vanguard FTSE All-World)

The $VWCE (+0,6%) (Vanguard FTSE All-World UCITS ETF) is the best-known alternative to the $ISAC (+0,69%) . It also combines industrialized and emerging markets, but according to the FTSE index methodology and with around 4,000 shares - i.e. somewhat broader.

Both funds fulfill the same purpose: global coverage in a single product. The differences lie in the details - for example in the country classification (e.g. South Korea is listed as an industrialized country in FTSE, but as an emerging country in MSCI).

The performance is also almost identical. The TER of the $VWCE (+0,6%) at 0.19% p.a. is even slightly lower than that of the $ISAC (+0,69%) . Both funds therefore offer an almost equivalent opportunity to invest globally over the long term.

Concentration in the $ISAC (+0,69%)

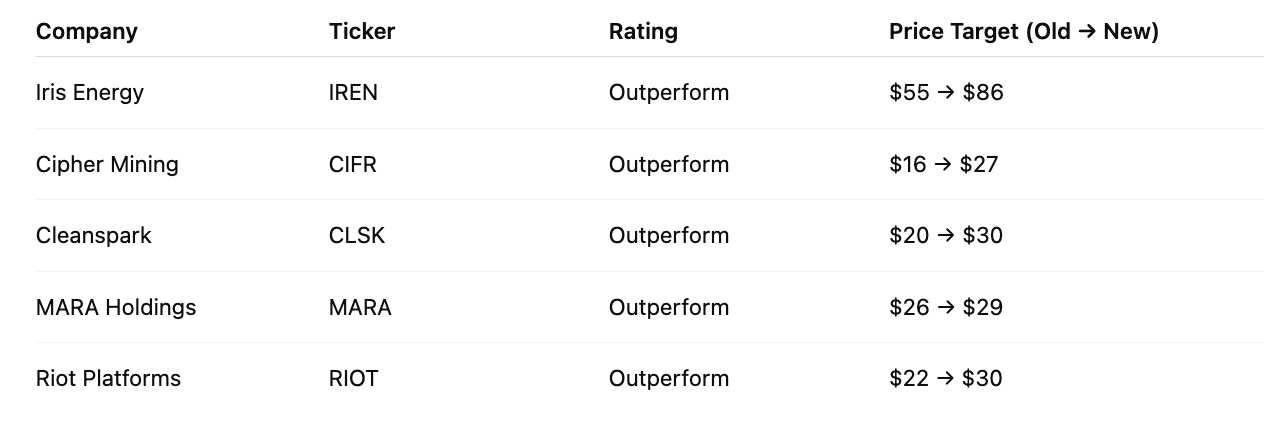

Despite its breadth, the ACWI is also concentrated on a few heavyweights. The top 5 positions account for around 18% of the fund (as at October 2025):

This shows how strongly the US technology sector shapes the global markets. This weighting is not a disadvantage, but a true reflection of global market capitalization. I consciously accept this structure, but balance it out with my other core components: $BTC (+3,05%) (Bitcoin) as an uncorrelated asset and $SEGA (-0,13%) (iShares Core Euro Government Bond ETF) as an anchor of stability.

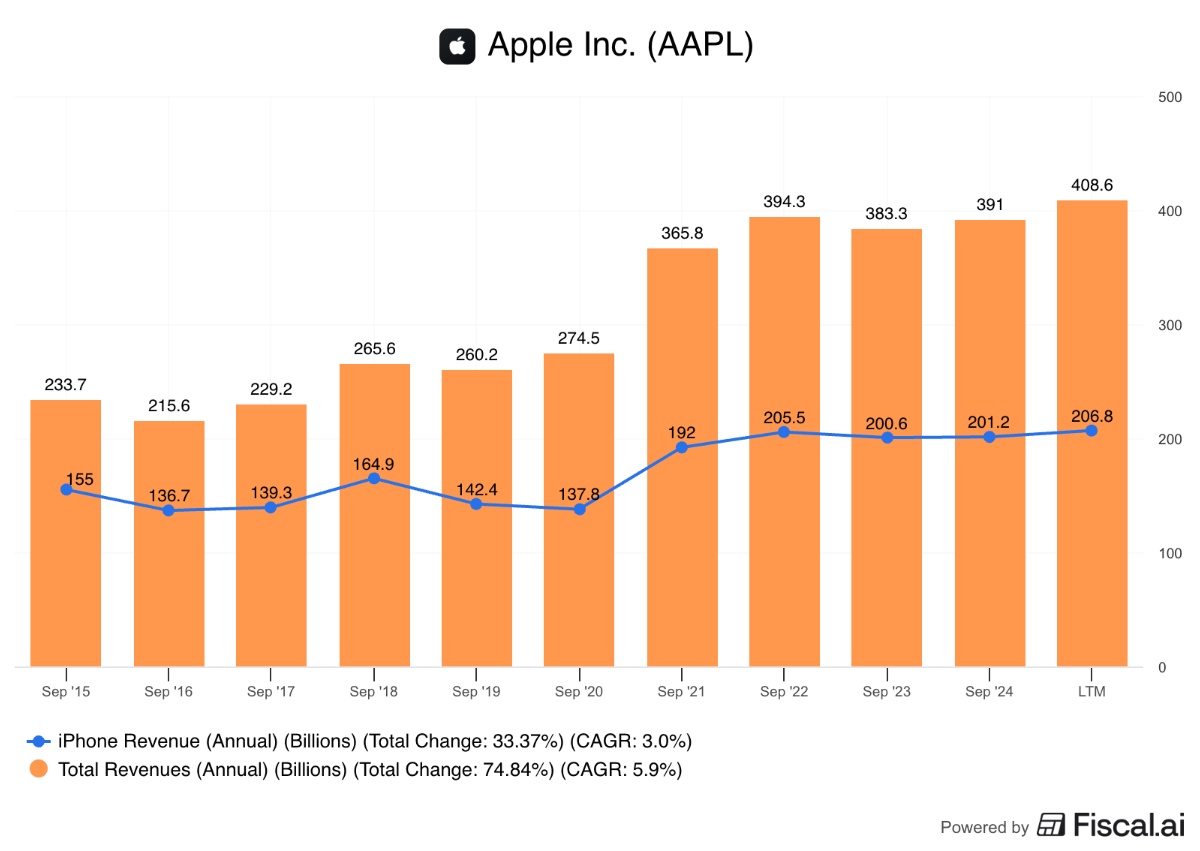

Five-year performance (as at October 2025)

The differences are manageable. The MSCI World benefited more from the dominance of the USA, while $ISAC (+0,69%) and $VWCE (+0,6%) are more broadly based. This global diversification can lead to more stable returns in the long term because it is less dependent on individual markets.

What newcomers can take away from this

In my opinion, an ETF is often sufficient. A global fund like the $ISAC (+0,69%) covers almost all markets - ideal for getting started.

Keep an eye on costs. A TER of 0.20 % is very favorable for this breadth.

Global means USA-dominated. Around two thirds of the fund comes from the United States - and that is currently the market reality.

Simplicity is an advantage. Those who manage fewer products remain more consistent in the long term.

Time beats actionism. The compound interest effect unfolds its power over years - not months.

The $ISAC (+0,69%) (iShares MSCI ACWI UCITS ETF) is the centerpiece of my portfolio. It stands for breadth, simplicity and global participation - and realistically reflects the global economy.

Together with the $BTC (+3,05%) (Bitcoin) - which not only brings potential returns but also diversification to the portfolio - and the $SEGA (-0,13%) (iShares Core Euro Government Bond ETF) as a defensive counterpart, a robust core setup is created that covers all dimensions: Growth, stability and risk diversification.

The rest - thematic or individual investments, rotation strategies or leveraged ideas - completes the foundation.

Questions at the end:

- How do you structure your core?

- Do you use an all-in-one ETF like the $ISAC (+0,69%) or do you prefer to combine your own with $XDWD (+0,59%) and emerging markets?

- And what role does $BTC (+3,05%) diversification, return or both play for you?