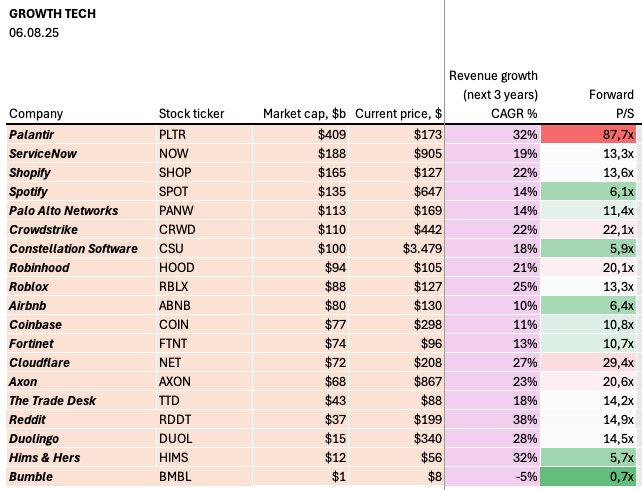

$ABNB (-0,68%)

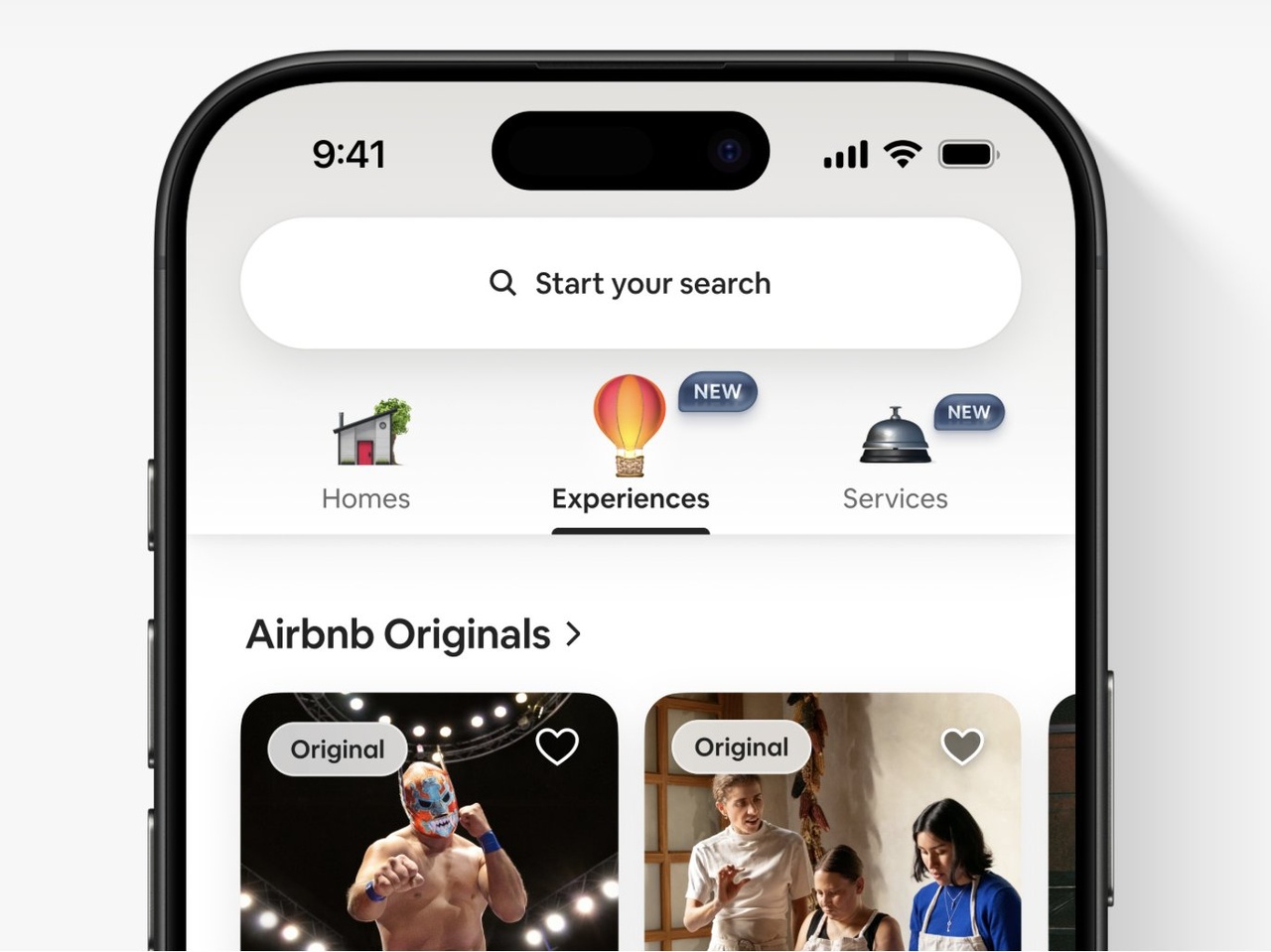

Airbnb follows the example of Expedia

Airbnb is now following the same path. Major buybacks have been underway since last year, reducing the number of outstanding shares from 686 to 652 million in the last 12 months.

Now, however, the company is going one better. A few days ago, the company increased its share buybacks from USD 1.5 billion to USD 7.5 billion, which corresponds to around a tenth of its market capitalization.

As the company has no significant debt, is solidly profitable and has cash reserves of USD 11.4 bn, it can easily afford to do so.

With a P/FCF of 16.4, the buybacks should create clear added value for investors.

Growth momentum is picking up again

This is especially true if the company continues to grow in the future - and it looks like it will.

In the first quarter, the number of nights and experiences booked increased by 8 % to USD 141.1 million and revenue by 6 % to USD 2.3 billion.

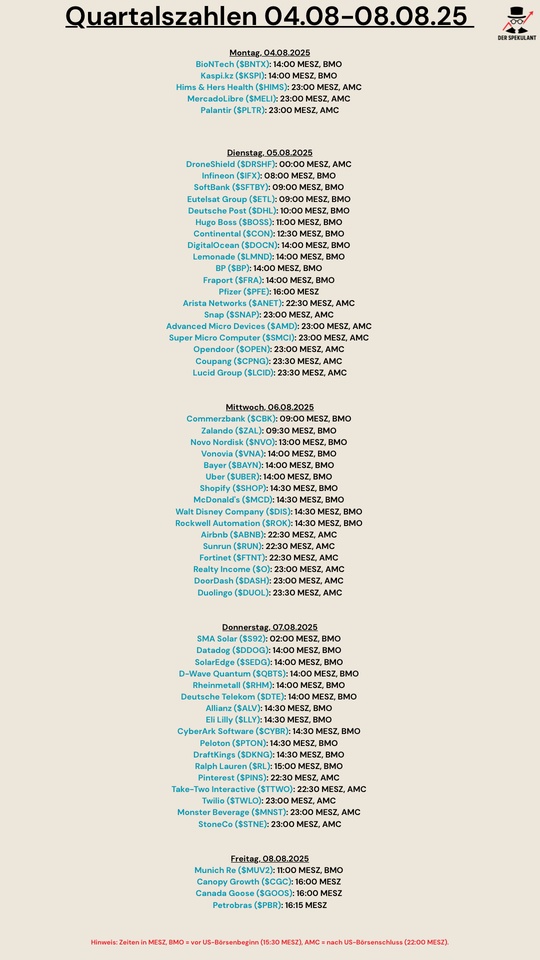

A few days ago, Airbnb provided a confident update on the second quarter.

At USD 1.03 per share, earnings were well above expectations of USD 0.94. With revenue of USD 3.10 billion, analysts' estimates of USD 3.04 billion were also exceeded.

For the year as a whole, this corresponds to a 13% increase in sales and a 20% jump in profits. The growth momentum has therefore increased.

The only slight disappointment is the free cash flow. In the last 12 months (TTM), FCF of USD 4.3 billion and an FCF margin of 37 % were achieved.

While this means that Airbnb is highly profitable (FCF margin of 37%), little progress has been made compared to the previous 12 months, when free cash flow was USD 4.2 billion.

According to the Executive Board, low single-digit growth in the USA is weighing on business. However, international expansion is progressing well.

For the third quarter, Airbnb is forecasting revenue growth of 8 - 10 % to USD 4.02 - 4.10 billion. The full-year forecast has been confirmed.

According to consensus estimates, free cash flow is expected to increase by 10 % to USD 7.62 per share this year.

Airbnb therefore has a forward P/FCF of 15.9, which is easily justified by the double-digit growth rates. Since the share price collapse in 2022, the P/FCF has averaged 19.8

Airbnb share: Chart from 11.08.2025, price: 121 USD - symbol: ABNB | Source: TWS

The share opened the day after the Quartalszahlen opened with a down-gap, but stabilized immediately.

From a technical perspective, however, a rise above USD 125 or better USD 130 would be necessary to trigger a clear Kaufsignalbe triggered.

If, on the other hand, the share falls towards USD 113, this could be an opportunity for anti-cyclical investors.

Source

https://www.lynxbroker.de/boerse/boerse-kurse/aktien/airbnb-aktie/airbnb-analyse/?a=3355991664&utm_medium=email&utm_source=newsletter&utm_campaign=newsletter-boersenblick&newsletter=true&mc-rss-cache-bypass=2025081206&goal=0_d93daae099-4df1c53835-410756260#buybacks-wachstum-volle-kassen-nachzugler-chance-airbnb