We need to talk about the healthcare sector today. After 2024 had already disappointed many companies in the sector due to the "corona effect" and was labeled a "transition year", I had actually called for a major recovery in 2025. What happened instead is of course clear: a complete bleed-out of the industry.

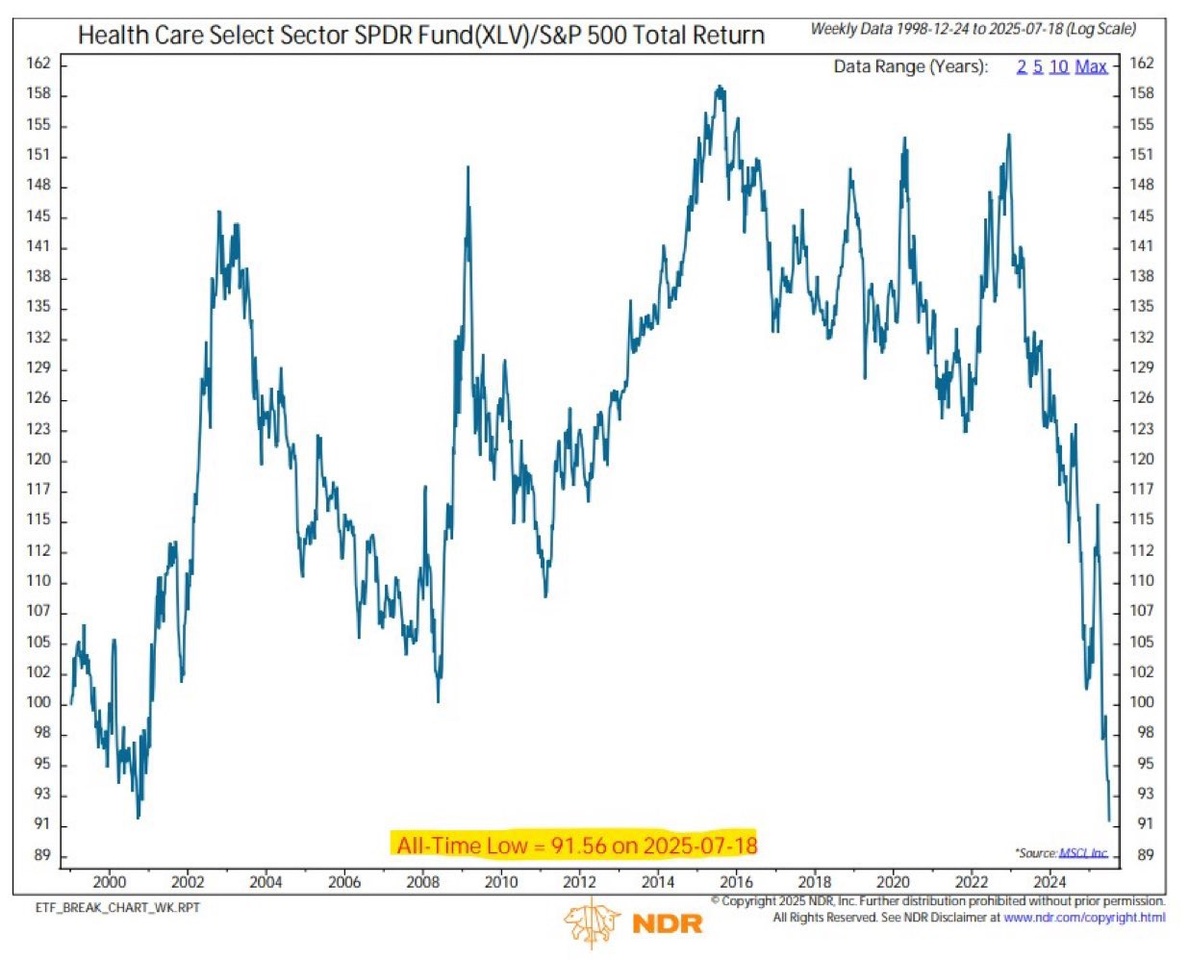

In fact, the situation in the healthcare sector is so bad that no returns at all have been achieved across the board in the last three years, and that is bad.

I had actually chosen the healthcare sector as a second pillar in my portfolio alongside my tech investments, as I have a great passion for the topic of healthcare and also like to spend a lot of time on it. Actually, I also had the impression that the healthcare sector is rather defensive as the demand for healthcare services is continuously increasing when there is an increasing number of sicker people in the world. I have therefore created a diversified portfolio of companies that have a predominance in the treatment of a specific disease: Heart defects, mucoviscidosis, diabetes - you can probably already guess where this is going.

At the moment I have several companies in my portfolio whose performance really resembles a horror movie: $ILM1 (+0,24%) , $AFX (-0,19%) , $UNH (-0,46%) , $NOVO B (-0,39%)

Plus some resurrected zombies like $TMO (+0,14%) , $ABBV (-0,51%) , $EW (-0,47%) , $MEDP (-9,17%) whose performance could be reactivated through life-sustaining measures.

Only $SYK (-1,49%) and $VRTX (-2,32%) are developing in line with expectations overall.

In summary, 40% pain, 40% okay and only 20% yes

However, the poor performance is not at all related to the selection of companies. Other giants such as $MRK (-0,73%) and even the most solid healthcare company in the world $JNJ (-0,67%) are not performing satisfactorily either. Some people here in the comments always act as if Novo Nordisk and UNH were the worst companies in the world and everything was foreseeable - but that's just not the case. In fact, they are only falling so sharply and getting so much media coverage because they have always been regarded as the absolute gems in contrast to solala companies like $PFE (-0,23%) it really wasn't an everyday occurrence for them to halve overnight.

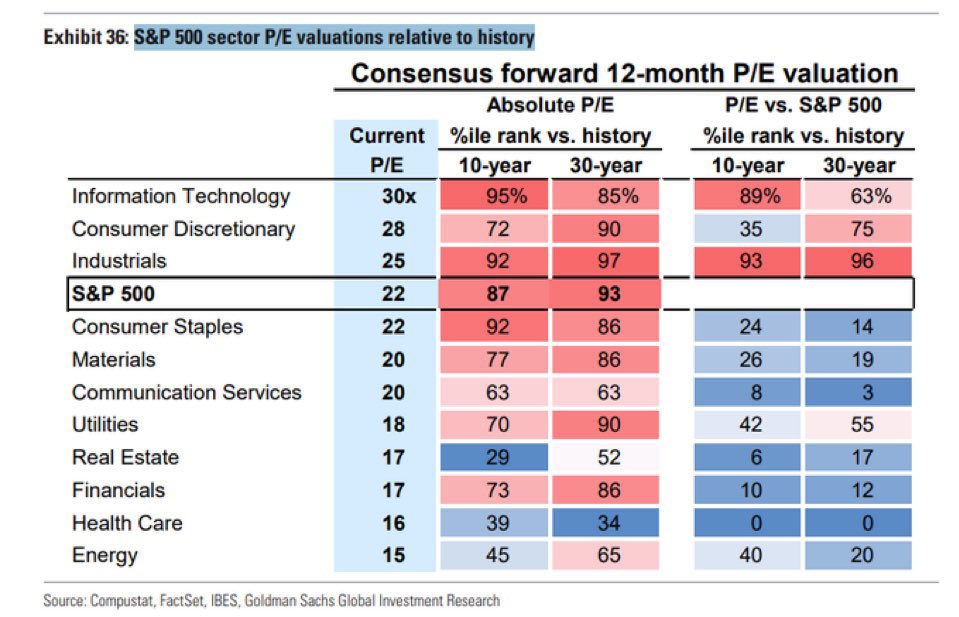

Overall, the healthcare sector, which has been battered for years, is now also considered undervalued. So we can still hope for a recovery. Nevertheless, it is slowly becoming a huge problem for me if I put 1/4 of my capital into assets that are outperforming the savings book and not compensating for inflation. The opportunity costs in particular are astronomical, as I have been 80% right in the tech sector in recent years and 80% wrong in the healthcare sector. I spend more money with my left hand than I earn with my right.

The saying comes to mind: "The tide lifts all boats" which is actually supposed to protect against overconfidence. But isn't it also true that an ebb tide lowers all boats? Perhaps neither the great hit rate in the tech sector nor the subterranean hit chance in the health sector is dependent on my investment decisions, but simply a static anomaly.

What I also want to address specifically is that I find it incredibly annoying that investing in the healthcare sector is such a drama club. I sometimes wonder whether we're doing business here or filming a telenovela. I mean, the whole thing with $HIMS (+2,06%) is a complete kindergarten. Why is it that in the automotive industry, complete strangers manage to merge or form alliances just like that and in the healthcare industry they can't even manage to sell a few medications for 3 months without it degenerating into a mud fight and a war of the roses? My gosh.

But now it's up to you. I would be particularly interested to know how people who have been on the market for more than 10 years see it. Have health values always been such a rollercoaster ride or is the industry better than its reputation?