Next one.💪🏻

This time, from my point of view, exciting developments regarding my portfolio value $HIVE (-1,63%) which were explained in a press release:

San Antonio, Texas--(Newsfile Corp. - January 13, 2026)

HIVE Digital Technologies Ltd (TSXV: HIVE) (NASDAQ: HIVE) (FWB: YO0) (BVC: HIVECO) (the "Company" or "HIVE"), a diversified global digital infrastructure company headquartered in San Antonio, Texas.

digital infrastructure company headquartered in San Antonio, Texas, today announced its

expansion into Paraguay through a strategic joint venture with Paraguay's

Paraguay's leading telecommunications operator.

As part of this partnership, HIVE is introducing one of the first purpose-built BUZZ artificial intelligence cloud platforms in Paraguay, located in Asunción and hosted in a Tier III data center of the leading telecom operator in Paraguay. The platform is designed to provide high performance computing (HPC) and AI infrastructure for academic and research institutions, enterprises, financial service providers and healthcare providers in Paraguay and the entire South American region.

The first deployment is scheduled to begin in the first quarter of 2026 and will initially

with an enterprise-class GPU cluster that will be used for AI training, inference

inference and data-intensive workloads. The platform will be

scaled over time according to customer demand and subject to capital

availability of capital, with the renewable hydropower of

Paraguay, the national fiber optic network of Paraguay's largest telecommunications provider and enterprise-class data centers.

This expansion builds on HIVE's existing digital infrastructure in Paraguay, where the company develops and operates Tier I data centers and associated substations supported by access to large-scale renewable hydropower electricity. HIVE views Bitcoin mining as a means to build Tier I data center infrastructure and substations that monetize excess or unused electricity.

monetize surplus or unused electricity and convert energy into economic value.

into economic value. In this framework, each bitcoin represents a bundle of energy, a concept also

concept that has also been articulated by technology leaders such as Elon Musk and Jensen Huang in their discussions of Bitcoin as a form of monetized economic labor. The infrastructure required for production can serve as the fundamental basis for more advanced digital computing applications, including AI and high performance computing hosted in Tier III data centers.

HIVE's strategy in Paraguay is based on a long-term, multi-year vision to further develop energy-based digital infrastructure into scalable AI and data center capacity. The company believes that

believes that the growth of the AI-driven digital economy depends on a reliable

depends on a reliable power supply and high-performance dark fiber connectivity that enables secure, low-latency data transmission.

with low latency. While Tier III data centers capable of hosting GPU-intensive workloads require significantly higher capital investments

HIVE believes that its phased approach - starting with Tier I infrastructure - provides a disciplined and economically efficient path to higher-value AI-enabled facilities.

facilities.

Paraguay has experienced periods of strong economic growth in recent quarters

supported by a stable government and an investment-friendly policy environment. HIVE believes that

these conditions, combined with the country's energy profile, provide a

constructive backdrop for long-term investment in digital infrastructure.

infrastructure.

HIVE believes that this development is broadly consistent with the development of

digital infrastructure in Texas, including the San Antonio to West Texas

corridor from San Antonio to West Texas, where development began with Tier I data centers focused on energy-intensive workloads and later expanded to capital-intensive Tier III facilities that can support advanced enterprise and AI workloads.

workloads. The company believes that Paraguay is at a similar early stage in this infrastructure

similar early stage in this infrastructure development cycle, while recognizing that the

recognizing that outcomes will depend on a number of economic and regulatory factors.

and regulatory factors.

The company anticipates that continued investment in AI and HPC infrastructure will

and HPC infrastructure could support downstream economic activity, including potentially

activity, including a potential increase in demand for software

software developers, computer engineers, data scientists,

electrical engineers and other technical professionals, which over time would

would contribute to workforce development over time.

The expansion also reflects Paraguay's continued institutional commitment

Paraguay's ongoing institutional commitment to the United States. On December 15, 2025

U.S. Secretary of State Marco Rubio and Paraguayan Foreign Minister Rubén Ramírez

Foreign Minister Rubén Ramírez Lezcano in Washington, D.C., signed a

Troop Stationing Agreement (SOFA) between the United States and Paraguay.

Paraguay. While SOFAs are a common instrument of US foreign policy with countries such as

countries such as Germany, Italy and Japan, the agreement reflects continued

continued bilateral cooperation in areas such as security, stability

stability and law enforcement, which could contribute to greater institutional

could contribute to greater institutional trust.

The launch of the BUZZ AI cloud platform is designed to support the demand for accelerated computing across South America by providing companies with access to an AI infrastructure that operates in a Tier III environment and is powered by renewable energy.

Tier III environment and powered by renewable energy.

While future expansions will depend on the expansion of infrastructure such as dark fiber

fiber, customer demand, regulatory conditions and the availability of

availability of capital, HIVE believes that the conditions in Paraguay are

conditions in Paraguay are favorable for long-term participation in the development of

development of AI and hyperscale data centers.

Frank Holmes, Executive Chairman of HIVE, said: "Paraguay is an important location for HIVE

important location for HIVE, where we have demonstrated how energy-based digital

infrastructure can support long-term value creation. This

development is consistent with patterns we have observed in Texas, including in the

including in the San Antonio area, where infrastructure development began with Tier I data centers and later expanded to capital-intensive Tier III facilities capable of hosting demanding AI workloads. We are convinced that the

economic stability, the supportive political environment and the institutional

institutional relationships in Paraguay provide a constructive basis for the further

further development of the digital infrastructure."

Aydin Kilic, President and CEO of HIVE, added: "The launch of the AI cloud infrastructure in Asunción is a first step in bringing science

research institutions, companies, financial service providers and healthcare

healthcare organizations access to local high-performance computing capacity.

capacity. This initiative complements the existing operation of HIVE's Tier I data center in Paraguay, which currently uses approximately 300 megawatts

and, subject to market conditions and approvals, will be expanded by a further 100 megawatts in 2026.

could be expanded by a further 100 megawatts."

HIVE believes that Paraguay's combination of renewable energy sources, stable governance, supportive policy framework and growing digital infrastructure make it a potential

political framework and growing digital infrastructure, Paraguay has the

potential to play an important long-term role in South America in the field of AI

and high-performance computing.

https://de.investing.com/news/press-releases/eqsnews-hive-digital-expandiert-nach-paraguay-und-entwickelt-erste-spezielle-ai-buzz-cloudplattform-deutsch-3298968

$BTC (-0,58%)

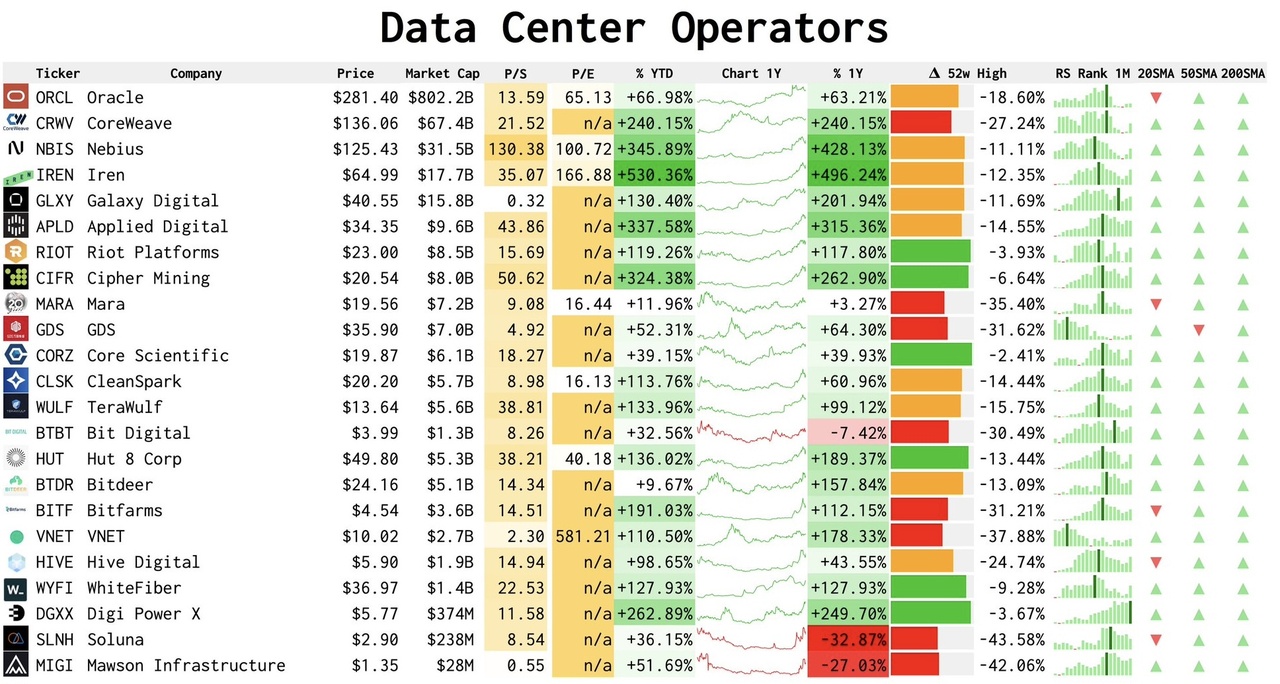

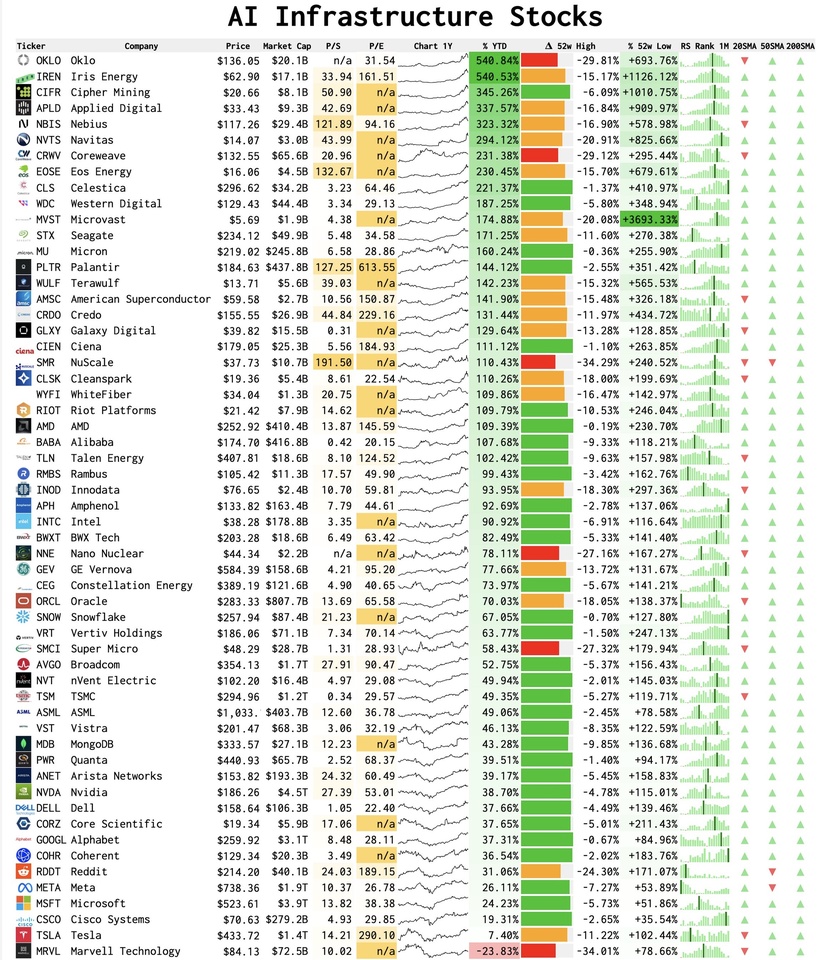

$NBIS (-9,32%)

$IREN (-6,41%)

$BITF (-1,14%)

$CIFR (-6,57%)

$CLSK (-1,33%)