From 18-year-old wannabe investment banker to successful private asset manager: my (bumpy) path to €300,000 in a custody account

Part 1 of X (let's see how many there will be): The new Gordon Gekko? Between Chinese small-cap recommendations from stock market letters and "AT&T is better than Amazon" (2010 - 2016)

(Part 2: https://app.getquin.com/de/activity/LUkWiLtZKX)

Previous story:

Inspired by @DonkeyInvestor I would now like to share my story and continue it if there is interest. Thanks for the cool idea!

My investment journey began about 2-3 years before my first securities purchase in 2013. While the financial crisis (2007-2009) only interested me marginally as a ~15-year-old, the emerging euro crisis from 2010 onwards aroused a much greater interest in the economy, sovereign debt and co. As part of some school work, I dealt with the debt crisis in Greece, among other things.

Through films like Wall Street or Margin Call - The Great Crash slowly sparked my interest in the stock market. With my first smartphone in 2012, I was able to secretly check share prices during lessons - which often led to the teacher confiscating it 😂 I primarily followed the prices of "cool" shares such as Daimler, Hugo Boss and Sony.

I grew a desire to become an investment banker myself and emigrate to Wall Street in New York (spoiler: neither happened 😉).

The first purchases:

My first purchases were made under contradictory circumstances. I was firmly convinced that a major crash was imminent (government debt, interest rate policy, ...) and was very convinced by well-known crash prophets such as Dirk Müller.

Nevertheless, I wanted to play along and bought my first shares.

In 2013, I started my dual business studies at a global bank. When I started my studies, I finally made my first securities purchases. On the one hand, my capital-forming benefits went into the DWS Top Dividende, and on the other, I set up an ETF savings plan on the DAX. In 2014, I added further shares such as AT&T $T (+0%) Verizon $VZ (+0,03%) Shell $SHEL (-1,85%) and Sony $6758 (-0,84%) were added. While Sony was a great investment, I unfortunately sold the stock far too early. My purchase price was around €12 and I sold at around €18. If I hadn't sold Sony, it would have been a tenbagger at times.

My main investment criteria at the time were

- Low P/E ratio

- High dividend yield

- And/or "cool" company

So in 2014 I had to choose between Amazon $AMZN (+0,03%) ("cool, but no dividend & much too high P/E ratio") and AT&T ("high dividend, low P/E ratio"). And, of course, the decision sucked with today's knowledge.

Another company was Macy's $M (-2,02%) . When I was in New York and visited the largest shopping center in the world, I was sure I had to have this stock.

The only two stocks I still have in my portfolio from my early years are Procter & Gamble $PG (+0,62%) (bought in 2015) and Unilever $ULVR (+0,48%) (bought in 2016).

In 2016, I had a total of 14 individual shares in my portfolio, 12 of which were sold in the following years and will probably never end up in my portfolio again.

The first lesson:

After I realized professionally that the path to investment banking and New York was probably not the right one after all (40 hours of work is really exhausting, I don't need 80 or more in investment banking), I slowly realized that I wasn't the next Gordon Gekko or Warren Buffett either.

It was too boring for me to just invest in shares - after all, I wanted to get rich quick and drive a Porsche! So from 2014, I also started investing in other things (no, unfortunately not crypto).

I tried my hand at various certificates, reverse convertibles and the like, all with little success. The biggest learning I had was with an absolutely hot tip from the internet. It was a classic pump and dump game from a stock market letter. Someone had stocked up on shares in a Chinese small cap (Tianbao Holdings) and then called on everyone to buy: "Share with the chance of a 10,000% return - forget Apple and co." It was advertised like this or something similar at the time.

I took my entire monthly salary (around €800) and thought to myself: get in! It didn't matter what the company was doing or why the opportunity should be so great! At first things went up and I was quickly up 20%. Then it went downhill - the initial investor had probably made his return and withdrawn the money. The stock exchanges quickly realized this and stopped trading. I tried to sell the shares on various stock exchanges and was able to get rid of them in Berlin, Bremen or somewhere else - with a loss of 50%. Two weeks of work for nothing. Although it was "only" a loss of €400, it really annoyed me. Not just the loss, but that I fell for something like that.

In hindsight, the €400 was extremely well invested and helped me a lot in my future investment career.

Asset development & return:

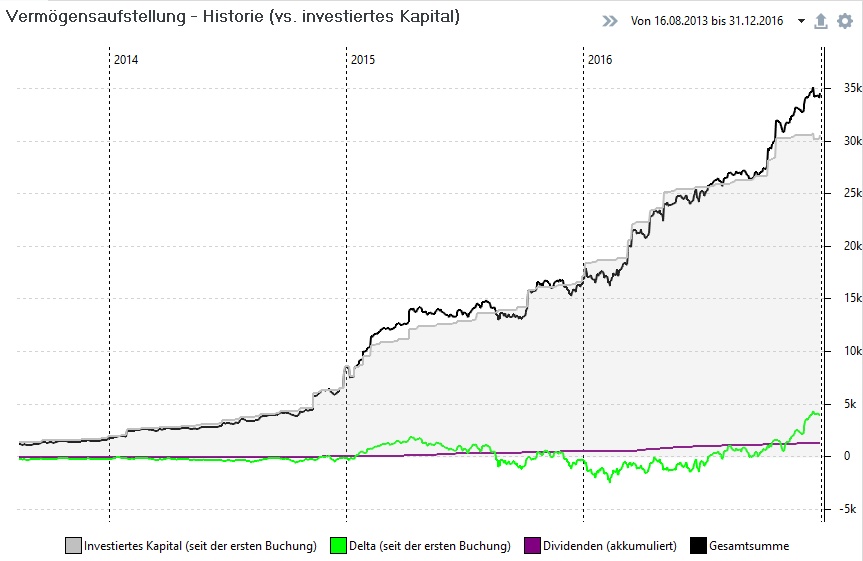

How did the first 3-4 years on the stock market go and how did my assets develop?

Year Deposit value Return

2013 2.000€ -12%

2014 8.600€ -1%

2015 17.000€ +4%

2016 35.000€ +14%

All in all, these were lost years for me in terms of returns. You can also see this from the green line, which was mostly in negative territory.

The stock markets did very well, and yet I mostly only saw losses or very low returns.

Conclusion & outlook:

So in 2016 it was clear to me: no investment banking, no New York, I'm not the new Warren Buffett and I'm not going to get rich overnight.

In the following 3 years from 2016 to 2019, I built on my initial experiences and slowly developed into a better investor. Nevertheless, more big mistakes followed (Bitcoin, Wirecard, ...).