Question of understanding:

Dear community, since there is not really a sample portfolio at flatex, or you can test this without losing money 😁, can someone explain the mechanics to me ?

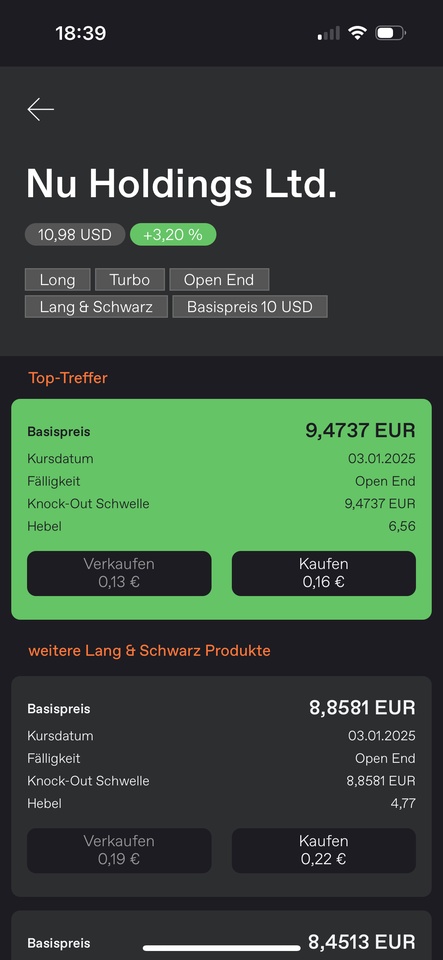

Using the example of $NU (-0,85%) when will I be undocked ? When does the bill expire?

Assuming I now buy 10,000 shares at 0.16 = 1,600.00 euros, how much of a loss do I have to make for it to become worthless?

Is the strike price equal to the knock-out threshold? Or do I have to start from the USD 10.98 (about 10.65 euros) and at -11 % the bill expires ?

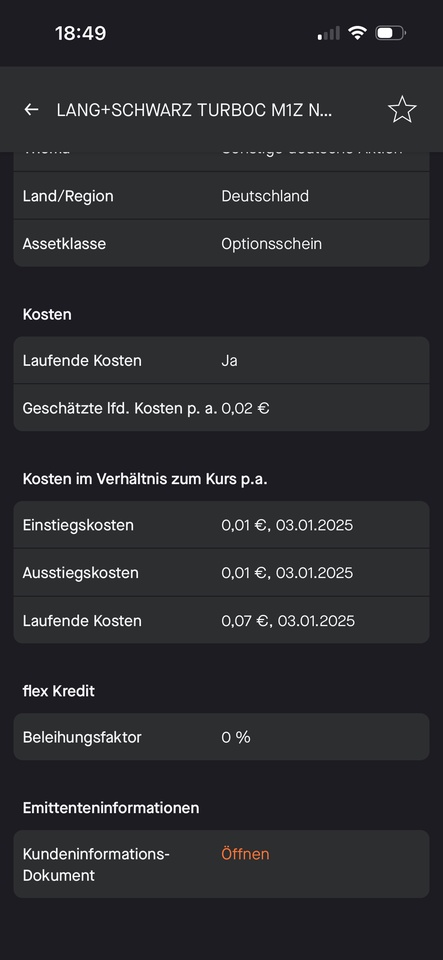

Perhaps someone here has some experience, learning by doing could be quite expensive, especially as I am not yet sure how the costs will be affected ?

Maybe it's a display error because of the weekend? 😁

The explanatory videos from flatex are usually not helpful here.

Thanks in advance ✌️