Hello Community,

Products, strategies or growth stories often take center stage. But what really determines the long-term success of a share is the capital allocation - i.e. the question of how the management deploys the available capital.

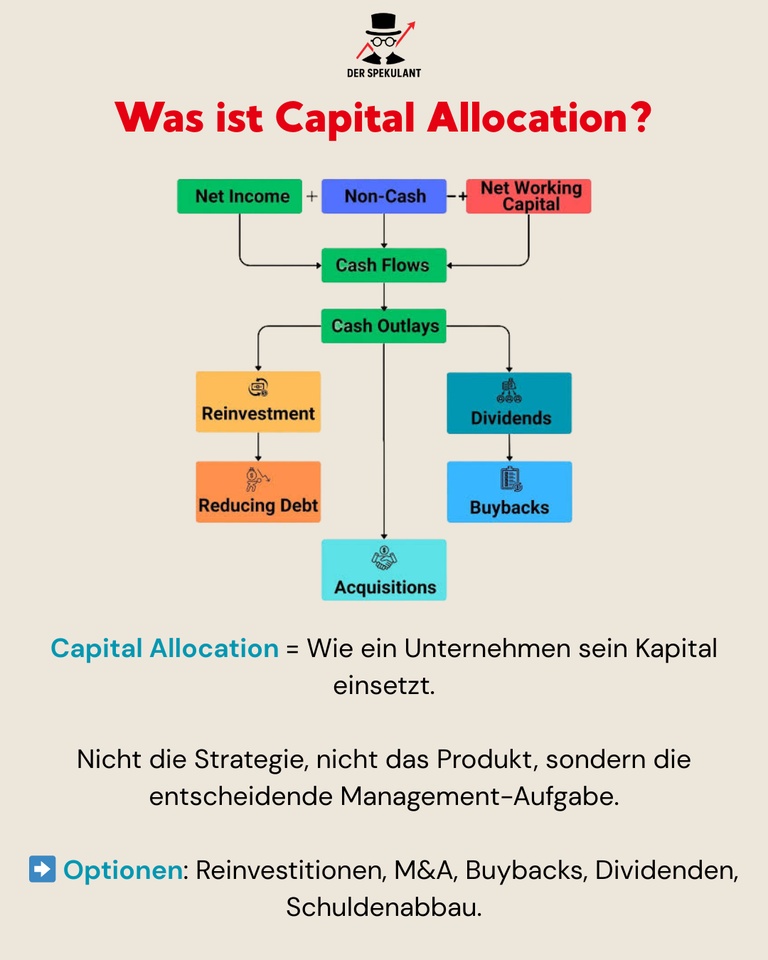

🔎 What does capital allocation mean?

Companies generate profits and cash flows. These can be used in various ways:

1️⃣ Reinvestment in own business (e.g. R&D, expansion, new products)

2️⃣ M&A (takeovers) - Only makes sense if there are real synergies

3️⃣ Share buybacks - only value-enhancing if the share is undervalued

4️⃣ Dividends - Return of capital to shareholders

5️⃣ Debt reduction - strengthens balance sheet & creditworthiness

🚦 Why is this so crucial?

Capital allocation is the lever for value creation per share.

❌ Poor allocation: Capital destruction (example: WeWork $WWOK - billions in prestige projects & "growth at any price").

✅ Good allocation: Compounder effect (example: Berkshire Hathaway $BRK.B (+0,46%) - Capital flows consistently into high-ROI investments).

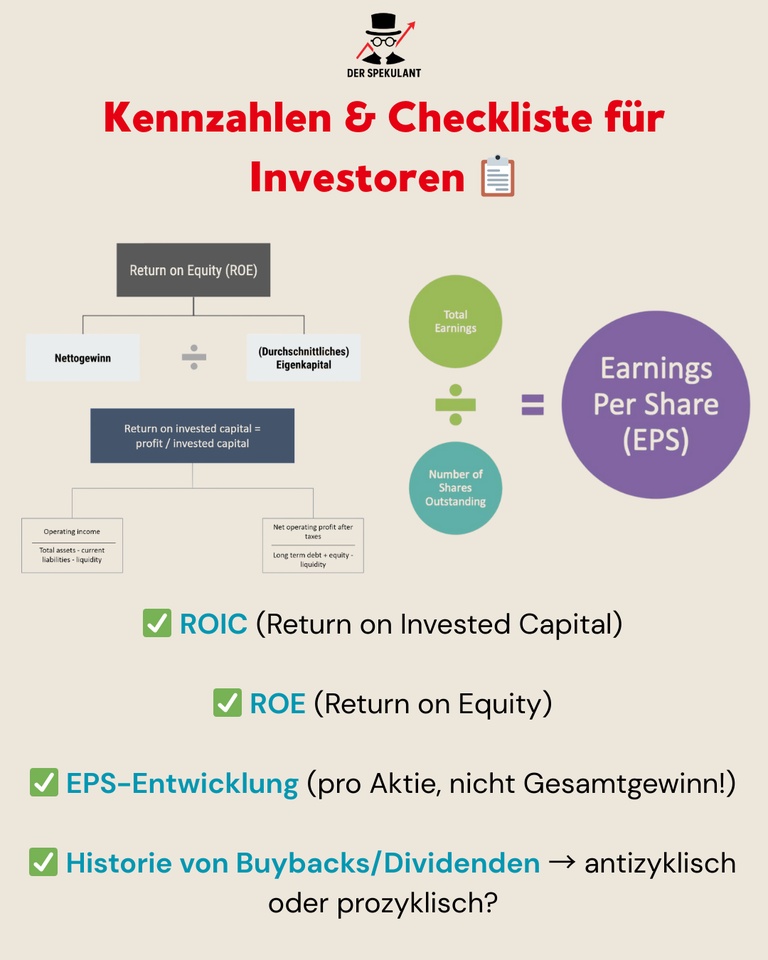

📊 What I pay attention to as an investor:

ROIC (Return on Invested Capital) → shows whether reinvestments create value.

ROE (return on equity) → measures the return on equity.

EPS growth per share (not only absolute profit - note dilution!).

Buybacks/dividend history → rational or marketing?

🏆 Best practices:

Constellation Software ($CSU (+2,14%)

)Serial acquisitions in the software sector with disciplined use of capital.

Novo Nordisk ($NOVO B (+0,28%)

): Reinvestment in R&D with extremely high ROI.

Berkshire Hathaway ($BRK.B (+0,46%)

): Flexible, rational, benchmark for capital allocation.

📌 Conclusion:

It is not the product, but the use of capital that determines the return. As an investor, you should always ask yourself:

👉 Can this management deploy capital better than I can?

➡️ Community question:

Which stock in your portfolio do you think has the best capital allocation? And which is the worst?

#CapitalAllocation

#Investieren

#Aktienanalyse

#BerkshireHathaway

#ConstellationSoftware

#NovoNordisk

#DerSpekulant