03.07.2024 +++ Tesla no longer growing so strongly +++ Moderna to develop new vaccine +++ Eli Lilly receives approval for Alzheimer's drug +++ Purchasing Managers' Index in DE, IT, FR and UK today +++

$TSLA (+0,75%) Tesla's vehicle sales fell again in the second quarter in the face of increasing competition. The company reported sales of 443,956 vehicles worldwide, a decrease of 4.8 percent compared to the same quarter last year. According to Factset, analysts had expected Tesla to deliver only 436,000 units. The US company is no longer growing as fast as in previous years, which underlines the challenges facing the entire industry. Other carmakers have launched dozens of new electric models, but demand has fallen short of initial expectations - despite falling prices and a series of low-interest and leasing offers. CEO Elon Musk is facing his biggest test in years. The Tesla founder wants to spend more money on developing new and more affordable models, while also investing in costly new technologies amid a slowing market for electric cars.

The pharmaceutical manufacturer Moderna $MRNA (+0,67%) is to develop an mRNA-based vaccine against avian flu for humans. The company has announced that it has been awarded 176 million US dollars by the government. The contract follows an unprecedented outbreak of avian flu in US livestock. So far, 137 dairy herds in a dozen states are known to be infected. Only three known cases of human infection with the H5N1 virus have been reported in the US since the outbreak. However, the authorities are monitoring the situation very closely. Scientists fear a potential pandemic threat. The US government, in collaboration with GSK, Sanofi and CSL Sequirus, has developed its own vaccines that could be used in the event of an H5N1 outbreak. However, production capacity is limited. Moderna is developing a pandemic influenza vaccine candidate called mRNA-1018 and began trials last year. Initial results are expected this year.

Eli Lilly $LLY (+0,49%) has received US approval for its Alzheimer's drug Kisunla, which will accelerate change in the treatment of this dementia. Kisunla is administered monthly and costs about $12,522 for six months of treatment, $32,000 for 12 months and $48,696 for 18 months. Some patients diagnosed with the disease have taken a pill to alleviate their symptoms. Others ended up in institutions that took care of them once they could no longer look after themselves. With the launch of drugs like Eli Lilly's Kisunla, Alzheimer's treatment promises to slow cognitive decline, albeit modestly.

More company news:

The shares of Tesla $TSLA (+0,75%) fell 1.6% after sales of electric vehicles manufactured in China fell 24.2% year-on-year in June, data from the China Passenger Car Association showed on Tuesday.

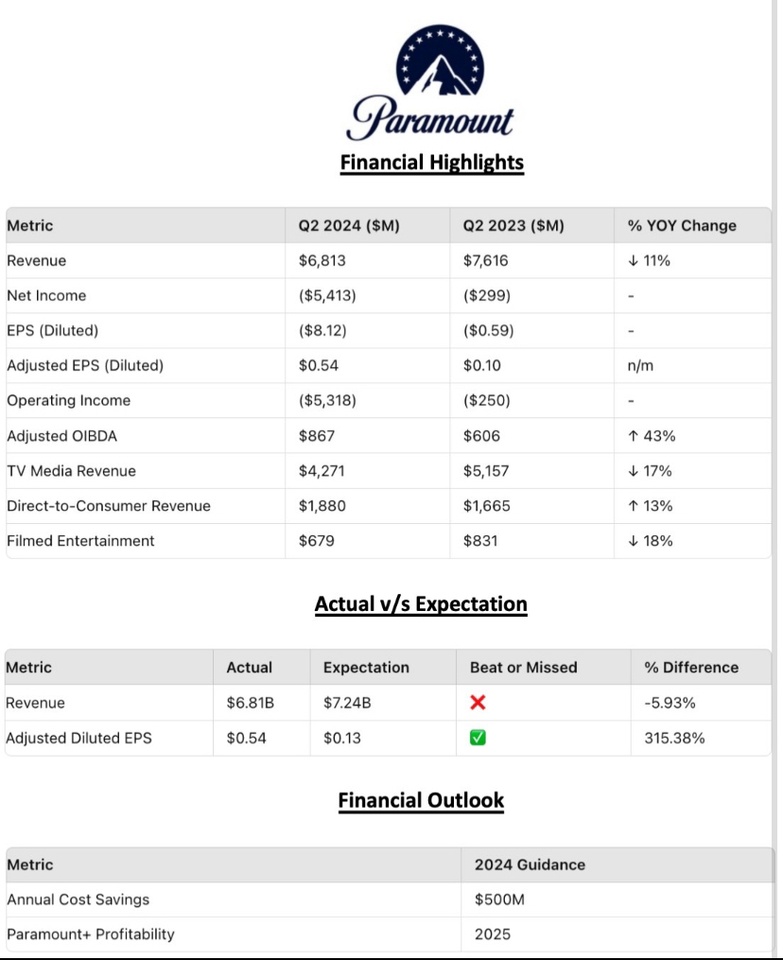

Paramount Global $PARA (+0,18%) shares rose 3.1% after the New York Times reported that billionaire Barry Diller is considering a takeover bid for the company after the studio he used to run backed out of a merger with Skydance Media.

The shares of Boeing $BA (+0,36%) fell 0.4% after the Associated Press reported that the U.S. Justice Department is waiting for the planemaker to accept an agreement to settle fraud allegations related to two fatal crashes of its 737 Max planes.

The shares of Carnival $CCL (+0,7%) fell 1.1% and Norwegian Cruise Line (NYSE:NCLH) shares fell 1.2% as Hurricane Beryl made its way through the Caribbean, potentially impacting cruise operations.

Shares of Polestar $PSNY fell 5% after the electric vehicle maker announced a first-quarter operating loss, adding that it will have to take steps to offset steep EU and U.S. import tariffs on its Chinese-made electric cars.

The shares of Pure Storage $PSTG (+4,39%) fell 5% after UBS downgraded the company, which develops all-flash data storage hardware and software products, to "sell" from "neutral," citing concerns about slowing growth, declining market share and an overvalued share price.

CrowdStrike $CRWD (+0,54%) fell 2.5% after Piper Sandler downgraded its stance on the cybersecurity company to "neutral" from "overweight", citing valuation concerns.

Incyte $INCY (+0,77%) fell 3.1% after BMO Capital Markets downgraded the drugmaker to "underperform" from "market perform", citing concerns that revenue from its key eczema cream Opzelura was likely to be "challenged".

Wednesday: Stock market dates, economic data, quarterly figures

Shortened trading hours US bond market (until 8 pm), US stock market (until 7 pm)

ex-dividend of individual stocks

Bank of Nova Scotia CAD 1.06

Quarterly figures / company dates Europe

07:00 Grenke new business 2Q

10:00 Voestalpine AGM

11:00 Krones AG Capital Markets Day

Economic data

- 09:45 IT: Purchasing Managers' Index/PMI non-manufacturing June FORECAST: 53.7 previous: 54.2

- 09:50 FR: Purchasing Managers' Index/PMI non-manufacturing (2nd release) June PROGNOSE: 48.8 1st release: 48.8 previous: 49.3 Total Purchasing Managers' Index (2nd release) FORECAST: 48.2 1st release: 48.2 previous: 48.9

- 09:55 DE: Purchasing Managers' Index/PMI non-manufacturing (2nd release) June PROGNOSE: 53.5 1st release: 53.5 previous: 54.2 Total Purchasing Managers' Index (2nd release) PROGNOSE: 50.6 1st release: 50.6 previous: 52.4

- 10:00 EU: Purchasing Managers' Index/PMI non-manufacturing euro area (2nd release) June PROGNOSE: 52.6 1st release: 52.6 previous: 53.2 Total Purchasing Managers' Index (2nd release) PROGNOSE: 50.8 1st release: 50.8 previous: 52.2

- 10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (2nd release) June OUTLOOK: 51.2 1st release: 51.2 previous: 52.9

- 11:00 EU: Producer Prices May Eurozone Forecast: +0.1% yoy/-4.0% yoy Previous: -1.0% yoy/-5.7% yoy

- 14:15 US: ADP Labor Market Report June Private Sector Employment PROGNOSIS: +160,000 jobs previously: +152,000 jobs

- 14:30 US: Initial Jobless Claims (week) FORECAST: 233,000 Previous: 233,000

- 14:30 US: Trade Balance May FORECAST: -76.30 bn USD previously: -74.56 bn USD

- 15:45 US: Purchasing Managers' Index/PMI Services (2nd release) June Forecast: 55.1 1st release: 55.1 Previous: 54.8

- 16:00 US: Industrial New Orders May PROGNOSE: +0.3% yoy previous: +0.7% yoy

- 16:00 US: ISM Non-Manufacturing Index June FORECAST: 52.8 points previous: 53.8 points

- 16:30 US: EIA oil report (week)

- 19:00 US: US stock market closes (shortened trading session)

- 20:00 US: Minutes of the FOMC meeting June 11/12

- 20:00 US: US bond market closes (abbreviated trading)