$KDP (-0,31%)

$7751 (-4,08%)

$NXPI (+0,65%)

$WM (-0,69%)

$CDNS (-0,07%)

$BN (+0,45%)

$SOFI (+1,04%)

$UNH (-0,27%)

$AMT (-1,25%)

$UPS (+0,27%)

$BNP (-0,69%)

$NVS (-0,23%)

$DB1 (-1,31%)

$MSCI (-0,29%)

$ENPH (-0,11%)

$BKNG (-0,35%)

$LOGN (-0,07%)

$V (-0,03%)

$MDLZ (+0,26%)

$PYPL (-0,01%)

$000660

$MBG (+0,12%)

$BAS (-0,09%)

$UBSG (-0,12%)

$SAN (-0,11%)

$CVS (-0,17%)

$OTLY (+0,55%)

$GSK (-0,07%)

$ETSY (-0,12%)

$CAT (-0,22%)

$KHC (-0,06%)

$ADYEN (-0,11%)

$ADS (-0,63%)

$AIR (-0,11%)

$SBUX (-0,09%)

$CMG (-0,16%)

$META (-0,12%)

$KLAC (+0,51%)

$MELI (+0,5%)

$WOLF (+0,75%)

$GOOGL (-0,22%)

$EQIX (-0,61%)

$MSFT (-0,09%)

$CVNA (-0,2%)

$EBAY (+0%)

$005930

$6752 (-0,17%)

$KOG (-0,24%)

$VOW3 (+0,22%)

$GLE (-0,11%)

$LHA (-0,26%)

$STLAM (-0,16%)

$SPGI (+0,02%)

$MA (-0,42%)

$PUM (+0,16%)

$AIXA (+0,04%)

$FSLR (+0,17%)

$AAPL (-0,24%)

$REDDIT (-0,95%)

$AMZN (-0,21%)

$NET (+0,09%)

$MSTR (-0,36%)

$GDDY

$TWLO (+0,39%)

$COIN (-0,28%)

$066570

$CL (+0,07%)

$ABBV (-0,05%)

$XOM (-0,3%)

Discussione su UNH

Messaggi

378Quarterly figures 27.10-31.10.25

I need your advice

Hello everyone,

I've been here at Getquin for about 3 months now and I have to say I find the contributions from @BamBamInvest

@Multibagger

@Tenbagger2024 all of you here extremely interesting. You all offer extreme added value and I am always amazed at how active you are here... Because of this I wanted to speak up and ask for your opinion as I am totally unsure what to do...

First of all, I'm still quite young, so I still have my whole life ahead of me and can still "allow" myself to invest riskily, although this is of course always objective. At the moment I don't really have a strategy that I'm following or a plan for the coming months/years. So far, I've mostly bought stocks based on recommendations from posts here or YouTube videos, and I've ended up with a pretty colorful bunch... I have of course looked into the companies myself but to be honest a lot of the purchases have just been repeat purchases without really knowing what I am doing.

Among other things, I own

$XRP (one of my first purchases)

But since the whole thing is not subject to a real system and in my opinion I diversify too much, since I invest with smaller amounts, it would help me a lot if you could maybe recommend something to me how I can proceed... Maybe just 2 stocks? Or an ETF?

I would be very happy to hear from you and wish you a nice rest of the weekend!

It's nice that you're giving it some thought. And I think it's important to have a strategy.

The beginning is probably the most difficult.

And the stock market doesn't just go in one direction. That's why it's also important to pay attention to robustness and to have a core.

I'm a fan of individual stocks.

But I would still recommend an ETF for the smallest amounts.

However, a global ETF is not always the first choice and there are great alternatives.

If you do decide to invest in individual stocks. Then I think it's a prerequisite that you learn how to analyze companies. So that you don't have to make your decision based on recommendations. But based on your own analysis.

€5.000,00 Mark

It’s almost the and of my first year investing at 19 years old, it’s been a good time and a rollercoaster for politics but still had a fun time and I’m looking forward to 2026.

I’m planning to invest €500.00 a month in these stocks/ etf’s

$VWCE (-0,23%) : 40% ~ €200

$EQQQ (-0,16%) : 20% ~ €100

$ASML (-0,33%) : 10% ~ €50

$CRWD (-0,21%) : 10% ~ €50

$CSPX (-0,16%) : 10% ~ €50

$UNH (-0,27%) : 10% ~ €50

I have some small positions and I’m not planning to sell these but just let them run.

If you think I should change something let me know!

To celebrate the 5k mark I’m having some beers tonight… up to the 10K 🚀

💰Milestone reached: 300k 2,5 years in.

I started out testing a lot of different strategies, but about 1.5 years ago I decided to fully commit to dividend growth investing — and it’s been the best decision so far.

Sticking to quality companies, buying the dips when others sold out, and focusing on long-term compounding really paid off earlier this year 💪🏻

The journey continues — slow, steady, and growing every month 📈

Right now focus is on : $HSY (+0,54%) , $NOVO B (-0,38%)

$UNH (-0,27%) to get yield in a good range.

I am Considering buying more of $V (-0,03%)

Is anyone currently buying UnitedHealth Group?

UnitedHealth Group $UNH (-0,27%)

is still a giant in the US healthcare market - but but the share is currently trading at around USD 356, down a whopping 36% on the previous year. Despite high analyst targets and historical strength, the Group is facing noticeable challenges, while major competitors such as CVS Health and Elevance Health are catching up on key metrics.

Strong base:

UnitedHealth Group remains the industry leader with around USD 400.3 billion in annual sales and USD 322.96 billion in market capitalization. The company continues to grow - sales rose by 7.7% in 2024 and are expected to increase by as much as 12% in 2025. The dividend has been increased without interruption for 15 years and the yield is currently 1.7 %.

Valuation & growth:

With a price/earnings (P/E) ratio of 21.8x (2025), the share is not expensive for a market leader, especially in view of forecast earnings growth of 5.2%. Analysts have issued an average price target of USD 372.04 - which would correspond to an increase of 4%. The most optimistic analysts even see potential up to USD 626.

Opportunities/risks, etc. in my blog.

https://steady.page/de/finanzen-anders/posts/c2335bfc-a7a2-4b7d-a08c-e736307291c2

Inspiration needed

Hello everyone,

I have cleaned up my portfolio a bit and trimmed it to 30 positions (please ignore the very small positions, it is more expensive to sell them than to keep them). The different ETFs on msci, msci em, dax and NASDAQ are due to historical reasons (sub. Deposits, change from synth. To physical replication, too many taxes with complete change). At the end of the year I will sell the 2 DWS old funds and then have the tax refunded promptly --> grandfathering. I just don't know where to switch to.

I am currently saving:

$TDIV (+0,1%) 250/m

$IWDA (-0,11%) 600/m

$IEMA (-1,4%) 250/m

$EQAC (-0,16%) 250/m

$ALV (-0,14%) 50/w

$KO (+0,15%) 50/w

$PEP 50/w

$UNH (-0,27%) 50/w

$V (-0,03%) 50/w

$ULVR (-0,15%) 50/w

And I reinvest the dividends from $O (-0,1%) and $MAIN (-0,28%) monthly

I try to have all positions that I want to hold long-term at 2-4 percent (exceptions: ETFs, $EWG2 (-2,31%) and $BRK.B (-0,33%) )

At the moment semiconductors ($AMD (-0,52%)

$PLTR (+0,18%)

$MU (-1,55%) and $MPWR (-0,17%) ) are my "yield positions", which I would like to sell if the price continues to rise.

But at the moment I'm lacking inspiration. What is my portfolio missing in the long term? Which themes could I "play" to achieve short-term returns. Or just leave everything as it is.

I would be grateful for any opinions.

Greetings 👋

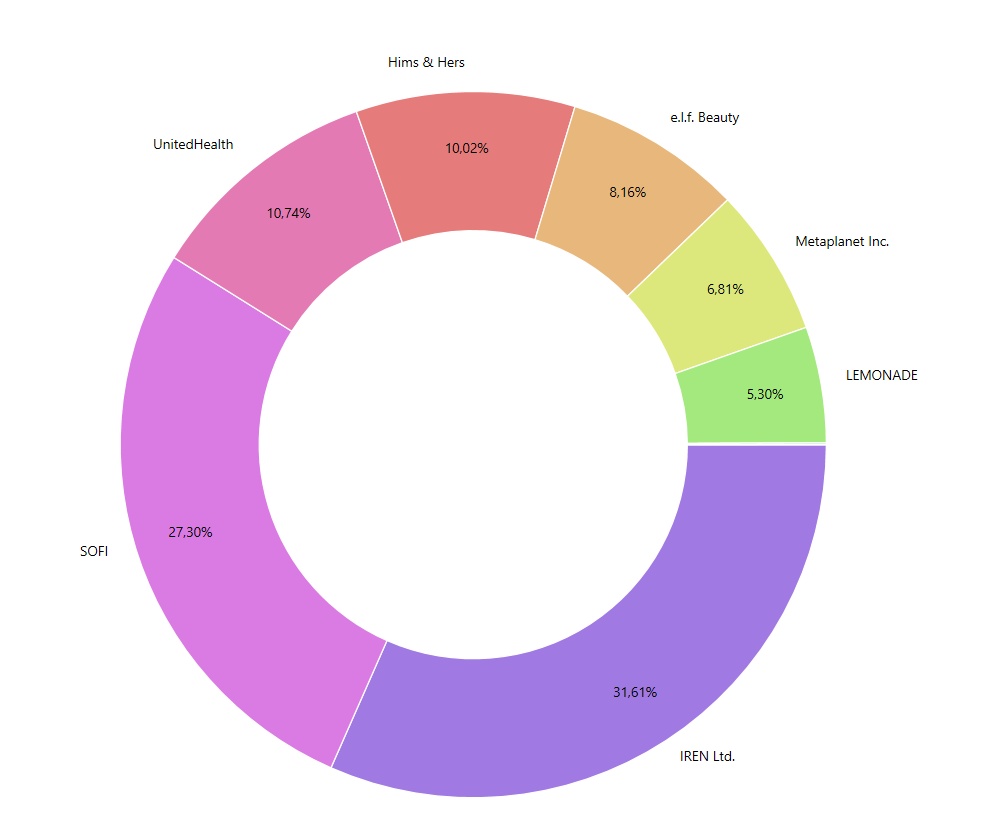

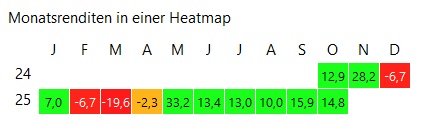

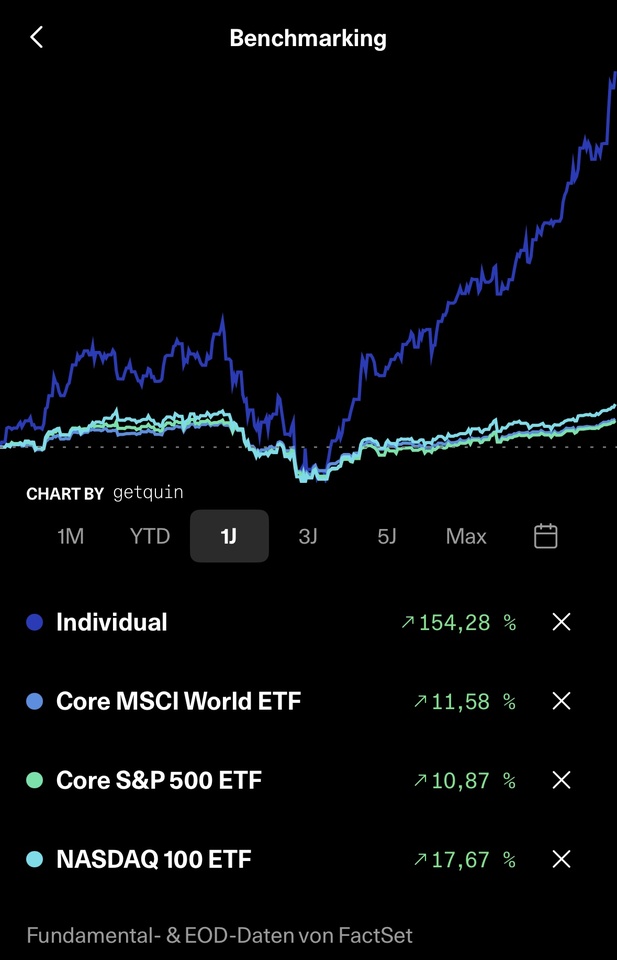

Annual performance Oct 2024-Oct 2025

$IREN (-1,71%)

$SOFI (+1,04%)

$HIMS (+0,05%)

$LMND (-0,03%)

$UNH (-0,27%)

$3350 (+1,06%)

$ELF (-0,78%)

Many would probably not have expected things to go so well after the weak start to the year.

But it shows me personally that my research, my confidence in my company selection and what I saw in the selected companies has paid off.

Not only once was I down more than 50% on the companies listed, but I constantly bought more and remained true to my selection, as nothing had changed in my opinion.

Yes, the portfolio is very focused and overweight, but I still believe that the positions will largely continue to outperform the market in the future.

And yes, you need strong nerves, I won't deny that, and you have to question your selection regularly, so it helps a lot if you take notes on why you bought the companies.

Believe in your convictions ✌️

The trading dividend opi..... Part 1 Shadow

There was some movement in the portfolio today, a stop loss and a limit order were triggered. Surprisingly, my broker booked this at 8.01, although the SL was at 8. Anyway. So this pretty much went in the wrong direction, happens and reduces the tax on the other trades, which are all going and have gone very well. My first real loss-maker after previously $GXI (-0,03%) with 6% and after the setback in May $UNH (-0,27%) were sideways for too long and closed 0.5% down as the only non-winners.

Review of September 2025

📈 Performance:

S&P500: +2.80%

MSCI World: +2.60%

DAX: -0.09%

Dividend portfolio: +0.74%

My high and low performers in September were (top/flop 3):

🟢 ($TSLA (+0,26%) ) Tesla +33.20%

🟢 ($UNH (-0,27%) ) UnitedHealth +14.25%

🟢 ($D05 (+0,29%) ) DBS +12.94%

🔴 ($DTE (-0,39%) ) Deutsche Telekom -8.29%

🔴 ($TSCO ) Tractor Supply -9.43%

🔴 ($TXN (-0,18%) ) Texas Instruments -10.30%

Dividends:

September 2025: € 203.56

September 2024: € 140.14

Change: +45.26%

Sales:

🟥 ($T (-0,3%) ) AT&T (27 shares) +36.05%

Purchases:

🟩 ($2318 (+0,1%) ) Ping An Insurance (150 pcs.)

🟩 ($UNP (-0,19%) ) Union Pacific (3 shares)

Savings plans:

- ($CTAS (-0,25%) ) Cintas (50€)

- ($MC (-0,42%) ) LVMH (50€)

- ($MSFT (-0,09%) ) Microsoft (25€)

What else has happened?

As announced, I asked the tax office to recalculate the advance payments. This was done and fortunately I no longer have to pay anything in advance.

If things go well, I'll even get some money back next year.

The bill for the car has also arrived and amounts to €1500. But that really pays for everything.

My nest egg has melted down to €900 and now I have to build it up again. Once again, the target is €10,000.

I was on vacation in Egypt from the end of September until last weekend. As always, it was super nice and just pure relaxation.

🥅 Destinations 2025:

Deposit of €10,000 and thus a custody account volume in the share portfolio of ~€73,000

Target achievement at the end of September 2025: 69.19%

How was your September?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.

Shares, ETFs, savings plans & real estate - our freedom roadmap ✨📈

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (-0,1%) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (-0,17%)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (-0,04%)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

900 € flow in monthly:

- 💵 €500 in SPDR S&P 500 ($SPY5) (-0,17%)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (+0,1%)

- ₿ 200 € in Bitcoin ($BTC) (-0,04%)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (-1,31%) , $UNP (-0,19%), $RACE (+0,5%) , $MRK (-0,4%) , $MUV2 (-0,05%) , $DGE (-0,97%) , $DE (+0,01%) , $TXN (-0,18%) , $AWK , $ADP (-0,1%) , $PLD (-0,02%) , $HEN (+0,04%) , $ITW (+1,05%) , $UNH (-0,27%) , $LLY (-0,43%) , $BEI (+0,18%) , $MCD (+0,27%) , $DTE (-0,39%) , $WMT (-0,07%) , $COST (+0,02%) , $WM (-0,69%) , $JPM (+0,11%) , $BLK (-0,55%) , $SY1 (-3,85%)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

My portfolio is structured in

Normal risk sectors ETF and share savings plans

High risk with small caps

High risk leveraged with derivatives.

So fully focused on maximizing returns

Titoli di tendenza

I migliori creatori della settimana