$TWLO (+0,71%) Twilio Inc. released its second quarter 2025 results on August 7, 2025, reporting accelerated revenue growth and improved profitability. Despite the seemingly strong results, Twilio shares fell 12.76% to $106.77 in pre-market trading, suggesting that investors may have concerns about the company's outlook or other forward-looking indicators.

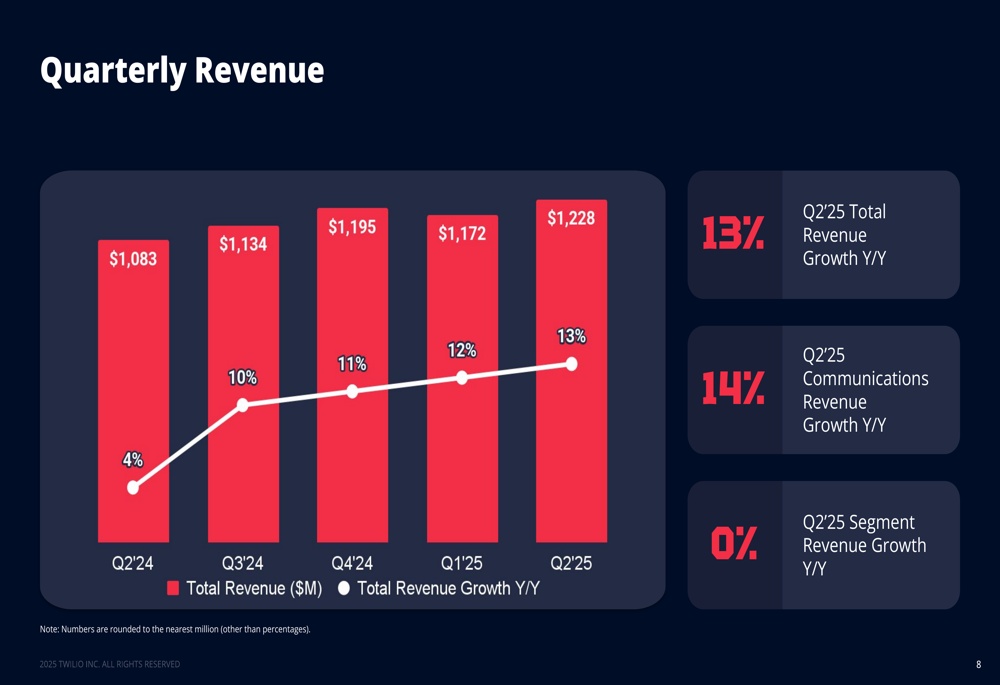

The cloud communications platform provider reported total revenue of $1.228 billion, representing 13% year-over-year growth, with the Communications Services segment showing notable strength while the Segment division was flat.

Quarterly performance highlights

Twilio delivered solid financial results across key metrics for Q2 2025, continuing the trend of accelerated growth from previous quarters.

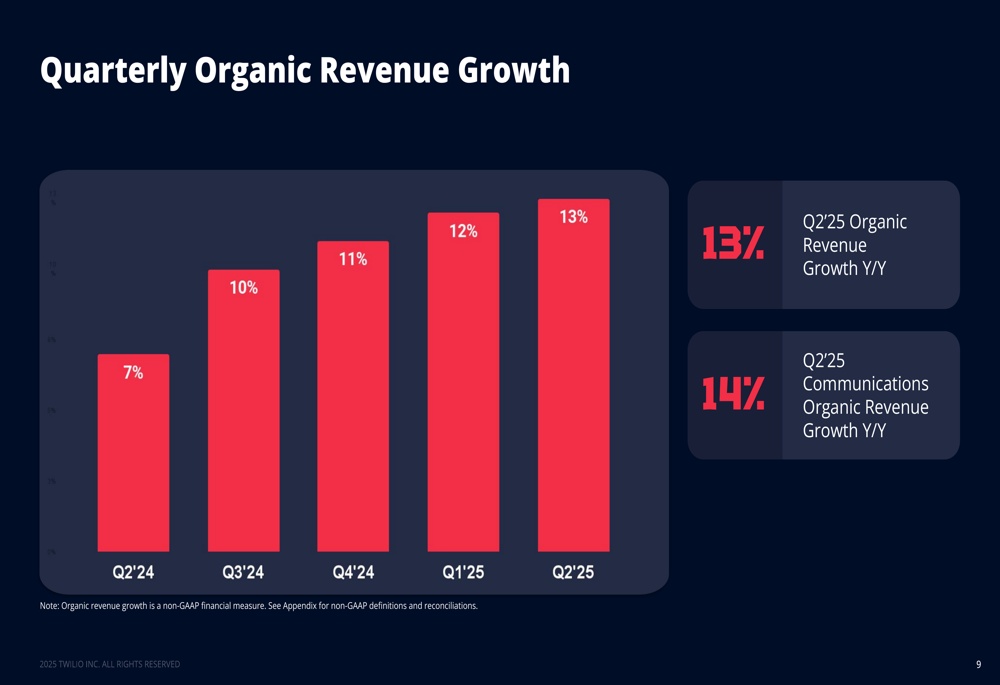

Total revenue reached USD 1.228 billion, an increase of 13% year-over-year. This marks the fifth consecutive quarter of accelerated growth, following 4% in Q2 2024. The company's organic sales growth, which excludes certain special effects, also showed a steady improvement:

The company's Dollar-Based Net Expansion Rate, a key indicator of customer spend growth, improved to 108% from 102% in the same quarter last year, reflecting Twilio's success in expanding relationships with existing customers.

The overall quarterly performance showed strength in several financial metrics:

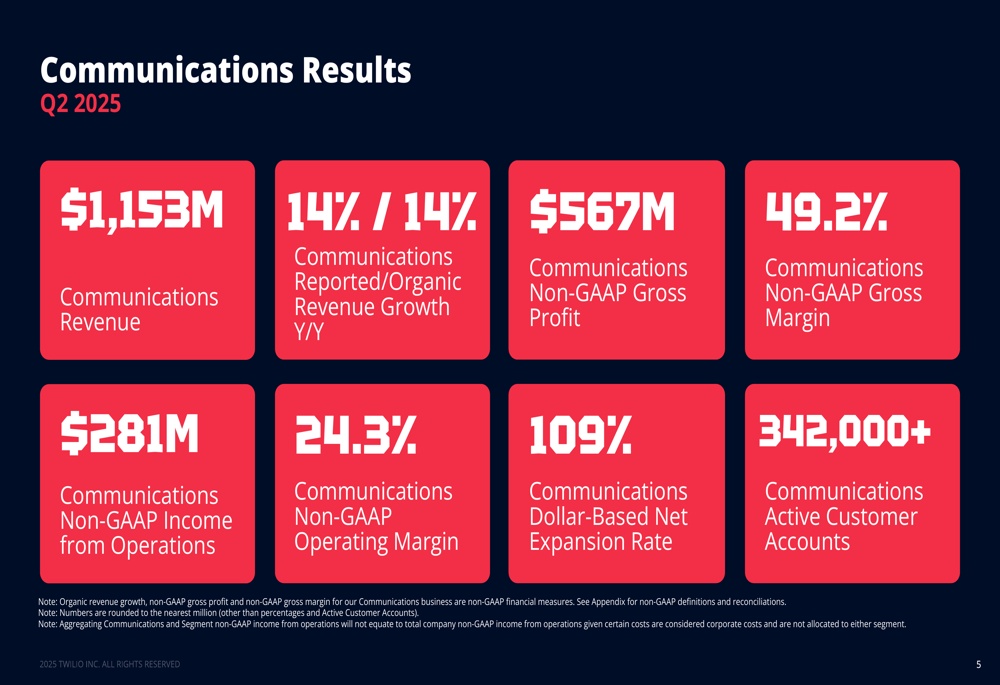

Twilio's business performance showed a clear divergence between its two main segments. The Communications Services segment, which accounts for the majority of the company's revenue, delivered strong results with year-on-year growth of 14%:

In contrast, the Segment business unit, which focuses on customer data platforms, reported stagnant revenue growth of 0% year-on-year, although it maintained higher gross margins at 74.3%:

The divergent performance of the segments underscores the ongoing challenge for Twilio to drive growth in all business areas. Messaging remains the dominant revenue driver with a 54.4% share of total revenue in Q2 2025, compared to 51.8% in Q2 2024

Operational efficiency & profitability

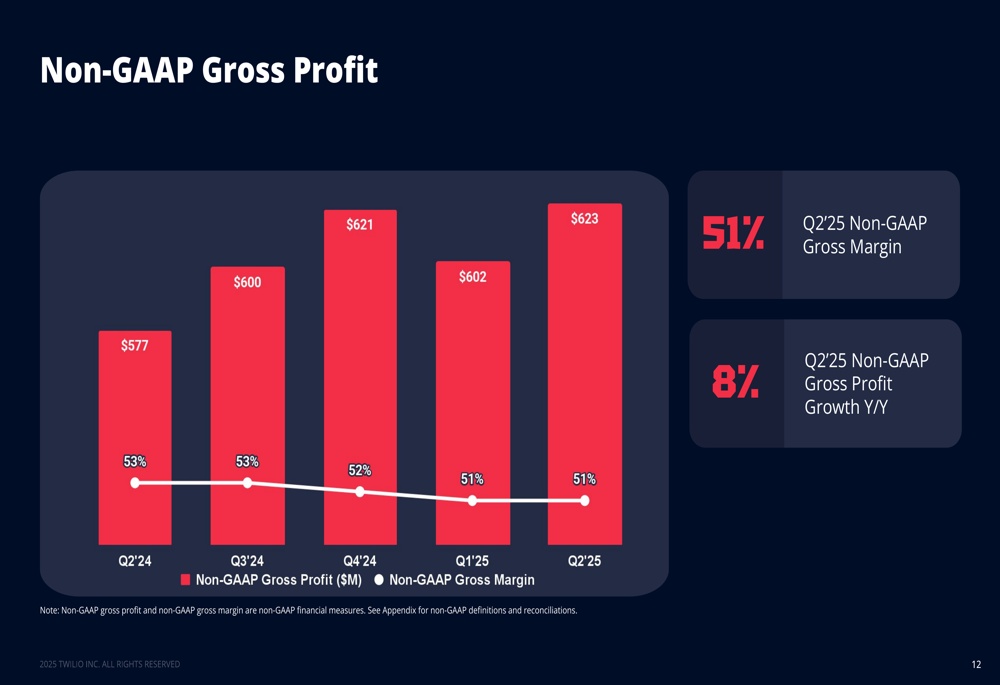

Twilio demonstrated improved operating efficiency and profitability during the quarter. Non-GAAP gross profit reached USD 623 million, although the gross margin decreased slightly to 51% from 53% in the previous year:

The company showed a more significant improvement in operating profitability, with non-GAAP operating income increasing 26% year-over-year to $221 million, with an operating margin of 18%:

Of particular note, Twilio achieved GAAP profitability with an operating income of USD 37 million. This represents a margin of 3%, compared to -2% in Q2 2024, and represents significant progress on the company's path to sustainable GAAP profitability.

Free cash flow was particularly strong, growing 33% year-on-year to USD 263 million with a margin of 21%:

Customer wins & strategic initiatives

Twilio highlighted several significant customer wins during the quarter, highlighting the company's ability to acquire new customers and expand relationships with existing customers. In the communication services segment, the company signed contracts with companies in various industries, including fintech, marketing automation and AI.

Notable successes included a multi-year email contract with a SaaS platform for marketing automation, a seven-figure contract to replace a competitor in the US messaging business and a contract for verification solutions with Manus AI. The company also launched a pilot project for RCS (Rich Communication Services) with Postscript, a leading SMS marketing platform, which illustrates Twilio's focus on next-generation messaging technologies.

In the "Segment" division, the company signed new contracts with JustFab (an online fashion retailer) and Centerfield (a performance marketing company) and expanded its relationships with several existing customers, including Metcash, a leading wholesale company from Australia, despite stagnating revenue growth.

Forward-looking statements

For Q3 2025, Twilio forecasts revenue of USD 1.245 to 1.255 billion, which corresponds to year-on-year growth of 10-11%. Organic revenue growth is expected to be 8-9%. The company expects non-GAAP operating income of USD 205 to 215 million and non-GAAP diluted earnings per share of USD 1.01 to 1.06.

For the full year 2025, Twilio raised its guidance for organic revenue growth to 9-10% (previously 7.5-8.5%) and expects non-GAAP operating income of $850 million to $875 million. In addition, the forecast for free cash flow was raised to USD 875 to 900 million (previously USD 850 to 875 million):

Despite the increased forecast for organic sales growth and free cash flow, the expected slowdown in growth from 13% in Q2 to a forecast 8-9% in Q3 could contribute to the negative market reaction following the publication of the results.

Conclusion

Twilio's Q2 2025 results demonstrate the company's ability to accelerate revenue growth and improve profitability metrics, especially in its core business, the Communication Services segment. However, the stagnation in the segment and the projected slowdown in growth for Q3 appear to be weighing on investor sentiment.

The company's focus on operational efficiency has led to positive results in free cash flow generation and margin improvement, but the market seems to expect more balanced growth across all business segments. As Twilio continues to navigate the competitive cloud communications environment, the ability to reinvigorate growth in Segment while maintaining momentum in Communications Services will be critical to future performance.

Source: investing.com & twilio.com

Anyone invested here ?