paychex Paychex is a US company that specializes in outsourcing payroll, human resources and benefits for small and medium-sized businesses.

Founded in Rochester, New York in 1971, the company offers Paychex Flex, a cloud-based platform that combines payroll, tax automation, HR management, time tracking and benefits administration in one easy-to-use platform. The company serves over 710,000 customers, mainly in the US and Northern Europe.

The German subsidiary (Paychex Deutschland GmbH) offers payroll and HR solutions, including cloud software for payroll and HR administration. Paychex combines technology with consulting services to help companies manage payroll and HR efficiently.

Services include full payroll processing, automated tax processing, employee self-service options, HR recruiting, onboarding and employee development tools. Pricing is based on company size and specific requirements.

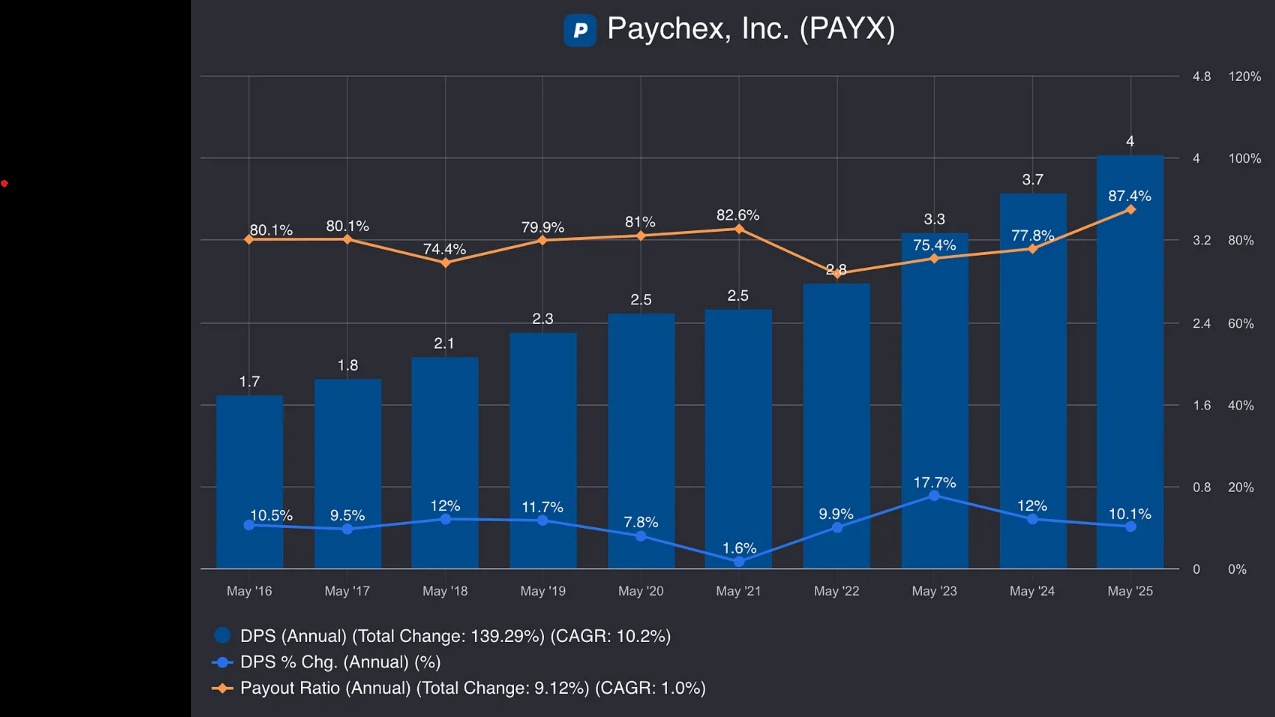

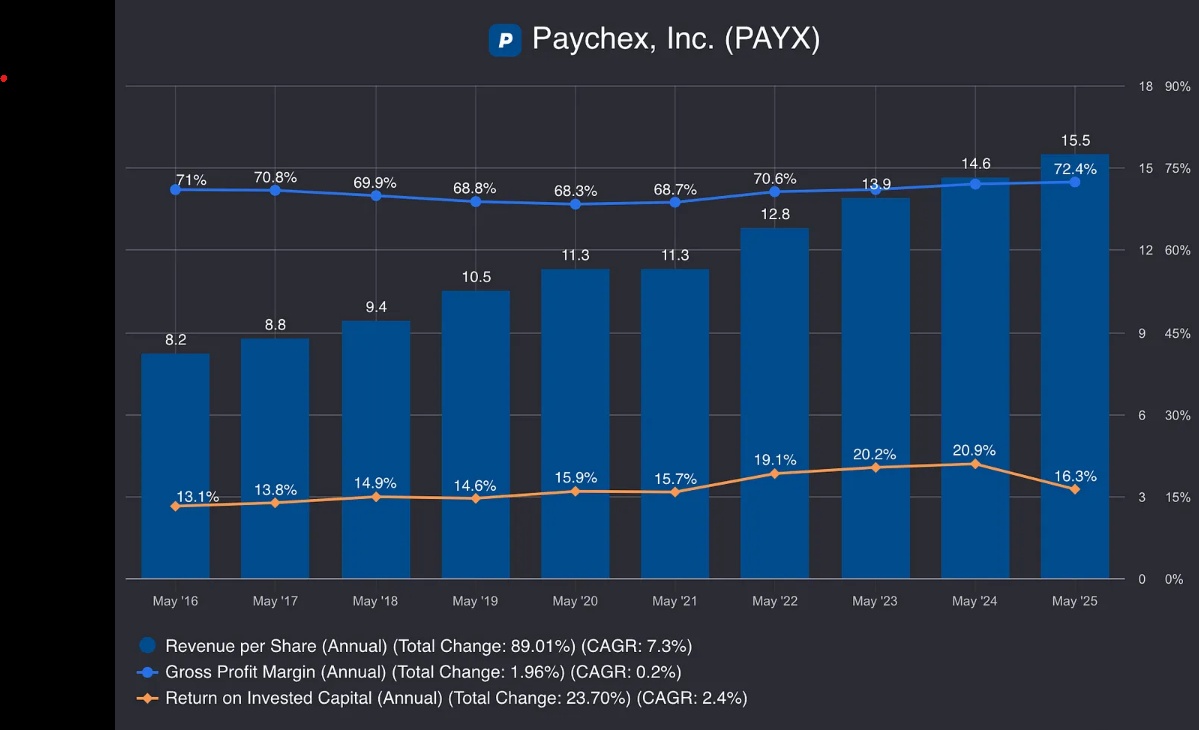

Paychex emphasizes data security through physical and electronic safeguards. The company is listed on the NASDAQ-100 and S&P 500 and has a market capitalization of around 38 billion euros in 2025.

It remains a leading provider of payroll and HR solutions worldwide and in Germany in particular, supporting thousands of companies with integrated digital payroll and HR management services.