Paychex Inc. is one of the leading providers of human capital management - i.e. payroll, HR, benefits and related services - primarily for small and medium-sized companies in the USA. The company was founded in 1971 and today pays every twelfth private employee in the USA. from.

Long-term performance: Impressive

- Total return (10 years): over +300 %

- Ø annual growth: approx. 15 %

Key financial figures at a glance

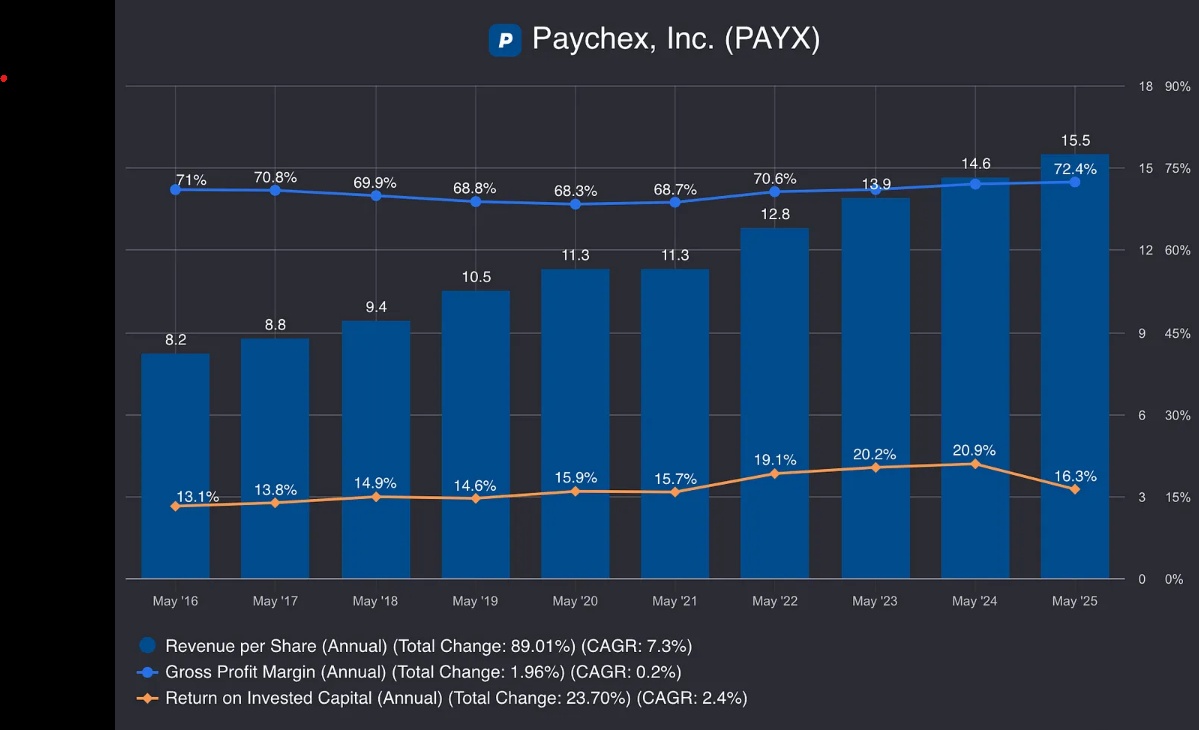

💵 Revenue per share (RPS)

- From 8.20 USD (FY16) to 15.50 USD (FY25)

- Ø growth:

7.3 % per year

💰 Gross margin

- Stable at around 70 %, most recently even 72.4 % (FY25)

📊 Return on invested capital (ROIC)

- 16.3 % in FY25 - a strong figure that indicates efficient use of capital

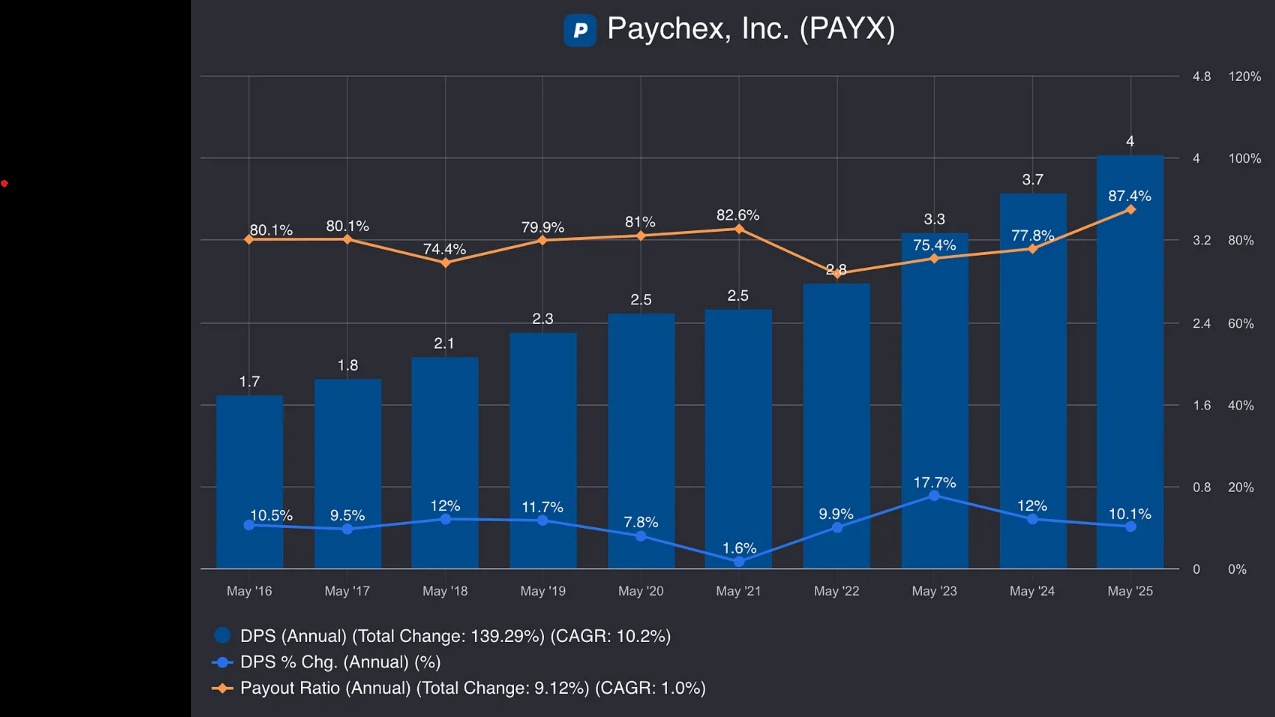

💸 Dividend strength

- Dividend increased for 10+ years

- From 1.76 USD (FY16) to almost 4.00 USD (FY25)

- Growth mostly >10 % per year

- High payout ratiobut easily sustainable due to low CapEx

Challenges & risks

🏦 Macroeconomic uncertainty

- More insolvencies among small customers

- CEO John Gibson warns of cautious spending & hiring

🧾 Elimination of the ERTC (Employee Retention Tax Credit)

- Burden of 200-300 basis points on sales growth

- Particular impact on the Payroll Tax business

- Share fell after Q4 figures by almost 10 %

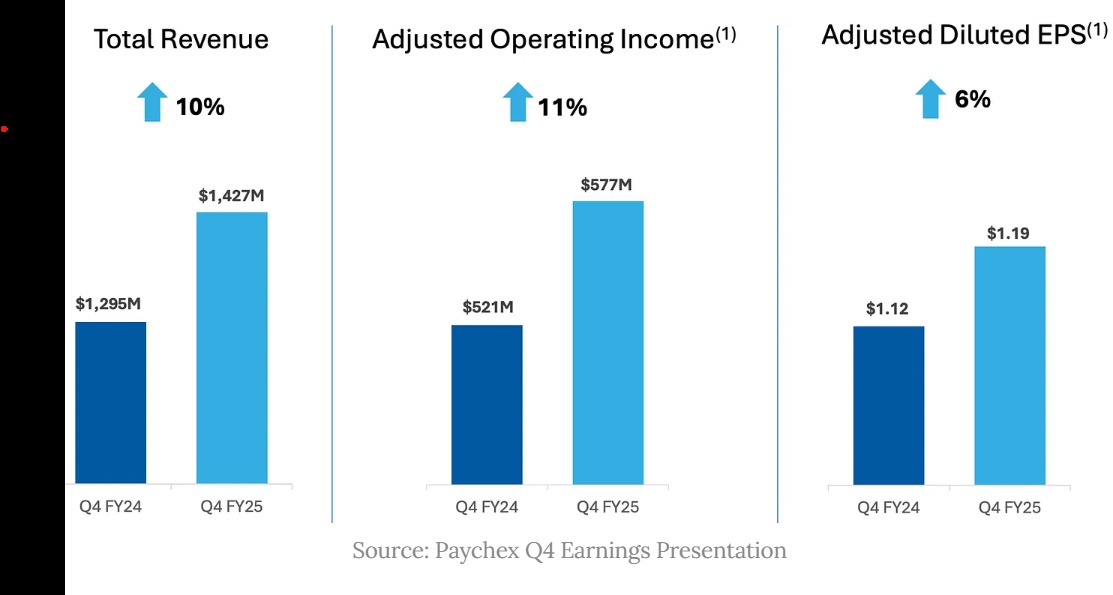

📊 Q4 & financial year 2025 at a glance

- Q4 turnover: USD 1.43 billion → +10 % YoY

- EPS (non-GAAP): USD 1.19 → in line with expectations

- Most important segments:

- Management Solutions: +12 % sales (75 % share)

- PEO & Insurance: +4 %

- Interest on customer deposits: +18 % (mainly due to Paycor acquisition)

- FY25 total sales: +6 %

- EPS (adjusted): +6 %

- Operating margin: +60 basis points

- Dividend payments: USD 1.5 billion

- Share buybacks: > USD 100 million

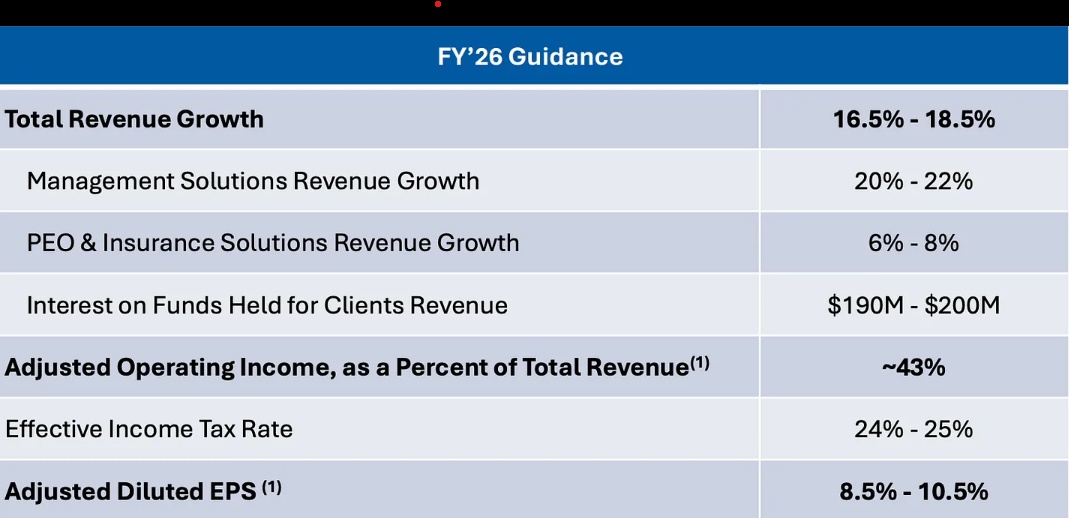

🔮 Outlook for 2026

- Initial forecasts have been published (see presentation below for details)

- Focus is on product penetration, cross-selling and AI initiatives

Conclusion

Paychex remains a highly profitable quality company with a strong dividend history and solid return on capital.

However, in the short term macroeconomic risks and the absence of special effects such as the ERTC are weighing on growth.

For long-term investors with a focus on stability and dividend yield PAYX could nevertheless remain interesting - especially if the environment brightens up again.

My YouTube channel for more stock analysis: www.youtube.com/@Verstehdieaktie