Hello dear Getquin Community,

Over the past few days, I have been working intensively on the topic of cyber security and its fundamental importance in various sectors such as healthcare, technology, energy, armaments & defense, e-commerce, software, insurance, industry, utilities, commodities, banks, fintech, holdings, crypto and blockchain. I took a closer look at the big players, the hidden champions and the essential blade manufacturers in the industry. My aim was to gain as comprehensive a picture as possible of the different levels of this industry.

If I have overlooked any important aspects or have not categorized something correctly, I look forward to your comments and interesting additions @Tenbagger2024

@Multibagger

@Simpson

@Vegasrobaina . Together we can understand the topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

At the request of @Multibagger I have subsequently added my personal favorites in each sector. I have an investment horizon of five to ten years. In addition to the quarterly figures, my main focus was on the long-term competitive advantages and the strength of the respective moat.

Contribution:

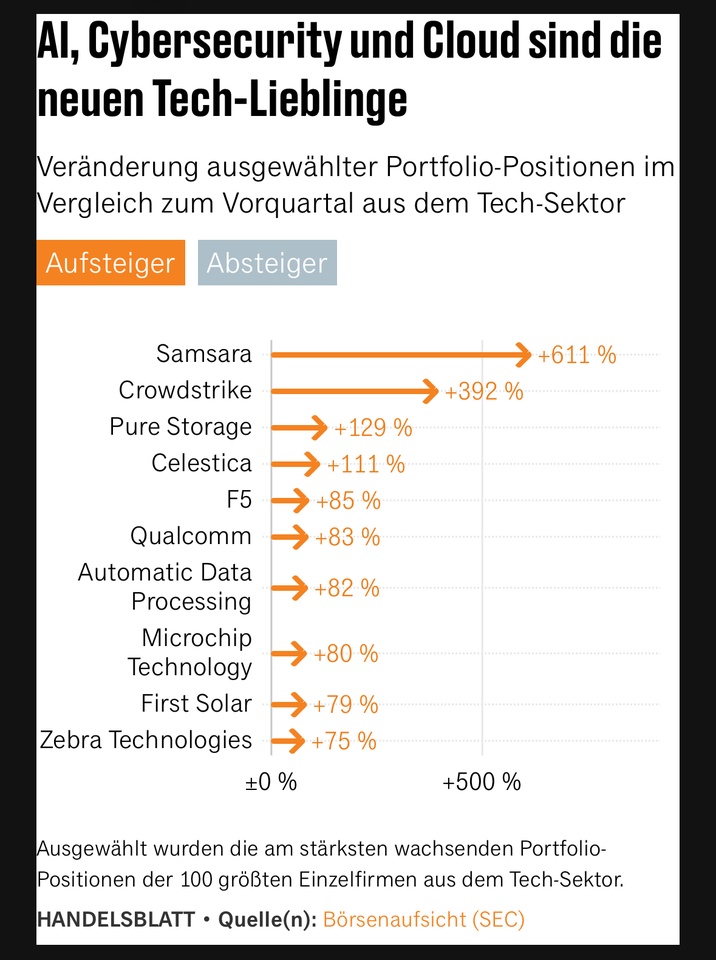

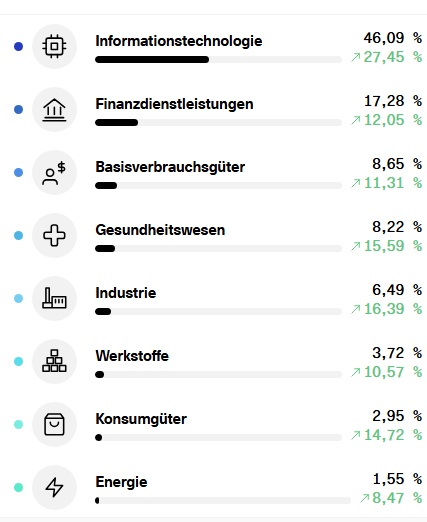

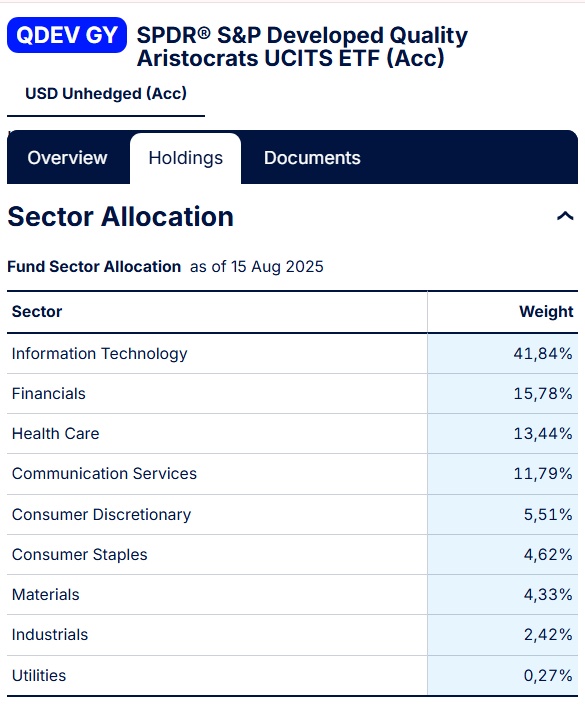

Cybersecurity is evolving from a peripheral topic to the foundation of global markets. Whether healthcare, banking, utilities, armaments & defense, energy, industry or the digital infrastructure for artificial intelligence and blockchain, the need for protection mechanisms is increasing everywhere. While the big players such as $PANW (+0,46%) Palo Alto Networks, $CRWD (-0,44%) CrowdStrike or $ZS (-0,96%) Zscaler are in the spotlight, more and more specialized providers are emerging that are essential in their niches and often have disproportionately high growth potential. Hidden champions such as $SECT B (+0,04%) Sectra in the healthcare sector, $NCNO (-1,34%) nCino in the banking sector or $ESTC (-0,42%) Elastic in the data center show that cyber security has long been a diversified ecosystem. In addition, we must not overlook the blade manufacturers, i.e. the companies that provide the technological basis. These include chip manufacturers such as $NVDA (-1,17%) , $INTC (-3,2%) Intel or $AMD (-4,24%) AMD, data center operators such as $EQIX (+0,52%) Equin$DLR (-0,61%) Digital Realty as well as software and infrastructure providers such as $ESTC (-0,42%) Elastic, $DDOG (-1,68%) Datadog or $ANET (-0,03%) Arista Networks, without whose technology the security providers' solutions would not be scalable. The capital markets are reacting to this with valuation premiums, as the dependence on secure infrastructures is comparable to electrification in the 20th century. Investors are now faced with the question of whether to favor the established market leaders or invest in smaller companies that fly under the radar but could potentially be the real winners of tomorrow.

🔑Takeaway:

Cybersecurity is not an isolated trend, but a key investment factor across all industries from hospitals to data centers from payments to crypto platforms.

Healthcare

Major players:

$PANW (+0,46%) Palo Alto Networks (PANW), $FTNT (+0,08%) Fortinet (FTNT), $CHKP (-0,88%) Check Point (CHKP), $CRWD (-0,44%) CrowdStrike (CRWD), $S (-2,45%) SentinelOne (S), $CYBR (-1,03%) CyberArk (CYBR), $ZS (-0,96%) Zscaler (ZS), $NET (-1,41%) Cloudflare (NET), $AKAM (-2,14%) Akamai Tech. (AKAM)

- Core provider for firewalls, zero trust, endpoint and web security

My top 2 recommendation in this sector are $ZS (-0,96%) Zscaler global Zero Trust Exchange, huge barrier to entry as infrastructure is built globally and $PANW (+0,46%) All-in-one platform, extremely high customer retention, hard to replace + acquisition of the company $CYBR (-1,03%)

Hidden champions:

$SECT B (+0,04%) Sectra (SECT-B.ST) - secure imaging & healthcare security

$VRNS (+0,46%) Varonis Systems (VRNS) - protection of sensitive patient data

Imprivata (private, partnerships with listed players) - identity management for clinics

My top recommendation

$SECT B (+0,04%) Niche leadership in healthcare security & medical technology

Blade manufacturer:

$NVDA (-1,17%) Nvidia (NVDA), $INTC (-3,2%) Intel (INTC), $AMD (-4,24%) AMD (AMD) - Chips & computing power for security appliances

$EQIX (+0,52%) Equinix (EQIX), $DLR (-0,61%) Digital Realty (DLR) - Data center infrastructure for clinical data

$ESTC (-0,42%) Elastic (ESTC), $DDOG (-1,68%) Datadog (DDOG) - basic software for monitoring & analytics

My top 2 recommendations are $NVDA (-1,17%) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,52%) - largest global colocation provider, enormous switching costs

🔑 Takeaway healthcare

Healthcare data is highly sensitive and clinics are at high risk of ransomware. In addition to large security providers, hidden champions such as Sectra and Varonis are gaining in importance as they secure directly at the interface between patient data and medical devices.

Technology, Data centers & AI, Telecommunications

Major players:

$ZS (-0,96%) Zscaler (ZS), $S (-2,45%) SentinelOne (S), $CHKP (-0,88%) Check Point (CHKP)

- Protection for cloud and AI environments

My top recommendation $ZS (-0,96%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$ESTC (-0,42%) Elastic (ESTC) - Security-Analytics

$ANET (-0,03%) Arista Networks (ANET)

- Network switches for data centers

My top recommendation $ANET (-0,03%) - High-end switches, hyperscaler customers

Shovel manufacturer:

$EQIX (+0,52%) Equinix (EQIX), $DLR (-0,61%) Digital Realty (DLR)

- Data center infrastructure

$NVDA (-1,17%) Nvidia (NVDA), $INTC (-3,2%) Intel (INTC), $MRVL (-3,92%) Marvell Tech. (MRVL)

- Chips & computing power for AI and security

My top 2 recommendation $NVDA (-1,17%) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,52%) - largest global colocation provider, enormous switching costs

Special players Telecommunications

$AKAM (-2,14%) Akamai Tech. (AKAM) & Cloudflare (NET) - secure traffic and mobile data

$RDWR (-2,64%) Radware (RDWR) - DDoS protection for telcos

$CSCO (+0,12%) Cisco (CSCO) - network security for carriers

$CLAV (+3,38%) Clavister Holding AB (CLAV) - through SD-WAN and carrier security

My top recommendation $AKAM (-2,14%) - Established CDN + Security

🔑 Takeaway technology, data centers & AI

Data centers and AI platforms are the backbone of the digital economy. Zero Trust and cloud security from Zscaler or SentinelOne meet shovel manufacturers such as Equinix or Nvidia, who are indispensable with infrastructure and chips.

Energy

Major players:

$FTNT (+0,08%) Fortinet (FTNT, NASDAQ) - OT/ICS security for power grids and power plants

$PANW (+0,46%) Palo Alto Networks (PANW, NASDAQ) - Zero Trust & network protection for energy suppliers

$CHKP (-0,88%) Check Point (CHKP, NASDAQ) - Critical infrastructure protection, gas and oil industry

My top recommendation $FTNT (+0,08%) - ASIC hardware + software, cost advantage

Hidden champions:

Dragos (private, IPO candidate) - leader in OT security, specialized in energy infrastructures

$RDWR (-2,64%) Radware (RDWR, NASDAQ) - DDoS defense for energy networks

$NCC (+8,36%) NCC Group (NCC.L, London) - penetration tests & audits for utilities

$CLAV (+3,38%) Clavister Holding AB (CLAV) - OT/ICS and infrastructure security

My top recommendation $CLAV (+3,38%) - small niche player (carrier security)

Shovel manufacturer:

$SBGSY (-1,01%) Schneider Electric (SBGSY, OTC) - OT/ICS hardware with security components

$ENR (-2,95%) Siemens Energy (ENR, Frankfurt) - Energy infrastructure with embedded security solutions

$AVGO (-0,59%) Broadcom (AVGO, NASDAQ) - Security chips for networks in energy environments

My top recommendation $AVGO (-0,59%) - Chip giant + Symantec Enterprise Security

E-Commerce

Major players:

$NET (-1,41%) Cloudflare (NET, NYSE) - DDoS and API protection for online stores & payment platforms

$AKAM (-2,14%) Akamai (AKAM, NASDAQ) - Application security & bot management in e-commerce

$FFIV (-0,54%) F5 Networks (FFIV, NASDAQ) - API & payment security for digital platforms

My top recommendation $NET (-1,41%) - worldwide network for DDoS/API, network effects

Hidden Champions:

$RSKD (-0,24%) Riskified (RSKD, NYSE) - Fraud prevention in online trading

$VRNS (+0,46%) Varonis Systems (VRNS, NASDAQ) - Protection of customer data

$CYBR (-1,03%) CyberArk (CYBR, NASDAQ) - Identity & access protection for payment processes

My top recommendation $CYBR (-1,03%) - Standard for Privileged Access

Shovel manufacturer:

$V (-0,61%) Visa (V, NYSE) & $MA (+0,2%) Mastercard (MA, NYSE) - not classic cybersecurity, but operators of secure payment networks

$ESTC (-0,42%) Elastic (ESTC, NYSE) - fraud analytics for e-commerce platforms

$DDOG (-1,68%) Datadog (DDOG, NASDAQ) - monitoring & security analytics for retail infrastructure

My top recommendation $V (-0,61%) - Global payment network, enormous network effect

🔑 Takeaway:

Energy is particularly vulnerable due to OT/ICS systems, specialists such as Dragos are emerging here.

E-commerce needs fraud prevention in addition to traditional web security, which is why players such as Riskified are occupying a niche.

Armaments & Defense

Major players:

$NOC (-0,62%) Northrop Grumman (NOC, NYSE) - leader in cyberdefense for military & intelligence agencies, also developing offensive cyber capabilities

$BAESY (+0,59%) BAE Systems (BAESY, OTC) - strong cyber intelligence division, protects critical military and government networks

$RTX (+2,29%) Raytheon Technologies (RTX, NYSE) - defense company with growing cybersecurity portfolio for military communications & satellites

My top recommendation $NOC (-0,62%) - Top defense contractor with cyber dominance

Hidden champions:

$PLTR (-3,25%) Palantir Technologies (PLTR, NYSE) - Data and analytics platform with strong cybersecurity component, often for defense contractors

$CACI (-2,61%) CACI International (CACI, NYSE) - specializes in cyber intelligence, network protection and military IT services

$LDOS (-2,09%) Leidos Holdings (LDOS, NYSE) - IT and cybersecurity service provider for US defense and NATO

$CLAV (+3,38%) Clavister Holding AB (CLAV) - used by government and military organizations

$ADVE Advenica (ADVE) - Specialized security, relevant for government agencies and national infrastructure

My top recommendation $CACI (-2,61%) - Cyber intelligence, deep roots in the defense sector

Shovel manufacturer:

$LHX (-1,21%) L3Harris Technologies (LHX, NYSE) - provides communications and cyber hardware for military networks

$GD (-0,83%) General Dynamics (GD, NYSE) - with its IT division GDIT also a provider of cyber defense infrastructure

$KTOS (-7,23%) Kratos Defense (KTOS, NASDAQ) - specializes in drones, satellite systems and cyber hardening of defense communications

My top recommendation $GD (-0,83%) - strong role in defense cyber with GDIT

🔑 Takeaway:

In the defence sector, the boundaries between traditional defense and cybersecurity are becoming blurred. Alongside the large defense contractors, hidden champions such as Palantir, CACI and Leidos are emerging to provide pure cyber and data expertise. Shovel manufacturers such as L3Harris and Kratos secure the technical infrastructure.

Software & insurance

Big players:

$OKTA (-1,38%) Okta (OKTA), $CYBR (-1,03%) CyberArk (CYBR), $CRWD (-0,44%) CrowdStrike (CRWD)

- Identity, endpoint and cloud security

My top recommendation $CRWD (-0,44%) - Network effect through Falcon & Threat Graph

Hidden champions:

$VRNS (+0,46%) Varonis (VRNS) - Data Security

SailPoint (private, formerly NYSE) - Identity Governance

$FROG (-0%) JFrog (FROG) - DevSecOps & Supply-Chain-Security

$CYBE (-1,4%) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0%) Gen Digital (GEN) - one of the largest consumer cybersecurity providers worldwide (Norton, Avast, LifeLock), strong in identity protection and data protection for consumers & small businesses

$RBRK (-4%) Rubrik (RBRK) - data compliance and security in the area of cloud data security

My top recommendation $GEN (+0%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$MSFT (+0,65%) (MSFT), $GOOG (+0,51%) Alphabet (GOOGL), $AMZN (-1,75%) Amazon (AMZN)

- Cloud security base

$FFIV (-0,54%) F5 Networks (FFIV) - API protection for SaaS & insurance platforms

My top recommendation $GOOG (+0,51%) - global cloud security + Mandiant, strong moat through infrastructure & Threat Intel

🔑 Takeaway Software & Insurance

Data and identity protection take center stage. Major players such as Okta and CyberArk secure access, while hidden champions such as Varonis and JFrog provide specialist solutions. Cloud providers such as Microsoft and Amazon are both platform operators and security suppliers.

Industry, supply & raw materials

Major players:

$FTNT (+0,08%) Fortinet (FTNT), $CSCO (+0,12%) Cisco (CSCO), $PANW (+0,46%) Palo Alto Networks (PANW)

- Network protection for critical infrastructures

My top recommendation $FTNT (+0,08%) - ASIC hardware + software, cost advantage

Hidden champions:

$RDWR (-2,64%) Radware (RDWR) - DDoS protection

$NCC (+8,36%) NCC Group (NCC.L) - OT-Security & Penetration Tests

$SECT B (+0,04%) Sectra (SECT-B.ST) - secure infrastructure in the OT/healthcare intersection

$CLAV (+3,38%) Holding AB CLAV) - OT/ICS and infrastructure security

$ADVE Advenica (ADVE) - Specialized security, relevant for public authorities and national infrastructure

My top recommendation $ADVE - Specialized Crypto/OT-Security for public authorities

Shovel manufacturer:

$AVGO (-0,59%) Broadcom (AVGO) - security chips

Juniper Networks (JNPR) - network backbones

$ANET (-0,03%) Arista Networks (ANET) - high-end switches

My top recommendation $AVGO (-0,59%) - Chip-Giant + Symantec Enterprise Security

🔑 Takeaway Industry, Utilities & Commodities

OT/ICS systems in production, energy and raw materials are attractive targets. Fortinet and Palo Alto dominate, but hidden champions such as Radware and the NCC Group offer special expertise for attacks on industrial control systems.

Banks, Fintech & Holdings

Big players:

$CRWD (-0,44%) CrowdStrike (CRWD), $PANW (+0,46%) Palo Alto Networks (PANW), $ZS (-0,96%) Zscaler (ZS)

- Core protection for banks & digital platforms

My top recommendation $ZS (-0,96%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$NCNO (-1,34%) nCino (NCNO) - Cloud Banking Security

$NCC (+8,36%) NCC Group (NCC.L) - Audits & Compliance

$CYBE (-1,4%) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0%) Gen Digital (GEN) - through fraud prevention and identity topics

My top recommendation $GEN (+0%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$FFIV (-0,54%) F5 Networks (FFIV) - API security for payments

$AKAM (-2,14%) Akamai Tech. (AKAM) - Web & Payment Security

$ESTC (-0,42%) Elastic (ESTC) - Fraud Analytics

My top recommendation $FFIV (-0,54%) - Leader in Application & API Security

🔑 Takeaway Banks, Fintech & Holdings

High regulatory pressure makes cybersecurity a mandatory field. In addition to established providers, banks are relying on hidden champions such as nCino or Darktrace for cloud banking and anomaly detection. Shovel manufacturers such as F5 or Akamai secure payment APIs and banking portals.

Crypto & blockchain

Big players:

$PANW (+0,46%) Palo Alto Networks (PANW), $FTNT (+0,08%) Fortinet (FTNT), $CRWD (-0,44%) CrowdStrike (CRWD)

- Core protection for exchanges, wallets and blockchain infrastructure

My top recommendation $FTNT (+0,08%) - ASIC hardware + software, cost advantage

Hidden champions:

$BBAI (-7,2%) BigBear.ai (BBAI) - Blockchain Fraud Detection

$RIOT (-8,66%) Riot Platforms (RIOT) - Mining with a focus on security

$CHKP (-0,88%) Check Point - the new blockchain firewall initiative (Web3)

My top recommendation $CHKP (-0,88%) - Strong brand & existing customers, but limited innovative strength

Shovel manufacturer:

$NVDA (-1,17%) Nvidia (NVDA), AMD (AMD) - chips & mining hardware

$NET (-1,41%) Cloudflare (NET), $AKAM (-2,14%) Akamai Tech. (AKAM)

- Network protection for wallets & exchanges

My top recommendation $NVDA (-1,17%) - GPUs, quasi-monopoly in high-end compute

🔑 Takeaway crypto & blockchain

Crypto ecosystems are heavily affected by attacks on exchanges, wallets and smart contracts. While traditional security players provide protection, niche providers such as BigBear.ai and Riskified are emerging that specialize specifically in fraud and blockchain risks.

Source: Own analysis, image material: schwarz-digits