Yes, that makes sense. That's why I sold the discount certificate after Friday's rise, even though it would very likely have gained 5% by the end of the year. That would not have been worthwhile for me in relation to the term. $IBM (-0,18%) would still be over $265 and the maximum amount of $2.50 would have been paid out.

Discussione su IBM

Messaggi

107Quantum computing without the big risk

Anyone who would like to invest in this area but is afraid of the risk of $QBTS (-7,95%) or other hotstocks, will find in $IBM (-0,18%) a great alternative that is already highly profitable.

Investing.com - IBM reported on Friday the successful execution of a centralized quantum computing algorithm on standard chips from Advanced Micro Devices. This marks a significant step towards making quantum computing commercially viable.

Quantum computers use qubits to solve complex problems that would take conventional computers thousands of years to solve - for example, analyzing the interaction of trillions of atoms over a period of time. However, these qubits are susceptible to errors that can quickly impair the computing power of quantum chips.

Back in June, IBM developed an algorithm designed to counteract these errors when used with quantum chips. According to a research paper to be published on Monday, IBM has now demonstrated that these algorithms can run in real time on the Field Programmable Gate Array (FPGA) chips from AMD can run.

Jay Gambetta, Vice President of Quantum Computing at IBM, emphasized that this success proves the practicality of the algorithm. It runs on standard AMD hardware, which is not "ridiculously expensive".

"Implementing it and proving that it is even ten times faster than required is a big deal," said Gambetta.

The company is working towards completing a quantum computer called Starling by 2029. Gambetta noted that the work on the algorithm announced on Friday was completed a year ahead of IBM's schedule.

IBM Q3’25 Earnings Highlights

🔹 Revenue: $16.33B (Est. $16.1B) 🟢; UP +9% YoY

🔹 Adj EPS: $2.65 (Est. $2.44) 🟢

🔹 Free Cash Flow: $2.37B (Est. $2.21B) 🟢

🔹 AI Book of Business: >$9.5B

FY25 Guidance

🔹 Revenue Growth (cc): > +5% (prior at least +5%); FX tailwind ~+1.5 pts

🔹 Free Cash Flow: ~$14B (Est. $13.48B) 🟢

Q3 Software

🔹 Revenue: $7.21B (Est. $7.21B) 🟡; UP +10% YoY

🔹 Hybrid Cloud (Red Hat): UP +14% YoY

🔹 Automation: UP +24% YoY

🔹 Data: UP +8% YoY

🔹 Transaction Processing: DOWN -1% YoY

Consulting

🔹 Revenue: $5.32B (Est. $5.20B) 🟢; UP +3% YoY

🔹 Strategy & Technology: UP +2% YoY

🔹 Intelligent Operations: UP +5% YoY

Infrastructure

🔹 Revenue: $3.6B; UP +17% YoY

🔹 Hybrid Infrastructure: UP +28% YoY

• IBM Z: UP +61% YoY

• Distributed Infrastructure: UP +10% YoY

🔹 Infrastructure Support: UP +1% YoY

Financing

🔹 Revenue: $0.2B; UP +10% YoY

Commentary

🔸 “Clients globally continue to leverage our technology and domain expertise to drive productivity… Our AI book of business now stands at more than $9.5 billion.” — Arvind Krishna, CEO

🔸 “Disciplined execution led to acceleration in revenue growth and profit… double-digit growth in adjusted EBITDA and another quarter of strong free cash flow.” — James Kavanaugh, CFO

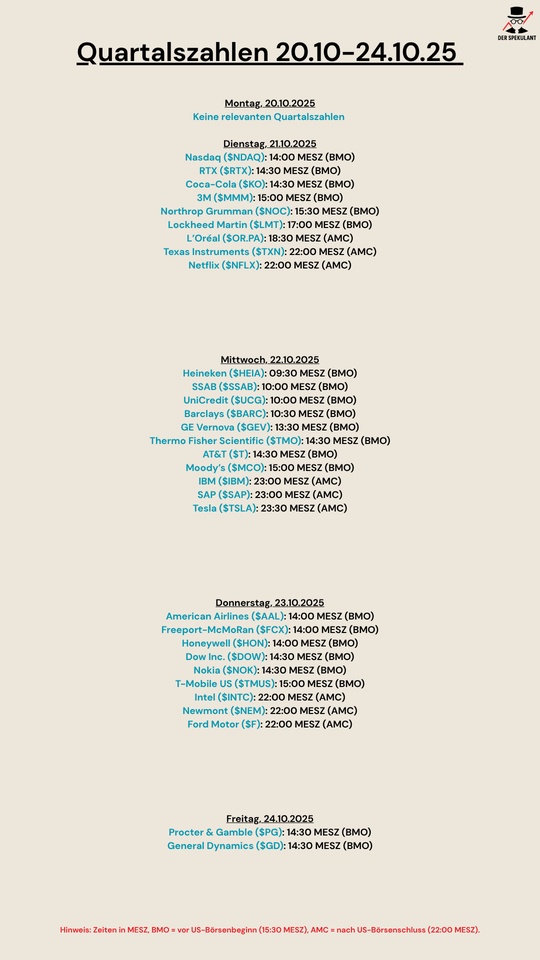

Quartalsberichte 21.10-24.10.25

$NDAQ (-0,94%)

$RTX (-0,05%)

$KO (+0,23%)

$MMM (-1,02%)

$NOC (+0,14%)

$LMTB34

$OR (-1,98%)

$TXN (-1,53%)

$NFLX (+0,59%)

$HEIA (-0,18%)

$SAAB B (+0,43%)

$UCG (+1,47%)

$BARC (+2,05%)

$GEV (-2,49%)

$TMO (-1,55%)

$T (+0,23%)

$MCO (-0,94%)

$IBM (-0,18%)

$SAP (-0,89%)

$TSLA (+1,6%)

$AAL (-4,96%)

$FCX (+0,77%)

$HON (-0,61%)

$DOW (-1,81%)

$NOKIA (+27,2%)

$TMUS (-0,34%)

$INTC (+5,63%)

$NEM (+0,98%)

$F (-1,32%)

$PG (-0,15%)

$GD (-1,66%)

Quantum computer test: HSBC opens the door to a new financial market era

HSBC $HSBA (+3,38%) was the first bank in the world to use a quantum computer in the financial market - a breakthrough that is likely to accelerate the race for technology.

With the most powerful quantum processor to date, Heron from IBM $IBM (-0,18%) the major British bank has improved the prediction of the price at which a bond will be traded by 34 percent.

The basis for this was an anonymized data set of European bond deals, as the bank announced on Thursday (25.9.). This could significantly increase the efficiency of the market.

The experiment is considered a milestone because real transactions were included on a large scale for the first time. Until now, the technology was mainly limited to universities and specialized tech companies.

Companies such as Google's parent company Alphabet $GOOGL (-1,01%)IBM and Microsoft $MSFT (+1,81%) are already investing billions of dollars in quantum research, but the road to everyday applications remains long.

》No live trade《

HSBC's attempt was aimed at over-the-counter trading, in which transactions are carried out directly between two parties - without an exchange or broker. Philip Intallura, Head of Quantum Technology at HSBC, emphasizes that although it was not a live trade, it was very much a demonstration on a real production scale. "We firmly believe that we are on the cusp of a new era of computer technology in financial services - and not just in the distant future," says Intallura.

While technology companies are setting the pace in terms of development, banks such as JP Morgan Chase $JPM (+0,02%)Goldman Sachs $GS (-0,15%)Citigroup $C (-0,23%) and HSBC are also investing heavily in quantum projects.

Management consultancies McKinsey and KPMG expect far-reaching benefits: better risk management, optimized portfolios, more accurate predictions of asset prices and sharper fraud detection.

》Faster with physics《

The foundation of quantum computers is physics itself. Unlike conventional computers, they do not work step by step, but in parallel. This allows extremely complex problems to be solved very quickly.

Alphabet showed just how big the leap is at the end of last year: the quantum processor Willow solved a problem in five minutes that even the most powerful supercomputers since the beginning of the universe would have calculated - and not come up with the result.

For me the top pick

in the field of quantum technology is $IBM (-0,18%) . And not just since today. I already made this known here 2-3 months ago.

International Business Machines (+3.3%): HSBC reported the successful completion of the world's first known quantum-assisted algorithm trading test based on IBM's quantum computing technology.

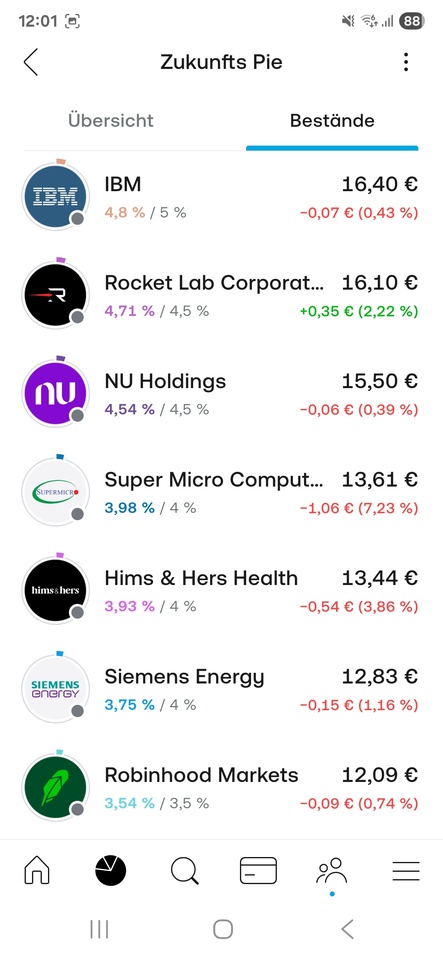

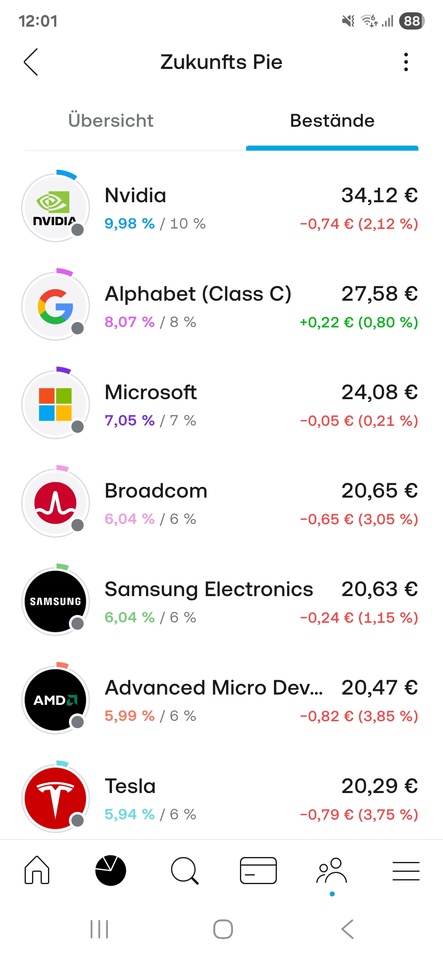

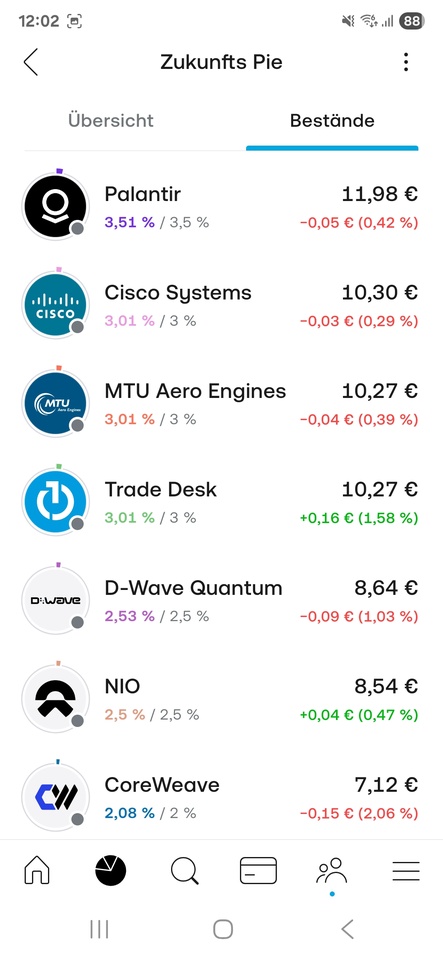

Once again 212

So 1.5 weeks have now passed. The first gimmicks are over and my Watchlist Pie has returned a total of 4.5% in one week. This has now been sold and I have built up a pie to save for the next 8-10 years. I'm starting with 50€ a week until I've completed the broker's test phase. After that I'll ramp it up to about 1k per month.

There are still a few stocks missing, but the big ones will be scaled down a bit. Among others $IREN (-2,4%) ....

What do you think of the selection?

$NVDA (+6,67%)

$GOOGL (-1,01%)

$MSFT (+1,81%)

$AVGO (+2,76%)

$005930

$AMD (+0,01%)

$TSLA (+1,6%)

$IBM (-0,18%)

$RKLB (-1,78%)

$NU (-0,72%)

$SMCI (+1,25%)

$HIMS (-2,43%)

$ENR (+0,05%)

$HOOD (+0,19%)

$PLTR (+0,73%)

$CSCO (+1,42%)

$MTX (-0,41%)

$TTD (-3,25%)

$QBTS (-7,95%)

$9866 (+0,63%)

$CRWV (+0,43%)

And what of course should not be missing is $SIKA (-5,86%) These are still weighted at 2% 😉 As a craftsman, I really enjoy using the products myself. The technological progress compared to other products such as StoCretec or others is already enormous, but it would go beyond the scope of this article.

However, I see Tesla as doomed🙈🫡

Nevertheless, I wish everyone (who doesn't push Tesla as the most valuable company in the world) good luck :)

D-Wave Quantum... worth an investment?

Hello everyone,

I wanted to ask you if you are invested in $QBTS (-7,95%) and if so, at what buyin?

I see the future in quantum computers, but find $QBTS (-7,95%) still quite expensive at the moment.

A 1300% increase within one year is pretty steep...

Where is your buy zone?

Or do you prefer to invest in $GOOGL (-1,01%) and $IBM (-0,18%) for the development of quantum chips?

Looking forward to your opinions :D

Cons: They continue to run too hot for me, 8 million turnover is less than our local bakery chain (😉), but 5 billion market capitalization?

Megatrend robotics, freshly updated, added value guaranteed!

After my first post on humanoid robots received a lot of positive feedback, I went into more detail. I have subsequently added my favorites in each sector.

Extended analysis of the value chain including shovel manufacturers and potential hidden champions

New categorySecondary key sectors (sales, marketing, financing)

In additionTop 25 companies worldwide, as well as Top 10 Europe and Top 10 Asia

I have also added a video link for beginners. This will give you an idea of how far the development of humanoid robotics has already progressed.

Thank you for your attention and your support 🙏

🌐 1. value chain of humanoid robots (with hidden champions)

1. research & chip design

$ARM (-3,19%) ARM (UK) - CPU-IP, energy-efficient processors

$SNPS (-1,93%) Synopsys (US) - EDA software, chip design

$CDNS (-1,1%) Cadence (US) - EDA & Simulation

$PTC PTC (US) - Engineering Software, CAD/PLM

$DSY (-2,52%) Dassault Systèmes (FR) - 3D Design & Digital Twin

$SIE (-0,38%) Siemens (DE) - Industrial Software & Lifecycle Mgmt

$ADBE (-0,05%) Adobe (US) - Design, AR/UX

ANSYS (US) - multiphysical simulation - acquisition by Synopsis

Altair (US) - CAE, simulation, digital twin - acquisition by Siemens

$HXGBY (-0,46%)

Hexagon (SE) - Metrology & Simulation

$AWE (-4,1%) Alphawave IP Group (UK) - High-speed chip IP for AI/robotics

1.Synopsis, 2.Siemens and 3.Adobe are my top 3 in this sector

2. manufacturing technology & equipment

$ASML (-0,46%) ASML (NL) - Lithography (EUV)

$AMAT (-1,72%) Applied Materials (US) - Semiconductor equipment

$8035 (+4,29%) Tokyo Electron (JP) - wafer fabrication

$KEYS (+0,3%) Keysight Technologies (US) - Metrology

$6857 (+4,45%) Advantest (JP) - Chip test systems

$TER (+17,46%) Teradyne (US) - test systems + cobots

$6954 (+0,14%) Fanuc (JP) - Industrial robots, CNC

$CAT (-0,77%) Caterpillar (US) - autonomous machines

$KU2G KUKA (DE) - industrial robots

Comau (IT) - automation - not listed on the stock exchange

$ROK Rockwell Automation (US) - industrial automation

$JBL (+1,5%) Jabil (US) - contract manufacturing (EMS/ODM)

$KIT (-2,14%) Kitron (NO) - European EMS/ODM manufacturer

$AIXA (-2,11%) Aixtron (DE) - deposition equipment for compound semiconductors

$LRCX (-0,92%)

Lam Research (US) - Etch/deposition systems

$MKSI (-3,21%)

MKS Instruments (US) - Plasma/vacuum technology

$ASM (-4,65%)

ASM International (NL) - Deposition systems

1.ASML, 2.Keysight Technologies, 3.Fanuc are my top 3 in this sector

3. chip manufacturing (foundries)

$TSM (+0,97%) TSMC (TW) - leading foundry

$SMSN Samsung Electronics (KR) - foundry + memory

$GFS (-2,07%) GlobalFoundries (US) - specialty chips

$INTC (+5,63%)

Intel Foundry Services (US) - new western foundry player

$981

SMIC (CN) - largest Chinese foundry

$UMC

UMC (TW) - Power/RF/Embedded chips

1.TSMC, 2.Intel, 3.Samsung Electronics are my top 3 in this sector

4. computing & control unit ("brain")

$NVDA (+6,67%) Nvidia (US) - GPUs, AI chips

$INTC (+5,63%) Intel (US) - CPUs, FPGAs

$AMD (+0,01%) AMD (US) - CPUs, GPUs

$MRVL (-0,17%) Marvell (US) - Network Chips

$MU (+0,71%) Micron (US) - Memory

$DELL (+1,61%) Dell Technologies (US) - Edge & Infrastructure

Graphcore (UK) - AI chips (IPU) - not a listed company

Cerebras (US) - Wafer-scale engine - not a listed company

SiPearl (FR) - European HPC chip - not a listed company

1.Nvidia, 2.Marvell, 3.Micron are my top 3 in this sector

5. sensors ("senses")

$6758 (+0,02%) Sony (JP) - image sensors

$6861 (-0,52%) Keyence (JP) - Industrial sensors

$STM (-0,91%) STMicroelectronics (FR/IT) - Sensors, MCUs

$TDY Teledyne (US) - optical/infrared sensors

$CGNX (-2,17%) Cognex (US) - Machine Vision

$HON (-0,61%) Honeywell (US) - sensor technology, security

ANYbotics (CH) - autonomous sensor fusion - not a listed company

$AMBA (-0,05%) Ambarella (US) - video & computer vision SoCs for real-time image recognition

$OUST

Velodyne Lidar (US) - Lidar sensors - acquisition by Ouster

$AMS (+0,24%)

OSRAM (AT/DE) - optical sensors

1.Teledyne, 2.Keyence, 3.Ouster are my top 3 in this sector

6. actuators & power electronics ("muscles")

$IFX (-1,33%) Infineon (DE) - Power Electronics

$ON (-1,96%) onsemi (US) - Power & Sensors

$TXN (-1,53%) Texas Instruments (US) - Mixed-Signal Chips

$ADI (-2,16%) Analog Devices (US) - Signal Processing

$PH Parker-Hannifin (US) - Hydraulics/Pneumatics

$MP (-0,71%) MP Materials (US) - Magnets

$APH (+0,5%) Amphenol (US) - Connectors

$6481 (-1,65%) THK (JP) - Linear guides & actuators

$6324 (-1,73%)

Harmonic Drive (JP) - Precision gears & servo drives for robotics

$6594 (-13,11%)

Nidec (JP) - Electric motors

$6506 (-2,31%)

Yaskawa (JP) - Drives & Robotics

$SU (-0,94%)

Schneider Electric (FR) - Energy & control solutions

$ZIL2 (+1,49%)

ElringKlinger (DE) - Battery & fuel cell technology, lightweight construction

1.Parker-Hannifin, 2.MP Materials, 3.Infinion are my top 3 in this sector

7. communication & networking ("nerves")

$QCOM (-3,34%) Qualcomm (US) - mobile communications, edge AI

$ANET (+0,5%) Arista Networks (US) - Networks

$CSCO (+1,42%) Cisco (US) - Networks, Security

$EQIX (-2,29%) Equinix (US) - Data centers

NTT Docomo (JP) - 5G/6G carrier - not a listed company

$VZ Verizon (US) - Telecommunications

$SFTBY SoftBank (JP) - Carrier + Robotics

$ERIC B (+4,17%)

Ericsson (SE) - 5G/IoT infrastructure

$NOKIA (+27,2%)

Nokia (FI) - 5G/6G for industry

$HPE (-0,1%)

Juniper Networks (US) - Network technology - acquisition by HP

1.Arista Networks, 2.SoftBank, 3.Cisco are my top 3 in this sector

8. energy supply

$3750 (+0%) CATL (CN) - Batteries

$6752 (+2,94%) Panasonic (JP) - Batteries

$373220 LG Energy (KR) - Batteries

$ALB (-0,65%) Albemarle (US) - Lithium

$LYC (-12,24%) Lynas (AU) - Rare earths

$UMICY (-0,49%) Umicore (BE) - recycling

WiTricity (US) - inductive charging - not a listed company

$ABBN (-0,42%) Charging (CH) - charging infrastructure

$SLDP

Solid Power (US) - Solid state batteries

Northvolt (SE) - European batteries - not a listed company

$PLUG

Plug Power (US) - fuel cells

$KULR (-5,63%)

KULR Technology (US) - Thermal management & battery safety for mobile systems

1.Albemarle, 2.CATL, 3.Panasonic are my top 3 in this sector

9. cloud & infrastructure

$AMZN (+0,53%) Amazon AWS (US) - Cloud, AI

$MSFT (+1,81%) Microsoft Azure (US) - Cloud, AI

$GOOG (-0,82%) Alphabet Google Cloud (US) - Cloud, ML

$VRT

Vertiv Holdings (US) - Data center infrastructure (UPS, cooling, edge)

$ORCL (-0,05%)

Oracle Cloud (US) - ERP + Cloud

$IBM (-0,18%)

IBM Cloud (US) - Hybrid cloud + AI

$OVH (-1,71%)

OVHcloud (FR) - European cloud

1.Alphabet, 2.Microsoft, 3.Oracle are my top 3 in this sector

10. software & data platforms

$PLTR (+0,73%) Palantir (US) - Data integration

$DDOG (-1,01%) Datadog (US) - Monitoring

$SNOW (+0,14%) Snowflake (US) - Data Cloud

$ORCL (-0,05%) Oracle (US) - Databases, ERP

$SAP (-0,89%) SAP (DE) - ERP systems

$SPGI S&P Global (US) - financial/market data

ROS2 Foundation - robotics middleware - not listed on the stock exchange

$NVDA (+6,67%) NVIDIA Isaac (US) - robotics development - part of Nvidia

$INOD (-3,73%) Innodata (US) - data annotation & AI training data

$PATH (-6,96%)

UiPath (RO/US) - Robotic process automation

$AI (-1,16%)

C3.ai (US) - AI platform

$ESTC (-1,72%)

(NL/US) - Search & data analysis

1.S&P Global, 2.Palantir, 3.Datadog are my top 3 in this sector

11. end applications / robots

$ABBN (-0,42%) ABB (CH/SE) - Industrial Robots

$6954 (+0,14%) Fanuc (JP) - Industrial robots

$TSLA (+1,6%) Tesla Optimus (US) - humanoid robot

$9618 (+0,67%) JD.com (CN) - logistics robot

$AAPL (-0,1%) Apple (US) - Platform & UX

$700 (-1,68%) Tencent (CN) - Platform & AI

$9988 (-1,85%) Alibaba (CN) - logistics & platform

PAL Robotics (ES) - humanoid robots - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

$TER (+17,46%) Universal Robots (DK) - cobots - belongs to the Teradyne Corporation

Engineered Arts (UK) - humanoid robots - not a listed company

$ISRG (-1,47%) Intuitive Surgical (US) - surgical robotics

$GMED (-0,92%)

Globus Medical (US) - surgical robotics (ExcelsiusGPS platform)

$7012 (-3,88%) Kawasaki Heavy Industries (JP) - industrial robots, automation

$CPNG (+0,42%) Coupang (KR) - Logistics end user

$IRBT (-20,31%)

iRobot (US) - consumer robotics (e.g. Roomba), non-humanoid, but navigation/sensor fusion

Boston Dynamics (US) - humanoid & mobile robots-no listed company

Hanson Robotics (HK) - humanoid robots (Sophia) - not a listed company

Agility Robotics (US) - humanoid robot "Digit" - not a listed company

1.Apple, 2.Tencent, 3.Alibaba are my top 3 in this sector

🛠 2. cross enablers (shovel manufacturers) - with hidden champions

Raw materials & battery materials

Albemarle - Lynas - Umicore

$SQM

SQM (CL) - Lithium

$ILU (-0,04%)

Iluka Resources (AU) - Rare earths

$ARR (-6,68%)

American Rare Earths (US/AU) - New supply chains

my number 1 in the sector is Albemarle

manufacturing technology

ASML - Applied Materials - Tokyo Electron

$LRCX (-0,92%)

Lam Research (US) - Plasma/etching processes

$ASM (-4,65%)

ASM International (NL) - ALD equipment

$MKSI (-3,21%)

MKS Instruments (US) - Plasma/vacuum technology

my number 1 in the sector is ASML

Quality assurance

Keysight - Advantest - Teradyne

$EMR (+0,69%)

National Instruments (US) - Measurement technology - from Emerson Electric adopted

$300567

ATE Test Systems (CN) - test systems

$FORM (-3,46%)

FormFactor (US) - Wafer probing

my number 1 in the sector is Keysight

Motion & Drive

Parker-Hannifin

Festo (DE) - Pneumatics, Soft Robotics - not a listed company

Bosch Rexroth (DE) - Drives, Controls - not a listed company

$6481 (-1,65%)

THK (JP) - Linear guides

my number 1 in the sector is Parker-Hannifin

Sensors/Imaging

$TDY Teledyne

$BSL (-1,3%) Basler (DE) - Industrial cameras

FLIR (US) - Thermal imaging sensors - acquisition by Teledyne

ISRA Vision (DE) - Machine Vision - not a listed company

my number 1 in the sector is Teledyne

Magnets & Materials

MP Materials

$6501 (+2,88%)

Hitachi Metals (JP) - Magnetic materials

VacuumSchmelze (DE) - Magnetic materials - not a listed company

$4063 (+0,93%)

Shin-Etsu Chemical (JP) - Specialty materials

my number 1 in the sector is MP Materials

Chip Design & Simulation

Synopsys - Cadence - ARM

$SIE (-0,38%)

Siemens EDA (DE/US)-Mentor Graphics-strategic business unit of Siemens AG

Imagination Tech (UK) - GPU-IP - not a listed company

$CEVA (-0,41%)

CEVA (IL) - Signal Processor IP

my number 1 in the sector is Synopsys

Engineering & Lifecycle

PTC - Dassault - Siemens

Altair (US) - Simulation - no longer a listed company

$HXGBY (-0,46%)

Hexagon (SE) - Metrology

$SNPS (-1,93%)

ANSYS (US) - Simulation - takeover by Synopsys

my number 1 in the sector is Siemens

Networks & Data Centers

Arista - Cisco - Equinix

$HPE (-0,1%)

Juniper (US) - Networks - Acquisition of HPE

$DTE (-1,34%)

T-Systems (DE) - Industry cloud

$OVH (-1,71%)

OVHcloud (FR) - European cloud

my number 1 in the sector is Arista

Cloud infrastructure

AWS - Azure - Google Cloud

$ORCL (-0,05%)

Oracle Cloud (US) - ERP & databases

$IBM (-0,18%)

IBM Cloud (US) - Hybrid Cloud

$9988 (-1,85%)

Alibaba Cloud (CN) - Asian Cloud

$VRT

Vertiv Holdings (US) - Cloud/Infra

my number 1 in the sector is Alphabet (Google)

finance/information infra

S&P Global

$MCO (-0,94%)

Moody's (US) - Ratings

$MSCI (+8,46%)

MSCI (US) - Indices

$MORN

Morningstar (US) - Investment Research

my number 1 in the sector is S&P Global

Creative/Experience Infra

Adobe

$ADSK (-0,87%)

Autodesk (US) - CAD & Design

$U

Unity (US) - 3D/AR simulation

Epic Games (US) - Unreal Engine - not a listed company

my number 1 in the sector is Adobe

Platform & Ecosystem

Apple - Tencent - Alibaba

$META (+0,07%)

Meta (US) - AR/VR, Social Robotics

ByteDance (CN) - AI & platforms - not a listed company

$9888 (-0,2%)

Baidu (CN) - AI & Cloud

my number 1 in the sector is Tencent

Infrastructure/Edge

Dell

$HPE (-0,1%)

HPE (US) - Edge Computing

$SMCI (+1,25%)

Supermicro (US) - AI servers

$6702 (-0,59%)

Fujitsu (JP) - Edge & HPC

my number 1 in the sector is Dell

storage solutions

Micron

$HY9H

SK Hynix (KR) - Memory

$285A (-2,71%)

Kioxia (JP) - NAND

$WDC

Western Digital (US) - Storage solutions

my number 1 in the sector is Micron

🏛 3. secondary key sectors with hidden champions

Financing & Capital

$GS (-0,15%) Goldman Sachs (US) - investment bank; ECM/DCM, M&A, growth financing

$MS Morgan Stanley (US) - investment bank; tech banking, capital markets

$BLK (-0,88%) BlackRock (US) - asset manager; capital allocation, ETFs/index funds

$9984 (+7,13%) SoftBank Vision Fund (JP) - mega VC; growth equity in robotics/AI

Sequoia Capital (US) - venture capital; early/growth in AI/robotics - this is a classic venture capital fund

DARPA (US) - government R&D funding (robotics/defense) - independent research and development agency

EU Horizon (EU) - research funding/grants for DeepTech - Innovative Europe pillar

China State Funds (CN) - state industry/technology fund

Lux Capital (US) - VC for DeepTech - Uptake (US) - AI-based predictive maintenance

DCVC (US) - Robotics & AI focus - investing exclusively via VC fund investments

Speedinvest (AT) - EU VC for robotics - access to investment only via fund investments

my number 1 in the sector is Softbank

Maintenance & Service

$SIE (-0,38%) Siemens (DE) - Industrial Service, Lifecycle & Retrofit

$ABBN (-0,42%) ABB (CH/SE) - Robotics Service, Spare Parts, Field Support

$GEHC (+1,75%) GE Healthcare (US) - Medtech service incl. robotic systems

Uptake (US) - AI-based predictive maintenance - not a listed company

Augury (US/IL) - condition monitoring, condition diagnostics - not a listed company

$KU2 KUKA Service (DE) - Robotics maintenance

$6954 (+0,14%) Fanuc Service (JP) - global service network

Boston Dynamics AI Institute (US) - Robotics longevity - funded by Hyundai Motor Group

my number 1 in the sector is Siemens

Marketing & Advertising

$WPP (-0,24%) WPP (UK) - global advertising group; branding/communications

$OMC Omnicom (US) - marketing/PR network

$PUB (+1,39%) Publicis (FR) - communications/advertising group

$META (+0,07%) Meta (US) - Digital Ads (Facebook/Instagram)

$GOOG (-0,82%) Google Ads (US) - search & display advertising

TikTok / ByteDance (CN) - social ads & distribution - not a listed company

$AAPL (-0,1%) Apple (US) - Branding/UX; Acceptance & Platform Marketing

$WPP (-0,24%)

AKQA (UK/US) - Tech branding - Since 2012 majority owned by the WPP Groupbut continues to operate as an autonomous operating unit

R/GA (US) - Innovation marketing - not a listed company

Serviceplan (DE) - largest independent EU agency - not a listed company

my number 1 in the sector is Meta

Law, Regulation & Ethics

ISO (CH) - international standards, robotics standards

TÜV (DE) - certification & safety tests

UL (US) - safety/conformity testing

EU AI Act (EU) - legal framework for AI & robotics

UNESCO AI Ethics (UN) - global ethics guidelines

Fraunhofer IPA (DE) - Robotics safety standards

ANSI (US) - standards

IEC (CH) - Electrical engineering standards

Training & Talent

MIT (US) - Robotics/AI Research & Education

ETH Zurich (CH) - autonomous systems & robotics

Stanford (US) - AI/Robotics labs & spin-offs

Tsinghua University (CN) - Robotics/AI in Asia

CMU (US) - Robotics Institute

EPFL (CH) - Robotics research

TU Munich (DE) - humanoid robot "Roboy"

🌍 Top 25 companies for humanoid robotics

These companies are central to the development & production of humanoid robotsbecause without them, crucial parts of the chain would be missing:

Chips & computing power (brain of the robots)

$NVDA (+6,67%) Nvidia (US) - AI GPUs & Isaac platform, foundation for robotic AI

$2330 TSMC (TW) - world's most important foundry, produces the AI chips

$ASML (-0,46%) ASML (NL) - EUV lithography, indispensable for chip production

$005930 Samsung Electronics (KR) - memory, logic, foundry

$HY9H SK Hynix (KR) - DRAM & NAND memory for AI

$MU (+0,71%) Micron (US) - Memory solutions for AI workloads

my number 1 in the sector is ASML

Sensors & perception (senses of robots)

$SONY Sony (JP) - image sensors, market leader

$6861 (-0,52%) Keyence (JP) - Industrial sensors & vision systems

$CGNX (-2,17%) Cognex (US) - Machine Vision, precise image processing

my number 1 in the sector is Keyence

Actuators & motion (muscles of robots)

$IFX (-1,33%) Infineon (DE) - power electronics, motor control

$6594 (-13,11%) Nidec (JP) - World market leader for electric motors

$PH Parker-Hannifin (US) - hydraulics/pneumatics, motion technology

$6481 (-1,65%) THK (JP) - Linear guides & actuators

my number 1 in the sector is Parker-Hannifin

Communication, cloud & infrastructure (nerves & data flow)

$QCOM (-3,34%) Qualcomm (US) - Mobile & Edge Chips

$AMZN (+0,53%) Amazon AWS (US) - Cloud & AI infrastructure

$MSFT (+1,81%) Microsoft Azure (US) - Cloud, AI services

$CSCO (+1,42%) Cisco (US) - Networks & Security

$VRT Vertiv Holdings (US) - Data Center Infrastructure

my number 1 in the sector is Microsoft

End Applications & Platforms (robots themselves)

$TSLA (+1,6%) Tesla (US) - humanoid robot Optimus

$ABBN (-0,42%) ABB (CH/SE) - Robotics & Automation

$6954 (+0,14%) Fanuc (JP) - industrial robots & CNC systems

$7012 (-3,88%) Kawasaki Heavy Industries (JP) - industrial robots

PAL Robotics (ES) - humanoid robots (TALOS, ARI, TIAGo) - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

Universal Robots (DK) - cobots

my number 1 in the sector is Tesla

🇪🇺 Top 10 European key companies for humanoid robotics

$ASML (-0,46%)

ASML (NL)

World market leader in EUV lithography - no modern chips for AI & robotics without ASML.

$IFX (-1,33%) Infineon (DE)

Leading in power electronics & motor control - crucial for actuators of humanoid robots.

$STM (-0,91%)

STMicroelectronics (FR/IT)

Sensors, microcontrollers & power chips - the basis for control & perception.

$SAP (-0,89%)

SAP (DE)

ERP & data platforms, important for integrating humanoid robots into industrial processes.

$SIE (-0,38%)

Siemens (DE)

Industrial software, automation, digital twin - key for engineering & lifecycle management.

$KU2 KUKA (EN)

Robotics pioneer, industrial robots & automation - know-how for humanoid motion mechanics.

PAL Robotics (ES) - not a listed company

Specialist for humanoid robots (TALOS, ARI, TIAGo), internationally used in research & service.

Neura Robotics (DE) - Not a listed company

Young high-tech company, develops cognitive humanoid robots with advanced AI (4NE-1).

Universal Robots (DK) - Not a listed company

Market leader for cobots - platform for safe human-robot collaboration.

Engineered Arts (UK) - not a listed company

Develops humanoid robots such as Amecaknown for realistic facial expressions & gestures - important for HRI (Human-Robot Interaction)

🌏 Top 10 Asian key companies for humanoid robotics

$2330

TSMC (Taiwan)

World's largest semiconductor foundry, produces high-end chips (e.g. Nvidia, AMD, Apple) - no AI hardware without TSMC.

$005930

Samsung Electronics (South Korea)

Foundry, memory, logic chips, image sensors - extremely broadly positioned in robotics components.

$HY9H

SK Hynix (KR) - Memory

$SONY

Sony (Japan)

Market leader in CMOS image sensors, essential for robotic vision & perception.

$6861 (-0,52%)

Keyence (Japan)

Sensor technology & machine vision for industrial automation, widely used in robotics.

$6954 (+0,14%)

Fanuc (Japan)

Industrial robots & CNC systems, one of the most important manufacturers of robotics hardware worldwide.

$6506 (-2,31%)

Yaskawa Electric (Japan)

Drives, motion control & robot arms - relevant for humanoid motion control.

$6594 (-13,11%)

Nidec (Japan)

World market leader for electric motors (from mini motors to high-performance drives).

$7012 (-3,88%)

Kawasaki Heavy Industries (JP) - Industrial robots

$9618 (+0,67%)

JD.com (China)

Driver for robotics in e-commerce & logistics, invests in humanoid robotics applications

Build robots, earn shovels

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (-3,19%)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (-1,93%)

Synopsys (SNPS, USA) - Chip design software

$CDNS (-1,1%)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (-0,46%)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (-1,72%)

Applied Materials (AMAT, USA) - Process equipment

$8035 (+4,29%)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (+0,3%)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (+4,45%)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (+17,46%)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (+0,97%)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (-2,07%)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (+6,67%)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (+5,63%)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (+0,01%)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-0,17%)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (+0,02%)

Sony (6758.T, JP) - CMOS image sensors

$6861 (-0,52%)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-0,91%)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (-1,33%)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-1,96%)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-0,91%)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (-1,53%)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (-2,16%)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (-3,34%)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (+2,76%)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (+6,36%)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (+2,94%)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (+0,53%)

Amazon (AMZN, USA) - AWS

$MSFT (+1,81%)

Microsoft (MSFT, USA) - Azure

$GOOG (-0,82%)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (-2,29%)

Equinix (EQIX, USA) - Data center operator

$ANET (+0,5%)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (+1,42%)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (+0,73%)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (-1,01%)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (+0,14%)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (-0,05%)

Oracle (ORCL, USA) - Databases, ERP

$SAP (-0,89%)

SAP (SAP, DE) - ERP/cloud systems

$PATH (-6,96%)

UiPath (PATH, USA) - Automation software (RPA)

$AI (-1,16%)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (+0,14%)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (+1,6%)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (+0,67%)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (-0,46%)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (-1,72%)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (+4,29%)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (+4,45%)

Advantest (6857.T, JP) - Semiconductor test.

$TER (+17,46%)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (-0,65%)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (-12,24%)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (-0,49%)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (-1,93%)

Synopsys (SNPS, USA) - EDA software.

$CDNS (-1,1%)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (-3,19%)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (+0,3%)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (+0,5%)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (+1,42%)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (-2,29%)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (+0,53%)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (+1,81%)

Microsoft (MSFT, USA) - Azure.

$GOOG (-0,82%)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

The AI bubble: opportunities, risks and lessons from the Dot.com crisis

The possibility that we are currently in an AI bubble is real. As with previous hypes, the valuation of AI companies seems to be ahead of their actual profitability. Moreover, the S&P 500 is heavily overconcentrated in a handful of large tech players that are benefiting from the AI hype. Should these fall, the entire index will be pulled down with them.

That risk is compounded by the fact that the S&P has become historically expensive, with P/E ratios well above average. The risks are clear: if promised growth fails to materialize, valuations could collapse hard. The situation is reminiscent of the dot.com bubble of the early 2000s, but with an important difference: now, a lot of credit is being borrowed to finance AI growth. That makes a blow more dangerous, because debt puts extra pressure in a downturn.

Conclusion: AI could change the world permanently, but current valuations seem fragile. A bubble need not mean AI disappears, it does mean investors should prepare for sharp corrections.

$NVDA (+6,67%)

$MSFT (+1,81%)

$AMZN (+0,53%)

$GOOGL (-1,01%)

$META (+0,07%)

$AVGO (+2,76%)

$TSM (+0,97%)

$ORCL (-0,05%)

$PLTR (+0,73%)

$ADBE (-0,05%)

$AMD (+0,01%)

$AAPL (-0,1%)

$IBM (-0,18%)

$QCOM (-3,34%)

$MU (+0,71%)

$SNOW (+0,14%)

$CRM (-0,63%)

$MDB (-1,54%)

$AI (-1,16%)

$VOO (+0,04%)

Titoli di tendenza

I migliori creatori della settimana