$NDAQ (-0,14%)

$RTX (+0,1%)

$KO (-0,37%)

$MMM (-1,74%)

$NOC (-0,1%)

$LMTB34

$OR (-0,56%)

$TXN (-1,56%)

$NFLX (-1,61%)

$HEIA (-2,16%)

$SAAB B (+5,28%)

$UCG (-2%)

$BARC (+0,23%)

$GEV (-1,56%)

$TMO (+0,74%)

$T (+2,17%)

$MCO (+2,02%)

$IBM (+8,06%)

$SAP (-3,22%)

$TSLA (-3,07%)

$AAL (+8,03%)

$FCX (+0,06%)

$HON (-2,23%)

$DOW (+1,43%)

$NOKIA (+1,13%)

$TMUS (-1,05%)

$INTC (-7,3%)

$NEM (-4,95%)

$F (+6,36%)

$PG (-0,4%)

$GD (+2,31%)

Discussione su FCX

Messaggi

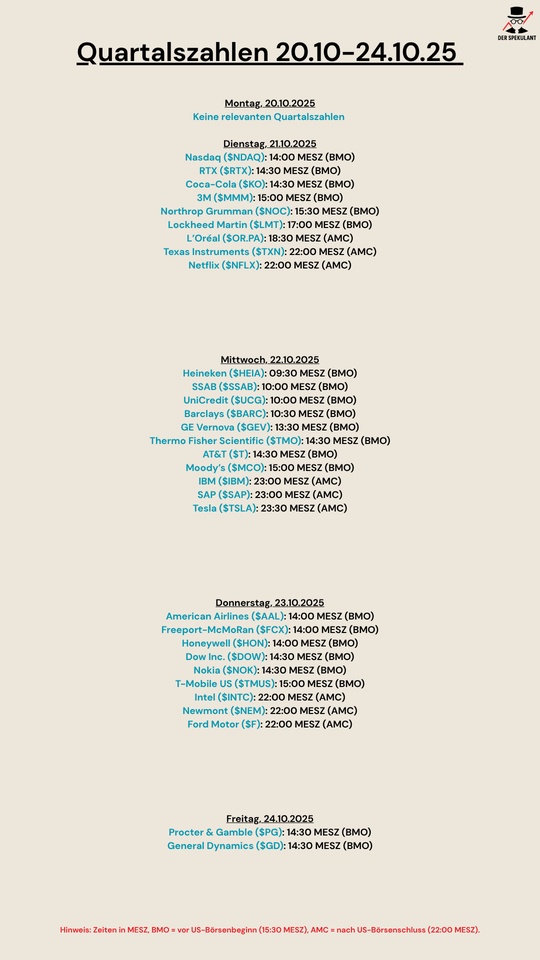

14Quartalsberichte 21.10-24.10.25

Gold price - analysis 🥇🪙

+50% since the beginning of the year

Customs policy

Monetary policy

Gold ETFs

World Gold Council

Gold price forecast

Silver price forecast

Link: https://shorturl.at/ruX9X

$GLD (-0,34%)

$GLD

$ABX (+1,71%)

$NWPG

$FCX (+0,06%)

$GLDA (+0,03%)

$GOLD (+0%)

$GOLD

$IGLN (-0,64%)

#gold

#silber

#edelmetalle

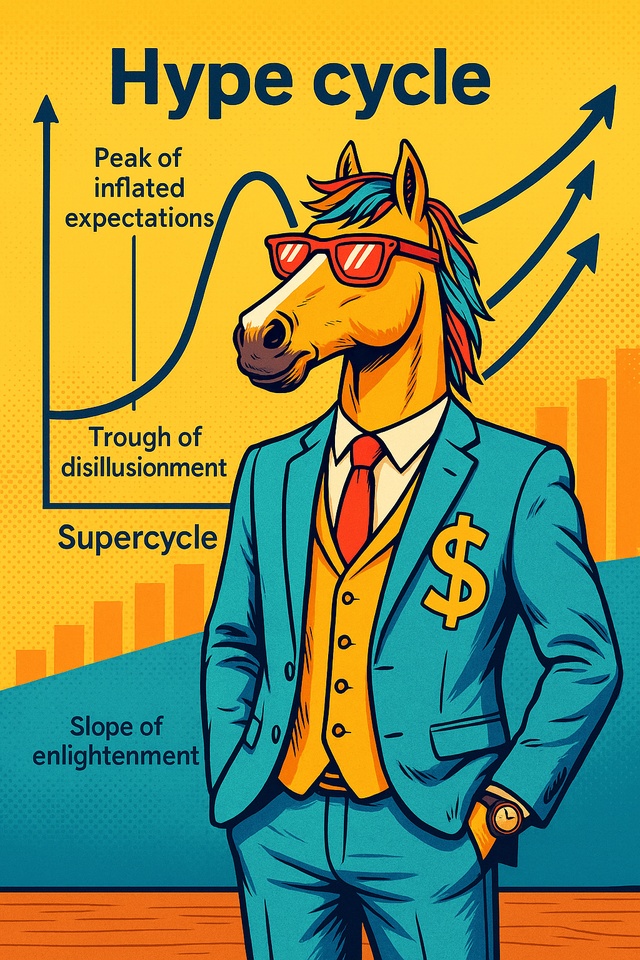

Supercycles: opportunities and risks for investors

From time to time, there are movements on the markets that last longer than a normal upswing. This is known as a super cycle - a phase in which certain commodities or technologies are in demand for many years and their prices rise significantly. This is usually due to fundamental changes in the economy and society.

A well-known example is China in the 2000s. Rapid construction activity and industrialization led to raw materials such as iron ore or coal becoming increasingly expensive over the course of a decade. In this context, there is often talk of the "commodity supercycle", which was driven by the massive demand of Chinese construction and industrial policy. In recent years, this is how I perceive the technology sector in particular: cloud services, automation and artificial intelligence have caused demand for semiconductors to explode.

I currently have the impression that new super cycles could be on the horizon again. In the uranium sector in particular, it is noticeable that many countries are bringing nuclear energy more into play. This is already reflected in my own portfolio. I differentiate between core stocks and leverage stocks. The core stocks are my basic investments: $CCO (+2,26%) (Cameco) and $YCA (+2,16%) (Yellow Cake). Both are established, comparatively stable and form the foundation on which my uranium strategy rests. Leveraged stocks, on the other hand, are more speculative and react much more strongly to market movements. Here I am betting on planned positions in $NXE (+3,67%) (NexGen Energy), $DML (+2,54%) (Denison Mines) and $PDN (-0,42%) (Paladin Energy). I have currently set orders for these stocks, which will only be executed when the risk/reward ratio is right. This allows me to build up the positions in a controlled manner and keep the risk within limits.

Another example of a possible super cycle is the defense industry. Prices there have already risen sharply in recent years, driven by geopolitical tensions and rising defense spending. I personally missed this trend - but this is precisely the lesson: markets move in waves and anyone who misses a cycle should not look back, but forward. Because there are always new opportunities if you recognize the structural changes early on.

In addition to uranium, copper could also play a role again. The major producers in particular $FCX (+0,06%) (Freeport-McMoRan) and $SCCO (+0,2%) (Southern Copper) are particularly interesting if the global grid expansion and electrification actually trigger a new boom in demand.

I am interested: What's your take on this? Is a new super cycle emerging here, especially in the uranium sector - or is this more of a short wave? Which stocks do you think are exciting and what strategies are you pursuing yourself?

Copper?

Any opinions on future copper/iron price movements?

After the strong silver and gold rally, they could/should follow suit. In my opinion they are still undervalued, the Chinese are pumping liquidity into the markets, so that could be promising, right?

I don't know many stocks there, something like Rio Tinto with a focus on dividends interests me less, more the growth stocks.

I did a bit of reading and found that in the copper sector $ASCU (-1,21%) , $ERO (+0,93%) , $HBM (+2,56%) , iron stocks like $ASX (-0,31%) etc. - but I'm not very impressed by the chart.

$FCX (+0,06%) I remember it from earlier times, but it's also bobbing along.

It's not intended to be a long-term position, but rather a short/medium-term trade. At least it would make sense to me if shares in this sector were to pick up soon.

In terms of returns, however, I see $BMNR (+3,32%) almost a greater leverage, assuming that an ETH rally follows, which I expect.

I look forward to your opinions!

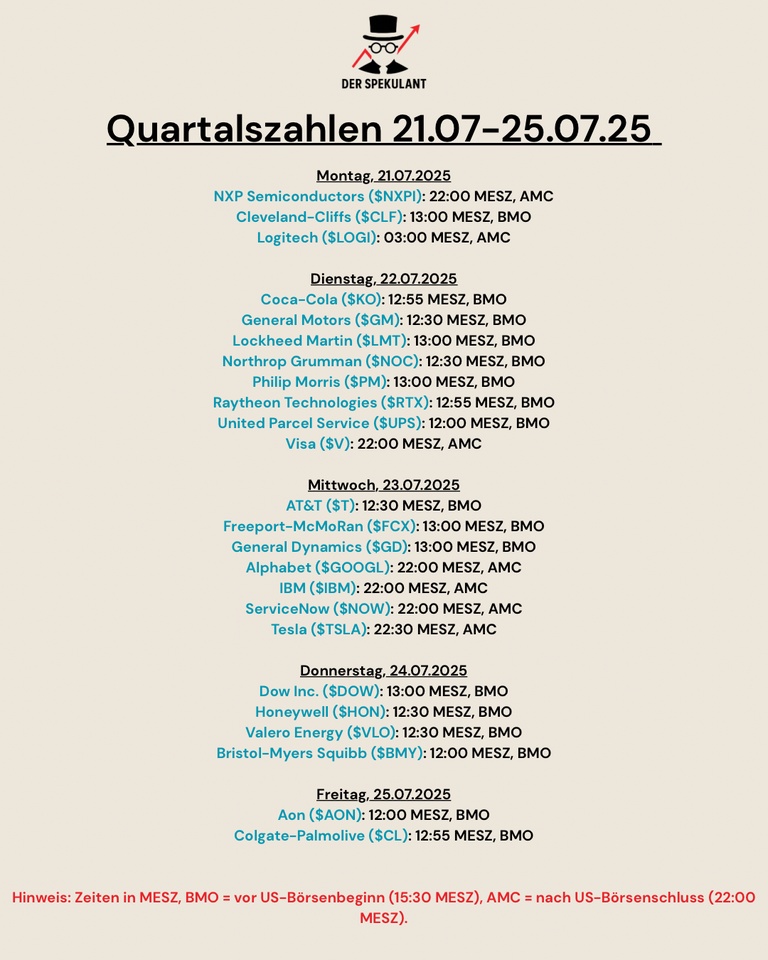

Quarterly figures 21.07-25.07.25

Here is a clear overview of the quarterly figures due next week.

$NXPI (-0,53%)

$CLF (-0,62%)

$LOGN (-0,21%)

$KO (-0,37%)

$GM (+3,46%)

$LMT (-0,76%)

$NOC (-0,1%)

$PM (+0,09%)

$RYTT34

$UPS (+0,01%)

$V (+0,08%)

$T (+2,17%)

$FCX (+0,06%)

$GD (+2,31%)

$GOOGL (+1,8%)

$IBM (+8,06%)

$NOW (-0,5%)

$TSLA (-3,07%)

$DOW (+1,43%)

$HON (-2,23%)

$VLO (-1,25%)

$BMY (-0,97%)

$AON (-1,12%)

$CL (-0,97%)

Trump's new tariffs, rising inflation and a trade war on the horizon?

In the following post, I would like to discuss the new US tariffs and their potential economic consequences. The background and the potential impact on inflation and companies, as well as the winners and losers on the stock market, will be discussed.

Again, of course, the stocks mentioned do not constitute investment advice, but merely serve as examples of possible beneficiaries or losers of tightening trade restrictions. Historical developments are no guarantee of future returns.

__________

In this post:

- Influence on inflation

- New tariffs in force

- Reaction of the countries

- Consequences for the global economy

- Winners & losers

- Investment opportunities

__________

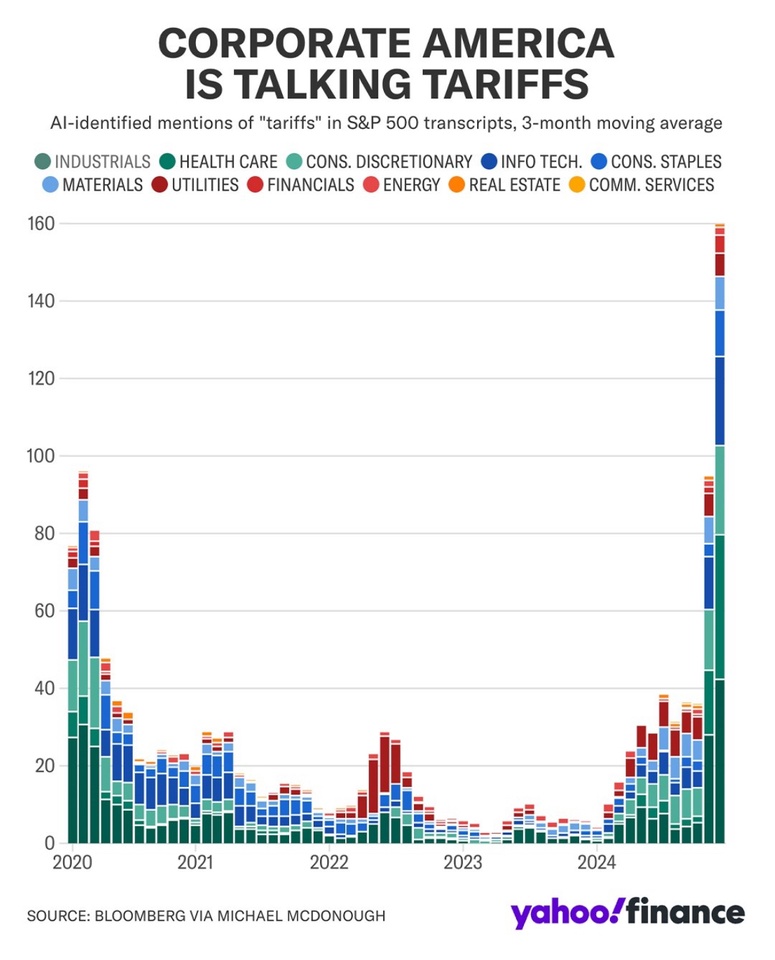

The topic of "tariffs" is currently not only very present in the media, but the term "tariffs" has also been discussed with a strong increase in the past earnings calls of companies in the S&P 500, as the following chart shows [1].

The chart shows that the discussion about tariffs has intensified in recent months and is having an ever greater impact on the outlook in companies' annual reports.

The data is presented as a three-month average and broken down into various sectors, including e.g. industry, healthcare, consumer goods, information technology, etc.

I am curious to see how the stock markets will behave in the coming week. In addition to the current reporting season, the topic of "tariffs" will certainly dominate.

After the tough tariffs announced after Trump took office were not immediately enforced and there was a "slight" sigh of relief, there could now be a new reaction on the markets, as there was on Friday evening. slightly was already slightly noticeable on Friday evening when the markets turned towards the evening.

A looming trade conflict could not only affect individual companies, but also further fuel inflation in the US:

💰 Influence on inflation

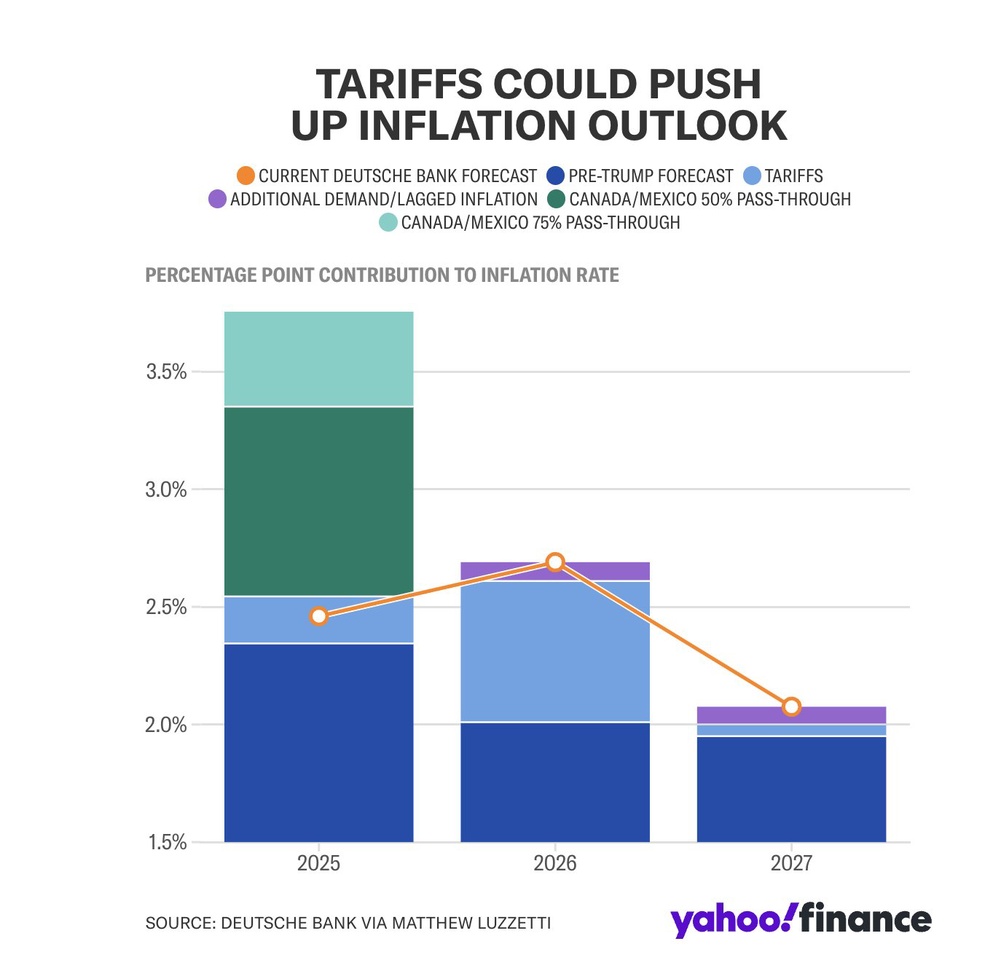

On January 31, Deutsche Bank published a forecast on the potential impact of tariffs on the inflation rate [2]:

The chart compares the current forecast with the forecast before the "Trump" era and takes into account various scenarios for the passing on of tariffs (pass-through) by Canada and Mexico.

Two scenarios are considered: one with a 50% pass-through of tariffs (additional increase shown in dark green) and one with a 75% pass-through (light green). It is clear that the inflation rate could rise sharply again this year and fall again by 2027.

🛃 New tariffs in force & further measures planned

As of today, February 1, 2025, the US government and Donald Trump have imposed new import tariffs on Mexico, Canada and China:

- 25% on imports from Mexico and Canada

- 10% on imports from China

According to the White House spokesperson, these measures are, among other things, a response to the failure of these countries to stop the influx of fentanyl and illegal immigrants into the USA. [3]

But this is just the beginning:

From mid-February, the USA will also impose tariffs on strategic goods [4], including:

- computer chips

- pharmaceuticals

- Steel, aluminum and copper

- Oil and gas imports (but only from February 18 with reduced 10% tariffs so as not to burden US petrol prices immediately).

🚨 Trump relies on escalation - Canada announces retaliation

Yesterday, Canadian government representatives, including Foreign Minister Mélanie Joly, tried to prevent the tariffs in Washington, but to no avail.

Trump made it clear before his departure to Mar-a-Lago [5]:

"We have a 200 billion dollar trade deficit with Canada. Why should we subsidize Canada?"

The EU could also soon be targeted, as Trump hinted:

"Absolutely! The European Union has treated us so terribly!"

🔄 Canada's reaction:

Prime Minister Justin Trudeau announced that Canada will not back down and will respond with "swift and robust countermeasures".

The government is planning a three-stage retaliation strategy [5]:

- 1️⃣ Targeted punitive tariffs on US products coming from Republican states (e.g. orange juice, whiskey, ketchup, peanut butter and motorcycles).

- 2️⃣ Tariffs on steel products and machine parts from the USA.

- 3️⃣ Escalation: Stop exports of oil, gas and electricity to the USA

However, this last step in particular would be a double-edged sword, as Canada is heavily dependent on energy cooperation with the USA.

Economic experts in the US are already warning of the consequences of a trade war [5]:

- The new tariffs could increase the cost of living of an average US household by 800 dollars per year.

- The oil and gas tariffs could increase the price of petrol in the USA by up to 20 cents per liter.

But Trump remains firm:

"Maybe there will be short-term disruption, but in the long run the tariffs will make us very rich and very strong."

🌎 Possible consequences for the global economy

(a) Rising prices in the USA

- Technology & electronicsHigher chip prices are hitting companies such as Apple $AAPL (+1,23%) , Dell $DELL and HP $HPQ (-0,92%) as many of their components come from China.

- Healthcare costs: Pharmaceutical companies such as CVS Health $CVS (+0,54%) and Walgreens Boots Alliance $WBA are facing higher purchasing costs.

- Construction & InfrastructureHigher steel prices are weighing on companies such as Lennar $LEN (+0,48%) D.R. Horton $DHI (-0,54%) and Caterpillar $CAT (+0,5%) .

(b) Retaliation & new trade wars?

- China could impose tariffs on US products, which could affect e.g. Archer Daniels Midland $ADM (+1,34%) Boeing $BA (+1,5%) and Qualcomm $QCOM (-0,49%) would be affected.

- The EU could make US imports more expensive, which would affect Tesla $TSLA (-3,07%) , Ford $F (+6,36%) and General Motors $GM (+3,46%) could be harmed.

(c) Effects on the stock market

- Volatility is increasing as there is uncertainty about the consequences for various industries.

- Particularly affected: Technology and automotive stocks with global supply chains.

🏆 Winners & losers - which companies will benefit, which will suffer?

Possible beneficiaries of the tariffs

US manufacturers of steel, aluminum & copper

- Nucor $NUE (-0,02%) , U.S. Steel $X and Freeport-McMoRan $FCX (+0,06%) could benefit as foreign competition becomes more expensive as a result of the tariffs.

Domestic pharmaceutical and biotech companies

- Pfizer $PFE (+0,19%) Moderna $MRNA (+1,86%) and Eli Lilly $LLY (+0,54%) could gain market share.

Energy companies with US production

- ExxonMobil $XOM (-0,4%) , Chevron$CVX (-0,65%) and Expand Energy $CHK (-0,49%) could benefit from rising prices for US oil and gas.

Chip manufacturers with US production

- Intel $INTC (-7,3%) and Texas Instruments$TXN (-1,56%) have US factories and could gain market share.

😥 Companies that could suffer from the tariffs

Chip manufacturers with global supply chains

- Apple $AAPL (+1,23%) NVIDIA $NVDA (+2,31%) , AMD $AMD (+6,32%) are dependent on Asian imports and could see higher production costs.

Car manufacturers with global suppliers

- Tesla $TSLA (-3,07%) , Ford $F (+6,36%) , General Motors $GM (+3,46%) are under pressure because components from Mexico and Canada could become more expensive.

Companies with strong export business

- Boeing $BA (+1,5%) and Caterpillar $CAT (+0,5%) suffer from possible retaliatory tariffs.

US retailers with a high import share

- Walmart $WMT (-0,64%) , Target $TGT (-0,47%) and Nike $NKE (-0,74%) could have to pass on rising prices to customers.

🧠 Possible investment strategies

Favor defensive sectors:

- Utilities (e.g. NextEra Energy $NEE (+0,96%) Duke Energy $DUK (-0,31%) ) and healthcare companies (e.g. UnitedHealth $UNH (+1,21%) , Johnson & Johnson $JNJ (-0,96%) ) remain more stable.

Exploit long-term opportunities in "reshoring":

- Intel $INTC (-7,3%) , Eli Lilly $LLY (+0,54%) , Nucor $NUE (-0,02%) could benefit in the long term.

Conclusion: Will the trade conflict escalate further?

With the new tariffs, Trump is taking a confrontational stance and Canada, Mexico and China are preparing for retaliatory measures. If further tariffs on European goods follow, the situation could worsen.

❓Which stocks do you think could be most affected? Which beneficiaries do you see?

Thanks for reading! 🤝

__________

Sources:

[4]

[5] https://www.tagesschau.de/ausland/amerika/usa-trump-strafzoelle-100.html

Detailed gold price analysis

Performance comparison

Trigger for the price increase

Gold purchases by central banks

Expectations of interest rate cuts

Gold demand in China and India

Gold ETFs

Link: shorturl.at/HHgOg

An initial position established. It is predicted that demand for copper will exceed supply as a result of the energy transition.

Is anyone else here invested in mining companies - who have you chosen?

$BHP (-0,99%)

$ABHPG

$RIO (-0,48%)

$GLEN (-0,75%)

$FCX (+0,06%)

$AAUKF

Tip of the day/idea

Tomorrow come here new figures, I am optimistic here!

Is not entirely without risk, if necessary hedge with a stop.

General

Alcoa Corp. is a leading international producer of bauxite and alumina and a producer of processed aluminum in the form of various cast and rolled products. The company is active in all major segments of the aluminum value chain, including mining, smelting, processing and recycling. Alcoa Corp. is an international leader in bauxite mining, operates alumina refineries, aluminum smelters and rolling mills worldwide, and is active in the energy sector.

Why

+Aluminum continues to be in high demand ( Renewable energy theme, China asking more for Corona).

+Smelter shutdowns in China's due to poor power supply.

+Energy costs for production have dropped the last months

+Growth in general industry USA/Europe and especially China is still intact

+Upward trend still intact

+Dividend 0.99 percent

+Expectations are low to negative

Disadvantages

-Low growth

-copper and coal is more in focus with investors (Here I also build out, as among others Freeport $FCX (+0,06%) and Rio Tinto $RIO (-0,48%) )

-Costs are not so quickly brought under control

My Wikifolio Depot

https://www.wikifolio.com/de/de/w/wf66zzzzzz

Source

Titoli di tendenza

I migliori creatori della settimana