Stock Summary Sunday #1

I think this is a nice platform to discuss some of my favorite stocks. That's why I like to start writing and highlight stocks I've been following. This doesn't necessarily mean I have them in my portfolio. But I would like to see other opinions to widen my knowledge and maybe my own view on them.

Beginning with

$BFIT (+0,44%)

Basic-Fit is an operator of fitness centers based in the Netherlands. The company operates more than 1.500 fitness clubs in the Netherlands, Belgium, Luxembourg, France, Germany and Spain. They currently have 4,05 million members who pay a monthly amount to train at their nearby fitness center with a total expected revenue of €1,24 billion in 2024. Basic-Fit is aiming to have around 3.000-3.500 fitness clubs in 2030. Meaning they would double their revenue in 5 years. Their main focus growth market would be France, Spain and Germany.

Basic-Fit has a market cap of €1,32 Billion. Their expected EPS for 2024 are €0,63 which makes a future P/E of 31. The expected EPS for 2025 are €1,31 which makes the future P/E a bit lower to 15 points.

Because of the huge ambitions to upscale their fitness clubs to 3.000-3.500 clubs in 2030 from 420 clubs in 2016, they have a high net debt of around €800 million excluding lease obligations. They are expecting to make profit in 2024 which means the debt will no longer rise enormously as the previous years.

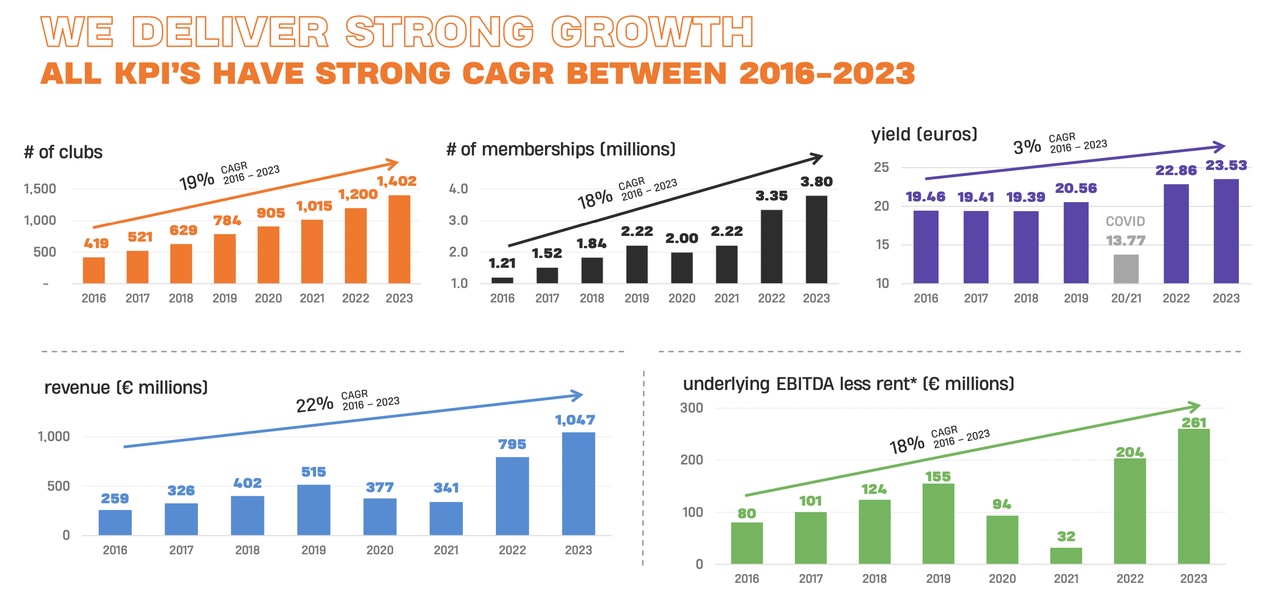

From now on it was worth it and they kept to their promises. Basic-Fit showed exponential growth in all their KPI's. See underneath:

Zooming in on their 2030 goals:

When they succeed to build 3.000-3.500 clubs, with an average of 3.200 members per club, they will have 9,6 to 11,2 million members in 2030. Each member will have a yield of €28,40 per month with this continuous yield growth. Meaning each member will bring a revenue of €340,80 per year making a total revenue of €3,27-€3,81 Billion in 2030. Because Basic-Fit doesn't have a profit margin yet, I expect them to have a margin similar to their competitors of around 10-12%. Assuming the 10% profit margin (lower range) they will have a net profit of €327-€381 million.

My question to you

Do you think Basic-Fit will continue to succeed in their promises? And do you think it is fair priced against their projected earnings in 2030? Let me know what you think of this stock!