Hello everyone,

Since I haven't shared an analysis with the community for a while, today I'm going to talk about a company that, in my opinion, divides opinion.

I hope that this article will help you understand why I see potential in this company, why the $META (+1,15 %) the healthcare industry is developing and what vision the company has for the year 2030. Let's Go ...

This article has taken a lot of time and I would therefore ask you to leave me some criticism and feedback

The analysis is divided into

- Company presentation

- Business model briefly explained

- Competitive advantage + strategic acquisitions

- Additional long-term drivers

- Risks from Amazon, Teladoc etc

- Quarterly figures Q3 25

- My personal assessment

Company presentation

Hims & Hers was founded in 2017 by Andrew Dudum. The company was created with the aim of simplifying access to health services and lowering inhibitions - especially in areas that many people are reluctant to talk about, such as hair loss, erectile dysfunction, acne or mental health.

The basic idea of Hims & Hers was to consistently digitize medical care and bring it directly to the individual patient. Patients answer medical questionnaires via an online platform, which are reviewed by licensed doctors. On this basis, prescriptions are issued - where appropriate - and the relevant medication is conveniently delivered to the patient's home. This approach reduces both the time required by patients and their reluctance to seek medical care.

The company originally launched with the "Hims" brand and a clear focus on men's health. With "Hers", the concept was quickly expanded to include women, significantly increasing the target group. In the years that followed, Hims & Hers continued to develop - moving away from individual products towards a holistic telemedicine platform with recurring subscription models and a constantly growing range of services.

In 2021, Hims & Hers went public via a SPAC. Although SPAC listings are often not too good for investors, the company has since been able to show that demand, scalability and vision are there.

With increasing user numbers, a broader product range and the trend towards digital healthcare, Hims & Hers is increasingly positioning itself as a relevant player in a structurally growing market. Ageing and the lifestyle of paying more attention to health are giving Hims & Hers an additional boost.

Business model - briefly explained

Hims & Hers operates as a direct-to-consumer healthcare platform that bundles medical services, technology and logistics in one model. The focus is not on individual visits to the doctor, but on a digital process that extends from diagnosis to regular care.

Specifically, interaction with the user begins via the online platform or app. There, medical questionnaires are filled out that are tailored to the respective problems.

This data is then reviewed by licensed doctors who work with Hims & Hers. On this basis, prescriptions are issued or treatment plans defined if medically appropriate. Subsequent processing, including billing, medication production (partly via the company's own infrastructure) and dispatch, is handled centrally by the company. Hims & Hers is only aimed at self-payers and is therefore not dependent on insurers etc.

A key component of the business model is the subscription system. Many treatments are designed for long-term use, allowing Hims & Hers to generate recurring revenue while ensuring continuous patient care. This model shifts the focus away from one-off transactions towards long-term customer relationships.

Hims & Hers is currently a fast-growing company and is therefore investing heavily in marketing. Although this leads to falling profits in the short term, in the long term it is building a strong brand that is increasingly establishing itself alongside the traditional, expensive healthcare system in the USA.

Overall, Hims & Hers is positioning itself less as a normal healthcare provider and more as a platform-based online healthcare company that offers medical care in a subscription model and is constantly expanding into new growth areas.

The competitive advantage + strategic acquisitions

A central, often unnoticed competitive advantage of Hims & Hers lies in the continuously growing wealth of data, which is fed by millions of direct customer interactions. In the last quarter, this already amounted to over 2.4 million!

Unlike traditional healthcare providers, Hims & Hers is not just at the end of the value chain, but accompanies the entire treatment process - from the initial inquiry to diagnosis, treatment, progression and reordering. In order to expand this treasure trove of data, the company is constantly making acquisitions:

Acquisition of MedMatch

With the acquisition of MedMatch (a technology-driven platform for the intelligent allocation of patients, treatments and medical decision-making paths), this data-driven approach was strengthened in a targeted manner.

The integration of such technologies allows Hims & Hers to increasingly personalize medical questionnaires, treatment recommendations and product offerings and make them more efficient.

Artificial intelligence also comes into play, for example...

The resulting advantage leads to

- Better treatment quality: huge databases allow therapy successes, drop-out rates and side effects to be systematically evaluated and treatment protocols to be continuously optimized.

- Higher conversion & retention: More precise allocation of patients to suitable therapies increases the probability of success - and therefore long-term customer retention.

- Economies of scale in product design: New products and indications can be developed, tested and scaled more quickly based on data.

- Decreasing marketing dependency: The better the understanding of your own users, the more efficient customer acquisition and cross-selling becomes.

- Preventive measures: By knowing a lot about the health of your customers, preventative measures can be taken before a problem arises!

This wealth of data increasingly acts like a moat. Although new competitors can offer similar products, they do not have comparable historical user data, treatment results and behavioral patterns in this depth and breadth.

At the same time, the lead increases with each additional subscriber - a classic network effect within a regulated market.

Acquisition of Trybe Labs

Hims & Hers expanded its business model in 2025 with the acquisition of Trybe Labs, a provider of at-home laboratory tests, thereby taking a further step towards vertical integration. Among other things, this acquisition enables the company to integrate blood tests and biomarker analyses directly into its own platform and manage medical decisions on a more data-based basis.

Strategically, this step is particularly relevant because it allows Hims & Hers to keep sensitive healthcare data in-house, reduce dependencies on third-party providers and build up a continuously growing database.

And let's be honest, if we were in such a network, where a lot is already known about our health, where blood tests have already been given and we have already been successfully treated, how likely is it that we would suddenly cancel our subscription and transfer all our data to a new provider?

Or that we would suddenly start ordering from Amazon Pharmacy at the drop of a hat? -> this is where I see Hims & Hers' biggest moat... the huge amounts of data that the company owns and uses remind me a little of $META (+1,15 %) or $GOOGL (-1,46 %) .

So you could say Hims & Hers is becoming the meta of the healthcare industry....

Additional long-term drivers for Hims & Hers

Hims & Hers' growth is supported by several structural factors that reinforce each other and give the business model a long-term tailwind.

One key driver is the change in society's approach to health. Topics such as mental health, hair loss and sexual health are increasingly losing their deterrent effect. At the same time, there is a growing willingness to access medical services digitally. Hims & Hers is positioning itself precisely at this intersection of "de-tabooing" and digitalization.

Added to this is the trend towards telemedicine, which has become firmly established since the coronavirus pandemic. Patients now expect simple, location-independent and fast solutions. The Hims & Hers model consistently meets these expectations and benefits from the fact that digital first contacts are becoming increasingly accepted in the healthcare sector.

One factor that is perhaps not so clear to us here in Germany is the expensive and inefficient healthcare structure in the USA. For many people, visits to the doctor, prescriptions and follow-up treatments are associated with high costs, long waiting times and non-transparent billing. This is where Hims & Hers comes in, offering standardized treatments at clear, predictable prices. For many users, the model represents a cheaper and more convenient alternative to the traditional healthcare system.

Another growth driver is the subscription model. Many treatments are long-term, which generates recurring revenue. As the user base grows, the predictability and scalability of the business increases, while marketing and fixed costs are spread across more subscribers.

The continuous expansion of the product portfolio also plays a key role. Hims & Hers is increasingly penetrating indications that are medically more complex and economically more attractive - such as mental health or weight management, GLP1, etc. These areas are characterized by higher customer loyalty. These areas are characterized by higher customer loyalty and longer treatment duration.

Last but not least, the strong brand acts as a growth driver. Through clear communication, modern design and high visibility, the company is able to build trust and differentiate itself from traditional healthcare providers. As brand awareness increases, so does the proportion of organic new customers, which further improves the efficiency of growth.

Overall, Hims & Hers benefits from a structural environment in which rising healthcare costs, digital acceptance and changing consumer habits come together - an interplay that gives the company a long-term tailwind.

Quarterly figures Q3 25

As the article is already relatively long, I will not comment on every single figure here...

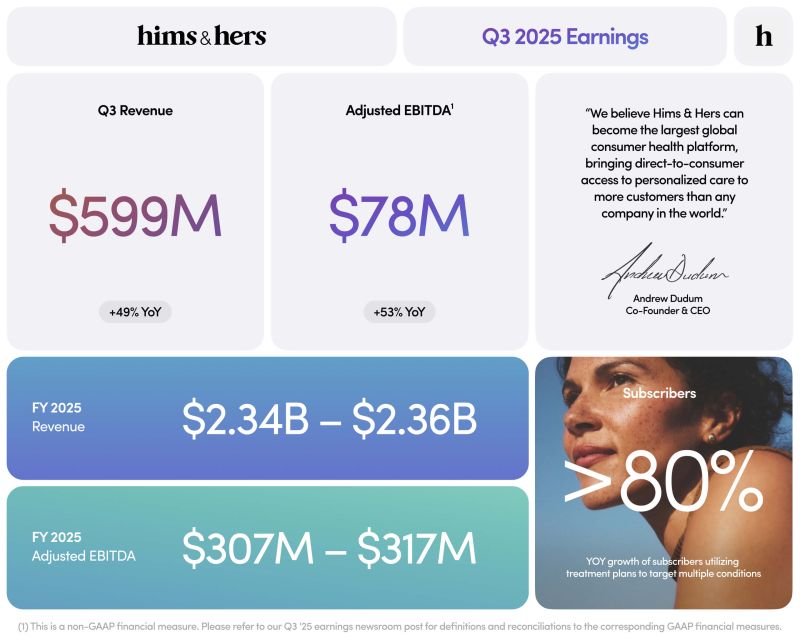

Turnover: approx. 599 million $,

+49 % compared to Q3 2024

Subscribers: 2.47m, +21% YoY

Adjusted EBITDA: ~$78.4m, +53% YoY (!)

Net result: ~$15.8m, slightly weaker due to one-off effects and marketing expenses

Free cash flow & operating cash flow: stable positive (~$148.7m operating)

Gross margin: slightly lower due to investments in growth and infrastructure. Investments in infrastructure, marketing and technology may have a negative impact on margins in the short term, but will ensure long-term growth.

Guidance 2025: revenue $ 2.335-2.355 bn -> 58-60% more than 2024

Adjusted EBITDA 307-317 million $

-> 51-57% more than 2024

-> Rule of 40 in the last quarter at approx. 72!

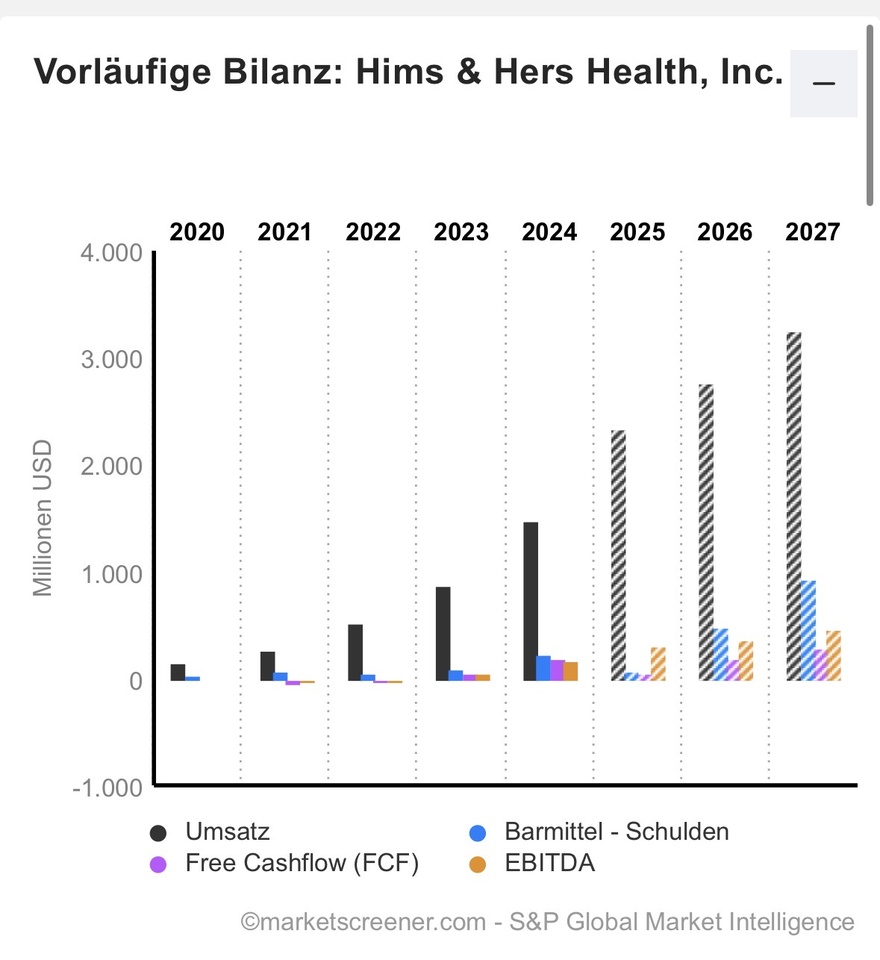

And growth is expected to continue in the coming years:

Profits are expected to fall slightly at first because investments in new production facilities and marketing expenditure will increase for the time being in order to establish the brand in the long term and win new customers. This is typical for a fast-growing company and I am convinced that these short-term profit fluctuations will be reflected in long-term growth!

Management goals 2030

And here we come to a point that I personally really like and that I miss in Western politics, for example 😬. You have long-term goals and a clear roadmap. I won't go into every point, but I'll try to give you a brief overview here:

Hims & Hers is pursuing a clear and long-term vision until 2030; the company is to become the leading digital healthcare platform in North America and Europe, with a broadly diversified product portfolio, stable profitability and a scalable, international presence.

Financial target for 2030:

- Revenue: at least $6.5 billion by 2030 - equivalent to growth of over 20% per year from 2025 to 2030!

- Adjusted EBITDA: at least USD 1.3 billion, which would mean a significant improvement in margins.

- The aim is to achieve a Rule of 40 score of >50% on a sustained basis in order to optimally combine growth and profitability.

Strategic goals:

Scaling the user base: 10-15 million active subscribers, organic growth through brand strength.

Expansion of the product portfolio: sexual and hair health plus mental health, weight management, hormone health, longevity and preventive medicine.

International expansion: Europe and Canada, >30 % share of sales outside the USA.

Data-driven platform: Use of own data treasure trove for personalized treatments, AI-supported diagnoses and optimized patient engagement.

Partnerships: Collaborations with global pharmaceutical and healthcare players, e.g. for weight management products or therapeutic programs. E g possibly with Novo Nordisk, @Aktienfox I wrote an article about this a few days ago...

Personal assessment of the risks - Amazon, Teladoc etc.

Competition from big tech and telehealth platforms

The most recent point for me is Amazon's pharma division: the market for digital health offerings is highly competitive, and big players such as Amazon Clinic/Pharmacy, Teladoc or Ro have enormous resources, customer reach and established infrastructure.

Hims & Hers could well come under pressure here, particularly in terms of price structure or customer churn.

At the same time, I believe the company is well positioned: The integrated user experience - from diagnosis to prescription to delivery - and the personal service create trust and loyalty. Once you are in the network, you won't leave it so quickly to switch to an online pharmacy. This combination is difficult to copy and gives Hims & Hers the opportunity to assert itself as a trustworthy, user-oriented alternative to the large platforms. In addition, the tough competition is not yet reflected in Hims & Hers' user numbers! The number of users and the amount that individual users pay per month is increasing from year to year. Of course, I would not ignore this in future annual reports, but would pay particular attention to growth and the number of customers...

Regulation and compliance

This is actually also an advantage for Hims & Hers. Telemedicine and prescription products are subject to strict regulations, both in the US and internationally. New regulatory requirements could delay the introduction of new products or make expansion more difficult. Hims & Hers addressed this area early on by investing in compliance structures, data protection measures and a licensed medical network. This creates a buffer against competitors who first have to fight their way through complex regulatory hurdles. The long-term experience in dealing with regulations and licensing rules is an advantage that creates a certain barrier to entry for competitors.

My personal assessment

I am convinced that Hims & Hers occupies an important position in a structurally growing healthcare market and can benefit more than average from long-term trends such as digitalization, prevention and personalized medicine.

Short-term fluctuations in profits or margins therefore do not change the attractiveness of the underlying business model that much for me and do not prevent me from remaining convinced of the overall concept.

I see a particularly strong competitive advantage in the extensive patient data, which, in combination with continuous and scalable marketing activities, helps to build a strong, trust-based brand in the digital health sector.

In addition, I find the current valuation as a result of the recent price correction attractive, especially for a company that continues to show quite high growth rates and is increasingly scaling operationally.

Valuation ratios KUV, because earnings are still relatively volatile due to rising capital expenditure:

- Current P/E ratio (TTM): 3.45 (based on rolling sales of the last twelve months).

- Comparison with the previous year: At the end of 2025, the KUV was significantly higher at approx. 5,97. The decline is the result of strong sales growth coupled with moderate share price performance.

- Forecast 2026: Analyst estimates for the full year 2026 assume a KUV (forward) of approx. 2,33 if the sales targets are achieved.

The share price was also driven by a short squeeze at times, but this is not particularly relevant for me as a long-term investment...

Insider selling:

With regard to the repeatedly reported insider selling, it should be noted that insiders continue to hold around 10% of company shares - a high figure by market standards. Against this backdrop, I believe it is likely that sales will continue to take place regularly in the future without this being interpreted as an extraordinary warning signal. On the contrary: such a high proportion of insiders is rather unusual and indicates that the company will continue to be heavily invested in.

Overall, I therefore see the potential for Hims & Hers to develop into a multibagger over the next 5 to 10 years and will therefore increase my holdings accordingly.

I hope you have enjoyed my analysis of Hims and have at least understood the main aspects I have listed. I myself am invested in the company, not for short-term gains, but rather because I see long-term potential here. Why don't you write and tell me which of you are invested and what I may have overlooked?

And feel free to give me feedback, it took me a relatively long time to do the research and I would therefore like to know what I can do better!

LG small investor 😊👋

Sources

https://www.hims.com/about/the-company

https://goldesel.de/artikel/kurzanalyse-hims-hers

https://de.finance.yahoo.com/nachrichten/hims-hers-wächst-brutal-detail-205424109.html

https://www.stock-world.de/hims-hers-aktie-wachstum-trifft-skepsis/

From minute 48:

https://de.marketscreener.com/kurs/aktie/HIMS-HERS-HEALTH-INC-109987976/finanzen/

https://de.finance.yahoo.com/quote/HIMS/key-statistics/

https://teq.capital/de/research/investment-hypothese-hims-hers/

https://www.stock-world.de/hims-hers-aktie-wachstum-trifft-skepsis/

https://www.onvista.de/aktien/kennzahlen/HIMS-HERS-HEALTH-Aktie-US4330001060

https://www.boerse-express.com/news/articles/hims-hers-aktie-bange-fragen-841348

https://www.kapitalmarktexperten.de/hims-hers-aktie-wachstum-broeckelt/

https://stefansboersenblog.com/2025/09/09/hims-and-hers/

$HIMS (-3,47 %) are also in the depot $IREN (+6,84 %)

$RKLB (-0,33 %)

$SOFI (-1,71 %)

$PNG (+3,74 %)

@Tenbagger2024

@Multibagger

@BamBamInvest

@SAUgut777

@Aktienfox

@All-in-or-nothing

@Shiya

@Hotte1909

@Simpson

@Wiktor_06

@TradingHase

@TomTurboInvest

@Semos25

@Iwamoto

@HoldTheMike

@ImmoHai

@EpsEra

@Creutzfeldt_Jakob