Here is the analysis that was asked for (e.g. @Dividendenopi @jkb92 @Hotte1909

@TomTurboInvest ) While the masses wait for news noise or copy baskets, I filter for AAA quality.

My system is simple, but merciless:

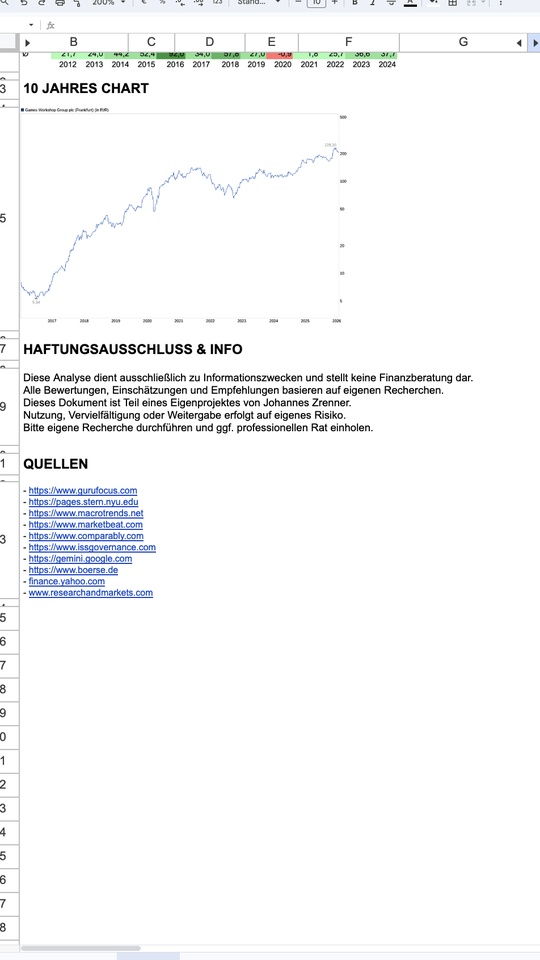

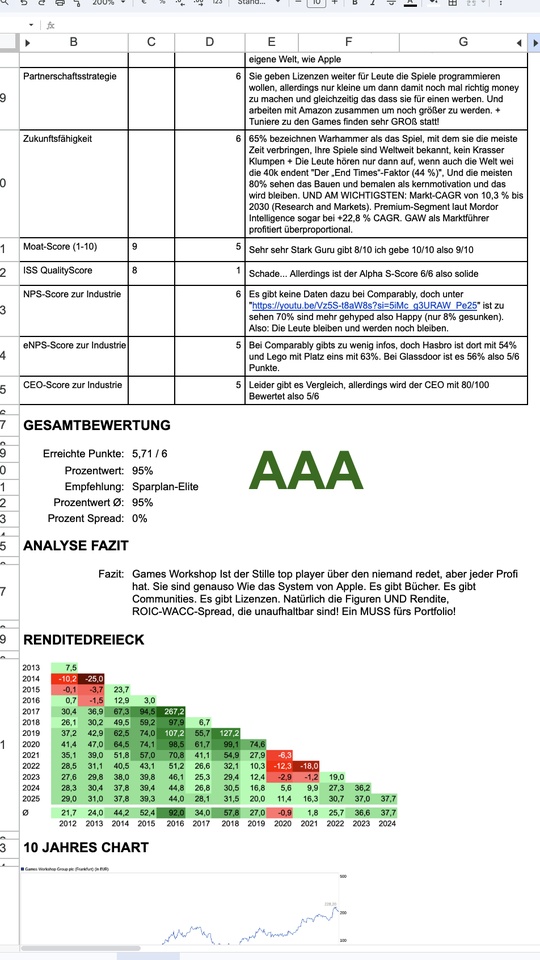

- ROIC-WACC Spread: The only metric that shows true value creation.

- Owner Earnings Growth according to SBC: Because cash flow is the only truth.

- Systematic valuation: If you can't calculate intrinsic value, you're just gambling.

If you want to understand why $GAW (-0,63 %) or Mastercard are not "lucky grabs", but mathematical necessities, can take a look at the metrics in the sheet. The rest can continue to hope for the next "multibagger hype".

I'm happy to discuss the figures - but please do so on the basis of cash flow and return on capital, not on the basis of hope.🫡