Looks like I did shoot straight once again🤑

Discussion sur KGH

Postes

6Reconstruction of Ukraine: geopolitics and opportunities for investors

Hey guys,

I wanted to address a topic that is certainly of interest to us as investors: the reconstruction of Ukraine and which stocks could benefit from it. The geopolitical situation is constantly changing and there are many uncertainties. What happens if Donbass goes permanently to Russia? Will this slow down the reconstruction of Ukraine or could it still create opportunities for companies in the region?

America is getting involved mit🇺🇸

The USA is playing a central role in the reconstruction of Ukraine. A lot of money is already flowing into the region from the US, particularly for infrastructure, energy and technology. But it's not just about government aid - many US companies also have an interest in investing in the region. Considering how heavily the US is involved in supporting countries such as Poland and Ukraine, there are a number of companies here that could definitely benefit.

What happens if the Donbass goes to Russia?⚔️

If the Donbass is finally controlled by Russia, the geopolitical situation will of course worsen. This could slow down reconstruction in Ukraine, as this part of the country was an important industrial location. Nevertheless, billions of euros will flow into the western and central parts of Ukraine, and Poland could become an even more important partner in reconstruction.

Which stocks could benefit?📈🚀

If you look at who is active in the region, there are some exciting candidates that could benefit from the reconstruction. Here are a few companies that I think are well positioned:

♦️ Strabag (Austria): $STR (+1,13 %) A construction company that is active in many infrastructure projects in Europe. They could play an important role in the reconstruction of roads, bridges and buildings - also in Poland and Ukraine.

♦️ PGE (Polska Grupa Energetyczna): $PGE (-0,77 %) Poland's largest energy company. PGE could benefit from the expansion of the energy supply in Ukraine.

♦️ Budimex: $BDX (+3,83 %) Another Polish construction company that is doing well in infrastructure projects. When Ukraine awards major construction contracts, Budimex could be one of the first ports of call.

♦️ KGHM: $KGH (+5,58 %) This company is active in copper production. And we know how important copper is for reconstruction - whether for power lines, machinery or other infrastructure.

♦️ Asseco Poland:

$ACP (-0,41 %) An IT company that is active in many areas. They could play a key role in modernizing the digital infrastructure in Ukraine.

♦️ General Electric (USA) $GEC GE operates globally and Ukraine needs a lot of energy infrastructure. GE could benefit by providing solutions in the field of energy supply.

♦️ Siemens: $SIE (+2 %)

$ENR (+2,59 %) The German company could play a crucial role in reconstruction through its expertise in energy and infrastructure.

Conclusion❔☝🏽

The geopolitical situation will keep us busy for some time, but one thing is clear: the reconstruction of Ukraine will require a lot of resources and investment, and many companies from Poland, the EU and the US are well positioned to benefit. Even if the Donbass aligns with Russia, the need for construction projects, energy and technology in western Ukraine and Poland will continue.

What do you think? Which companies do you think are interesting? Do you have any stocks on your radar that have a good chance in this context? Let us hear your opinions and ideas!

Then rather the companies that benefit from the 500B of the German infrastructure package

A bit late here comes my monthly update or better said the review for February.

You can find the blog post here:

But as always, I'll post the full text for you right here at getquin:

The recovery continued at least at the beginning of February and held until towards the end of February. Last week, interest rate worries came up again, because of inflation concerns, especially from the US. This put pressure on stock prices, because rising inflation can lead to interest rates being raised by central banks. This in turn drains liquidity from the market, as debt becomes more expensive with higher interest rates and market participants tend to focus on reducing debt rather than taking on new debt. Since much of the economy and money supply is based on debt, when interest rates rise because of deleveraging, liquidity decreases and thus there is less demand for stocks. This also explains why, at least in the short term, stock prices usually fall when interest rates rise - and vice versa.

In addition, central banks have started to sell bonds again, thus withdrawing additional liquidity from the market - this in contrast to quantitative easing, when the European Central Bank (ECB) and the U.S. Federal Reserve (FED) in particular bought up bonds and flooded the market with cheap money. In contrast, the Japanese central bank is buying more bonds than ever before, and to an extent that offsets or even overcompensates for the ECB and FED sales. The reason for this is that the Japanese central bank is focusing on controlling the yield curve and has thus been pursuing an unconventional monetary policy for years. Only time will tell which effect will have a stronger impact on the market.

Value & Momentum worldwide

After the strong increase between September 2022 and January 2023, the return in the Value and Momentum portfolio has decreased again somewhat. Today we see an average return of 15.9% and a return since start of return since start of 56.7%.

It is interesting to note that during the recovery at the beginning of 2023, the stocks that did very well in 2022 did particularly well. Defensive stocks from the commodity sector took a break. Nevertheless, there are opinions in the market that expect commodity prices, such as gas, to double towards the end of the year. Goldman Sachs only recently ventured a forecast in which they see the price of gas once again exceeding USD 100 per megawatt hour - as opposed to around USD 50 today. The reason for this is likely to be a structural deficit in the supply of gas and a lack of infrastructure. In recent years, natural gas has been so cheap that there has been little investment in LNG terminals and pipelines. This is now leading to the possibility of supply bottlenecks. However, the mild winter meant that there was never an actual bottleneck in natural gas supplies to Europe, even though deliveries from Russia were drastically cut back. It is impossible to predict whether the forecasts regarding commodity prices will actually materialize.

As always, it remains exciting. One effect I see is that there are again more companies to choose from that are cheaply valued and also have high quality and momentum. I like that a lot because the value and momentum portfolio has become very commodity-heavy in 2022 after all. The commodity sector has dominated 2022. For my taste, I would prefer a slightly more balanced sector distribution in the portfolio. Nevertheless, one should not be guided only by gut feeling and emotions. That's why I use an investment strategy in asset management that is scientifically broadly based and can demonstrably lead to an excess return.

Rebalancing Value and Momentum

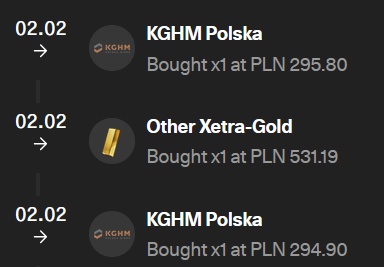

In February, two companies were added to the portfolio: $KGH (+5,58 %) KGHM Polska Miedź is a large producer of copper and silver. An exotic company that has made its way into the portfolio is the $BVH Bluegreen Vacations Holding Corporation. The company markets and sells rights to vacation homes and manages them. I was a bit surprised myself to find such a company among the top 10% - worldwide and this only with exceptionally strong momentum and good quality. Now I am curious if and how much the company can contribute to the value and momentum portfolio.

Sold this month was $SDF (+0,44 %) K + S AG, which has lost almost all of its momentum. Initially it looked very good: The stock rose from around EUR 23 in February 2022 to over EUR 35 in April 2022, meaning that within about two months, it had gained over 52%. If I had a crystal ball, I would of course have sold then. Today, we are back in the range of the entry prices. Only thanks to the dividend, the yield is a meager 0.44%. Today there are companies which are more promising. Since only one share made it into the portfolio in February 2022, only one share was sold in February 2023.

Titres populaires

Meilleurs créateurs cette semaine