Hello dear Gequin Community,

I am currently working on restructuring my portfolio. Historically, I currently have a few funds and a number of individual shares.

I would like to switch the funds to ETFs and continue to save in them.

Classically, I would now select the following ETFs:

$VWCE (+0,46 %) / $VHYL (+0,45 %) and $VFEG (+0,23 %)

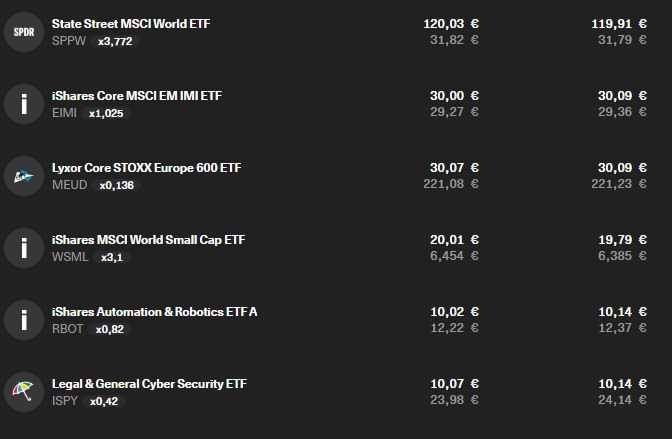

Now my little thought experiment: Why should I limit myself to three ETFS when I could spread the whole thing much more widely? I have also thought about something like this (with smaller sums, of course):

Of course I have a few duplications here, but I am much more differentiated.

Does this approach make sense in your eyes or is it a modest idea?