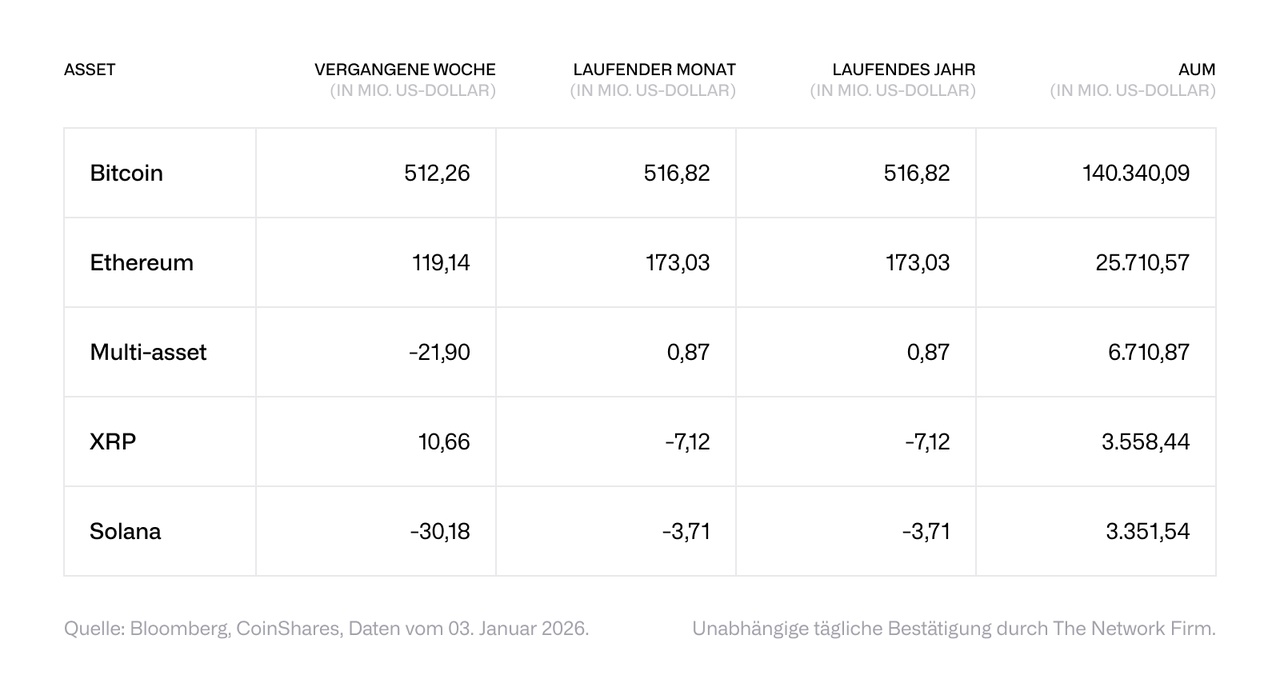

#xrp and #solana recorded the highest inflows last week, amounting to USD 70.2 million and USD 7.5 million respectively. Since the ETFs were launched in the US in mid-October, they have recorded inflows totaling USD 1.07 billion and USD 1.34 billion respectively, clearly bucking the negative sentiment for other asset classes. In contrast, Bitcoin and Ethereum saw outflows of USD 443 million and USD 59.5 million respectively last week. Since the launch of the XRP and Solana ETFs, Bitcoin and Ethereum have seen outflows totaling USD 2.8 billion and USD 1.6 billion respectively.

CoinShares Physical Staked Solana

Price

Discussion sur SLNC

Postes

8From fringe phenomenon to foundation: crypto after 2025

2025 has finally shown that crypto is no longer a parallel universe. Digital assets have grown out of the experimental phase and arrived at the core of the global financial markets. Bitcoin has grown up with ETFs, options markets and the first steps towards corporate adoption. Stablecoins have quietly developed into a global settlement infrastructure, tokenization has advanced from pilot projects to real volumes - especially in private credit and US government bonds. At the same time, decentralized applications are generating real cash flows for the first time, and venture capital is returning, more disciplined and fundamental than in previous cycles. In short, 2025 was the year crypto stopped justifying itself.

2026: Ethereum and Solana in focus

2026 is not about the next hype narrative, but about integration. Macro factors such as liquidity, real yields and monetary policy will continue to set the pace, while major shifts take place in the background: an increasingly multipolar monetary system, growing geopolitical relevance of non-state stores of value and more regulatory clarity. #ethereum is growing into its role as an institutional infrastructure, #solana dominates performance- and volume-intensive applications, specialized platforms are replacing broad all-rounders. For companies, the question is shifting from "whether crypto" to "how much efficiency can be gained". The financial system is not rebuilding itself loudly, but quietly - and 2026 will be the year in which this new architecture becomes visibly resilient.

(Author: James Butterfill, CoinShares, Head of Research)

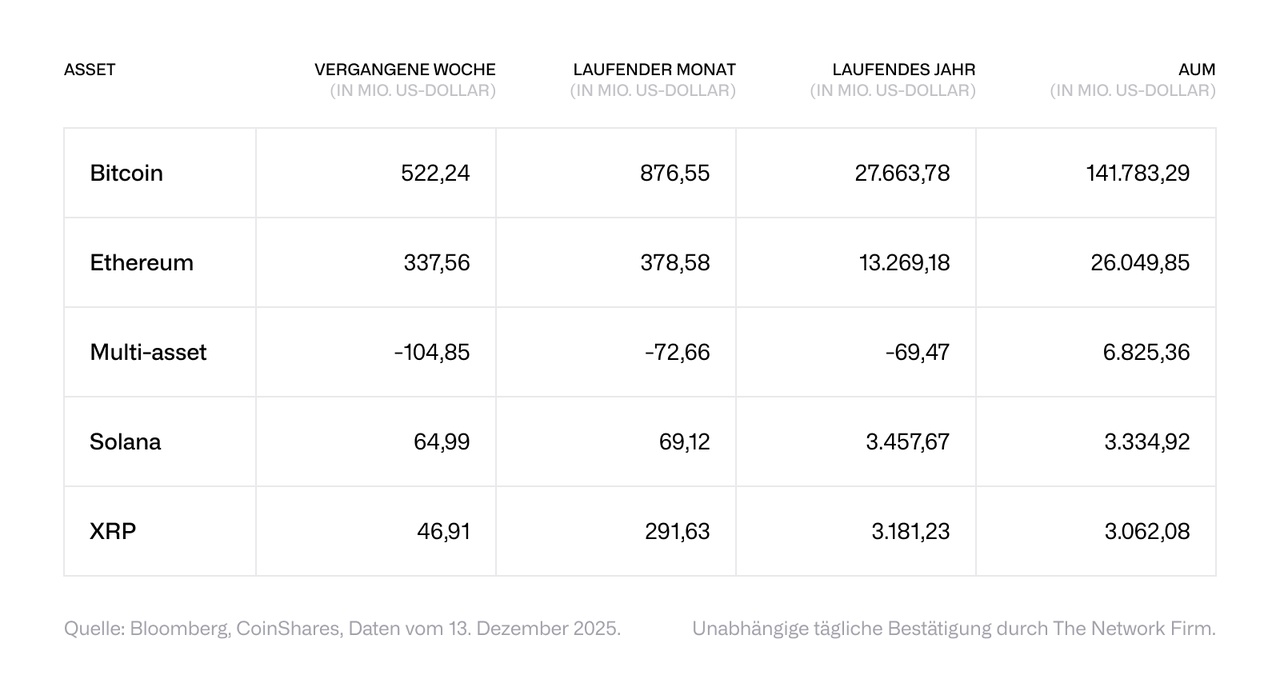

Third week in a row with moderate inflows

#bitcoin attracted inflows of USD 522 million, while short bitcoin investment products continued to record outflows totaling USD 1.8 million. This indicates a recovery in sentiment. Despite this, Bitcoin remains a relative laggard this year, with year-to-date inflows totaling USD 27.7 billion, compared to USD 41 billion in 2024.

#ethereum Bitcoin recorded inflows of USD 338 million last week, bringing year-to-date inflows to USD 13.3 billion. This represents an increase of 148% compared to 2024.

The inflows at #solana remain lower at USD 3.5 billion since the beginning of the year, but still represent a tenfold increase compared to 2024. Aave and Chainlink saw inflows of USD 5.9 million and USD 4.1 million respectively last week, while Hyperliquid saw outflows of USD 14.1 million.

$BITC (+1,68 %)

$CETH (-0,73 %)

$SLNC (+2,81 %)

$GB00BMY36D37 (+1,04 %)

Solana: Fundamentals remain intact, market prepares for recovery

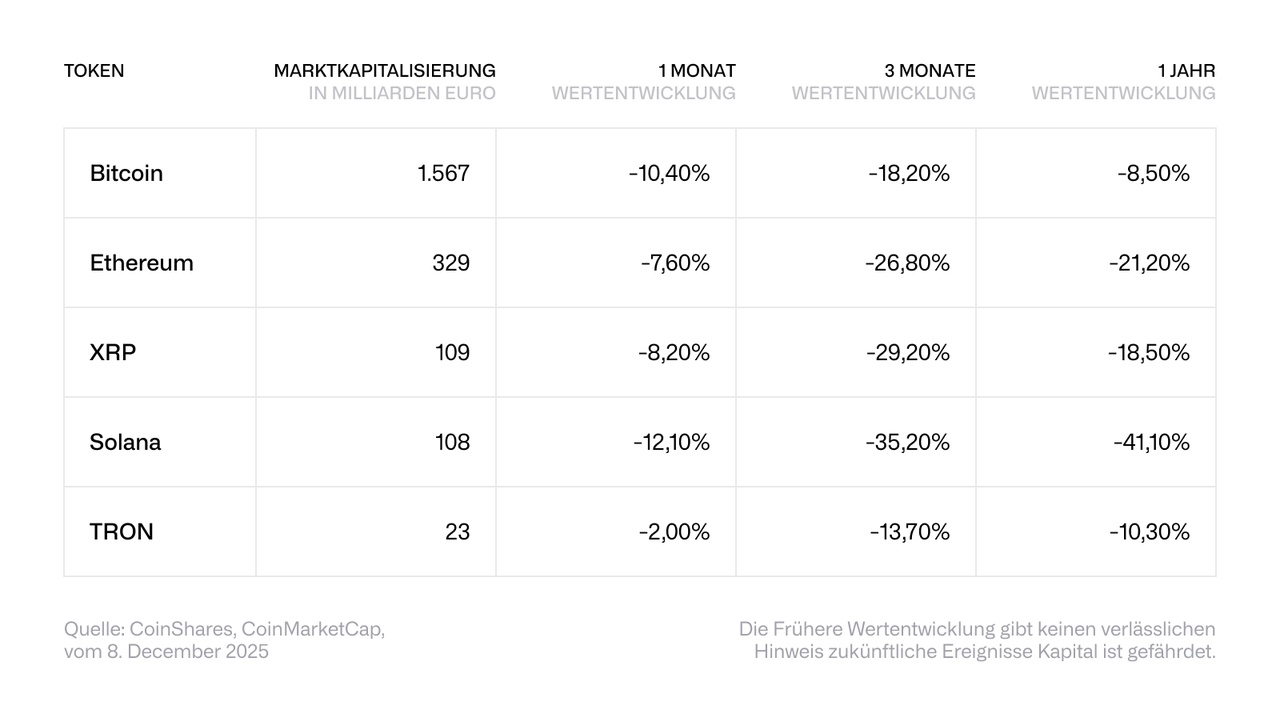

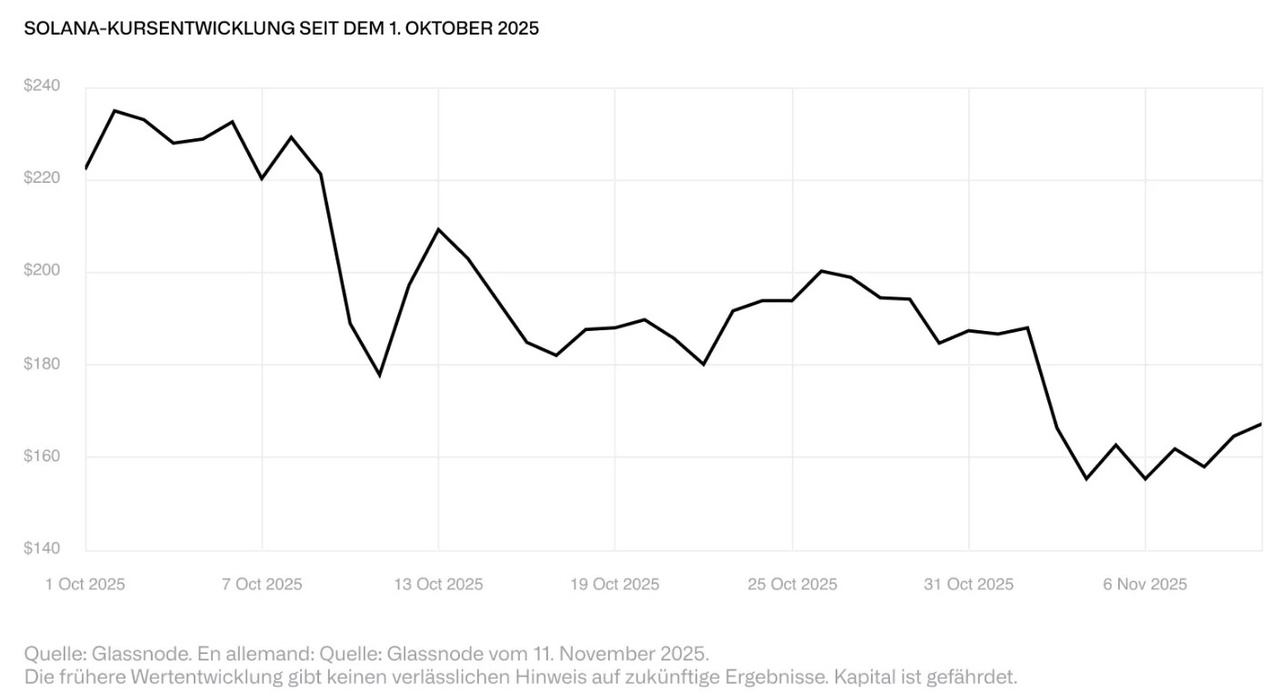

Solana's recent weakness reflects market positioning rather than fundamental problems. In the weeks leading up to the expected ETF admissions on October 10, numerous speculative long positions built up, supported by inflows of over a billion US dollars into European Solana ETPs in just three weeks. This bullish sentiment made SOL vulnerable when the government shutdown in the United States and the wave of deleveraging on October 10 triggered a rapid shakeout of leveraged positions in derivatives and structured products.

The adjustment was exacerbated by the fact that ultimately only the Solana ETFs from Bitwise and Grayscale came to market within a narrow procedural window - not the broad product range that many had been banking on. The result was a classic "sell-the-news" effect, as expectations were for a deeper and more coordinated wave of demand, which failed to materialize.

From a structural perspective, little has changed. On-chain activity remains robust and ETF channels are now open, although initial inflows have lagged the narrative. At around USD 165, down from around USD 225 on October 10, the market has completed a significant position adjustment - creating scope to look at the asset more constructively again. $SLNC (+2,81 %)

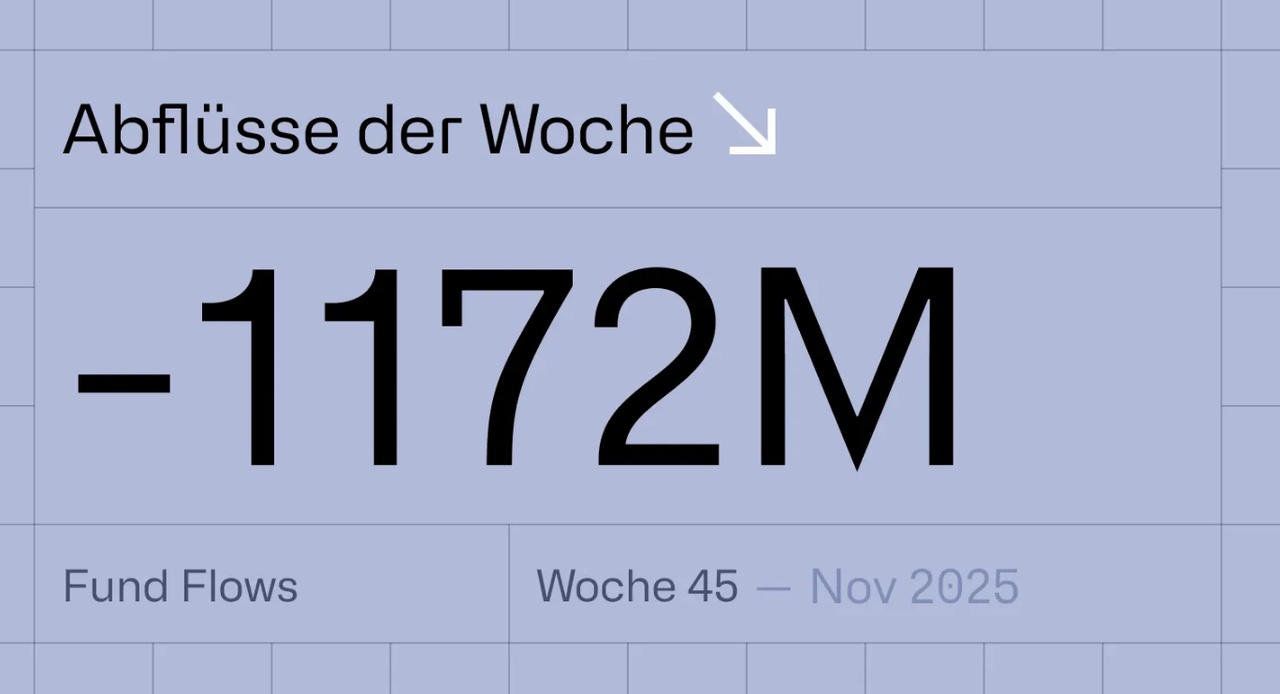

Further outflows for BTC and ETH, SOL robust

Digital asset investment products recorded outflows totaling USD 1.17 billion for the second consecutive week as negative sentiment persisted due to continued volatility in crypto markets following the October 10 liquidity cascade as well as uncertainty over a potential US interest rate cut in December. The main focus was on #bitcoin, which saw outflows totaling USD 932 million last week. Short Bitcoin ETPs, on the other hand, saw inflows of USD 11.8 million - together with similar inflows in recent weeks, this represents the highest weekly figure since May 2025. Ethereum also registered significant outflows of capital totaling USD 438 million. Solana remains robust going forward. Deposits at #solana amounted to USD 118 million in the past week and a total of USD 2.1 billion in the last nine weeks. $SLNC (+2,81 %)

The full overview of CoinShares Weekly Fund Flows is available via the following link: Digital asset fund flows | November 10th 2025

Meet CoinShares Physical Crypto ETPs

Why physically collateralized crypto ETPs are important

The global demand for regulated, transparent and simple ways to invest in cryptocurrencies is growing - especially in Germany. Many investors want to benefit from the performance of digital assets without having to deal with wallets, private keys or technical setup. This is exactly where CoinShares Physical ETPs come into play.

CoinShares is a European market leader in digital asset investments with offices in Switzerland, Jersey, the UK and Sweden. CoinShares Physical ETPs offer a simple, secure and transparent way to invest in assets such as Bitcoin, Ethereum and others - with the added benefit of physical collateralization that creates transparency and direct connection to the underlying asset.

What is an ETP and what does "physically backed" mean?

An ETP (Exchange Traded Product) is an exchange-traded financial product that tracks the price of an underlying asset - in this case cryptocurrencies such as Bitcoin or Ethereum.

A "physically backed" ETP means:

- Each ETP unit is directly backed by real crypto assets.

- The underlying coins are held in secure cold storage vaults.

- Investors have a claim to the underlying digital assets.

The main benefit: Investors receive direct price participation without having to hold or manage the assets themselves.

Why choose CoinShares Physical ETPs?

Security & custody

All coins backing the ETPs are stored in highly secure, institutional cold storage solutions. Custody is provided by reputable third-party providers such as Komainu - a joint venture between Nomura, Ledger and CoinShares.

Transparency

CoinShares publishes daily:

- The exact amount of cryptocurrencies held,

- The net asset value (NAV) of each ETP,

- The number of ETP units issued,

- The amount of staking income distributed to investors.

Investors can see what they own and how it is structured at any time.

Regulation & Structure

The CoinShares Physical ETPs:

- Are listed on European exchanges, including Xetra in Germany,

- Are issued in accordance with applicable EU financial regulation and are subject to ongoing supervision by competent authorities,

- Are domiciled in Jersey - a jurisdiction with strong financial control.

Physical Collateral & Coin Entitlement

Each ETP unit grants the holder an entitlement to a certain amount of cryptocurrency ("Coin Entitlement"). This amount is updated daily and published transparently on the CoinShares website. This means that investors are not only financially but also economically linked to the underlying crypto asset.

What products are currently available?

CoinShares offers a growing range of single asset ETPs, including:

- CoinShares Physical Bitcoin - $BITC (+1,68 %)

- CoinShares Physical Staked Ethereum - $CETH (-0,73 %)

- CoinShares Physical Litecoin - $CLTC (+0,16 %)

- CoinShares Physical XRP - $XRRL (-1,32 %)

- CoinShares Physical Staked Tezos - $XTZS (+2,49 %)

- CoinShares Physical Staked Polkadot - $CDOT (-0,2 %)

- CoinShares Physical Staked Cardano - $CSDA (-0,72 %)

- CoinShares Physical Staked Solana - $SLNC (+2,81 %)

- CoinShares Physical Staked Chainlink - $CCHA (-0,32 %)

- CoinShares Physical Uniswap - $CIWP

- CoinShares Physical Staked Cosmos - $COMS (+1,35 %)

- CoinShares Physical Staked Polygon - $CPYG (+6,37 %)

- CoinShares Physical Staked Algorand - $RAND (-0,01 %)

- CoinShares Physical Top 10 Crypto Market ETP - $CTEN (+0,63 %)

- CoinShares Physical Smart Contract Platform ETP - $CSSC (+1,29 %)

Advantages for investors in Germany

- Access via Xetra and brokers such as Trade Republic, Scalable Capital, ING etc.

- Transparent fee structure: no hidden costs - only a simple annual management fee

- Easy to declare for tax purposes thanks to treatment as a standard security

- Physically secured and held in institutional custody

- Staking rewards possible for selected ETPs

Conclusion: Simple, secure and regulated access to crypto

CoinShares Physical ETPs offer German investors one of the most trustworthy and transparent ways to invest in cryptocurrencies - without technical hurdles, without private keys, without wallet management. This means:

- Crypto as a portfolio component, just like shares or ETFs

- Ideal for long-term investors with a focus on security and regulation

- Available via leading German brokers and platforms

Titres populaires

Meilleurs créateurs cette semaine