I have staked some on Coinbase $ATOM (+0,76 %) but the price has been slipping for months and I wanted to hear what you think about the coin? 🤔

Discussion sur ATOM

Postes

45Buying altcoins? Why?

(The short version)

Because there is not much capital available and savings plans are not possible with the current income.

Instead of plunking a 4-digit sum into some ETF or sinking it into shares, I'm relying on the naivety of my generation of investors and the value (lol) that the coins are supposed to have in a few generations.

So the active strategy is:

Take advantage of the market phases in crypto and actively trade (buy/sell every few months).

Would also have worked with $BTC (-0,14 %) but when the strategy was created a few years ago, the movements in altcoins were more pronounced.

You're always smarter afterwards.

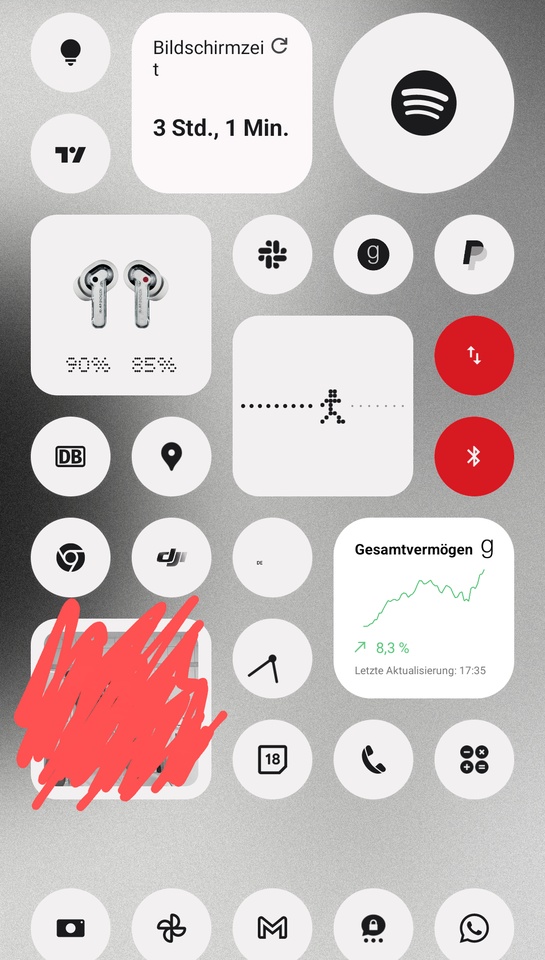

I am still slightly negative in the current position due to early entries this year, but today it looks good on the home screen.

$ATOM (+0,76 %)

$GRT (-0,18 %)$LINK (+0,9 %) BRRRR TO THE MOON and all that

Crypto and taxes

This may sound silly now, but I was hoping that $ATOM (+0,76 %) will only make up the difference to the other altcoins next year, because the €600 allowance has already been taken away for this year.

Regarding taxation.

I know that:

- 600€ free for crypto assets

- Tax-free after one year of holding

Questions:

- move between wallets relevant?

- Staking?

Googled both but not satisfied.

$ATOM (+0,76 %)

#coinbase

#staking

#atom

#cosmos

#passiveincome

#crypto

Hi dadraussen,

do you use Cosmos Staking at Coinbase? What are your experiences?

I can't find anything comparable at the moment.

VG,

Timo

Crypto care on Sunday

The (unexpected) Crypto comeback made me update my bets on the next bull run. Found that I'm really so not in it anymore.

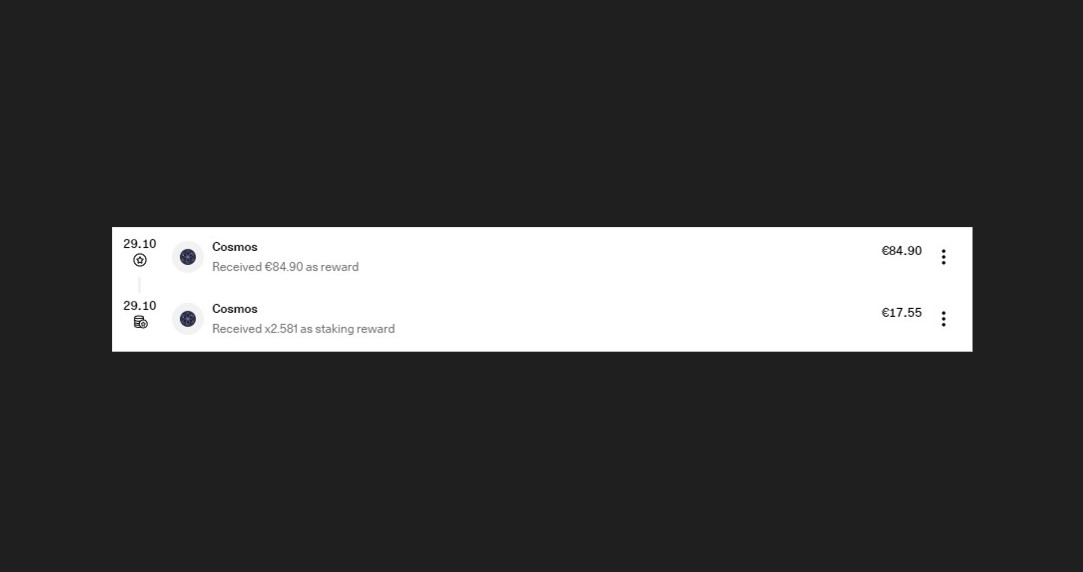

-> Staking Rewards from $ATOM (+0,76 %) = understandable, should collect them more often

-> Was able to claim a PASG token, some history with my NFT. Free money, so give it here, but converted. A coin based only on a non-existent game (where the release is not even fixed) is then too bottomless for me.

Are you building up positions? I'm curious if it will start again now and if it will $BTC (-0,14 %) detaches from the stock market or whether we see the 12000 before yet.

Hi guys,

after the past month I feel the need to share some things about my portfolio.

There were some changes, additional and new purchases, nerves and a lot of lessons learned. But one after the other.

Disney had to give way from the depot and make room for the following candidate. Disney remains super interesting, but through the exchange no longer for me. The opportunity to take advantage of the setback in the other value outweighed the perspective and perceived security that Disney offers me or does not offer to outperform a world in the medium term.

ASML had a textbook setback here in mid-March in the wake of the bank quake, which I had exploited very well. In the meantime, I also manage to incorporate charts well into my buying decision. The had namely revealed that we have a support at about 560€. So I struck at 561€, with the foresight that it will not go lower without major negative influences for the time being. So it came then also.

With the whole switch between $DIS (+1,1 %) and $ASML (-0,36 %) I am currently very satisfied.

Super exciting it became with my renewable energy bet. At 76 € we entered a few days ago down to 60 € and partly below. I had already placed the StopLoss order just below 60. The SL to set, and whether at all for me meaningful or not, I find difficult at the moment. It was also based on the chart.

I had deleted it fortunately again because I have referred to why I got in in the first place, especially since I absolutely wanted to wait for the consolidated financial statements 2022 on 31.03. and "participate". And it was a good thing I did. By re-buying I was able to lower the EK and now with +10% around the reported figures, I'm here again +-0. From now on, it's hopefully back in the right direction 📈

AutoStore from two of my posts lost a patent lawsuit on Thursday vs. $OCDO (-0,68 %) lost. Out of 6 patents, two were invalidated in advance, two were withdrawn by AutoStore, and two were "dismissed" (I can't think of a suitable German word right now) with Thursday's ruling.

I am struggling with the value at the moment, even before the court decision. The stock is in the portfolio because I like the product. The company may be growing nicely, but the surrounding does not correspond to my strategy. In addition $AUTO (+1,06 %) is very volatile, going up 20% a week and down again.

Therefore, I play with the idea to put the money back into the $RBOT (+0,43 %) which has performed much better YTD. Somehow I feel thereby also confirmed that I just drive with the sector ETF and not the individual stocks in the area.

Fortinet is becoming the favorite stock in the portfolio, which somehow nothing can shake. Falling low, great volatility? Fortinet does not know that. Here, it climbs one step after the other and never looks back. At least that's how it feels. Nice value, which I was also able to buy in mid-March. Want to expand the position even further, the question remains only when and at what price.

$QNT (+1,84 %) and $ATOM (+0,76 %)

With Quant and Cosmos I have added two crypto bets to the portfolio. But the way there was a single farce, which you should not really tell anyone 🙄

With $AUDIO (-0,78 %) I already had a crypto bet last year, but I sold it in the wake of the crisis around Solana.... With -80%.The money went directly into bitcoin, so made up a few percent again. With Audius itself I did not want to go more, the idea behind it convinced, the implementation rather not.

But because I am convinced that blockchains have come to stay, I am not investing in a specific project with a use case, but in the need for different blockchains to be able to communicate with each other in the future. This is about so-called interoperability, where Quant and Cosmos are trying to solve exactly that, but taking different approaches, which for me are not mutually exclusive. Of course, the positions are kept small.

The position at $QNT (+1,84 %) was like a small war, because I constantly wanted to get the best return by choosing the best entry point. The back and forth between the fear that it won't go down that much more, so you've already missed something, and the greed for every percentage point of return really got me to the point where I really felt like I was being made fun of and had to seriously ask myself what I was actually doing.

Stop. Reset. Back to the basics.

Now I am quite happy. Buy a position and leave it when you are convinced. The essentials.

What else has kept me busy?

I have to say, this month quite a lot, too much. I have 4 weeks in the wake of the banking crisis and what you have read at the crypto part, so much read, heard, consumed myself that I must say today, it was too much.

As nice as it is to read above that you have caught a supposedly right entry point, but it is so nerve-wracking. Constant back and forth and questioning yourself whether what you are doing is perfect.

But it also took this overshooting the mark to really reach the limits. You don't have to do everything perfectly, small mistakes and inaccuracies are the rule on the stock market, it's just about avoiding the big mistakes.

Lessons learned, again!

And now have a nice evening you dear 😘

P.S.: Actually I just wanted to write a post to attach this GIF by all means 🤣