Hello everyone

About me:

I have just turned 19 and am still training to be a design engineer. I started investing at the beginning of the year. As my salary is not particularly high, I have not been able to invest regularly until now. I invested what was left over at the end of the month. However, I would like to change this and invest regularly in my portfolio.

My goal:

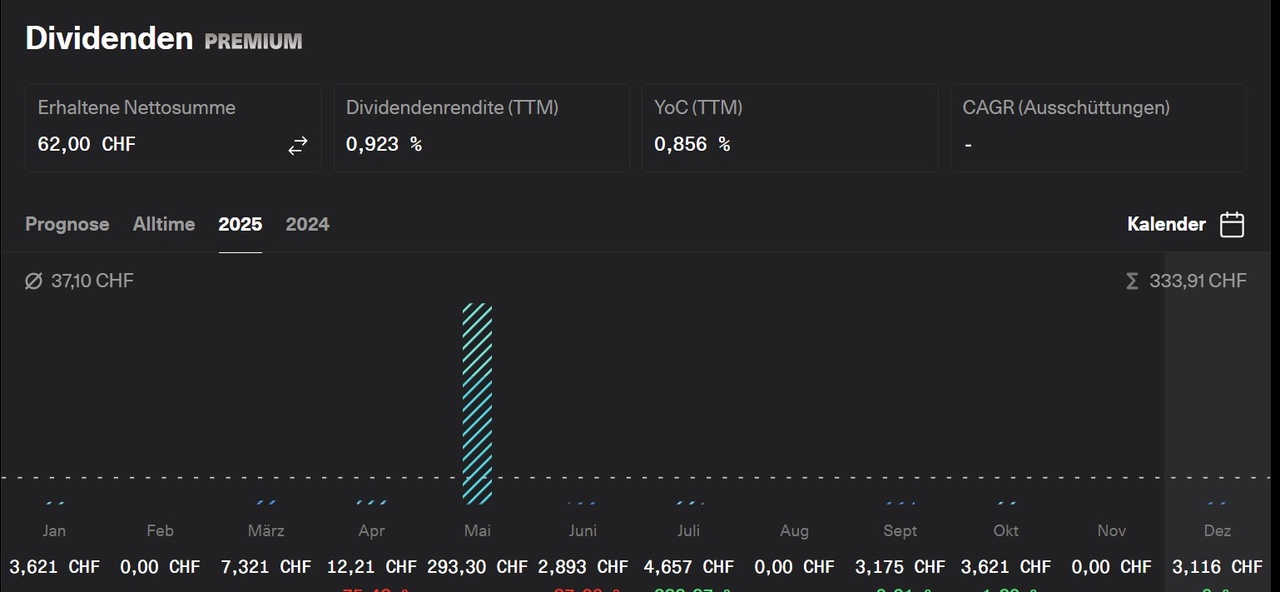

My goal is to generate passive income so that I can benefit from monthly dividends.

My selection:

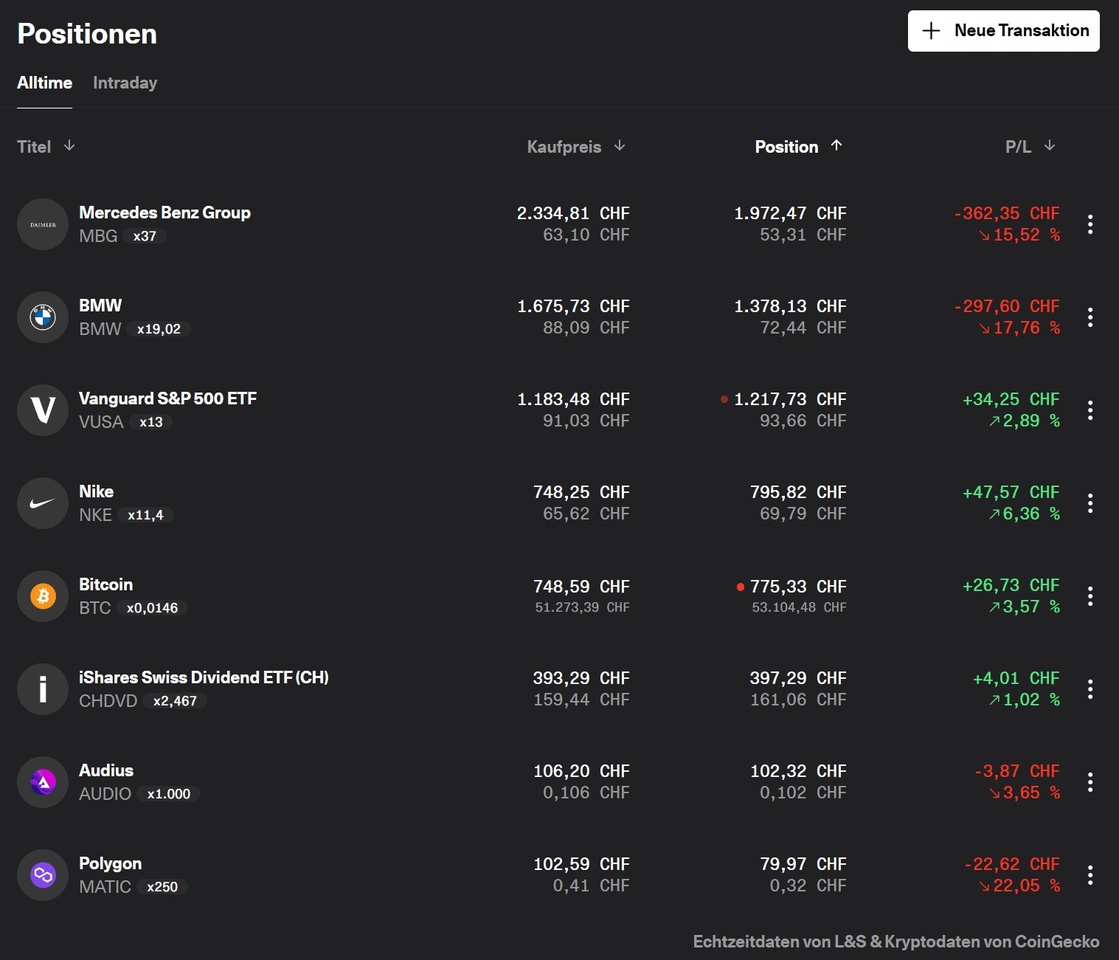

A large part of my portfolio is invested in $BMW (-1,1 %) and $MBG (-0,33 %) because they pay high dividends (unfortunately the market has now plummeted). I am also invested in $VUSA (-1,45 %) and $CHDVD because they also pay good dividends, pay out several times a year and because I have heard a lot of positive things about them. With $NKE (-2,42 %) I got a good entry, but I don't know whether I should keep this position or sell it as soon as I have a 10% profit. Regarding $BTC (-4,92 %) I have been decorating weekly for a while, but not again for a long time. I've done a bit of research and reading and have been convinced that cryptocurrencies and especially $BTC (-4,92 %) will reach a new "high". If this is the case, I would exit the position and invest the entire amount in the S&P500, for example (what do you think of this idea?). I have the same idea with $AUDIO (-3,12 %) and $MATIC (-3,05 %) . With $AUDIO (-3,12 %) I already had a previous experience, which ended positively after 1 month and I exited the position. When it fell again later, I got back in, but unfortunately without success so far. However, I have no time pressure and the money invested in $AUDIO (-3,12 %) and $MATIC (-3,05 %) I don't need it and I'm using it to gain "experience". It's good if it ends positively, but if it ends negatively, at least I've learned something from it.

Next steps:

Next, I want to find a stock that pays me dividends in February, August and November. I already have my eye on $AAPL (-0,21 %) . What do you think?

My wish:

I would be happy if someone could give me tips on what I could adjust in my portfolio, possibly also which stocks I should get in or out of and how I should divide my money between the stocks/cryptocurrencies in the future if I were to invest CHF 100 every month.

Many thanks in advance