1) Executive Summary

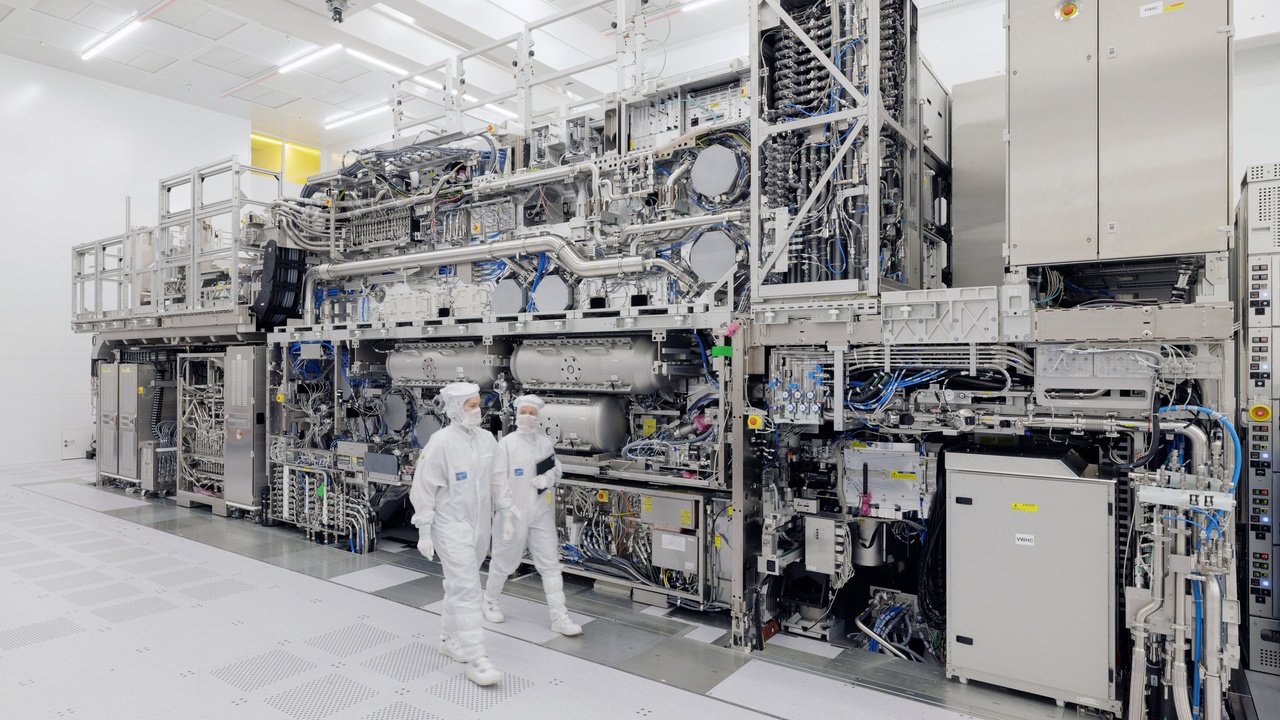

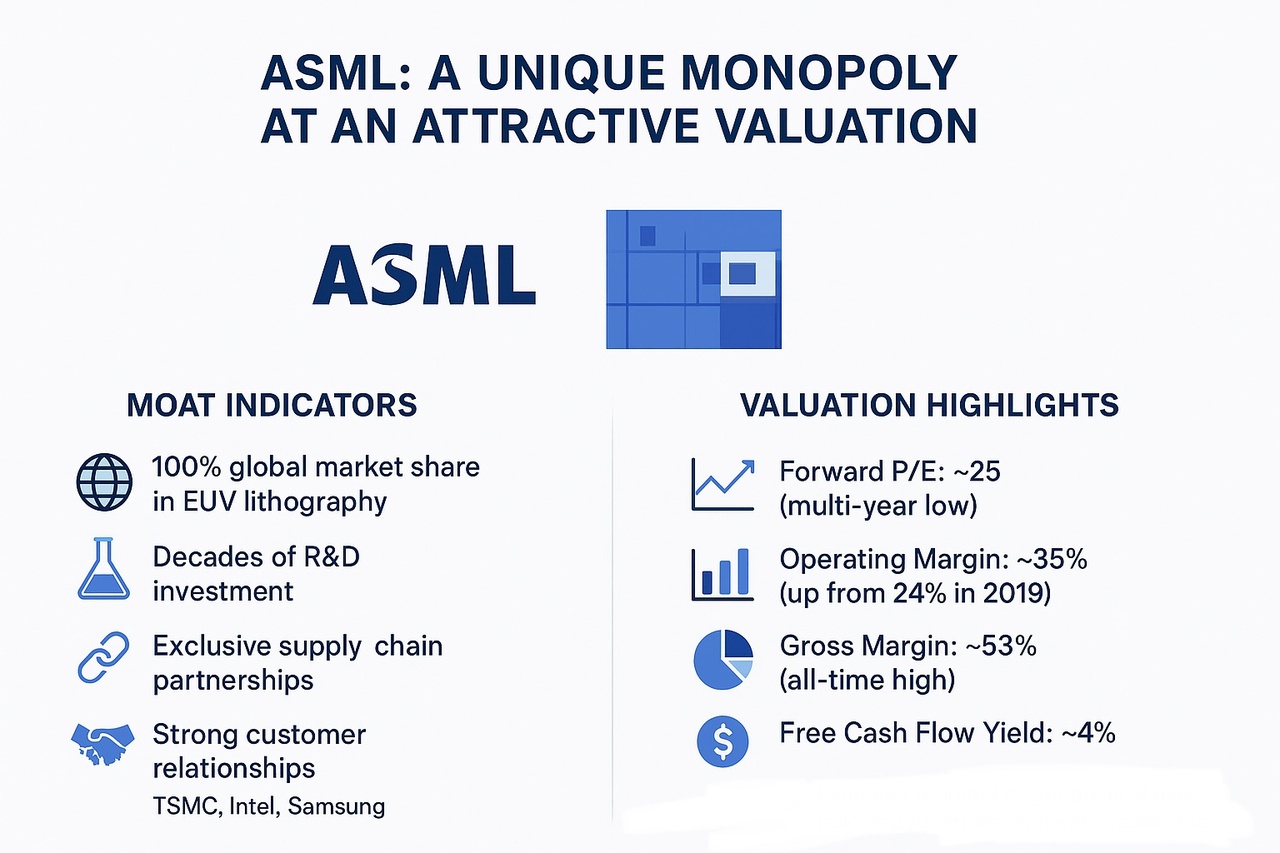

ASML is the world’s only supplier of extreme ultraviolet lithography (EUVL) systems. This technology is essential for the production of the most advanced chips worldwide.

The company’s monopolistic position in the semiconductor industry provides considerable pricing power and a large moat, forcing customers to buy from a single source: ASML.

Its moat also does not show any sign of fading and is underpinned by decades of R&D, control over the supply chain, and global dependence.

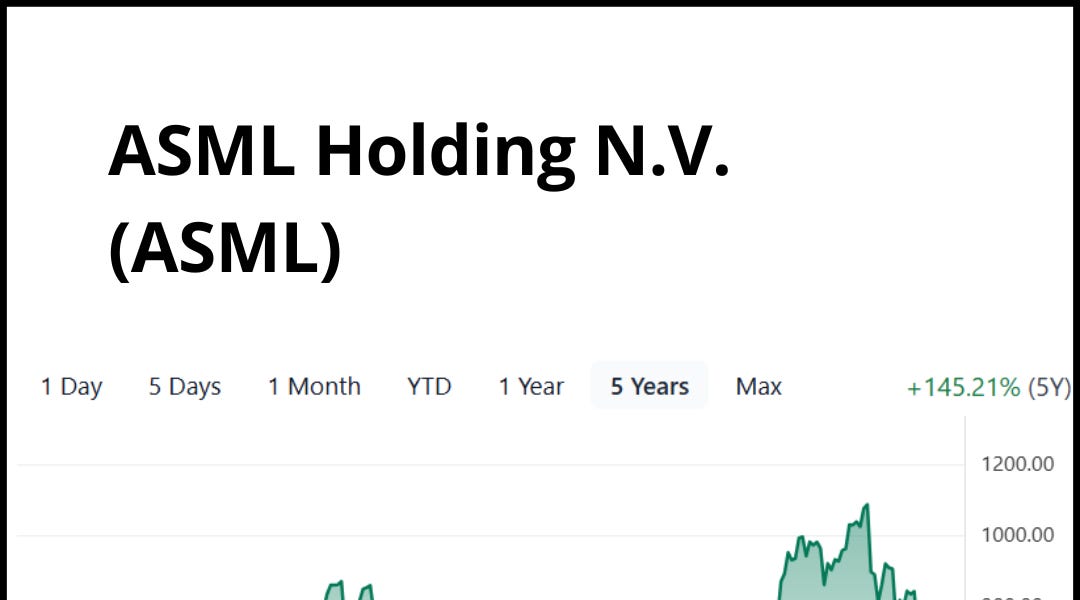

Despite being at the forefront of the AI boom, ASML trades at a forward P/E ratio of ~25-26, well below its average, offering a rare opportunity to own a dominant, critical infrastructure provider, without a massive price tag.

2) Investment Thesis

ASML operates as a monopoly, plain and simple. The company is the exclusive supplier of EUVL machines essential for powering the AI revolution. ASML controls 100% of the global market for these machines – not a single known competitor. Additionally, ASML owns almost the entire value chain for these machines – it acquired multiple suppliers to fortify its position.

Furthermore, the company is not just reliant on selling EUVL machines, as service revenue is responsible for roughly 27% of all revenue. ASML is more than a simple manufacturer of some advanced lithography tools, it is a fully integrated high-tech company, laying the foundation for an AI-dominated future.

Subsequently, as these machines advance, chip foundries like TSMC and Intel have no other choice than purchasing newer models, in order to maintain their position. ASML is in a unique spot to set the pace of innovation for global foundries, which is powering the AI boom and data center expansion.

Finally, ASML illustrates a classic case of market mispricing. Investors undervalue the monopolistic position of the company and rather tend to focus on short-term trade headwinds. It would also be wise to consider that the force creating the tariff concerns, would never allow the U.S. to fall behind in the AI race, and there is no company more crucial to facilitating innovation in that regard than ASML.

This represents a (near) perfect opportunity to add a monopoly in the arguably fastest-growing industry worldwide, to your portfolio at a forward P/E ratio around 25, a multiple-year-low valuation.

3) Growth Drivers

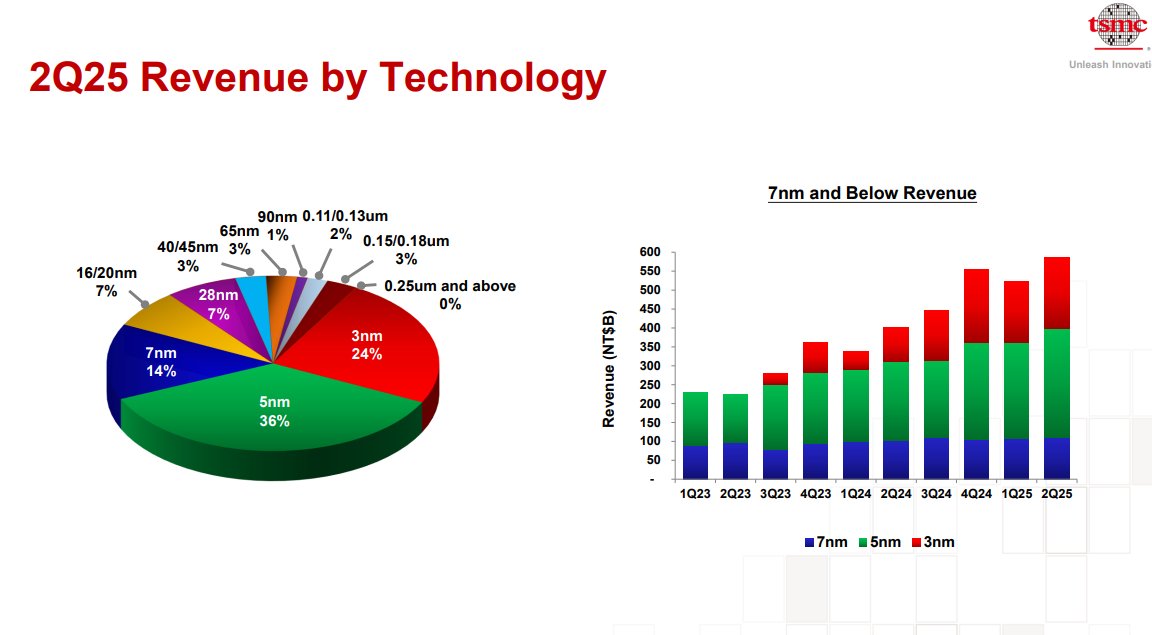

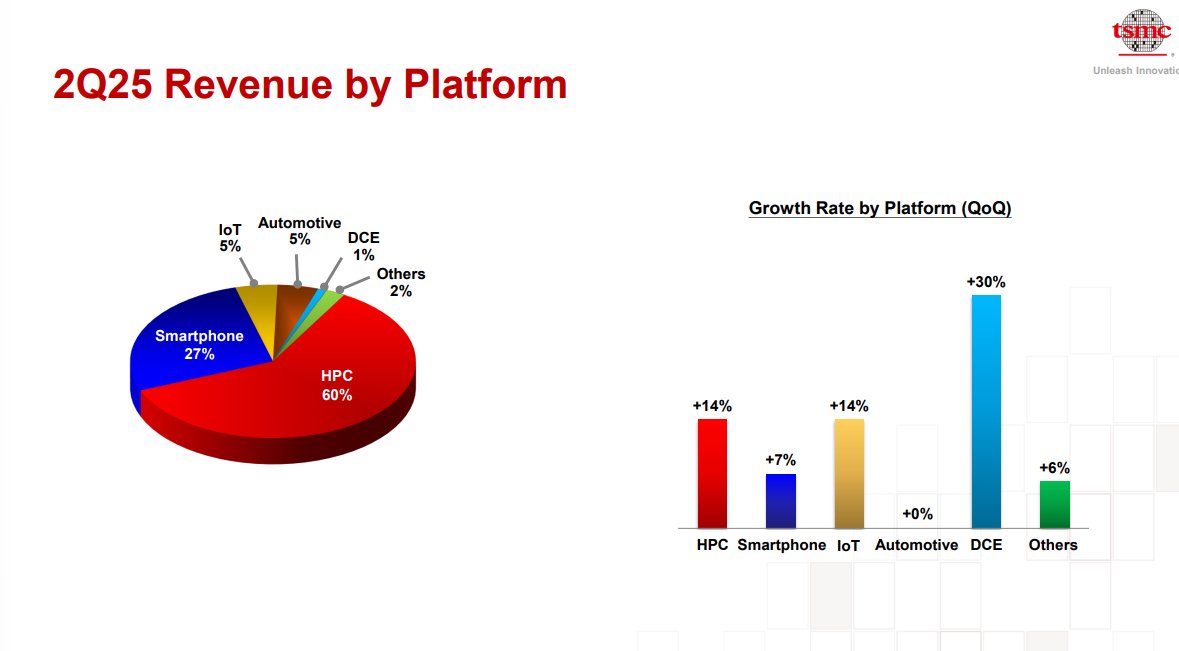

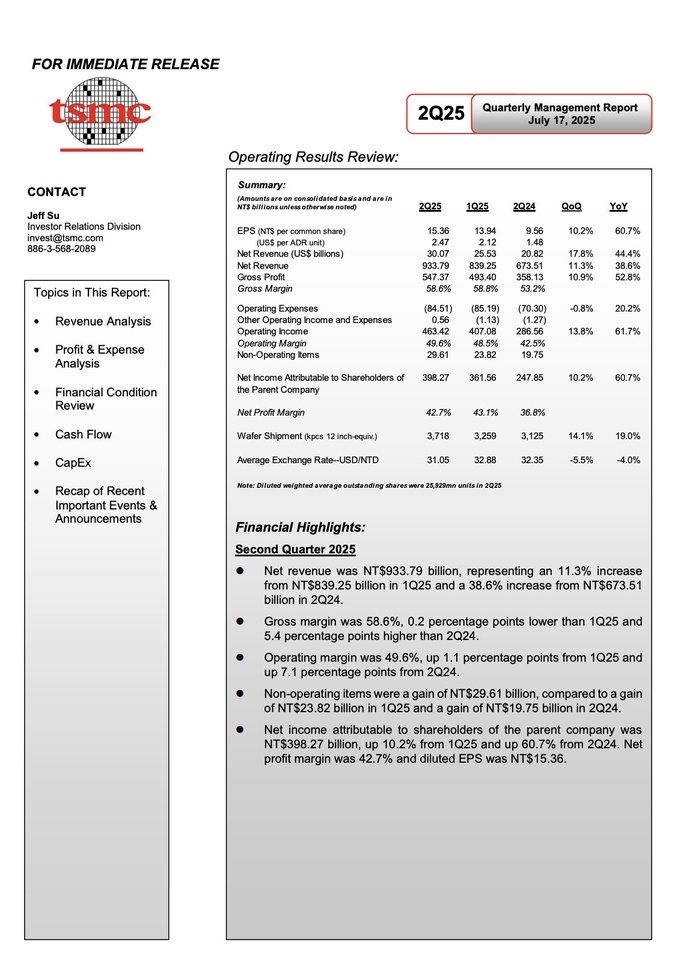

While the AI race is fully underway now, underappreciated innovators like ASML drive this immense growth. Global demand for WFE (Wafer Fab Equipment) is rising rapidly, which is reflected by ASML’s healthy growth (Revenue CAGR ~15%, 2021-2025).

The scaling of AI models moves demand for WFE to more advanced machines and is likely to lead to a rise in total sold products (at a higher price point), as well as increased service revenue.

On top of the secular growth prospects, cyclical rebuild cycles, as happening for DRAM and NAND memory chip suppliers, play a major role in ASML’s global expansion. Companies like Micron need to level up their machines regularly to meet rising cloud demand.

Similarly, major chip foundries are constantly innovating, which can only be facilitated through advanced systems, delivered by ASML. In order to keep a competitive edge over competitors, global players like TSMC, will always buy the hottest and newest lithography machines, which benefits the only player in this market: ASML.

With rising CapEx, the company is in a prime spot to capitalise, which makes future growth estimates seem conservative.

4) Competitive Position

ASML’s technology is deeply embedded in the operations of the largest chip makers worldwide. Leading global foundries like Samsung, TSMC and Intel account for the lion’s share of ASML’s EUVL sales, which makes them heavily reliant on ASML’s maintenance services as well, boosting recurring, high-margin revenue generation.

To understand why ASML is in such a monopolistic position and has widened its moat over time, it is important to consider a few factors that prevent competitors from entering the market successfully.

A first technological barrier for other companies is the R&D intensity of the business: ASML has invested billions in EUVL for decades, apart from the millions of hours of development that were spent before the first commercial shipment.

Another substantial advantage for ASML is its control of the supply chain: the company has exclusive partnerships with Zeiss (optics) and Cyber (light sources), for instance, through partial ownership or full integration, ensuring value chain quality and safety.

Also noteworthy is the relationship ASML has built with customers over years of successful integration of its machines into global chip production facilities. Competitors would have to outshine ASML’s reputation or seriously undercut prices to lure foundries away.

5) Recent Financials

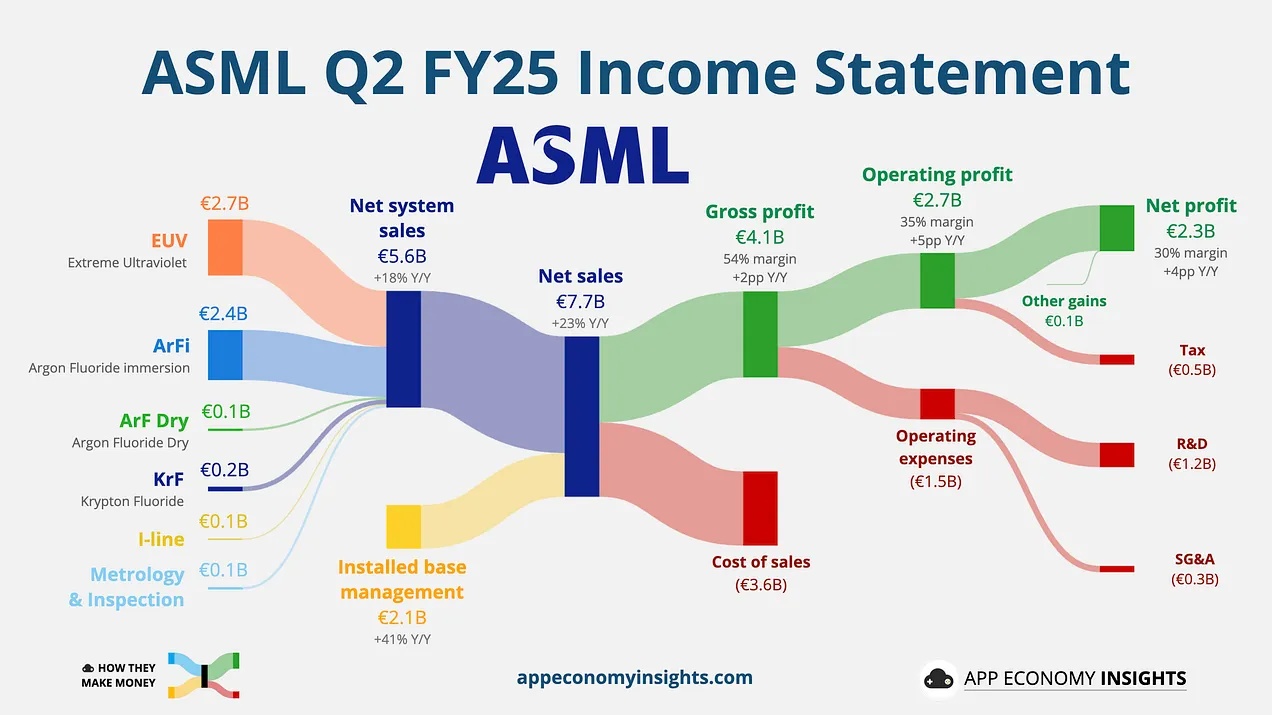

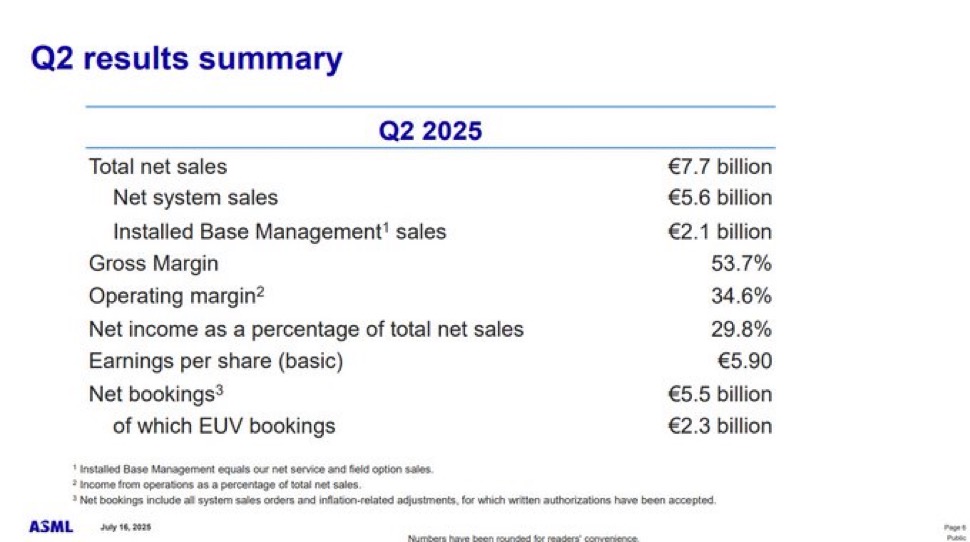

Highlights of the most recent Q2 2025 report:

· Total net sales: €7.7 billion (upper bound of guidance)

· System sales: €5.6 billion, with Installed Base Management hitting €2.1 billion (strong recurring revenue)

· ~54% gross margin and 35% operating margin (beating guidance)

· Net bookings: €5.54 billion, with ~€2.3 billion from EUV systems

· Announced dividend of €1.60/share and major buybacks of €1.4 billion

While there are many positive takeaways, from the results and the call, like strong execution (sales and margins beat expectations), high bookings in EUV signalling continued demand, recurring revenue strength and a healthy buyback program, not everything was great.

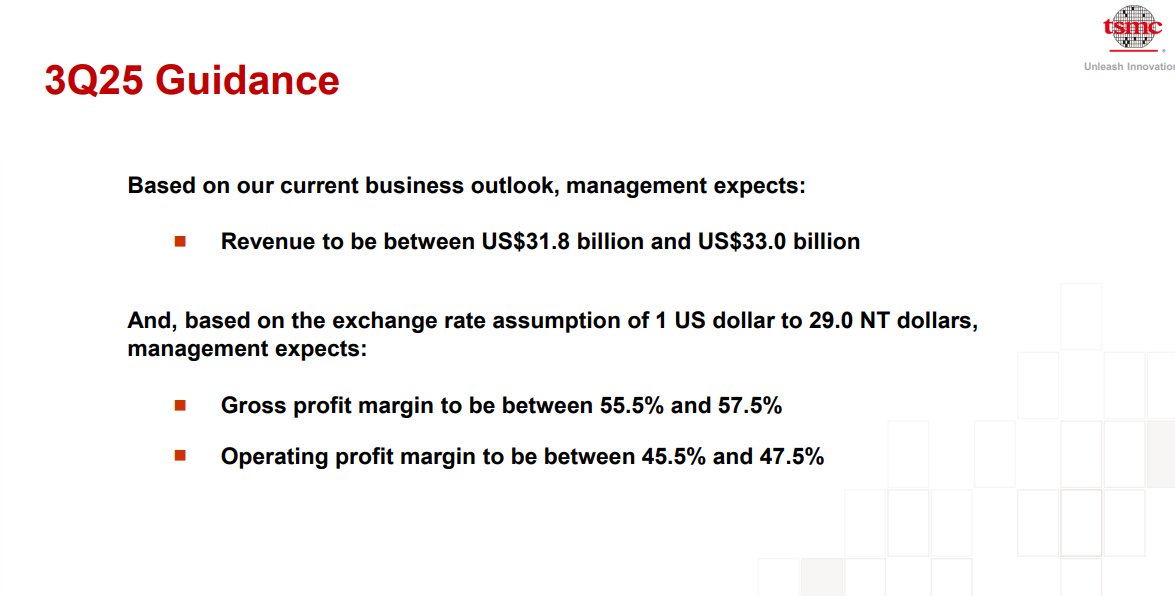

Most notably, the refusal of management to confirm growth for 2026, due to macroeconomic and geopolitical uncertainties and a disappointing sales guidance for Q3.

However, the positives seem to outshine the negatives on these results and geopolitical uncertainties tend to resolve fairly quickly in this day and age, considering the high deal flow announced by the White House, which makes me optimistic for a brighter guidance in the next earnings report.

6) Valuation

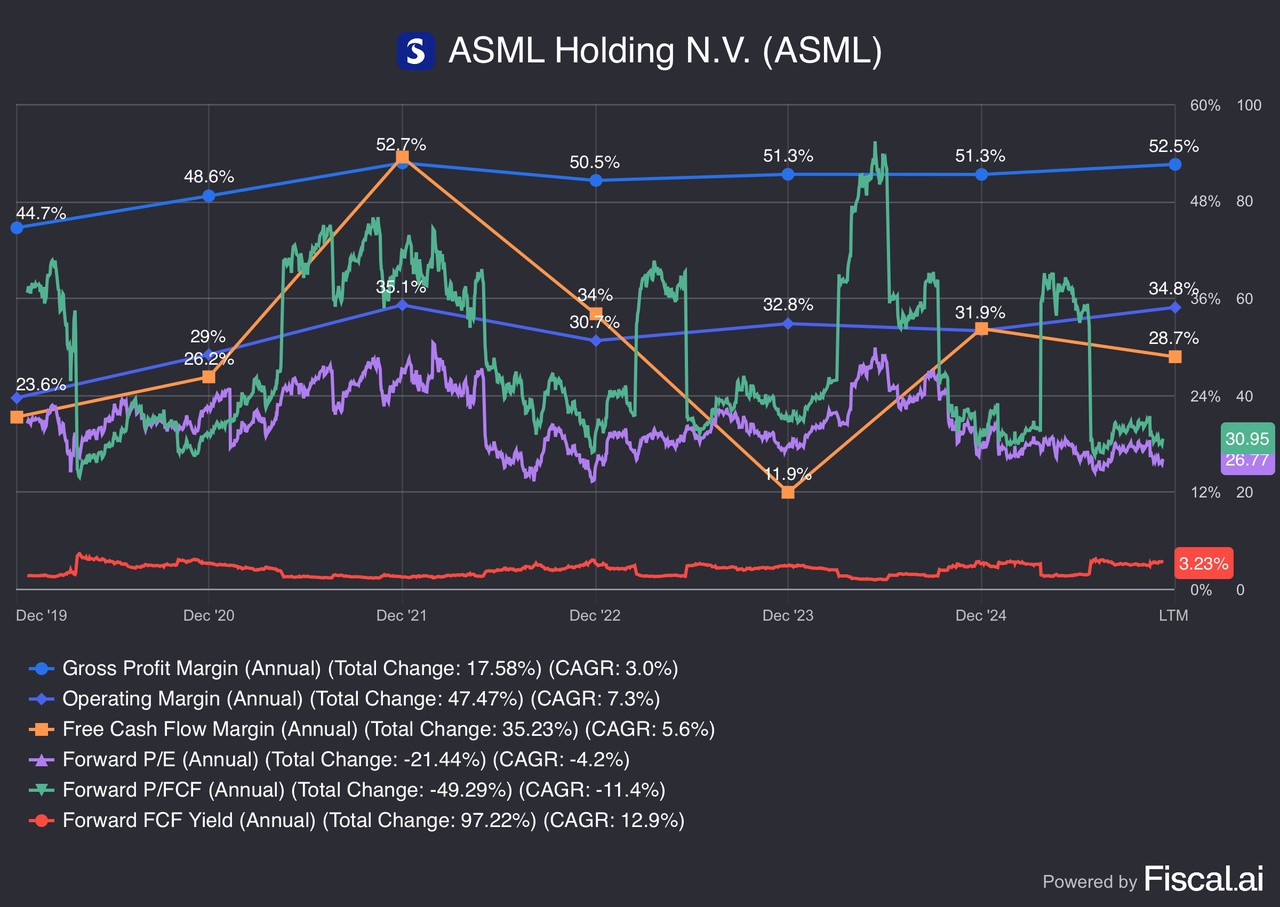

As mentioned above multiple times, ASML is cheap at current levels, considering its position. Here are some key metrics to underpin that assumption:

· Forward P/E: ~25/26 (avg. of ~34 in the last 5 years)

o Considerations: EPS consensus seems rather conservative, due to highlighted geopolitical tension during the last call

· Forward P/FCF: ~30 (falling rapidly YoY due to strong growth, expected to continue)

· Gross Margin: ~53% (at ATHs, up from 45% in 2019)

· Operating Margin: ~35% (up from 24% in 2019)

· FCF Yield: ~4% (avg. ~3.3% in the last 5 years)

Multiple factors including the company’s moat, and future potential, a multi-year low valuation combined with expanding margins and free cash flow yield, make the stock a compelling buy right now.

7) Risks

Trade restrictions form one of the key problems ASML faces, though it might not be as bad as it looks. Much of the uncertainty around possible tariffs has already vanished, especially after the U.S.–EU trade deal and President Trump’s confirmation that companies investing in America will be exempt from the immense tariff rates (>100% and rising) imposed on the semiconductor industry.

Another possibly considerable risk is innovations of Chinese competitors happening under the radar. Nobody can estimate how far China has already advanced and how soon they could launch alternative solutions to ASML’s products.

However, there is a geopolitical lifeline, even in the unlikely case that Chinese newcomers could overtake ASML: The U.S., especially under the current administration, and in part Europe aim to be as independent from China as possible, reducing the risk of U.S. foundries rotating their sales to a possible Chinese competitor. And even if no restrictions were imposed from the Western side, there is no incentive for China, an autocratic regime, to allow its tech to aid the U.S.’ advances in the AI race.

There is no company that does not face any risks, though ASML is in a relatively strong position to alleviate core uncertainties, especially those within their control, through innovation and strong management execution.

8) Catalysts & Timeline

In the near future it is possible that geopolitical pressures can keep the stock down, but it is critical to emphasize that these issues are temporary. The AI boom is fully underway and the chip market is booming, further solidifying ASML’s importance globally.

Mid to long-term the outlook is incredibly bright – the stock market usually does not misprice excellent companies forever and while Nvidia and AMD are getting most of the spotlight, ASML is compounding in the background. Macro headwinds are likely to fade over the next quarters and the stock is poised for a rebound.

9) Conclusion

ASML sits at the intersection of demand (AI, advanced logic, memory) and impresses with a near-insurmountable technological moat as the sole EUVL supplier. The Q2 2025 report demonstrates robust demand and healthy, expanding margins, and while management’s cautious tone might signal uncertainty, it is more likely they try to set low expectations, in order to beat later. This should not unsettle long-term investors, who believe in the AI revolution, resulting CapEx, and strong fundamentals.

Personally, I think the downsides are limited and, to a great extent, already priced in. It is vital to emphasize again that a Forward P/E ratio of 25 is certainly not expensive for a sole contender in their respective field, especially one so crucial for the future.

$ASML (+0,55 %)

$ASML (+0,22 %)

$TSM (+1,6 %)

$2330

$INTC (-7,57 %)

$005930

$NVDA (+1,43 %)

$AMD (+4,79 %)