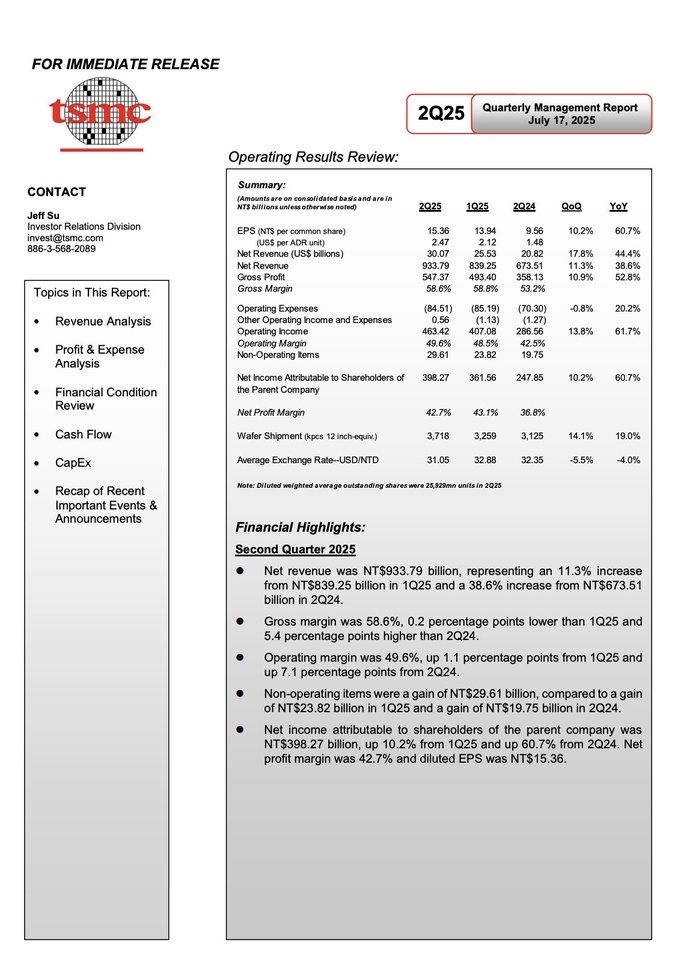

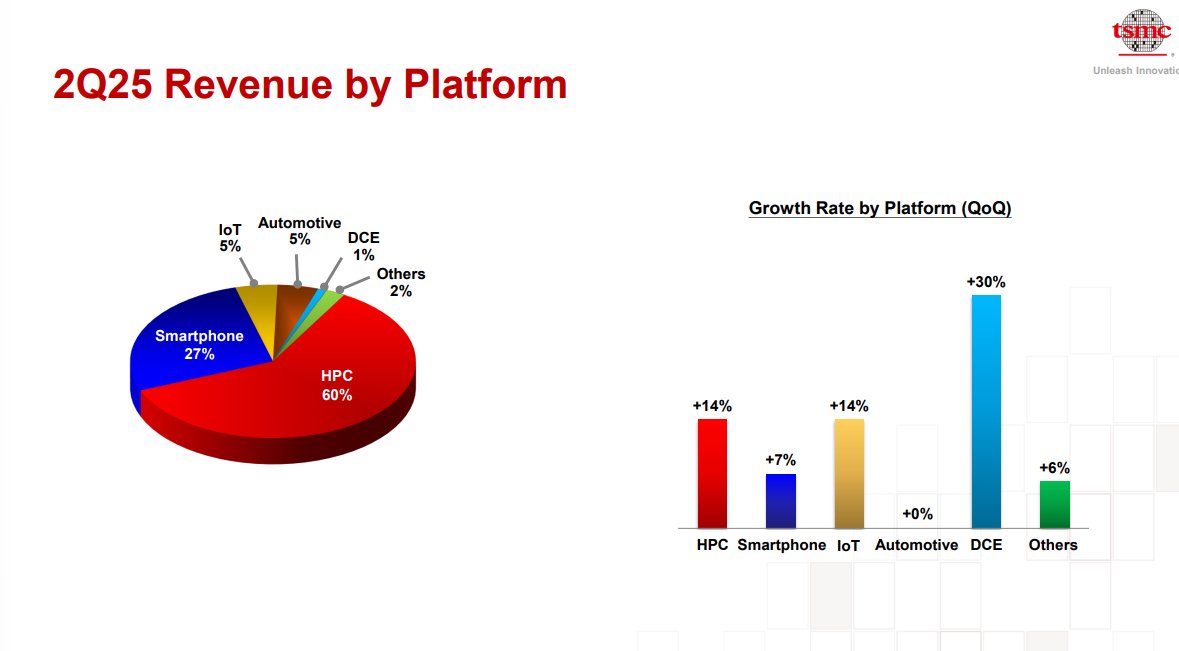

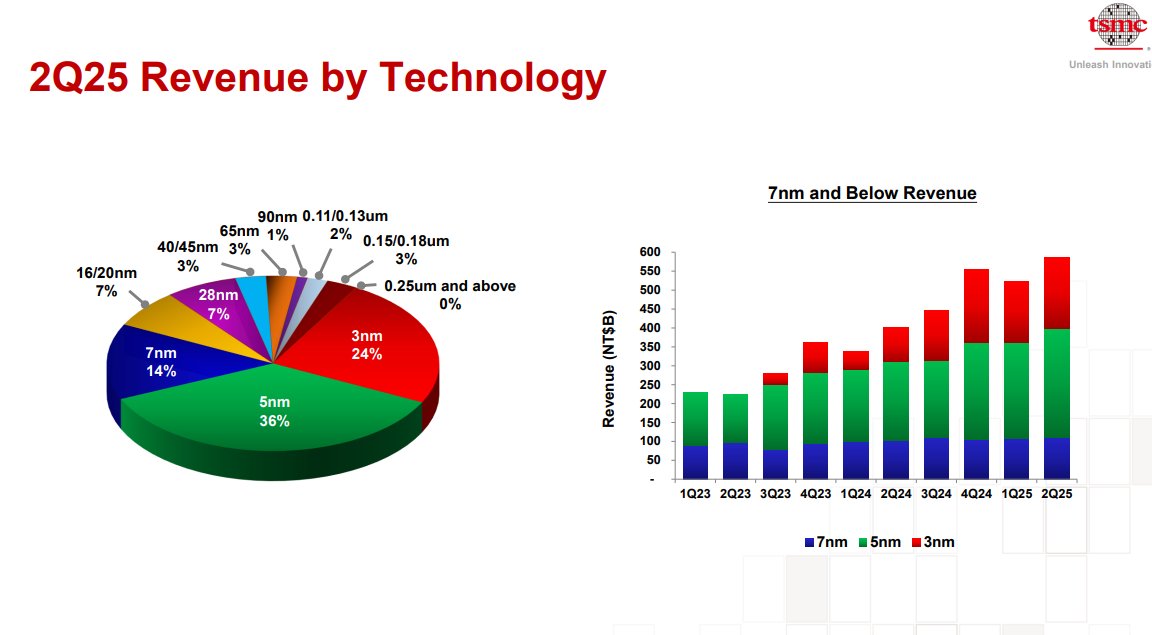

- Strong Q2 revenue supported by industry-leading 3nm and 5nm technologies, partially offset by FX headwinds.”

- “Gross margin pressure from FX and overseas fab dilution was partly balanced by higher utilization and cost improvements.”

- “Receivable and inventory days improved on higher N3/N5 wafer shipments.”

- Management flagged tariff uncertainty & FX volatility as 2H margin risks; long-term GM ≥53% goal reiterated.

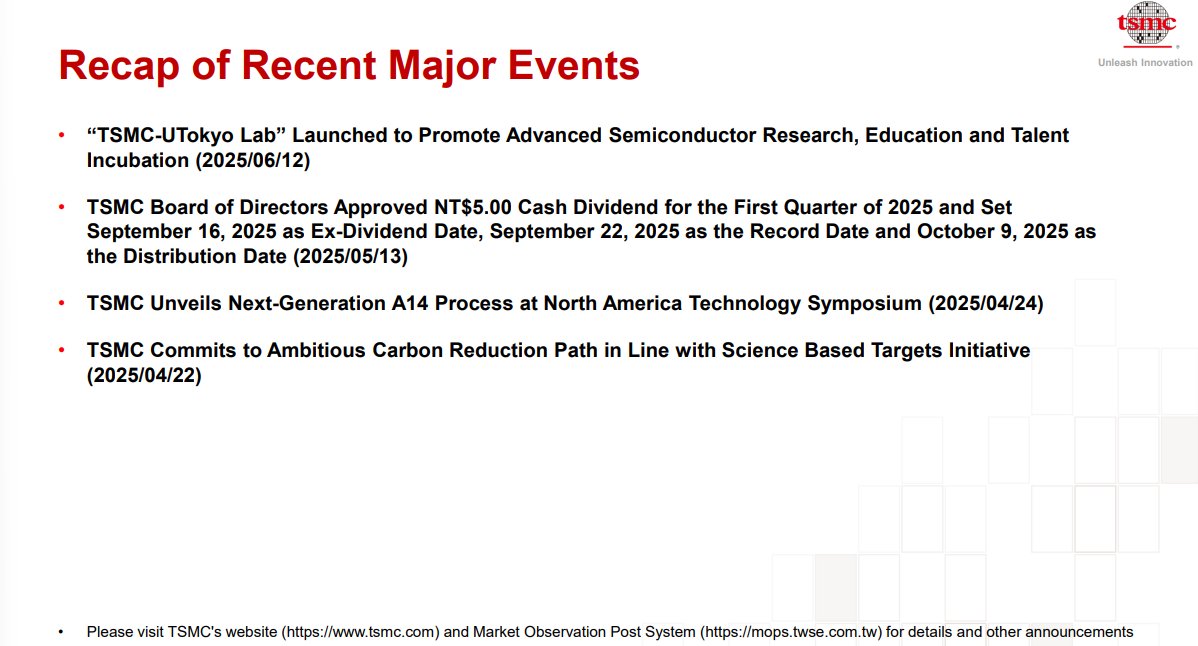

- U.S./EU fab build-out (~$165B multi-year) aimed at capacity diversification & customer security; overseas fabs carry structural margin dilution.

- N3 capacity remains tight; narrowing supply-demand gap at premium nodes while ramping N2 (HVM 2H25) and advanced packaging (CoWoS/SoIC).

$2330

$NVDA (+2,31 %)

$AMD (+6,32 %)

$AVGO (+1,78 %)

$ASML (-0,02 %)

$ASML (-0,45 %)