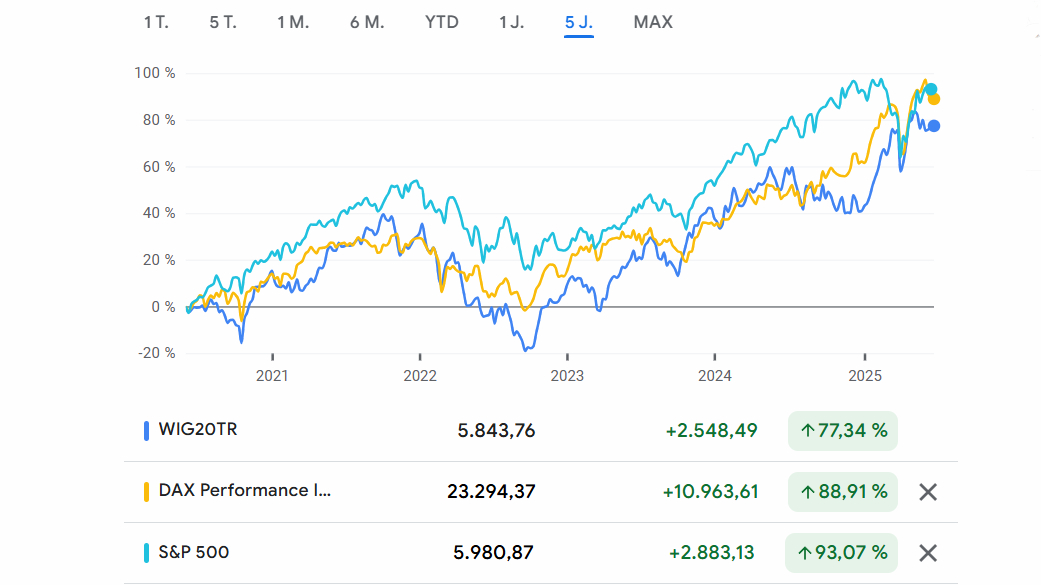

My bet with "The big scrap"

$MBR (+0,57 %)

Even if the title sounds like a chip shop, this is a real hidden gem from the waste management sector with a current market capitalization of around 225 million euros.

The stall may be small, but the fries taste best here ... don't they?

What does Mo-BRUK do anyway?

In a nutshell: Mo-BRUK earns money with waste - twice over. They accept industrial and hazardous waste for a fee and then process it into recyclable products or energy.

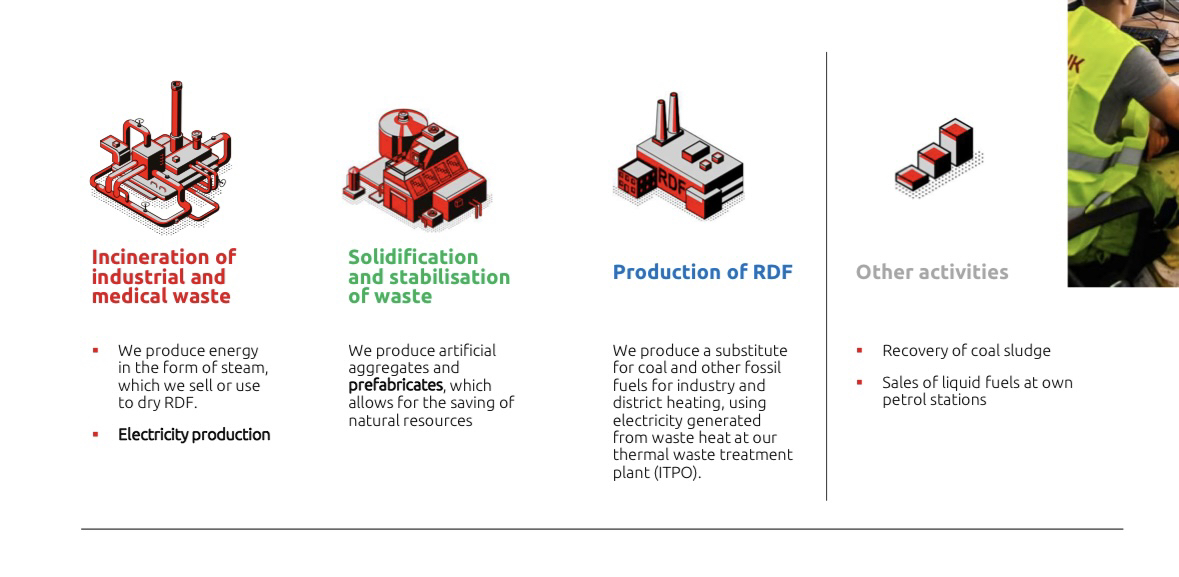

The business model is divided into three core business areas:

1. incineration of industrial & medical waste🔥

Materials such as solvents or hospital waste are incinerated at very high temperatures. This produces steam, which in turn is used to dry other waste (RDF) or to generate energy.

2. waste stabilization/solidification ♻️

Inorganic hazardous and non-hazardous waste is chemically and physically treated so that it no longer poses a risk. The end product is a solid granulate that can be used in cement construction, for example.

3. RDF production (Refuse-Derived Fuel)⛽️

Non-hazardous household waste is shredded and dried to be used as fuel in cement plants, for example. RDF is a recognized secondary fuel and helps to replace fossil fuels.

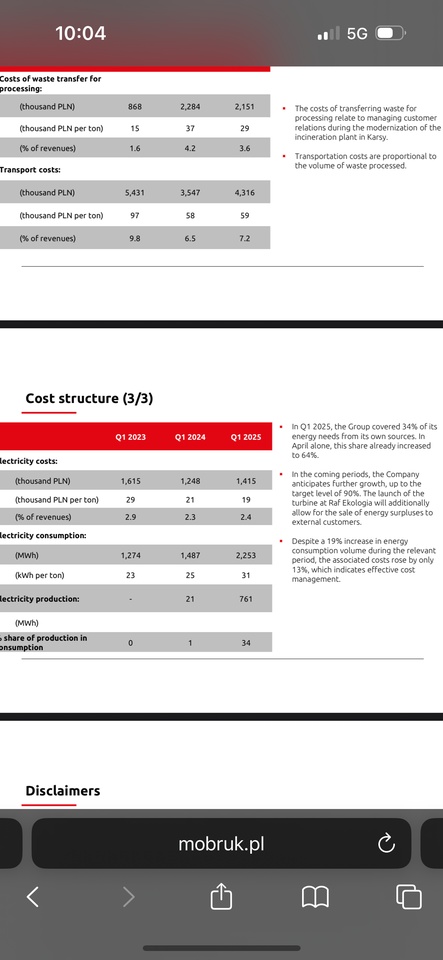

Exciting fact: Mo-BRUK was able to cover around 35% of its energy requirements from its own sources in the current year - the aim is to achieve a quota of 90% using its own turbines (RAF Ekologia) and PV systems.

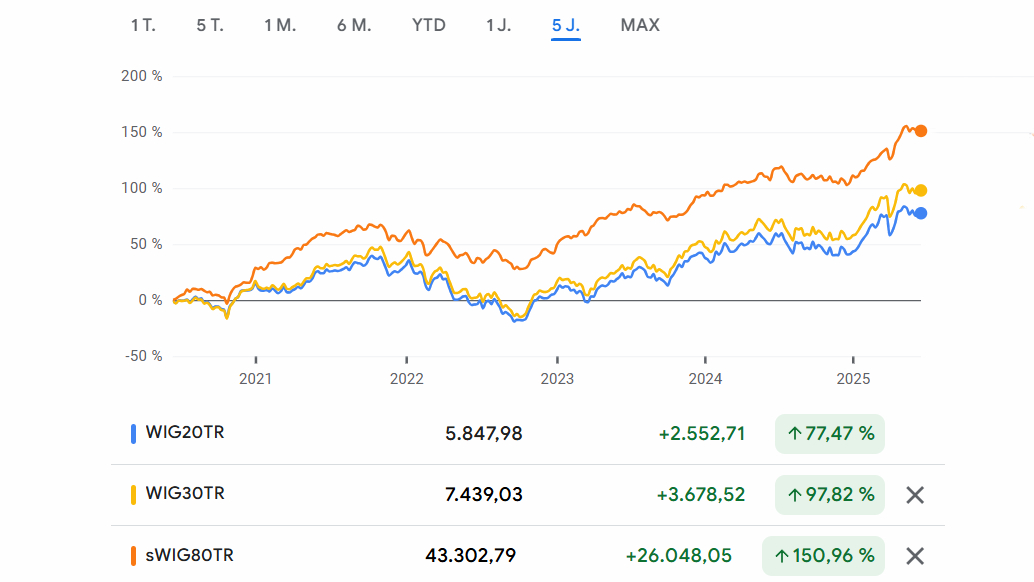

Poland - the EU's new economic miracle?🇵🇱

Underestimated by many just a few decades ago, Poland is now one of the most dynamically growing economies in the EU. Google, Microsoft, Intel and many German companies are investing heavily in local sites and data centers.

A geopolitical factor: as a frontline state on the EU's eastern flank, billions are also flowing into infrastructure, defense and industrial development.

Conclusion: where industry grows, so does the volume of waste. And this is precisely where Mo-BRUK is ideally positioned.

Poland's waste problem - Mo-BRUK's opportunity🚯

Despite EU directives, 38% of household waste still ends up in landfills in Poland according to Eurostat (2022) - in Germany, the figure has been close to 0% since 2005. In addition, there are thousands of illegal landfills with hazardous waste from home and abroad.

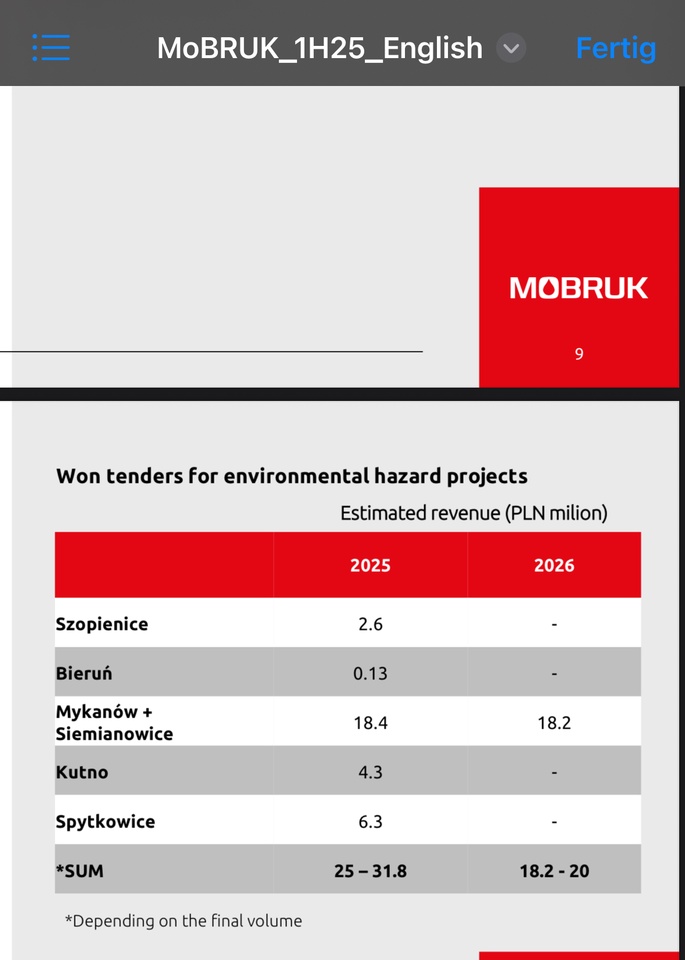

Mo-BRUK benefits directly from the political and regulatory will to eliminate these abuses - including special projects paid for by the state ("ecological bombs"). Although these "bombs" add a nice touch to sales, I would like to leave them out of the equation.

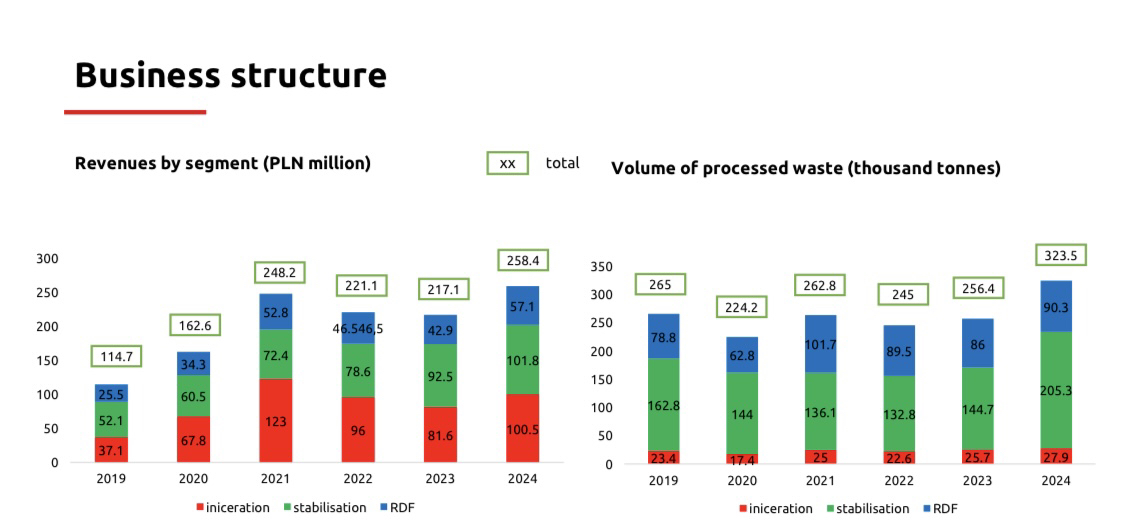

How dependent is Mo-BRUK on the individual segments?

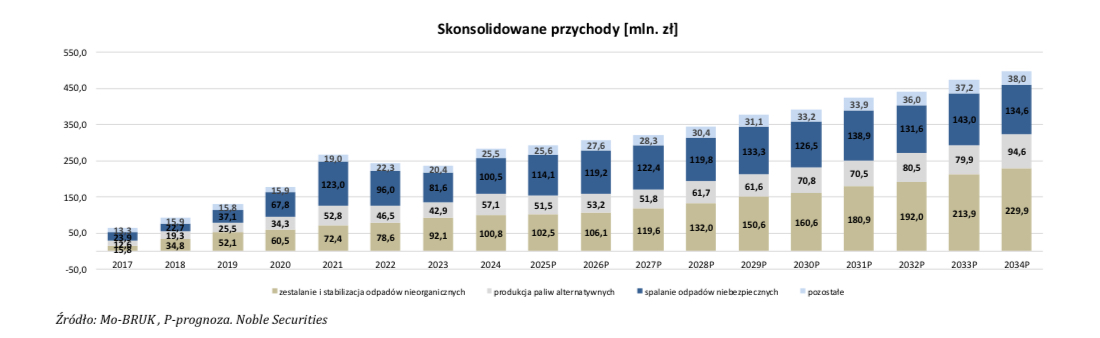

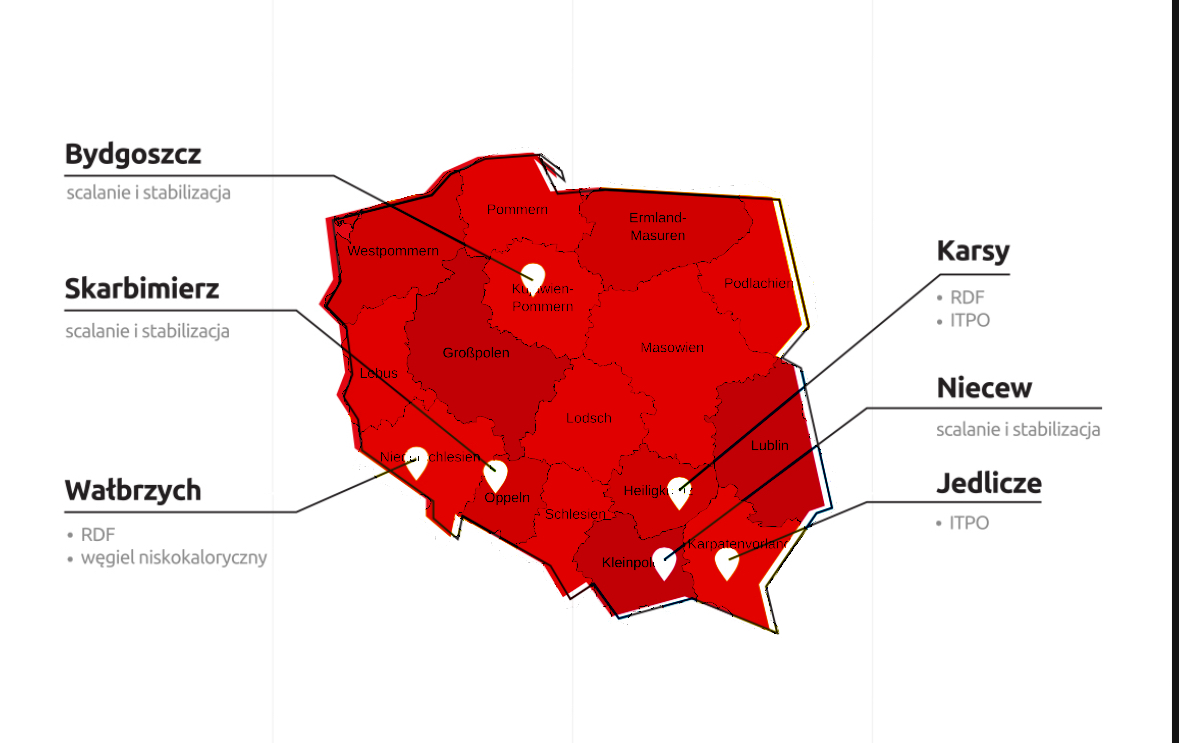

Combustion and stabilization account for around 80% of sales (~40% each), while RDF production accounts for around 20%.

Mo-BRUK used to be heavily dependent on just five customers - with the new plant in Karsy, the number has risen to 9-10, which significantly reduces the risk.

Importantly, incineration is particularly profitable - although it only accounts for 1/8 of capacity, it generates the same turnover as the entire stabilization area. This is due to the significantly higher prices for industrial and medical hazardous waste.

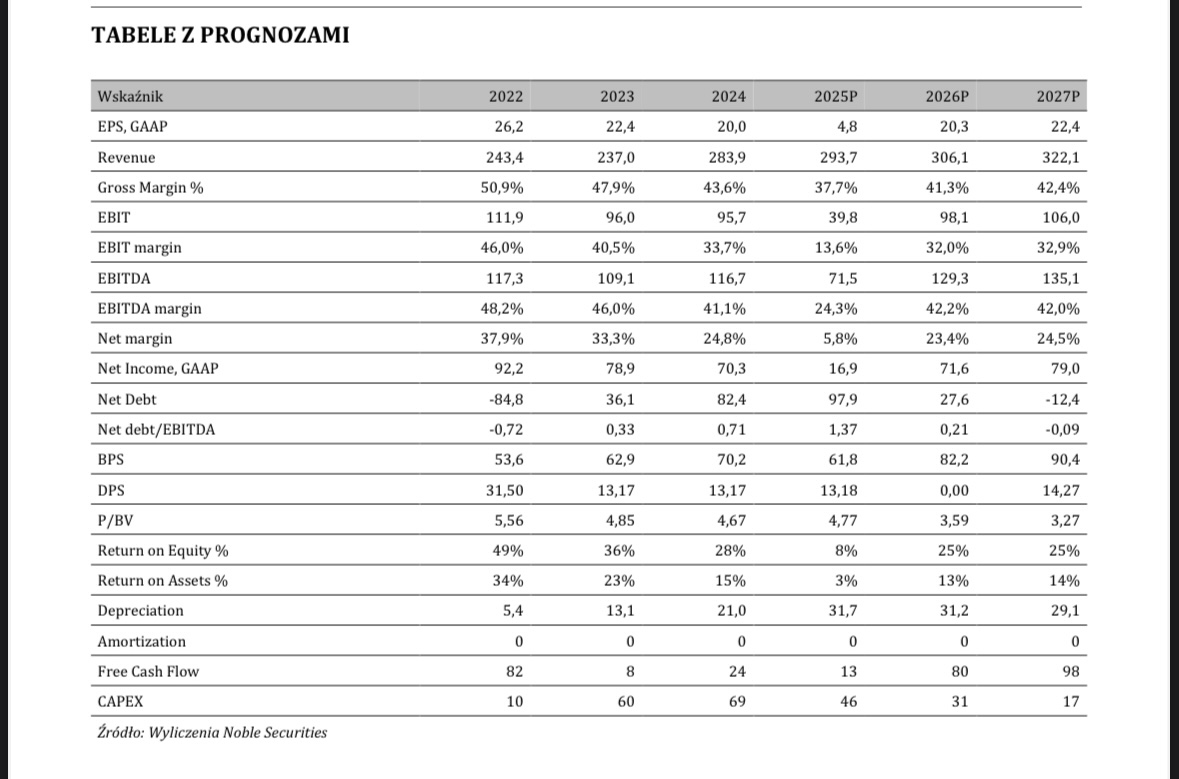

Is the drop in profits deceptive?

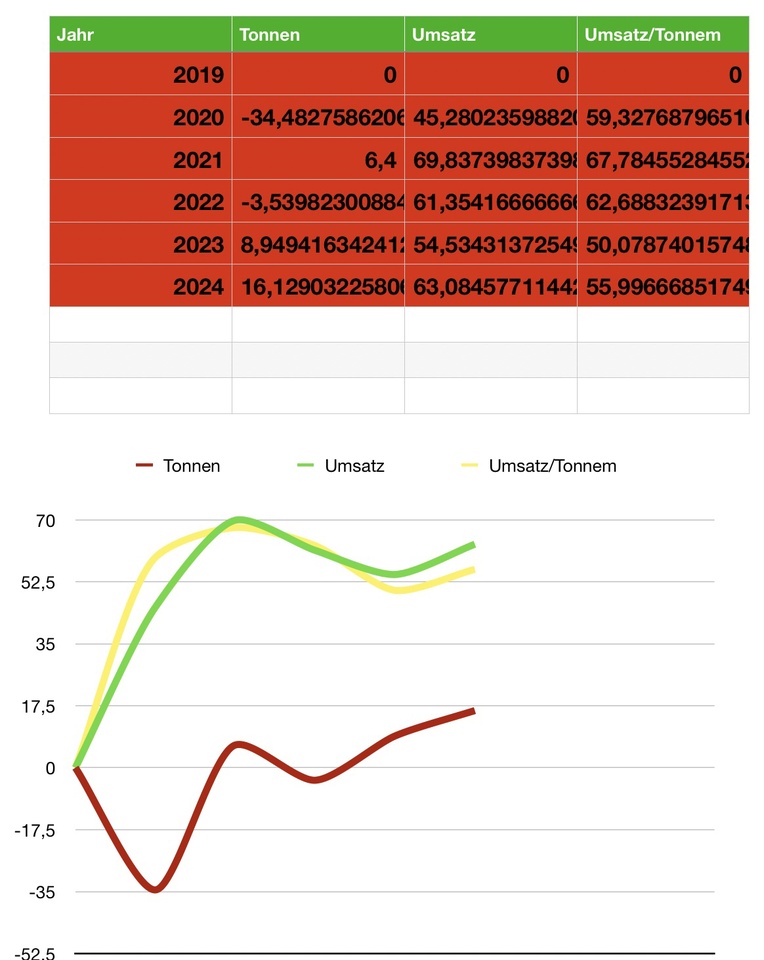

In 2024, Mo-BRUK achieved record sales of around € 61 million (+8% YoY) in its core businesses. However, the net margin fell to 24% - in previous years it was an impressive 40-50%.

Reasons for this:

- Extensive investments in new capacities (incineration +80%, stabilization +70%)

- Temporary shutdowns (e.g. closure of Wałbrzych, relocation to Karsy)

- Legal dispute regarding old fees (risk reduced to max. € 18 million - ruling expected in July)

- Acquisition of El-Kajo (95%), which will only gradually have a positive impact

The current margin weakness is therefore explainable and temporary. Even with a net margin of 24%, Mo-BRUK is one of the most profitable waste companies in Europe - Waste Management in the USA achieves around 11-12%.

Why am I invested?

Waste is crisis-proof and lets me sleep more soundly than other investments. It is a business that is easy to understand without any illumination. Regulatory complexity creates high barriers to entry, while at the same time the growing industry creates increasing demand.

Even if the pressure on margins may seem deceptive at first glance, I believe that this decline is temporary and has a more negative effect than it actually is due to deceptive coronavirus rates.

Mo-BRUK is technologically well positioned, has a diversified customer base (chemical companies, municipalities, hospitals, automotive industry) and a scalable, environmentally friendly business model:

I take waste, charge for it - and turn it into energy, fuel or building materials.

Cash in twice with other people's waste 💸

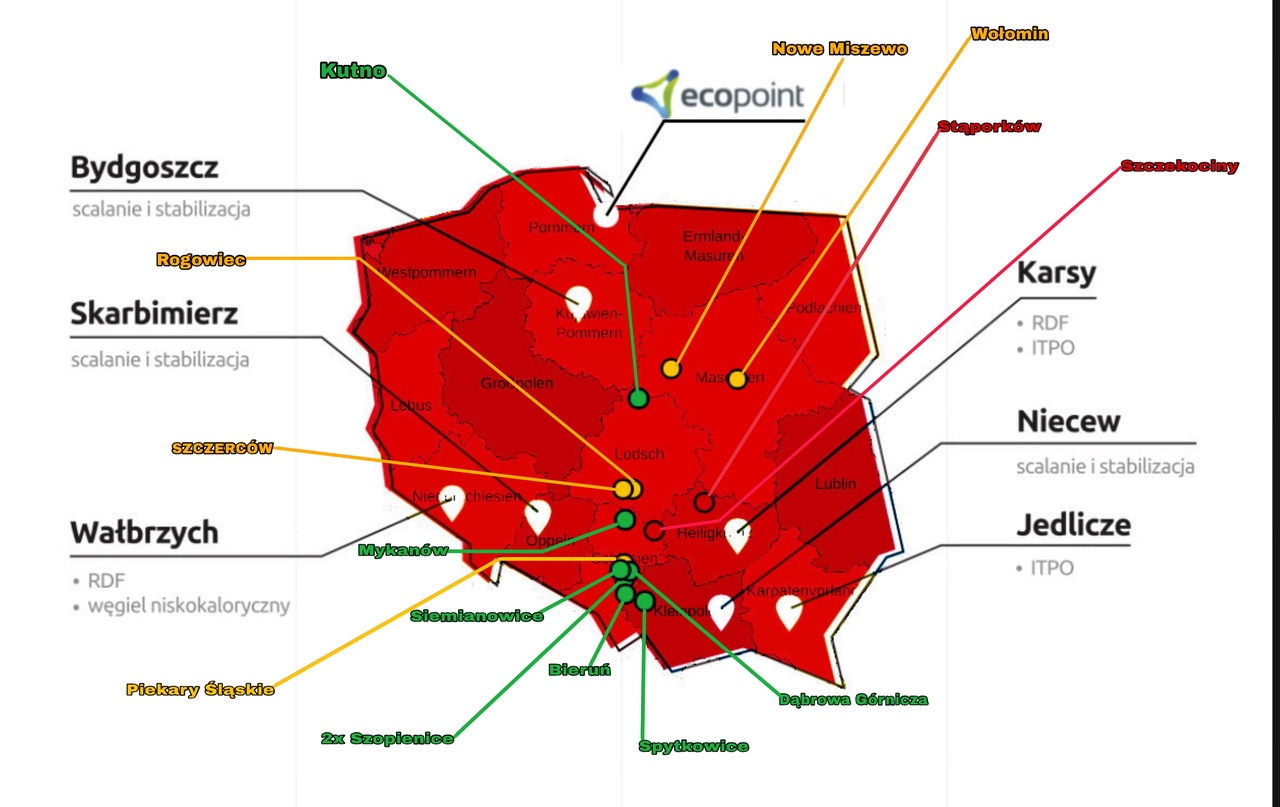

The company is expanding slowly but steadily: expanded capacities, the takeover of El-Kajo and the planned takeover of Eco Point (waste port industry in Gdansk) show that Mobruk is on the right track.

Key figures & dividend:

- Market capitalization: ~€225m

- P/E RATIO: ~14 🛍️

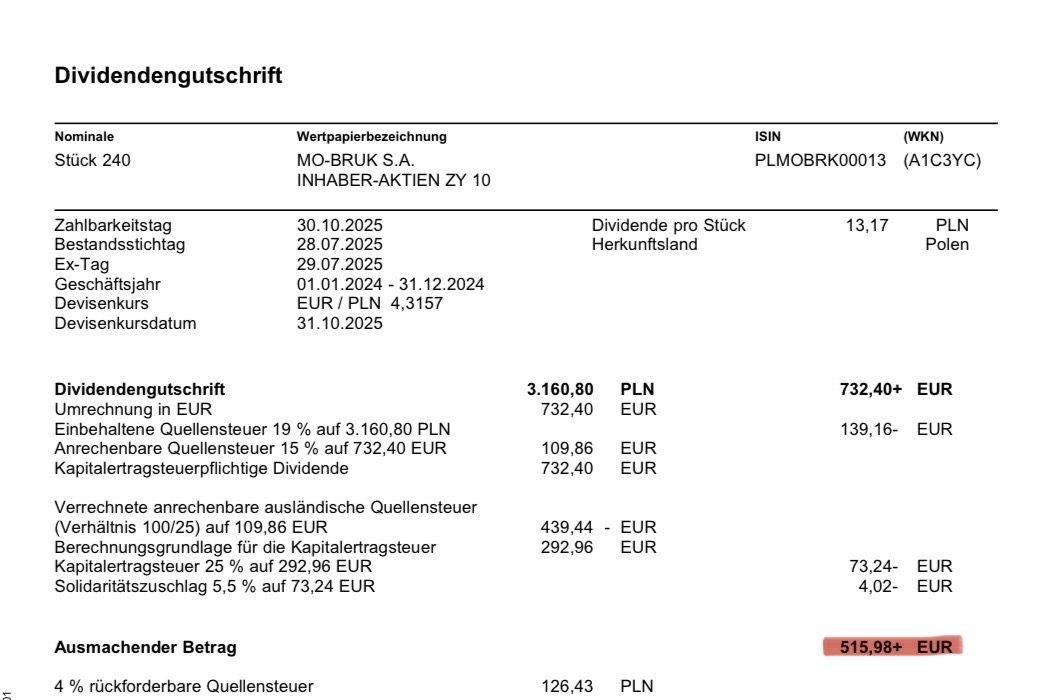

- Dividend: € 3.08/share (approx. 65% payout ratio)💰

- Shareholder structure: Mokrzycki founding family still holds 33% (partly via foundations)

The following share buy-back program is planned for the upcoming Annual General Meeting:

- 💶 Maximum amount: 125,000 shares (total of 3,512,885 ~3.56% of the share capital) / creation of a reserve fund with PLN 50 million (~€11.7 million)

- 💶 between PLN 200 and PLN 400 (~€47/~€94)

- 🗓️ until December 31, 2026

- 📬 via the stock exchange or public offer

In principle, Mo-Bruk distributes 50%-100% of the profit.

For me, Mo-Bruk is a value growth bet in a sector that has to grow structurally - whether we like it or not.

I hope I was able to arouse your interest in this garbage stock. It's my first little insight that I'm sharing here. Any suggestions for improvement are welcome!

I currently have a large position for me: 240 shares / average ~€71.

I would like to reinvest dividends in order to achieve the best possible personal dividend yield later on. 💰📈