$HITI (-0,47 %)

I haven't heard much about this stock here and, to be honest, I haven't really been interested in the cannabis stock sector so far - but now I'm in the process of building up the company alongside Rocket LAB USA $RKLB (+0,84 %) as my 2nd largest position.

The stock has already gained about +100% last year, but I firmly believe that this is just the beginning.

Background - How $HITI (-0,47 %) became the leading cannabis retailer in Canada 🥇

The beginning:

Raj Grover, the founder and CEO, who owns about 9% of the company, comes from a family of entrepreneurs and had already had success with several smaller companies before he $HITI (-0,47 %) founded the company. During a business trip to India, while looking for opportunities in fashion accessories or body jewelry, Raj came across the potential of cannabis consumption accessories. He shipped $10,000 worth of accessories from New Delhi to Canada and sold everything overnight. After repeating this success a few more times, Raj decided to open a store. This marked the beginning of the High Tide story.

In 2009, Raj opened Smokers' Corner with an initial investment of less than $50,000 and grew it into a multi-million dollar empire. At the time, there were only two or three competitors with less appealing businesses. Raj felt that by creating a differentiated business in a smart location, he could easily gain market share, and he was right. By leveraging his established roots in Indonesia, Thailand, China and India, he was able to not only provide a better customer experience, but also offer much more affordable products.

(Raj Grover, CEO of $HITI (-0,47 %) )

The legalization of cannabis in Canada:

Always striving to be one step ahead, Raj jumped at the opportunity when the Canadian Prime Minister announced that cannabis would soon be legalized for recreational use. With an existing customer base, it was only logical for Raj to expand into selling cannabis himself. He realized that if he only sold accessories, he would eventually lose customers to stores that offered both cannabis and accessories.

After nine years of focusing on consumable accessories and accumulating nearly $10 million in retained earnings, Raj raised $18.5 million for the first time in 2018 and ventured into the equity markets, marking the beginning of $HITI (-0,47 %) 's journey as a listed company. With easier access to capital compared to its peers, High Tide expanded its footprint across Canada, highlighting the significant acquisition of its competitor Meta in 2020, which increased the number of stores from 37 to 67.

The strategy shift that changed everything:

At the same time $HITI (-0,47 %) began acquiring e-commerce companies that sold accessories and CBD products (mainly oils) with higher margins - a crucial decision for the company. From the acquisition of several brands in the US, such as Smoke Cartel, FABCBD, Daily High Club, DankStop and NuLeaf Holdings, to the later acquisition of BlessedCBD in the UK, High Tide used its market power to increase margins and diversify revenue streams.

In the summer of 2021 $HITI (-0,47 %) was accepted for listing on the Nasdaq, representing a significant milestone.

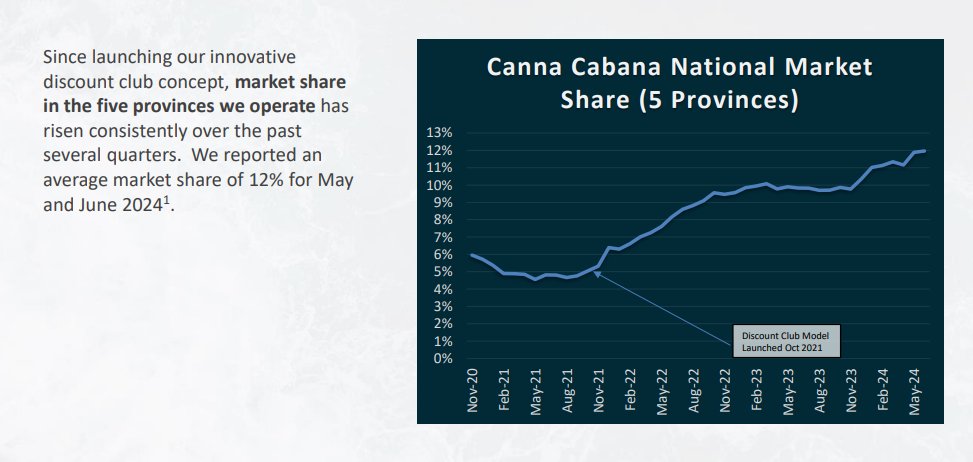

Later that year, a decision was made: High Tide introduced in October 2021 a discount club model for its retail stores. With consolidated margins higher than any competitor due to the aforementioned CBD-related acquisitions, High Tide was able to offer $HITI (-0,47 %) cannabis at remarkably low prices, attracting loyal members and quickly gaining market share.

Although this discount model initially involved selling cannabis at a loss, the move proved extremely successful. The market share of $HITI (-0,47 %) went from less than 5% to over 12% in less than three years, even though the company only accounted for about 5% of the total number of retail cannabis stores. Today, the rebate program has more than 1.55 million members and continues to grow each quarter (+41% year-over-year according to the latest report).

The first-of-its-kind rebate model was the deciding factor that $HITI (-0,47 %) made it the leading cannabis retailer in Canada. No competitor could match their prices, and Raj was targeting regular cannabis consumers who were very price sensitive.

Some of the closest competitors (e.g. Fire & Flower Holdings, Four20, Tokyo Smoke) went bankrupt after this price war. This shows how strong $HITI (-0,47 %) has become in this sector. And the market consolidation in Canada has only just begun.

This strategy has also significantly weakened the illegal market, which has further strengthened High Tide's market share.

Once the market share was captured, it was time to become profitable:

While Raj sacrificed margins to achieve this, economies of scale and several initiatives to improve margins enabled it $HITI (-0,47 %) to return to positive free cash flow in 2023 (4.3% margin TTM in the last quarter) and positive net profit in the latest quarterly figures, with a consolidated leadership position that is stronger than ever.

Overall, High Tide took a calculated risk to become the market leader in the country and it proved to be extremely successful. This success was only possible thanks to the CEO's extensive experience in the sector and his deep understanding of the cannabis consumer, which surpassed the knowledge of any other management team.

What happens now with $HITI (-0,47 %) what next?

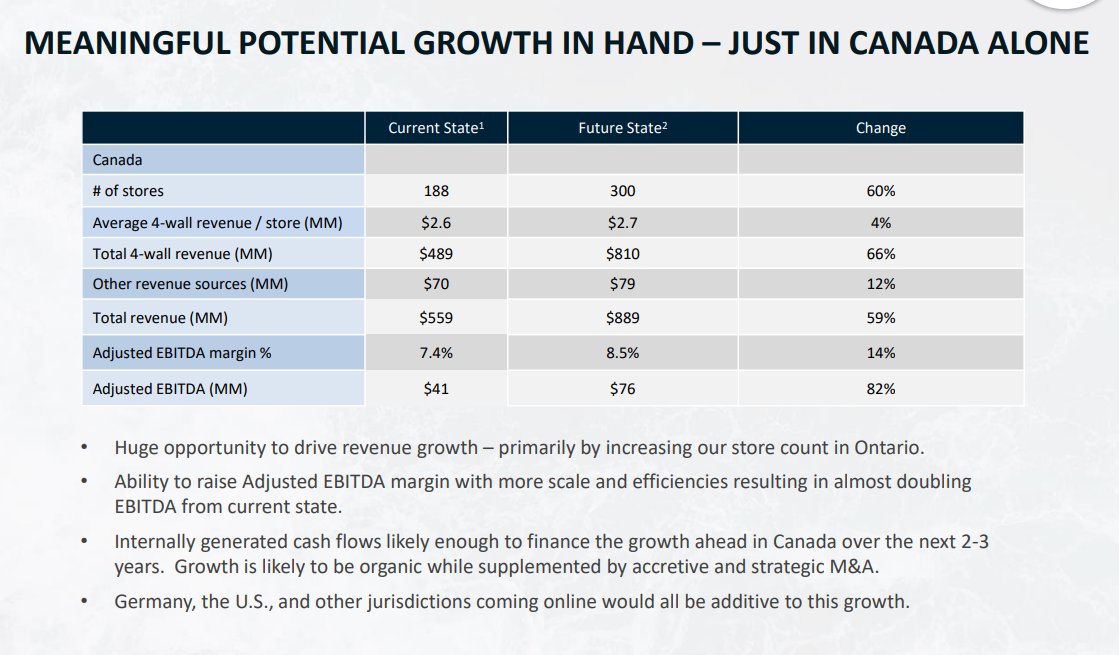

- While the focus on achieving positive free cash flow led to a notable slowdown in revenue growth, the company is now returning to its growth strategy at a rapid pace. $HITI (-0,47 %) Despite the legalization of cannabis over five years ago, there is still significant market potential to be captured in Canada.

- A recent regulatory change in Ontario now allows a company to operate up to 150 recreational cannabis stores, doubling the previous cap of 75. This change benefits large retail chains such as $HITI (-0,47 %) Raj Grover. Raj Grover has outlined plans to open 20-30 stores in 2024 (29 were ultimately opened in 2024) to capitalize on the opportunity and address the high presence of the illicit market in the region.

- High Tide recently acquired a store for 1.5x last quarter's annualized adjusted EBITDA. The CEO mentioned that he is constantly receiving calls from independent operators who want an acquisition as it is their only alternative to bankruptcy. Every month, dozens of cannabis businesses close in Canada because they simply can't compete with $HITI (-0,47 %) compete.

- This year (2025), High Tide is expected to reach a 15% market share, up from 12% today.

- Given the potential opportunity over the next 2-3 years in Canada alone, the company expects to reach 300 stores and generate at least 76 million Canadian dollars in adjusted EBITDA, with strong free cash flow.

$

- It's worth noting that these estimates are conservative, as Raj always follows the philosophy of promising less and delivering more.

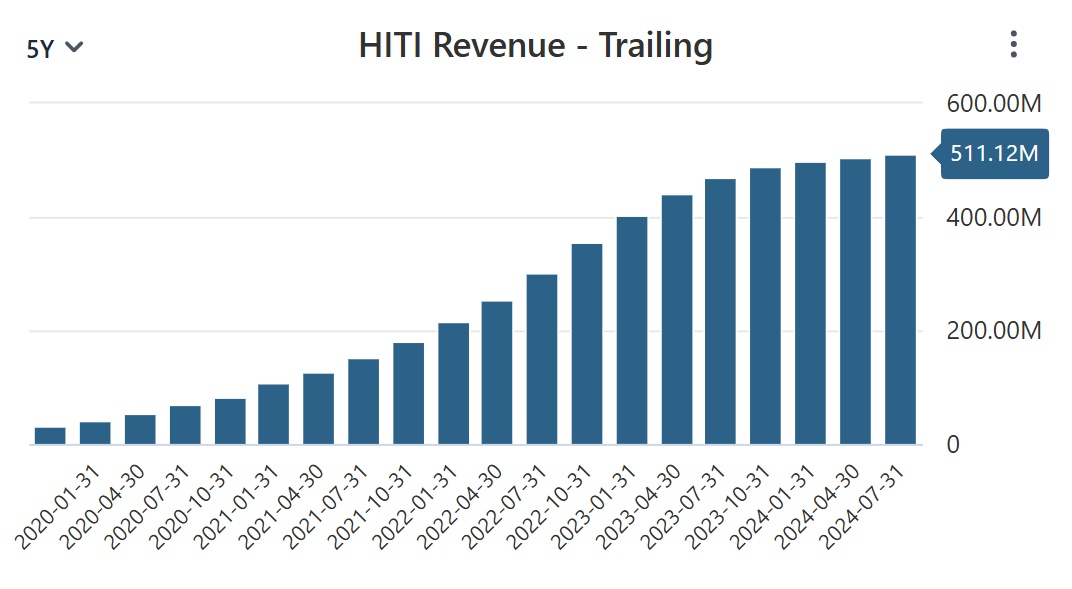

Looking at this chart, one might ask: "How does Raj return $HITI (-0,47 %) return to its high velocity growth strategy when growth has been essentially flat in recent quarters?"

Well, the growth in the number of stores is still offset by the following:

1)

Overall retail cannabis sales in Canada have declined due to macroeconomic conditions and a slight resurgence of the illicit market in certain areas (as mentioned in the last quarterly report). Despite these challenges $HITI (-0,47 %) continued to gain market share and even accelerated the pace at which it is expanding its market share as independent operators struggle to compete with prices in the illicit market. Therefore, its growth remains positive rather than negative. Importantly, recent data suggests that Canadian retail cannabis sales have begun to recover, providing a potential tailwind for future revenues.

2)

While brick-and-mortar stores have grown under these conditions, the company's e-commerce segment (which sells CBD oils, consumer accessories, etc.) has been underperforming for some time. This has kept the company's overall growth nearly flat. Excluding this segment, sales of $HITI (-0,47 %) increased by 10 % year-on-year in the last quarter. These CBD brands were critical to sustaining the initial launch of the company's discount club model in brick-and-mortar stores a few years ago. However, they are now a hindrance and are offsetting the growth of the core business. At this point, the e-commerce segment only accounts for 6.5% of total sales, so its influence is bound to diminish. Therefore, I am not worried. It is also important to note that Raj Grover recently said that $HITI (-0,47 %) is preparing to launch "an exciting and innovative set of offerings" to accelerate the momentum in this segment.

Looking to the future, I expect that $HITI (-0,47 %) will achieve high single-digit growth over the next 2-3 years based on its presence in Canada.

$HITI (-0,47 %) has never been better prepared to replicate its business model internationally.

Germany might have been just around the corner. However, that is no longer the case. The German coalition has collapsed and new elections have been called, where the CDU could win.

My thoughts:

- The downside is that we have lost a major catalyst for the company's sales growth.

- However, there are some ways to look on the bright side:

1) This expansion was not priced in, so the stock is unlikely to react to this news. No analyst had included Germany in their estimates, so $HITI (-0,47 %) is still as undervalued as it was before this news.

2) The company will continue to focus on Canada, which is doing very well. There is also potential for expansion into the US if a re-rating occurs. Simultaneous expansion into Germany and the US would require more capital than the company $HITI (-0,47 %) can currently afford.

3) Although $HITI (-0,47 %) not expanding into Germany, no other company is doing so. The market will continue to exist, and perhaps in a few years we can enter with a much stronger foundation to support that expansion.

Ongoing developments in the USA could $HITI (-0,47 %) green light for expansion there.

There are significant changes in store for the US cannabis sector. The potential reclassification of cannabis from Schedule I to Schedule III could open doors for US cannabis companies to be listed on major exchanges such as Nasdaq or NYSE, which would make it easier for institutional investors to get involved. The only reason High Tide hasn't entered the US market yet is to avoid jeopardizing its Nasdaq listing. This would finally open doors for the Canadian market leader.

Note: For those who don't know, US cannabis companies cannot be listed on the NYSE or Nasdaq, only on the OTC markets. Since $HITI only sells cannabis in Canada (and only offers CBD products or consumption accessories in the US), there is no problem. This is also one of the reasons why institutional ownership in the sector is so low.

High Tide, with its large e-commerce base of over 3 million US customers and profitable business operations, is poised to capitalize on these developments. Raj Grover's strategic approach as a second mover allows it to avoid pitfalls and strategically open stores in key states. The company is ready to build on its strong foundation and scale efficiently, with the goal of securing a significant market share with well-chosen locations and a clear expansion strategy.

Most US operators struggle to become profitable, even with gross margins in the 40-50% range, while $HITI is profitable in both free cash flow and net income, with a gross margin below 30%.

Although the company is not reliant on the US market for further growth, this provides an additional catalyst for its upcoming growth strategy.

Whether this expansion is rapid or not, these developments will attract a wave of new investors into the sector and contribute to an overall expansion of multiples.

Donald Trump

Since Trump's victory, there has been widespread panic about cannabis stocks. However, I believe this reaction is overblown and Trump is not bad for the sector at all.

Yes, Kamala Harris had promised to legalize marijuana if elected, so it's understandable why the market was betting on her victory. But when you get right down to it, the main catalysts for cannabis stocks remain cannabis reauthorization and the SAFE Banking Act. Back in September, Donald Trump publicly expressed his support for both developments.

Since his election, Trump has also made several pro-cannabis decisions within his team, including the appointment of Robert Kennedy Jr. as US Secretary of Health and Human Services and Chad Chronister as DEA Administrator. These decisions suggest that the policy environment under his administration may be more favorable for cannabis reform than many originally thought.

I believe cannabis stocks are at or very near the peak of pessimism, making this an excellent time to build a position.

to build a position.

However, most companies are not prioritizing the creation of shareholder value, with $HITI (-0,47 %) stands out among them. The company has shown strong relative performance following the US election, mainly because it is not reliant on new legislation to drive its growth and profitability. This resilience positions it well for the future, regardless of political outcomes.

High Tide becomes the Costco Wholesale $COST (+1,91 %) of cannabis!

The new paid membership further solidifies the position of $HITI (-0,47 %) as the market leader in Canada.

Following the success of its free discount model, which gained over 1.5 million members in less than three years, the$HITI (-0,47 %) i ELITE a paid membership with even better offers.

The launch started slowly, but membership is now growing at a record pace - 203% year-on-year in the last quarter. 🔥

It is remarkable that this growth is taking place while the subscription price is being increased.

Although the absolute number is still relatively small at 57,000, the conversion rate from regular Club members to ELITE members is improving every quarter. You only have to make a small purchase for the membership price to pay for itself - it's just like $COST (+1,91 %) .

In the last quarter, the proportion of ELITE members compared to regular members grew year-on-year from 1.7% to 3.7%.

The long-term vision is for High Tide to become the $COST (+1,91 %) of cannabis, generating strong and predictable cash flows and strengthening High Tide's competitiveness.

I believe this is one of the catalysts that will $HITI (-0,47 %) will help to further improve margins at the bottom line.

White label products will also play a critical role in improving $HITI's margins, but this will take time.

$HITI (-0,47 %) has a long-term goal of filling 20-25% of all in-store offerings with it.

This is an important catalyst that will contribute significantly to a gradual increase in gross margins.

The company is keeping margins stable, given the resurgence of the illegal market in Canada (more than 200 illegal stores have opened this year). This is the main reason for the overall decline in sales in the market. In areas where the illicit market has grown more, $HITI has recently reduced margins by 5-7% in order to remain competitive. However, this is not expected to be a long-term problem, especially as provincial governments begin to take action (e.g. a $31 million bill passed in Ontario to combat the problem).

The average revenue of a Canna Cabana store in the country in June 2024 was at an annualized revenue rate of $2.6 million compared to $1.0 million for competitors in the five provinces in which we operate.

- Average gross margin per store: 25%

- Average EBITDA margin per store: 12%

- Average cost of building a new store: USD 260,000

- Average amortization period: 10 months

This cost-effective model enables $HITI (-0,47 %) to expand organically by using its free cash flow instead of relying on external financing.

The same business revenues of $HITI (-0,47 %) have increased by 118% since the end of the 2021 financial year, when the discount club model was introduced.

In contrast, total sales in the five provinces in which it operates have increased by only 12% over the same period, meaning that the same store sales of the average operator have fallen by 21%.

High Tide's competitors are being completely overtaken.

$HITI (-0,47 %) is one of the few cannabis companies that can secure non-dilutive financing. This happened recently, but it was not the first time.

This is notable considering how reluctant lenders are to fund cannabis companies in Canada, where many companies have suffered bankruptcies when capital dried up, including major players backed by billionaires.

However, this funding comes with strict strings attached. Smart dilution may be necessary from time to time to differentiate from competitors and strengthen the company's long-term position, but is never done unnecessarily.

Founder & CEO Raj Grover, the largest shareholder, is the most affected by any dilution that takes place. He has already said that it will only happen at this low price if it increases the margins of $HITI (-0,47 %) and adds to the portfolio of stores/brands.

It is also worth noting that according to Raj $HITI will never be over-leveraged. His father was a small business owner and always taught him to prepare for the "what ifs".

$SNDL (-2,36 %) could pose the biggest threat to $HITI, but I'm not worried about their poor management team.

While the strategy of $SNDL (-2,36 %) acquiring distressed companies at depressed prices seems smart, they often struggle to make these companies profitable. In contrast, $HITI targets failing companies with promising locations to turn them around, and not just because they're cheap.

The attempts of $SNDL (-2,36 %) to diversify into different segments like alcohol has diluted their focus and effectiveness. They are no longer even a cannabis company, as the majority of their revenue comes from alcohol sales.

Despite their aggressive cash position, their mismanagement makes them less of a threat.

Despite the fact that $HITI (-0,47 %) being a relatively low margin retailer, gross and FCF margins (~8% high so far) still have room for further growth.

Cannabis prices in Canada are just beginning to stabilize and $HITI is waiting for the market to fully stabilize before aggressively launching white-label products. While many independent operators are closing and the market is consolidating, $HITI is not yet raising prices to avoid taking advantage of competitors. The long-term strategy is to leverage pricing incrementally.

Valuation

$HITI (-0,47 %) is the most superior cannabis company, but one of the cheapest.

Retail investors in Canada have lost more than $130 billion since the bubble burst in 2017 alone, so I understand why everyone is cautious in this sector.

But I've shown how $HITI stands out from the most well-known cannabis companies like $WEED (+0,38 %) , $TLRY (+1,89 %) and others. High Tide generates strong free cash flow and has a track record of consistently impressive execution.

Most importantly, it has a strongly aligned management team that cares about shareholders, which is rare in this sector.

The fact that this sector is at the height of pessimism makes it possible,$HITI (-0,47 %) i to buy at such a favorable valuation.

It's also worth noting that $HITI, unlike the other companies mentioned, entered the market late and was not part of the 2017-2018 bubble. That's why it's so underappreciated and most people don't even know about it.

Let's look at the numbers.

$HITI has generated $22 million CAD in free cash flow over the last 12 months, which means the company is currently valued at 16x LTM FCF. It's worth noting that this was the first full year of FCF profitability, so this number should improve significantly from here.

Since most cannabis companies are not FCF positive, we use EV/EBITDA as a proxy.

$HITI (-0,47 %) is trading at about 7 times adj. EBITDA. Importantly, adj. EBITDA is up 41% year-over-year in the last 12 months. It is astounding that it is trading at such a low multiple.

I expect the company to generate adj. EBITDA of CAD 90 million in 2027, which at a 15x multiple would provide almost 300% return on the current valuation. This estimate excludes potential international expansion, which I believe will happen soon in the US.

The discrepancy is huge when we look at other cannabis stocks listed on the Nasdaq. For example $TLRY (+1,89 %) trades at almost 30 times, $ACB (-0,33 %) at 12x (this company has restructured its business but is more focused on medical/premium cannabis), and $WEED (+0,38 %) is not even EBITDA positive.

High Tide is the best performing cannabis company and one of the few already generating both FCF and net income, but remains the cheapest.

Faster growth + better margins + a superior management team + a profitable business model + the lowest valuation = an absolute bargain price, at least from my perspective.

While most investors avoid this sector because of the well-known companies that destroy shareholder value, I am taking advantage of this opportunity by investing in what I believe is a hidden gem.

Signs that the bottom is behind us:

- The recent acquisition of Nova Cannabis by $SNDL (-2,36 %) at a low valuation multiple may have highlighted how undervalued $HITI is. Nova Cannabis was one of High Tide's few competitors, but has lost direction under the ownership of $SNDL. This acquisition occurred at an EV/TTM sales multiple of 0.55-0.6, while $HITI, a more established and superior company, was valued at 0.4x. Similarly, $HITI's EV/TTM gross profit multiple is 1.4x and differs significantly from Nova's 2.4x. This discrepancy shows that $HITI is undervalued and the market already recognizes this.

- After Trump's victory, which has put the entire cannabis sector (including $MSOS , $WEED (+0,38 %) , etc.) to a significant decline, the performance of $HITI remained strong. Despite the double-digit decline across the sector, $HITI has maintained a significantly higher value compared to pre-news prices. This resilience suggests that $HITI is too cheap to be ignored and the market is starting to recognize this.

Before concluding this post, I would like to point out the following:

$HITI (-0,47 %) $HITI has less than 11% institutional ownership, while over 75% of the market is held by institutions.

Peter Lynch talks about this a lot. If you want multibagger returns, find a hidden gem before the institutions do.

I think that's exactly the case here. I'm not going to sell it at 100% or 200% profit as I think it has the potential to become a billion dollar company soon.

Of course, this assumes that execution continues as it has been.