Hi all

here's some info on my strategy, it's core-satellite method

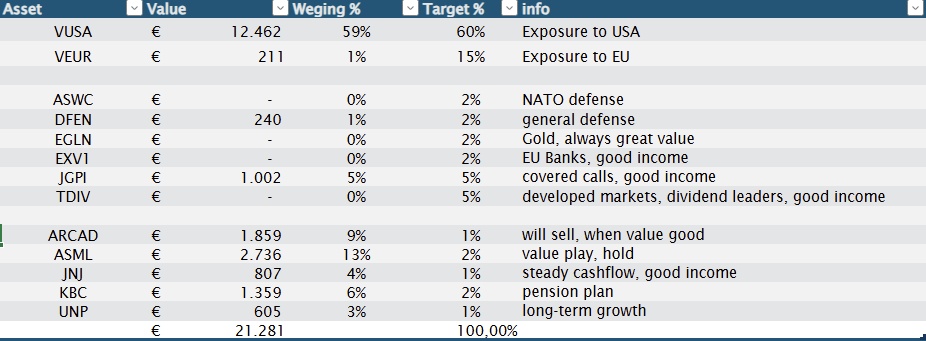

ETF's is the biggest part with

Core:

$VUSA (+0,68 %) & $VEUR (+0,03 %)

Satellite:

$ASWC (+0,42 %) & $DFEN (+0,9 %) as Defense investing, due to EU pulling 5% of GDP with 2030 target

$IGLN (-1,04 %) for the gold exposure, minimizing downtrend when markets drop

$JEGP (+0,44 %) to make use of market volatility as source of income

$TDIV (-0,37 %) past performance is great, dividends of 3-4% always nice income

Individual stocks: mostly dividend stocks as we can deduct €240-region of dividend income of those indidual stocks, sadly not of ETF's.

$$KBC (-3,67 %) is marked as pension plan. I do work for KBC and once a yearn i can buy stocks and deduct some of it from my taxes, also buying on cheaper prices.

$UNP (+0,92 %) will be a good long-term hold as america is still the biggest, and with trump it should have some long-term growth in it.

$ARCAD (-2,07 %) is a value play, aiming to sell around €58, but in meantime, giving dividend to deduct taxes.

$JNJ: (-0,16 %) always good to have this one, great long-term hold and steady source of dividends

$ASML (+1,23 %) : love this stock, it's a monopoly and is growing strongly, keeping this as long as i like the progress