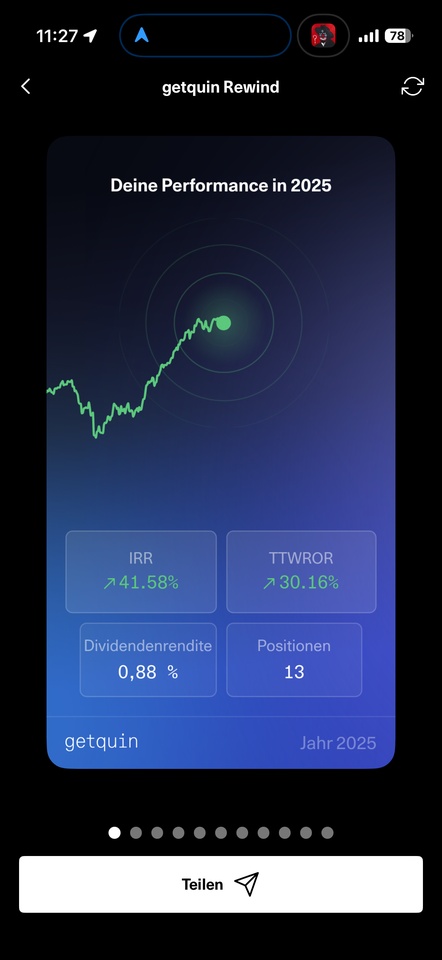

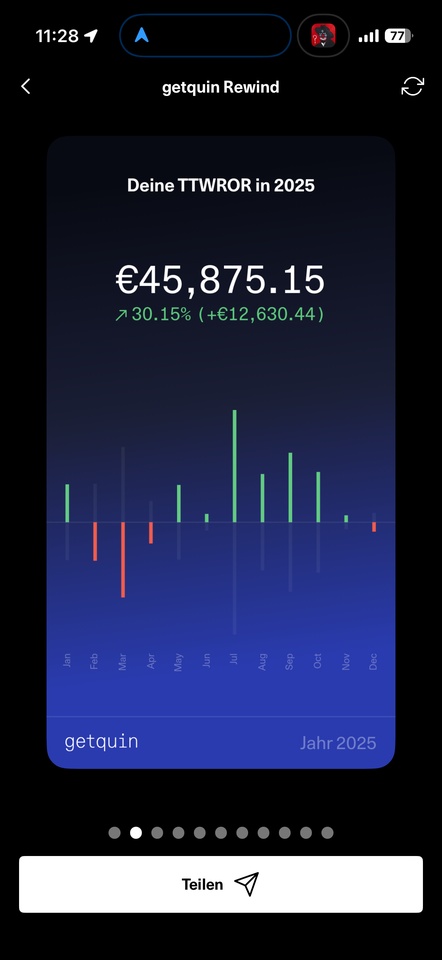

The year is coming to an end and for me personally it was the strongest year since I started investing 3 years ago.

There were many very red days, but of course also many very green days. The most important thing for me: no matter what happened, I stuck to my strategy.

My returns were not only generated by my savings plan, but also by making active decisions over the course of the year. I consistently invested several hundred euros a month through my savings plan. Mainly in ETFs such as the $IWDA (-0,44 %) and $IUIT (-2,31 %), supplemented by individual stocks such as $AAPL (-0,5 %)

, $PEP (+0,37 %) or also $ASML (-4,02 %) .

I also bought additional shares on strong sell-off days. There have been a few of those this year 😅

If you take a look at my portfolio, you can see that I like to invest in large, high-quality companies that have temporarily come under heavy pressure. I deliberately focus on a rebound. Examples of this are $UNH (+1,26 %)

, $MC (+0,29 %) , $ASML (-4,02 %) and $GOOGL (-1,37 %) , which were undervalued for me at the time.

This year I also invested in crypto for the first time: bought several $ETH (-2,7 %) for around 2k and later sold them completely at around 3.2k. ( A bit of luck definitely played a part in that :D )

All in all, it was an extremely exciting year from which I learned a lot and was able to take a lot with me.

Companies that I currently find interesting and am already invested in are: $ADBE (+0,71 %)

, $SBUX (+0,65 %) and $UPS (+1,95 %)