Depotrückblick February 2024 - Can the stock market only go up?

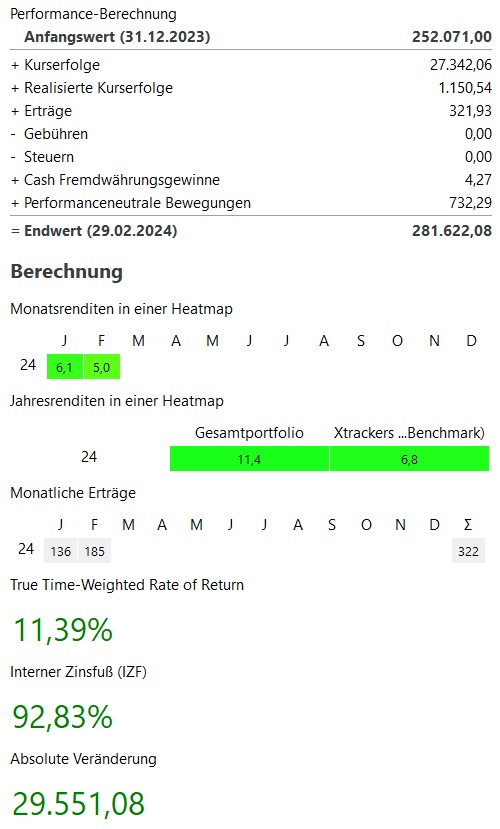

After November was the second-best November and December and January also joined the ranks, February 2024 is of course the second-best February for me since 2013.

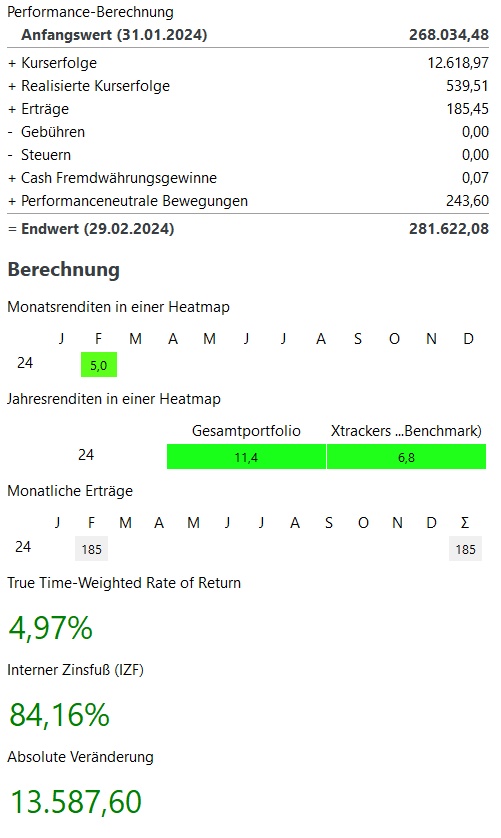

In total, February was a strong +5,0%! Only February 2014 was even better at +8.1%. In total, this corresponded to price gains of ~13.000€ in February 2024.

In the current year, my performance is currently +11,4% and thus significantly above my benchmark, the MSCI World with "only" 6.8%.

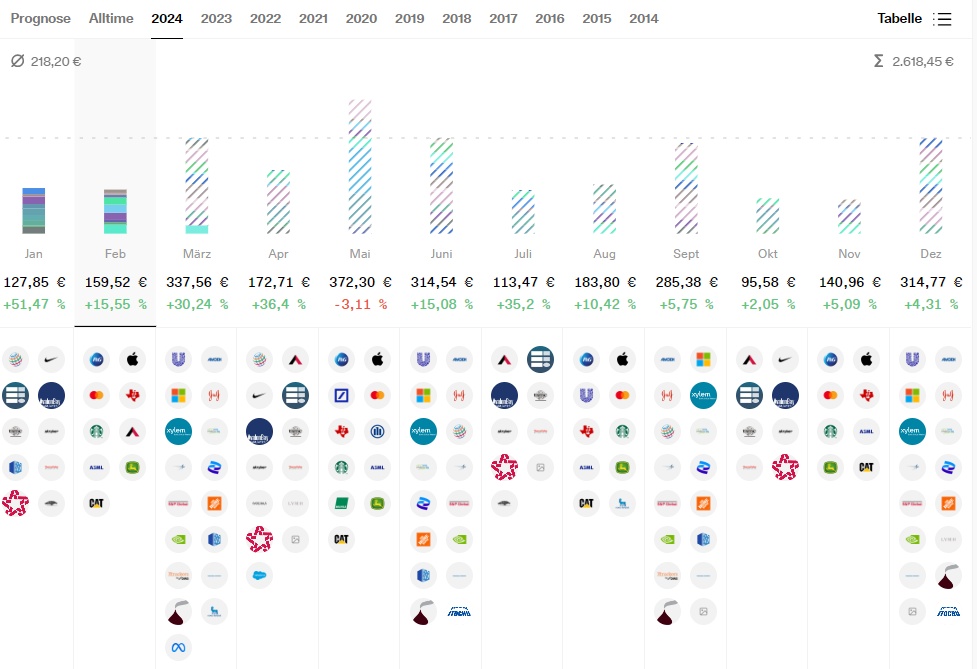

Winners & losers:

The development of the winners and losers in February is particularly exciting, as not every tech stock is up and running.

On the winners' side the monthly groundhog called NVIDIA

$NVDA (+0,44 %) with share price gains of ~€3,600. But also Bitcoin $BTC (+0,58 %)

and Ethereum

$ETH (+1,91 %) were also at the forefront with price gains of almost €2,000 each. The top 5 close Meta

$META (+0,95 %) and TSMC

$TSM (+1,05 %) complete the top 5.

But also on the loser side there is a lot of tech. With Palo Alto Networks $PANW (+0,87 %)

Atlassian $TEAM and MercadoLibre $MELI (+0,6 %) however, mainly high growth tech stocks.

In addition Alphabet $GOOG (+0,8 %) and Amgen $AMGN (+0,49 %)

were weak.

The performance-neutral movements in February were only €200. Even though I bought in for ~€1,300, I sold 5 NVIDIA shares for ~€3,000 on the other side. You can find the reasons for this in the post from mid-February. I needed part of the €3,000 for private expenses and the rest is currently in the clearing account as cash.

In total, my custody account now stands at ~282.000€. This corresponds to an absolute increase of ~€30,000 in the current year 2023. ~27.000€ of this comes from price gains, ~330€ from dividends / interest and ~700€ from additional investments.

Dividend:

- Dividends in February were +16% above the previous year at ~€160

- In the current year, dividends after 2 months are +23% over the first two months of 2023 at ~275€.

- After already Meta

$META (+0,95 %) announced its first dividend last month, this will be followed in April by Salesforce $CRM (+0,68 %) with its first dividend payment. In addition to the high-tech growth stocks, where I do not expect a dividend for some time yet, I am now particularly interested in Alphabet in particular.

Buys & sells:

- I bought in February for approx. 1.300€

- As always, my savings plans were executed:

- Blue ChipsAlimentation CoucheTard $ATD Alphabet $GOOG Amgen $AMGN Caterpillar $CAT Hershey $HSY Johnson & Johnson $JNJ Procter & Gamble $PG S&P Global $SPGI TSMC $TSM

- GrowthBechtle $BC8 Synopsys $SNPS (+1,07 %)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP

- CryptoBitcoin $BTC and Ethereum $ETH

- Sales as already mentioned above, there was only a partial sale of NVIDIA in February

It's really exciting to see how the snowball has started to roll. I was only able to add €700 net to my portfolio in January and February, yet my assets have increased by almost €30,000 compared to the end of 2023.

Nevertheless, I hope that performance-neutral movements of at least €1,000 per month will be possible again from March onwards.

Target 2024:

My goal for this year is to break €300,000 in my portfolio. As my portfolio already stands at €282,000 as of February, I am well on my way.

I very much doubt that the stock markets will continue to rise so strongly and will soon enter a sideways trend. If my net inflows then increase again, I am optimistic that I will reach my target by the end of the year.

What are your expectations for March? Full speed ahead or will there be a sideways movement for the time being?

And which company have you been waiting a long time for a dividend? Berkshire, Amazon and Alphabet or someone completely different?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy