At 54 billion euros, the 40 companies listed in Germany's leading index, the Dax, paid out as much to their shareholders this year as in the previous record year.

However, only 21.7 billion euros of these dividends, three percent less than in the previous year, went to domestic investors. 26.9 billion euros were transferred abroad. That was 2.4% more than a year ago and more than ever before.

52.6 percent of shares in the top listed companies are in the hands of foreign investors. Only one third of Dax shares are still held in Germany - almost one percentage point less than in the previous year. Around 14 percent of shares cannot be clearly allocated to a specific region.

This is shown by a recent study by management consultants EY, which was made available to Handelsblatt in advance. According to the study, 24 of the 40 DAX companies, three more than in the previous year, are predominantly held by foreign investors.

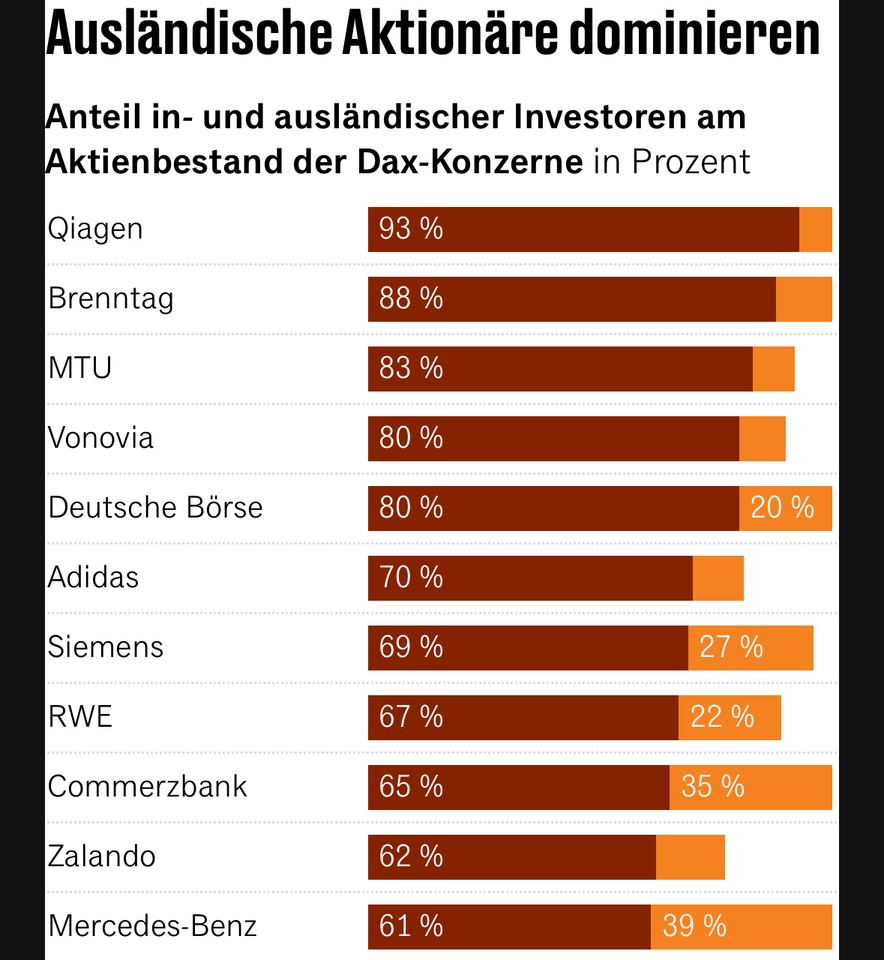

The highest foreign share is held by diagnostics specialist $QGEN (-1,73 %) Qiagen with 93 percent, followed by the chemicals trader $BNR (-2,75 %) Brenntag with 88 percent. The aviation supplier $MTX (-1,45 %) MTU , the real estate group $VNA (-3,13 %) Vonovia and the Frankfurt stock exchange operator $DB1 (+3,43 %) Deutsche Börse, four out of five shares are held in foreign portfolios.

The highest transfer abroad was made by $ALV (-2,6 %) Allianz. The insurer, 58 percent of whose shares are held outside Germany, paid dividends of just under 3.5 billion euros to foreign investors after its Annual General Meeting on May 8. Just under 2.5 billion euros flowed into the accounts of German investors.

The industrial group $SIE (-3,54 %) Siemens, the car manufacturer $MBG (-0,89 %) Mercedes and the telecommunications provider $DTE (-0,53 %) Deutsche Telekom each transferred more than two billion euros to foreign investors. The shares of all four companies have been among the highest dividend-paying stocks in the DAX for years: measured in terms of the absolute amount, but also in terms of the yield and reliability of the distributions.

US investors in particular have significantly increased their exposure to the top German companies in recent years, while at the same time investors from other European countries have become more cautious: Since 2010, the proportion of North American investors in those DAX companies for which corresponding time series are available has risen from 17.1 to currently 25.4 percent. The proportion of European investors, on the other hand, fell from 25.7% to 22.9%.

Henrik Ahlers, Chairman of the EY Management Board, sees the strong commitment of foreign investors as "proof of the continued attractiveness of top German companies and the trust that these companies enjoy worldwide". Although the problems of Germany as a business location are well known, "most DAX companies are now so strongly positioned worldwide that Germany is just one of many markets".

According to Ahlers, the recent good share price performance also testifies to the trust that top German companies continue to enjoy worldwide. It proves the reputation and credibility of major German corporations on the global market.

Source (excerpt) & graphic (excerpt): Handelsblatt, 04.08.25