DA Davidson Downgrades $ELF (-2,11 %) to Neutral from Buy, Lowers PT to $80 from $170

"ELF is still a best-in-class company, but we're lowering our rating to Neutral from Buy due to uncertainty over how long the POS slowdown will last. Our near-term concerns include: (1) tariffs; (2) higher mass beauty promo levels; (3) spending for expansion and ERP roll-out; and (4) innovation that is iterative, in our view.

We're cutting our FY26-FY27 sales growth forecast to +5%-6% from +12% and EBITDA growth to +5% from +15%. We think EBITDA margin could stay flat at 22%. Valuation could undergo a further protracted re-rating, and we're lowering our target multiple to 15x from 26x and PT to $80 from $170, based on 15x CY26E EBITDA of $314 million (reduced from $375 million)."

Analyst: Linda Weiser

$MS (-1,58 %) - Morgan Stanley Downgrades $ELF (-2,11 %) to Equalweight from Overweight, Lowers PT to $70 from $153

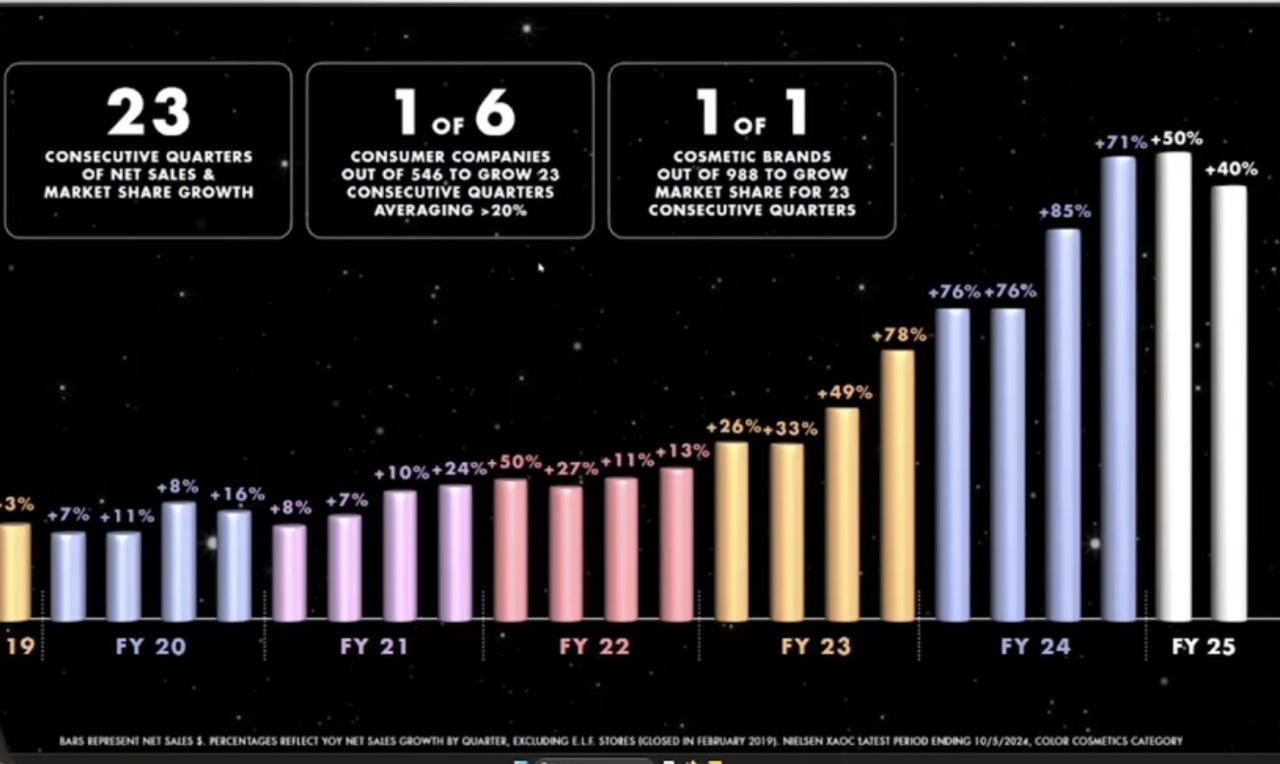

Analyst comments: "We are downgrading ELF to Equal-weight post Q3 results last night, which were overshadowed by ELF lowering implied Q4 guidance significantly, confirming January US scanner data weakness. We recently upgraded ELF after a prior sharp stock pullback as trends had leveled off in CQ4 of 2024 and ahead of easier comparisons in 2025, but that call has proved clearly wrong with weak January scanner data, confirmed by lower ELF FQ4 guidance after FQ3 results.

While the stock has already pulled back significantly and further after-market last night, the reality is beauty trends tend to be volatile in a fashion-oriented category. ELF's recent deceleration has also been driven both by category weakness and weaker ELF share after an outsized increase over the last couple of years, with less robust innovation contribution so far in 2025, which had been key to ELF's historical success. The January slowdown also comes despite easier comparisons and is large in magnitude, and ELF's small size and volatile (albeit strong) track record exacerbates risk, even though the slowdown so far is related to a short time period.

We also note that ELF velocity was significantly negative in January (see data below) and growth solely centered in the lip category (again see below), with the narrowness of growth increasing ELF's risk profile."

Analyst: Dara Mohsenian

UBS Downgrades $ELF (-2,11 %) to Neutral from Buy, Lowers PT to $74 from $158

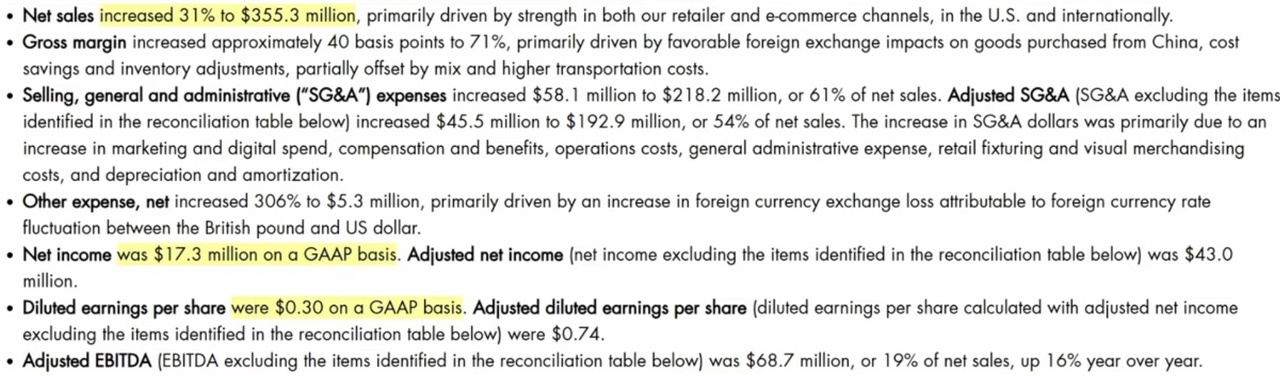

Analyst comments: "ELF shares are down nearly 30% over the last month due to a sharp deceleration in U.S. tracked trends. The company’s 3Q results and updated outlook suggest that this slowdown may continue, with growth potentially moving into the single-digit percentage range for the first time in four years.

Bulls may argue that this deceleration is already priced in given the share price reaction, but with uncertainty around the growth trajectory, we believe recent historical valuation may no longer be relevant. As seen with other growth names (SAM, CELH, etc.), valuation multiples can compress significantly if long-term growth expectations are questioned.

Beyond the top line, a key component of our previous bull thesis was outsized leverage driving strong EPS growth even as sales normalized. However, with a slowing sales backdrop—and before considering any tariff impacts—we now see less room for meaningful bottom-line expansion, modeling +11% EPS growth in FY26 (down from +20% prior). If we gain more clarity that this slowdown is only a short-term dynamic, we would revisit our thesis, but for now, we believe it is prudent to move to the sidelines."

Analyst: Peter Grom