- EPS: $0.74 (Est. $0.76) ❌

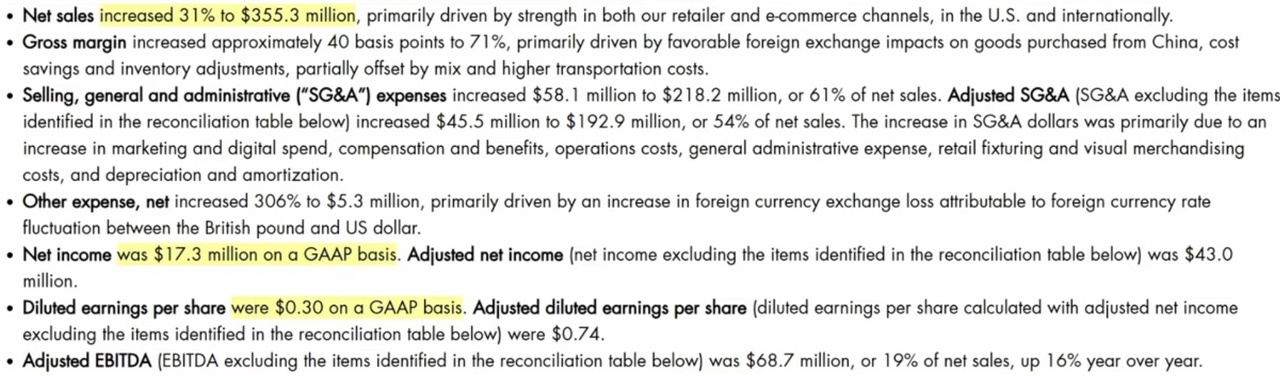

- Net Sales: $355.3M (Est. $329.67M) ✅ ; UP +31% YoY

Updated FY25 Guidance (Revised Downward):

- Net Sales: $1.30B-$1.31B (Prev. $1.315B-$1.335B) ❌

- Adjusted EBITDA: $289M-$293M (Prev. $304M-$308M) ❌

- Adjusted Net Income: $193M-$196M (Prev. $205M-$208M) ❌

- Adjusted EPS: $3.27-$3.32 (Prev. $3.47-$3.53) ❌

- Adjusted Effective Tax Rate: 19-20% (No Change) ❌

Other Key Metrics:

- Gross Margin: 71% (Est. 71.15%) ; UP +40 bps YoY

- SG&A Expenses: $218.2M (Est. $175.43M) ; UP +36.3% YoY

- Adjusted SG&A: $192.9M (54% of net sales)

- Net Income: $17.3M (Est. $44M)

- Adjusted Net Income: $43M

- Adjusted EPS: $0.74

- Adjusted EBITDA: $68.7M (Est. $72.57M) ; UP +16% YoY

Comment from the CEO and CFO:

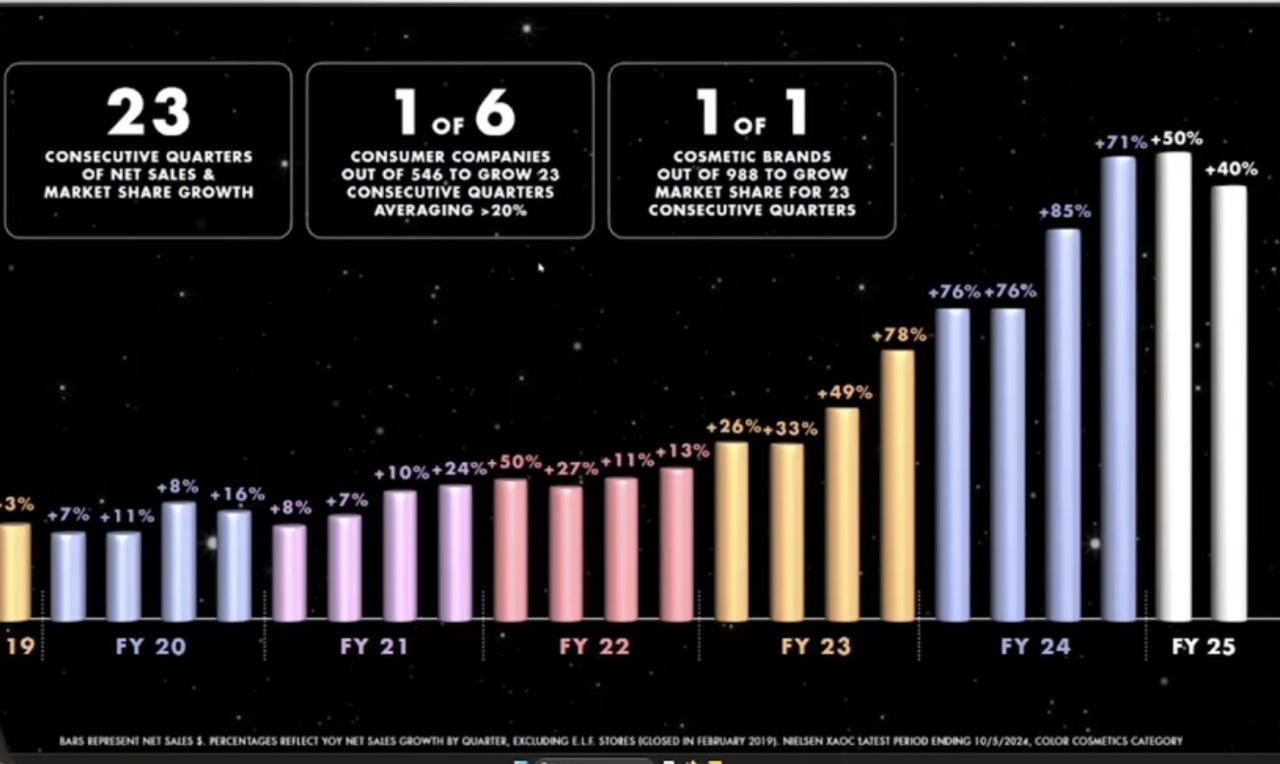

- CEO Tarang Amin: "We continue to gain market share, with net revenue growth of 31% and market share gains of 220 basis points in the US. We see significant new territory opportunities in digital, color cosmetics, skincare and international markets."

- CFO Mandy Fields: "Given the weaker than expected trends in January, we are taking a cautious approach and lowering our outlook for the 2025 financial year."

$OR (+1,45 %)

$COTI (+1,33 %)

$EL (+0 %)

$MC (+1,66 %)

#earnings

#quartalszahlen