Hello my dears,

due to the low acceptance and the few 👍, I actually wanted to do without my series of company presentations. But now I'm doing another company presentation for the dear one today @BamBamInvest . Of course, I've picked out a company from Austria for him. To inspire him a little, I have focused on three-digit profit growth.

My dear @BamBamInvest I look forward to your assessment in the comments.

Everyone else is of course also invited.

AT & S Austria $ATS (-1,19 %)

AT&S: High-tech substrates as a key component of the AI era and beneficiary of the Intel renaissance!

AT&S as one of the world's leading manufacturers of high-end printed circuit boards and IC substrates, supplies the physical skeleton on which microchips are enthroned. The structural growth drivers are the shift from monolithic designs to complex chiplet architectures. Compared to 2019, server ICs will require 4 times the net area and 8 times the production capacity by 2025. Without these highly complex substrates, the computing power of modern processors would remain unused. The disadvantage is that AT&S will always have to invest heavily in order to remain competitive.

The Austrian company AT&S is now one of the top gainers on the stock market. The Austrians report: "Data centers and servers remain the drivers: Demand here remains stable. High-quality products developed for artificial intelligence are particularly in demand. The trend towards high-quality IC substrates is also continuing here, from which AT&S will continue to benefit." The high-tech substrates are indispensable as central key components of modern AI chips.

AT&S - Austria Technologie & Systemtechnik is the European market leader in the manufacture and sale of printed circuit boards.

AT & S Austria: Microelectronics patent leader sets new impulses through electromobility and defense

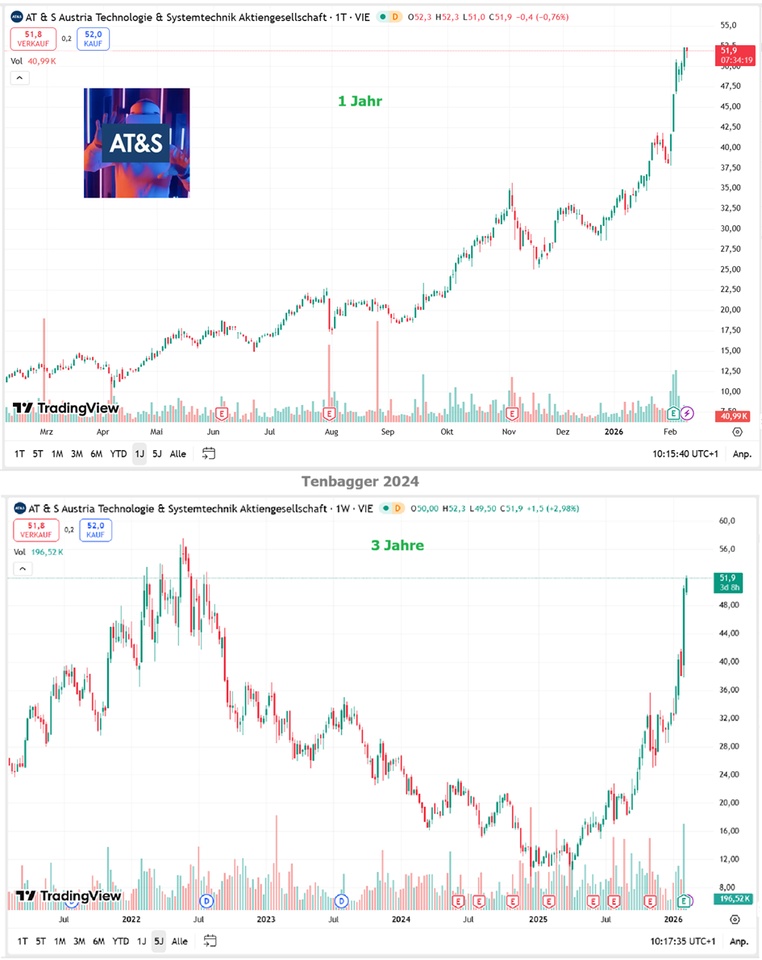

According to an analysis using the Patentsight tool, the Styrian microelectronics company currently has by far the highest patent quality in the HDI (High Density Interconnect) segment among the ten leading electronics manufacturers worldwide. After two consecutive years in the top position, the company was even able to extend its lead over the competition last year, as AT & S announced on October 10, 2025. The share has been on an upward trend since the end of December 2024 and has risen by 195% since then.

AT&S has positioned itself as the backbone of the global AI infrastructure and is benefiting from the technological shift towards modular chiplet designs. While data centers worldwide are thirsting for more power, AT&S supplies the necessary substrates, whose space requirements and complexity are increasing exponentially in the new AI era. Thanks to a close strategic alliance with Intel, the company occupies a critical key role in the semiconductor supply chain. AT&S is poised for a strong net profit increase by 2028!

High-tech from Austria: More than just printed circuit boards

When talking about the giants of the semiconductor industry, Silicon Valley or Taiwan often come to mind first. But a crucial piece of the modern electronics puzzle comes from Austria. Since it was founded in 1987, AT&S has developed from a traditional printed circuit board manufacturer into one of the world's leading suppliers of high-end interconnect solutions. Today, AT&S ranks 6th worldwide among high-end printed circuit board manufacturers and 5th for so-called ABF substrates. The latter are the highly complex carrier materials on which microchips are mounted. They form the interface between the tiny silicon die (single, still unhoused piece of semiconductor material) and the rest of the hardware. In a world where electronics must become ever smaller, faster and more powerful, this interconnection technology is a limiting factor for the overall performance of the system.

The AI turbo: when data volume demands space

Artificial intelligence (AI) is currently the strongest growth driver for the semiconductor industry. AT&S is in the front row here. Modern AI accelerators for data centers can no longer be manufactured as "monolithic" individual chips - i.e. as a single, huge component from a single casting. Such chips would be too error-prone and expensive to produce. Instead, the industry relies on the "Lego principle", so-called "chiplets". Here, various specialized functional units such as computing cores, graphics units and memory controllers are manufactured separately and only combined on a common substrate at the end. This trend towards functional integration plays directly into AT&S's hands. While a server IC was often still a simple single chip in 2019, the designs for 2025 require four times the substrate area and eight times the capacity. AT&S supplies the necessary IC substrates for this, which are not only larger, but also significantly more complex thanks to more layers and the finest connection technologies. The power supply is particularly critical. AI chips have an enormous power density. This is where AT&S scores with special embedding technology that integrates power modules directly into the PCB to minimize losses. In conjunction with state-of-the-art packaging concepts such as CoWoS (chip-on-wafer-on-substrate) or Intel's EMIB, AT&S is becoming an indispensable partner for the realization of supercomputers.

Renaissance by Intel and a look into the future

For a long time, the strong dependence on a few major customers was seen as a risk. However, the strategic partnership with Intel could now prove to be the decisive lever for a renaissance. Intel is investing in advanced packaging technologies such as EMIB, for which AT&S supplies the corresponding high-end substrates. The opening of new capacities, for example in Kulim, Malaysia, or the expansions in Leoben, are aimed precisely at this high-end market. Without the substrates from AT&S, Intel would not be able to physically install its most powerful processors for data centers and AI applications in computers or servers.

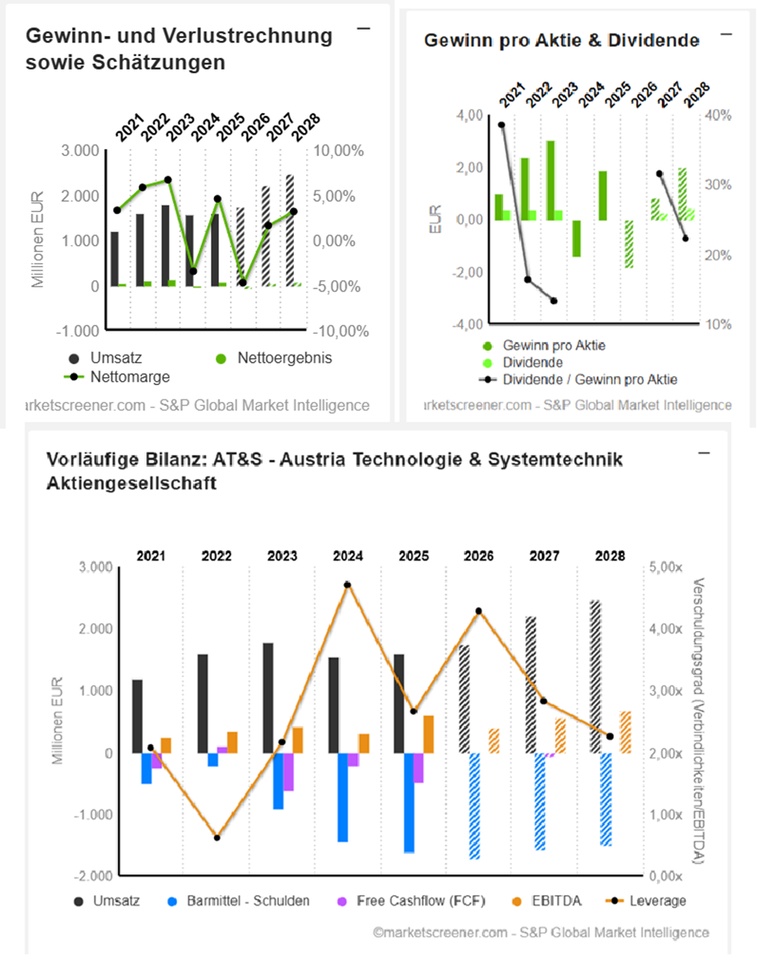

P/E ratio of 13 as of 2028

AT&S has to invest heavily to keep pace with the competition. A capex of EUR 250 million is planned for the current year 2025/26. With revenue of EUR 1.7 billion, the EBITDA margin is likely to end up at 23%. At the bottom line, the consensus expects an EPS loss of EUR 2.27. The turnaround should start in 2026/27. Turnover is set to soar to between 2.1 and 2.4 billion euros. The EBITDA margin should be 24 to 28%. AT&S should earn around EUR 0.76 net. Another year later, 3.06 euros are in the cards, bringing the P/E ratio down to 13.3. AT&S is cyclical and relies on high investments. This makes the share more interesting for traders who want to play the current upward trend in the AI profiteer than for investors.

(@Multibagger

@TomTurboInvest )

My dears, but I also see good potential over a longer-term period due to the growth and the P/E ratio.

AT&S achieves positive net income again in the 3rd quarter

(03.02.2026 / 07:00 CET/CEST)

- Revenue increases by 10% to € 1.3 billion in the first three quarters of 2025/26 compared to 2024/25

- EBITDA of € 297 million corresponds to a margin of 22.6

- Plants in Kulim and Leoben are developing as planned and contributing to sales as expected

- Exchange rate developments affect sales, earnings and equity

- Outlook for financial years 2025/26 and 2026/27 confirmed

Outlook 2025/26

AT&S expects to generate annual revenue of around € 1.7 billion in the financial year 2025/26 (2024/25: € 1,590 million), which corresponds to operational growth - adjusted for currency effects and the sold plant in Ansan - of around 20% compared with the previous year. At around 23%, the expected EBITDA margin will still reflect the start-up costs of the additional lines in Kulim (2024/25 incl. proceeds from the sale of the plant in Ansan, Korea: 38.1%; adjusted for proceeds: 17.7%). Management is planning an investment volume of around € 200 million (2024/25: € 415 million). The majority of these investments will flow into the expansion of IC substrate production at the new plant in Kulim. AT&S expects EBIT and operating free cash flow to be positive.

Outlook 2026/27

AT&S expects demand for products with high added value to remain strong and growing, especially for generative artificial intelligence. However, established markets such as servers for companies, PCs & notebooks have also recovered. AT&S has also decided to serve the defense sector more strongly in the future. In addition, the company will work even more closely with its customers in future to ensure that production increases can be implemented reliably. At the same time, this close cooperation will contribute to the structured introduction of new products and strengthen joint development activities in the long term. Against this positive market backdrop, AT&S currently expects to generate revenue of around € 2.1 to 2.4 billion and an EBITDA margin of 24 to 28% in the financial year 2026/27.

AUS RT TG: 52,00 Euro -0,90 (-1,70 %)

Revenue is distributed across the following markets:

- mobile devices and carrier media (56.6%);

- equipment for industry and the medical and automotive sectors (43.4%).

At the end of March 2024, the Group had 6 production sites in Austria (2), China (2), Malaysia and India.

Geographically, sales are distributed as follows: Austria (0.8%), Germany (8.9%), Europe (6.3%), America (77.1%), China (1.4%) and Asia (5.5%).

Number of employees: 12,876

Electronics solutions: Focus on applications and players

- Consumer Devices Digital

The ever-increasing performance of consumer electronics products coupled with the miniaturization of electronic devices makes new technologies necessary to meet the growing demands of the systems. AT&S's innovative products inspire developers to bring devices to market that are ever smaller and more powerful and meet the requirements of tomorrow's advanced applications.

- Infrastructure

High Frequency Electronics from AT&S enable the next generation leap in mobile data transmission. Higher frequencies for 6G and beyond.

- Automotive

Secure, fast and low-power communication is an important prerequisite for intelligent traffic and transportation systems. AT&S supplies advanced high-frequency electronics for the upcoming revolution.

Sensor technology and central data processing are key elements for vehicle safety, which will ultimately enable autonomous driving and robot cars. Drives will be electrified. Cars perceive their surroundings, make decisions and act. Together with the increasing importance of data communication, the number and requirements of the PCB and interconnect solutions used are growing. State-of-the-art technology from AT&S enables, for example, high-resolution scanning of the environment or the processing and transmission of the resulting data volumes as well as high-performance computing processes.

- Aerospace

For aerospace applications operating under extreme environmental conditions, AT&S specializes in complex, long-term available and extremely reliable printed circuit board solutions, which are mainly used for aircraft and satellites.

In communication networks involving satellites, AT&S technology ensures reliably high bandwidths, even under the most adverse conditions in space.

- Industrial

Advancing digitalization has a significant impact on the industrial environment - from smart manufacturing to smart mobility, from smart infrastructure to smart homes and smart buildings. The introduction of 5G and innovations in the field of sensor technology have made decentralized systems and real-time availability a reality in industrial production.

To best meet these requirements, AT&S offers maximum flexibility in the development and production of innovative PCB solutions and the ability to adapt quickly to changing specifications and technologies.

- Medical

AT&S has been an established partner to the medical industry for more than ten years, during which time it has developed and advanced new technologies for printed circuit boards. Their dedicated medical team is very familiar with the challenges of the industry. They support every phase of product development - from concept to series production.

In the medical and healthcare sector, reducing size and weight is the top priority, especially for devices such as pacemakers. Customers benefit not only from the medical technology know-how, but also from the cross-industry and cross-technology knowledge within AT&S.

Focus on microelectronics applications

- High-performance computing

- AI, edge computing and IoT

- servers

- Cloud computing

- Networking

- 5G base stations

- Automotive

Resilient production network for printed circuit boards

- Austria (Leoben, Fehring)

- China (Shanghai & Chongqing)

- India (Nanjangud)

- Malaysia (Kulim)

Enter Title of the Presentation

EUR in millions

Estimates

Year Turnover Change

2025 1.590 2,57 %

2026 1.738 9,34 %

2027 2.207 27 %

2028 2.457 11,31 %

Year EBIT Change

2024 31,12 -78,72 %

2025 277,4 791,37 %

2026 35,51 -87,2 %

2027 163,7 361,14 %

2028 254,8 55,62 %

Year Net result Change

2024 -54,19 -145,98 %

2025 72,2 233,22 %

2026 -84,12 -216,52 %

2027 33,54 139,87 %

2028 76,86 129,17 %

Year Net debt CAPEX

2024 1.447 858,8

2025 1.606 416,1

2026 1.717 190,3

2027 1.582 235,3

2028 1.507 338,8

Year Free cash flow Change

2024 -205,4 -22 %

2025 -490,6 -138,83 %

2026

2027 -66,2

Year EBIT margin ROE

2024 2,01 % -5,1 %

2025 17,45 % 8,79 %

2026 2,04 % -8,24 %

2027 7,42 % 3,41 %

2028 10,37 % 7,24 %

Year Earnings per share Change

2024 -1,39 -145,87 %

2025 1,86 233,81 %

2026 -1,832 -198,51 %

2027 0,8298 145,29 %

2028 1,979 138,47 %

Year Dividend Yield

2027 0,2612 0,5 %

2028 0,4384 0,84 %

Year P/E ratio ROE

2024 -13.9x 0x

2025 6.96x -0x

2026 -28.5x 0x

2027 63x -0x

2028 26.4x 0x

Market value 2,032

Number of shares (in thousands) 38,850

Date of publication 15,05,2025

Performance

1 week +25.72 %

1 month +60.92 %

6 months +149.64 %

1 year +373.30 %