Rebalacing

I broke the €1 million barrier around 8 months ago.

At that time, my portfolio was valued at 80% of getquin.

Since then I have invested a little $RHM (+0,49 %) and $NVDA (-1,44 %) but have not made any other changes.

Due to the massive rise in the price of gold and $BTC (-1,26 %) and a few start-ups in which I am invested, the portfolio has become "out of balance" (current valuation 50%).

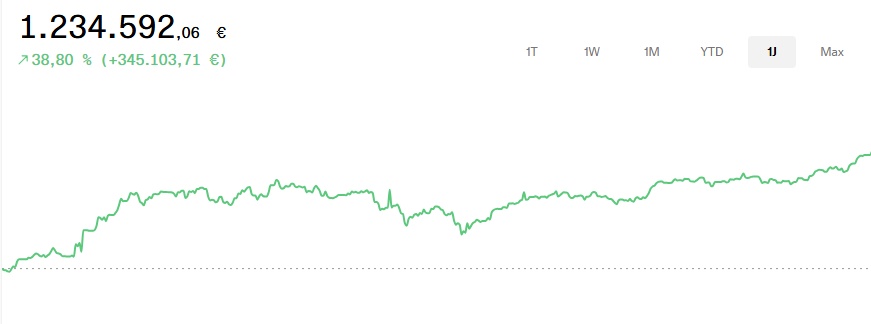

The value has risen massively in the last 8 months. Yesterday I cracked the 1.23 M€ mark.

Would you reallocate?

Currently crypto 27%, gold 26%, start-up 21%, rest ETF and a few individual stocks

Thanks for your input.