The pre-market session is showing strong resilience. It's not just a "green day," but a clear reaction to specific fundamental catalysts. Here is why the key players are moving:

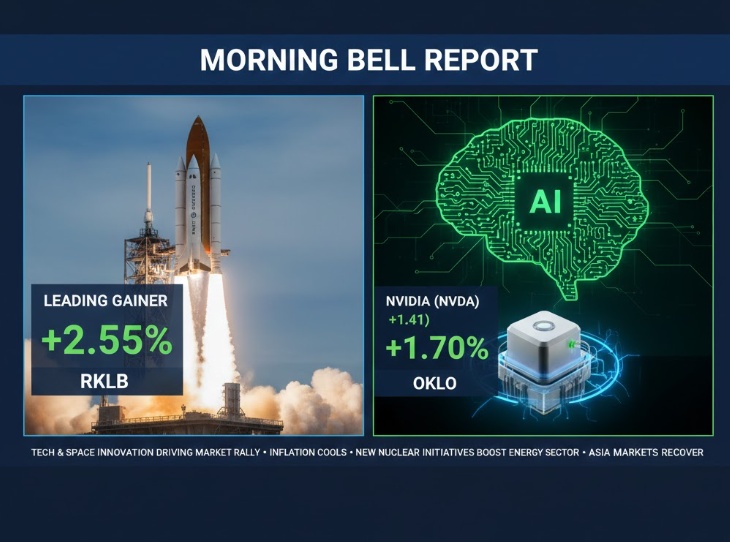

🚀 Aerospace - $RKLB (+4,29 %) (+2.55%): Rocket Lab's outperformance is driven by its increasing "launch cadence" and the de-risking of its Neutron program. As the space economy shifts from speculative to industrial, RKLB is capturing a massive share of the small-to-medium satellite market.

💻 Semiconductors - $NVDA (+3,71 %) (+1.41%): The bounce is fueled by softer-than-expected inflation data, which provides a "green light" for high-multiple tech stocks. With AI demand still outstripping supply, the fundamental case for Nvidia remains bulletproof heading into 2026.

⚛️ Energy - $OKLO (+1.70%) & $NNE : We are witnessing a "Nuclear Renaissance." The market is pricing in the massive power requirements of next-gen data centers. OKLO is benefiting from the positive spillover of recent regulatory breakthroughs in the SMR (Small Modular Reactor) space.

🌏 China Tech - $BABA (-0,9 %) (+1.48%): Sentiment on Chinese equities is improving as macro data points to a stabilizing export machine. Alibaba remains the primary vehicle for investors looking to play the recovery of the Eastern consumer.

The "Red" Side: What's Cooling Down? 🧊

Banking & Finance: We see slight pressure on $UCG (-2,58 %) (-0.50%) and $AXP (+0,64 %) (-0.27%). This isn't a crash, but profit-taking. After a strong run for financial stocks, investors are rotating capital out of Value to fund the new leg of the Tech rally.

Big Tech Lagging: While $MSFT (+1,99 %) and $GOOGL (-0,21 %) are slightly positive, they are underperforming the broader tech market. The focus has shifted from software platforms to hardware providers and infrastructure.

Conclusion: I am staying long on Energy Infrastructure and Specialized Tech. The convergence of AI power needs and Space logistics is the strongest narrative for the upcoming year.

What’s your top conviction for the final sessions of 2025? Let’s talk in the comments! 👇