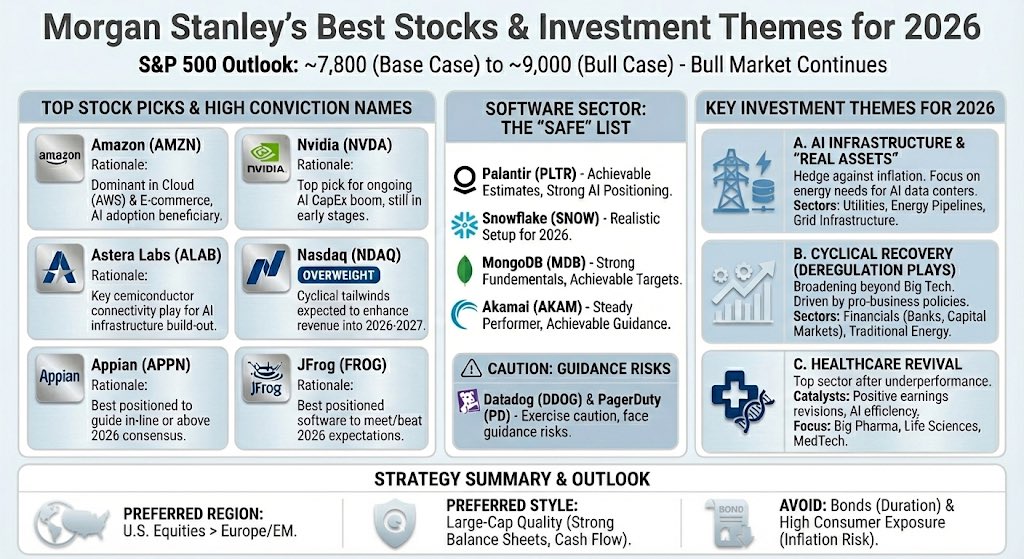

In my search for small and mid-cap stocks that could benefit from the AI megatrend, the company $FROG (-24,3 %)

caught my eye.

I myself am currently (yet) but would like to briefly introduce this exciting company to you.

It may also be of interest to your watchlist. 👀

Industry sector: DevOps / AI / Security

Market capitalization: approx. USD 5 billion

📍 What does JFrog do?

JFrog provides a platform for automated software delivery - from development to operation. It manages so-called artifacts (i.e. software packages, containers, AI models) and automates the entire delivery process. Companies use JFrog to deliver software faster, more securely and more consistently - whether in the cloud, on-premises or at the edge.

The goal: software should be delivered as smoothly as data - which is why JFrog calls its concept "Liquid Software".

🧠 How does JFrog use artificial intelligence?

JFrog itself is not a classic "AI company" - but AI is central to two things:

Security & Automation:

JFrog uses AI-powered analysis to automatically detect and assess vulnerabilities in software - even in complex open source stacks.

Deployment of AI models:

Many customers use JFrog to deploy their own AI models automatically and securely securely into production. This makes JFrog the infrastructure behind modern AI.

📈 Growth & momentum

- Q2 2025 revenue: USD 127.2 million → +23% YoY

- Cloud revenue: +45 %

- Customer loyalty (net dollar retention): 118%

- 61 major customers with sales of over USD 1 million - +45% year-on-year

JFrog is operationally profitable with a gross margin of 83% and a free cash flow margin of 28

The balance sheet is debt-free, with over USD 600 million in cash reserves - a stable basis for further growth.

📊 Valuation & market sentiment

The share is valued at a forward P/E ratio of approx. 61 and a sales multiple of around 9.

This is ambitiousbut is well underpinned by growth, margins and market position. The share price rose significantly after the last quarterly figures - there is technical momentum.

📍 Opportunities & risks

Opportunities:

- Important building block in DevOps and AI infrastructures

- High cloud share with strong growth

- High customer loyalty & strong cash flow

Risks:

- Valuation challenging

- Competition from GitLab, GitHub, AWS & Co.

👉 Conclusion

JFrog is not a short-term AI hype, but a strategically positioned company with real applications in the AI and software world.

Anyone looking to invest in the infrastructure behind modern software development - with a focus on automation, security and scalability - will find an exciting mid-cap with substance here.

📈 Current chart (as at August 8, 2025)

Brief summary (weekly chart)

- Trend: Higher lows/highs since 2022 → medium-term upward trend.

- Key resistance: USD 45-47 (multiple tops).

- Dynamic supports:

- ~37 USD ≈ rising 50-week SMA

- 29-31 USD ≈ 200-week SMA + volume base

Possible entry zones

Break-out buy: Weekly close > 47 USD → Target 55-60 USD, stop < 42 USD.

Pullback buy: Setback to the zone 35-38 USD (50-W-SMA) with bullish reaction.

USD 29-31 as "last-defense" support from the bottom formation.

ℹ️ Of course only a brief technical assessment, not investment advice.