From: Topic and Gemini

Date: December 06, 2025

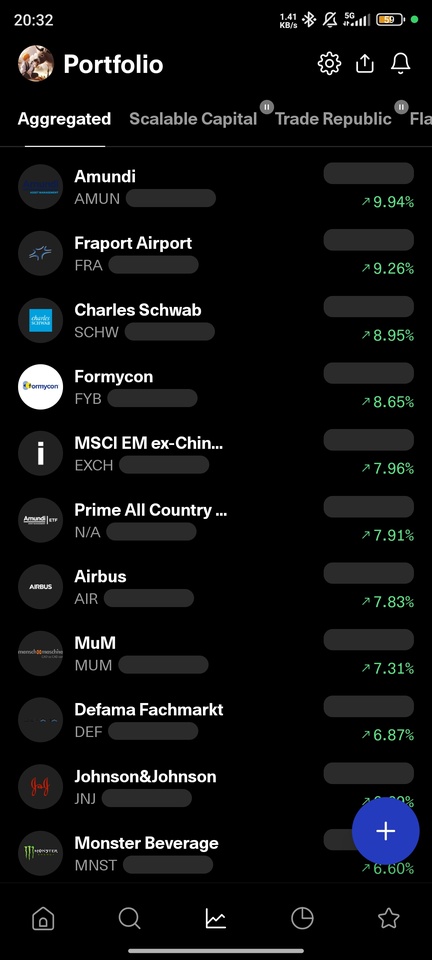

Current share price: ~€25

Anyone looking at the chart of the $FYB (+1,75 %) AG sees red. From over €60, the share price has halved. Is the growth story over? Or is this an opportunity to buy a quality stock with a massive technological moat at a discount?

We took a detailed look at the 2025 half-year report. Spoiler: It's complicated. Formycon is not a traditional biotech bet, but a company in radical transformation. Here's the deep dive.

1. the business model:

To understand Formycon, you need to know that they don't invent new drugs. They are the engineers who replicate biological blockbusters (such as eye drugs or cancer therapies) exactly as soon as their patents expire. This is called biosimilars. These are then marketed and sold by partners. This generates royalties and upfront payments, which Formycon counts as turnover.

Caution: This means that you are also significantly tied to the good execution of the partners.

Biosimilar good to know: The probability of success for the approval

of a biosimilar is already at the beginning at

almost 70%. Formycon even reckons with 80%.

2. the figures: A classic transition year

At first glance, the 2025 half-year report makes sobering reading. The company itself speaks of a "challenging market environment".

* Slump in sales: sales fell from € 26.9 million (H1 2024) to € 9.0 million (H1 2025). The reason: last year there were large one-off payments for the FYB202 product, which are missing this year.

* Red figures: EBITDA is € -17.9 million.

* The "real" loss: Adjusted EBITDA (including the investment in Bioeq) is as high as € -19.2 million.

Why? Development costs are continuing (especially for the promising FYB206), but the hoped-for license income from the finished products is still a long way off.

3. the elephant in the room: the US market problem

The real story is not in the financial figures, but in the operating business in the USA. Investors are painfully learning that approval does not necessarily mean sales.

The problem with FYB201 (Cimerli/Ranibizumab):

Formycon's partner Sandoz had to pause marketing in the USA in April 2025. The reason: the price pressure was too high and the strategy was not working. The product has to be "repositioned" and is not due to return until 2026. This will tear a huge hole in the expected revenue.

The slow start of FYB202 (Otulfi/Ustekinumab):

The product has been on the market in the US since March 2025. But the CEO openly admits: Market penetration is slower than expected and the discounts (rebates) that have to be granted to the purchasing cooperatives (PBMs) are higher than anticipated.

The result: in the first four months, only a meagre € 1.7 million in license revenue was generated.

4. why you still have to take a look

If everything is going so badly, why should you hold on to the share? Decisive for FYB206.

FYB206 is a biosimilar to Keytruda, the best-selling cancer drug in the world. And Formycon is in a good position here:

The US FDA has confirmed that Formycon does not need a Phase III clinical trial for this product.

Normally, these studies cost hundreds of millions and take years.

* Formycon saves massive amounts of money and time.

* Patient recruitment for Phase I has already been completed.

* A deal with a marketing partner is still being sought for 2025. Such a deal would immediately generate cash (upfront payment).

Here is a small example calculation:

The bill (per year):

Addressable market (originator): 25 bn.

2. **Biosimilar market (price-adjusted):** approx. 12.5 bn.

Turnover of the Formycon partner (10 % share): 1.25 billion $

Formycon margin (e.g. 25 % royalty): $ 312.5 million

In addition, the eye medication FYB203 (Eylea biosimilar) has been approved in the EU and the USA. As soon as the patent dispute with the original manufacturer is resolved, the next revenue stream will be available here.

Conclusion: A bet on the future

Formycon has delivered technically (4 approvals), but disappointed commercially. The company must now prove that it is not only good in the lab, but can also make money in the "shark tank" of the US healthcare market.

In order to bridge the lean period, Formycon has placed a bond for € 70 million. This secures liquidity, but increases the pressure to become profitable soon (target: 2026/2027).

My assessment:

At the current level of ~€25, a lot of pessimism is priced in. Anyone with patience and a strong belief in the success of FYB206 (Keytruda) will find an exciting entry opportunity here. Those looking for security should avoid the share. Either way, Formycon is extremely dependent on its partners. If they do not deliver, there will be no turnover.

What I like is the story.

1. formycon has operating leverage. Apart from R&D and the usual corporate costs, everything in the form of increased sales is directly added to EBIT. This means that the more biosimilars you bring out, the better you can offset the fixed costs and thus earn a disproportionately high share of sales

2. biosimilars are not like generics. They do have competition, but not nearly as much as in the generics market. Therefore, a small moat forms if you manage to market them properly. This is because too many players in the market do not allow the development costs to be recouped, which is why there are usually only up to 8 players per biosimilar.

3. biosimilars are extremely cool. Biosimilars are almost as profitable as patented drugs, but reduce the market price by almost 50%.

The biggest concern:

There are also economies of scale in the biosimilar market and especially in the US, the bigger players like to go into the main drugs because if their own pipeline doesn't deliver anything, they can at least gain some margin.

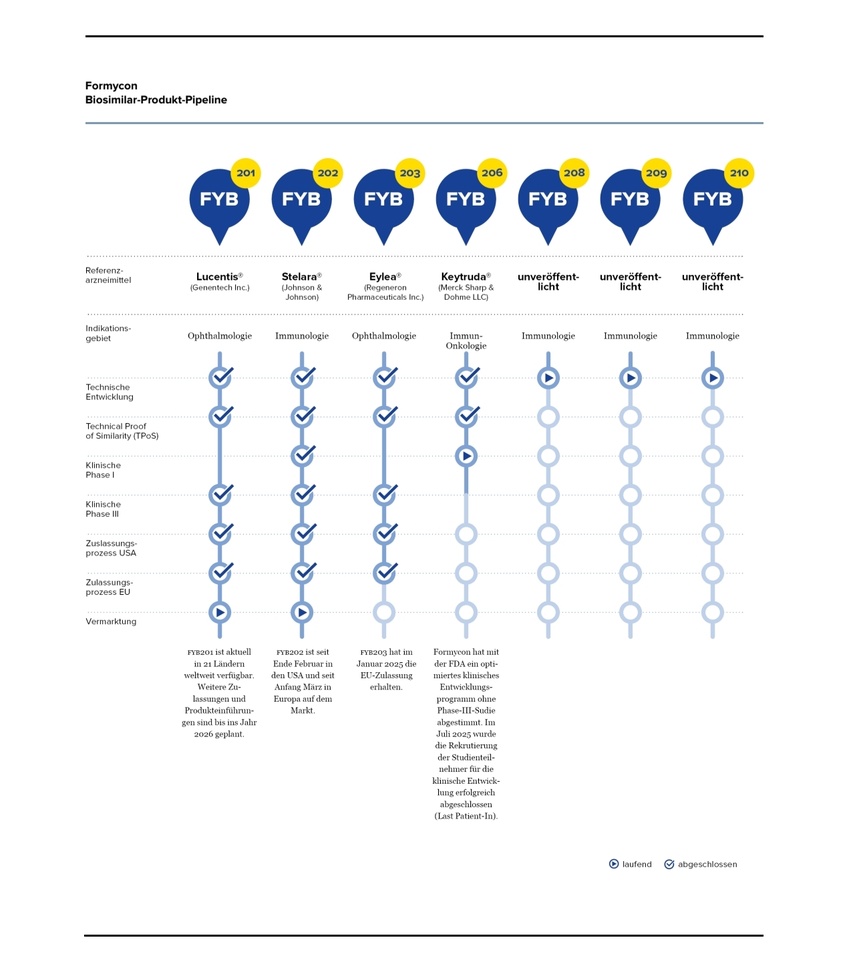

The pipeline

What is behind 208 has also been published; FYB208 is a biosimilar candidate for the immunological blockbuster drug Dupixent® (active ingredient: dupilumab). With the successful completion of the Technical Proof of Similarity (TPoS), FYB208 shows a high analytical comparability with the reference drug.2024 global sales amounted to USD 14.1 billion, an increase of 22% compared to the previous year. Growth continued at a similar rate in 2025, with Dupixent® generating sales of around USD 8 billion in the first six months of the year.Forecasts underline the great long-term potential of dupilumab: sales are expected to rise to more than USD 20 billion by 2030.